Russian Drilling Market: A Paradigm Shift

In all likelihood, the year 2014 will go down on record as a turning point for the Russian drilling market. New trends have been seen on this market for the first time in several years, i.e. a decline in the scope of total drilling instead of growth that was recorded over the last five years, and an increase in the closed segment of the market where E&P companies with their own drilling units or captive contractors run by VIOCs play an exclusive role.

Many Russian vertically integrated oil companies (VIOCs) have reported that the scope of drilling and, hence, volumes of oil production can be expected to decline in the near future. For example, LUKOIL Vice-President Leonid Fedun made a statement to this effect during the Second National Oil and Gas Forum at the end of October 2014. In his opinion, such an uninspiring forecast is attributable to a number of factors. Drilling productivity in Russia is falling sharply, while an increasingly large number of new wells will need to be drilled. “In order to maintain the current level of output, we will have to drill not 20 million linear kilometers, as is the case now, but 30 million. This makes it necessary to boost the number of wells completed from 6,000 to 9,000 per year and to increase the number of drilling crews by around 60%. Such numbers look quite dubious given that Western contractors are winding down their operations in Russia”, Fedun pointed out.

Inevitable

According to data from the Central Dispatching Department of the Fuel and Energy Complex (CDU TEK), the decline in Russia’s total exploration and production drilling reached 7 percent during the first half of 2014 as compared to the same period of 2013. Conversely, horizontal drilling has increased by 63 percent. At first glance, this figure appears to be a statistical aberration that reveals a broad disparity in the performance of production and horizontal drilling (we treat horizontal drilling as a type of production drilling – Note), but it is actually the initial manifestation of a new trend, which, according to the results of RPI’s analysis, can be expected to prevail on the Russian drilling market for at least the next two or three years. It is a logical occurrence in the history of the implementation and distribution of horizontal drilling in Russia.

Drilling of horizontal wells is currently a well-known method used to improve hydrocarbon recovery. Russia’s first horizontal well was drilled in 1947 at the Krasnokamenskoye field in Bashkortostan. However, horizontal welling was hardly practiced in Russia up until the beginning of the 1990s due to the complexity of this technique. By comparison, there were 35,000 horizontal wells worldwide as of the end of 2011. Specifically, the share of horizontal wells in the total number of production wells drilled had reached 42 percent in the United States

by 2010.

Horizontal drilling offers a number of well-known advantages, including the following:

» Higher return on capital investments due to an increase in the oil recovery rate

» Higher environmental security in the production process, making it possible to perform drilling without entering protected environmental areas

» The ability to bring on stream new earlier untapped formations

Horizontal drilling failed to gain popularity in Russia throughout the 2000’s mainly due to technological difficulties. As for the average at VIOCs, the proportion of horizontal drilling remained within the range of 10-12 percent of all production drilling. The only exceptions to the rule were the following companies:

» Surgutneftegaz

» Slavneft

Back around the beginning of the 2000’s, Surgutneftegaz raised its share of its horizontal drilling to 24 percent. The bulk of horizontal wells (over 1,000 as of 2010) were drilled at the Fedorovskoye field. However, during the second half of the 2000’s, the share of horizontal drilling dropped to 15 percent at this company due to technological difficulties related to this operation.

Slavneft lifted the share of horizontal drilling at its brownfields to about 29 percent in Western Siberia in 2010. The company regards this type of drilling as an effective production stimulation technique.

A new trend in horizontal drilling arose in 2009-2011. Most Russian VIOCs either dramatically scaled up their share of horizontal drilling or planned to increase its proportion within the next few years.

Companies opted to change their approach to drilling for the following reasons:

» High economic efficiency of horizontal drilling, enabling companies to reduce the number of producing wells while raising the flow rate

» Targets for commissioning new fields from 2011 through 2015, where in many cases it makes sense to immediately drill a horizontal well

» Improvements in horizontal drilling and well workover techniques

» Depletion of aging fields where new formations require more and more new completions and the flow rate of wells drilled need to be raised

» The need to commission tight reserves (high viscosity oil), and develop offshore fields

During the second half of the 2000’s, new drilling technologies – MWD and LWD methods (measurements while drilling and logging while drilling – Note), were greatly enhanced and gained widespread popularity, along with drilling tools (bits in particular), drilling fluids, and top drive drilling rigs. Workover methods were also enhanced, including squeeze cementing that could be used in horizontal well sections. All of these factors encouraged additional use of horizontal drilling. And before long the new technology yielded notable results.

According to an estimate by Rosneft experts, the use of horizontal drilling at the new Vankor field (of the 137 wells drilled there over 90 percent were horizontal wells in 2008-2010 – Note) made it possible to reduce the number of producing wells by 3-4-fold. At its East Siberian greenfields, Surgutneftegaz switched completely to horizontal drilling of producing wells.

According to the estimates of industry experts, Russia’s average flow rates in horizontal wells is 3-5 times higher than in directional wells that could be drilled in the same place. In certain cases, the flow rates at horizontal wells exceed those in directional wells by 10-12 times.

Horizontal drilling in the development of offshore fields allowed oil companies to abandon the use of offshore platforms, replacing them with onshore drilling facilities. This trend was seen in the Sakhlin-1 project, where over a 9 km section of a horizontal well was drilled from onshore.

The nearly simultaneous occurrence of these events during 2008-2011 translated into sharply higher interest in horizontal drilling on the part of oil companies, and this interest has not only been maintained, but also increased from 2012 through 2014. As a result, the annual scope of horizontal drilling in 2013 surged 60 percent compared to the previous year, while drilling in January-June 2014 exceeded the scope for the same period in 2013 by 62 percent.

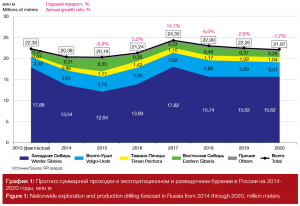

According to CDU TEK data, the rise in horizontal drilling volumes from 2009 through 2013 was accompanied by an increase in total drilling, and that four-year trend was broken only this year. This happened as the effect from completion of horizontal wells was so pronounced that an increasingly smaller number of producing wells was needed to achieve the targets set for incremental oil output. Finally, the tipping point occurred during the first half of 2014 when the increase in horizontal drilling was accompanied by a decrease in the scope of nationwide drilling. According to RPI’s estimate, an increase in total drilling can be expected no earlier than 2016-2017, as this is the period when simultaneous development is scheduled for large fields in the Bolshekhetskaya depression and Yurubcheno-Tomkhomskaya zone. After that, the downward trend in drilling volumes will likely resume in 2018-2020.

So far nobody has suggested any possible ways or means to halt this trend, since no large upstream projects with a big scope of drilling in Russia are currently in sight.

Horizontal Drilling: The Main Target of Sanctions

Western sanctions are the only factor that could curtail growth of horizontal drilling in the medium terms, i.e. after 2018. That would mean, of course, that the sanctions would not be lifted until that time.

The EU, US and Canada have introduced sectoral restrictions against Russia, including its oil industry, in two stages. The first stage targeted equipment supplies. It was imposed at the end of July – early August 2014. The second stage was executed in September. This round of sanctions targeted not only equipment deliveries, but also the provision of services, the exchange of information with Russian partners, and the participation of Western companies in the most technologically advanced upstream projects.

The main goals pursued by the sanctions included slowing down the expansion of horizontal drilling, including offshore projects. The list of equipment banned by the US from import into Russia included, specifically, drilling rigs, parts for horizontal drilling, and logging facilities.

In mid-September, the US introduced the second stage of sanctions. This stage banned Western companies from continuing operations under joint Arctic, deepwater and shale projects, i.e. exploration and production projects carried out with Rosneft, Gazprom, Gazprom Neft, LUKOIL and Surgutneftegaz. The new sanctions not only limited exports of oil industry products to Russia, but also prohibited the exchange of technologies and services in

this area.

At present, many projects operated by Rosneft and Gazprom Neft together with such companies as ExxonMobil, Royal Dutch Shell, Eni Spa and Statoil ASA, have been placed on hold.

RPI experts have analyzed the potential impact of the sanctions on the performance of many segments of the oilfield services market, including horizontal drilling. This analysis revealed that horizontal drilling volumes could show steady growth under these conditions until 2017, totaling 7.4-7.5 million meters per year. Then in 2018 the scope of horizontal drilling would decline by nearly 18 percent for two reasons: drilling in the Bolshekhetskaya depression and Yurubcheno-Tomkhomskaya zone will have peaked, and there will be increased difficulties in obtaining Western spare parts for previously purchased equipment. Nonetheless, we forecast renewed growth in the scope of horizontal drilling after 2019, which should reach 6.3 million meters in 2020.

Asset Aggregation

The second trend in the development of the Russian drilling market that arose in conjunction with an increased share of the closed segment of the drilling market became apparent last spring. In this case, the closed market is understood as the drilling market in which contractors are either units of VIOCs themselves, as in the case of Surgutneftegaz and Tatneft, or captive companies where a certain VIOC accounts for virtually all orders.

The first harbinger of growth in the closed market was Rosneft’s purchase of a 100 percent interest in Orenburg Drilling Company (ODC), an event discussed in RPI’s report Russian Oilfield Services Companies: New Opportunities and Challenges in Light of the Current Geopolitical Environment.

At that time, the management of this VIOC officially announced its plans to integrate ODC into the holding’s structure over the next few months so that the bulk of the company’s operations consisted of Rosneft orders. For this purpose, ODC’s drilling rigs were to be relocated to Western Siberia during the second half of 2014, to the district of Nefteyugansk, and to the Samara region.

In spring 2014, the idea of purchasing drilling rigs stood in stark contrast with reports swirling in the media several years in a row that RN-Burenie could be put up for sale. However, the further train of events showed that the accretion of drilling assets was a new trend being pursued by the country’s leading oil producer.

At the end of July 2014, Weatherford sold to Rosneft all of its Russian subsidiaries that engage in drilling, well servicing and workovers. These included:

» Nizhnevartovskburneft

» Nizhnevartovsk Well Repair Company 1

» Orenburgburneft

The companies were acquired by Weatherford from TNK-BP in 2009 and only five years later they ended up being sold again. At the end of July 2014 their further fate was still unclear. However, the veil of secrecy was to be lifted before long – around the end of August.

At that time, Rosneft agreed to purchase a 30 percent stake in North Atlantic Drilling for about $925 million. The company was to pay for the deal by contributing 150 drilling rigs and making a cash payment. A month earlier in July, Rosneft and North Atlantic entered into long-term agreements under which six of North Atlantic’s offshore drilling rigs were to be used on the Russian shelf until 2022.

According to the results of RPI’s analysis, this meant that Rosneft assigned virtually all of its operable onshore drilling rigs to North Atlantic Drilling, including RN-Burenie, the former drilling assets of Weatherford and Orenburg Drilling Company. Under the terms of the deal, Rosneft was required to sign five-year contracts for the use of North Atlantic’s drilling facilities.

As a result, Rosneft pursued two goals: to solve the problem of securing offshore drilling rigs that would be capable of performing exploration drilling at its Arctic offshore license blocks, while also taking control of a major captive drilling contractor that could handle its most lucrative drilling order for many years to come.

However, as it turned out, these ambitious plans had to be revisited in light of Western sanctions. At the end of September 2014, the media reported that North Atlantic’s drilling rigs would not be operated in the Russian Arctic due to the sanctions imposed against the country. The first offshore well Universitetskaya-1 turned out to be the last, after which North Atlantic’s drilling rig discontinued Arctic operations, but not before a major new oil field, Pobeda, was discovered.

In autumn 2014, new broke that the sale of Slavneft’s drilling assets, which was planned a year ago, would not take place and these assets would remain with the parent holding, performing a large scope of work for it.

Three years ago, Slavneft ran four companies that specialized in exploration and production drilling:

» Megionskoye Department of Drilling Work (Megion UBR)

» Ob Geologiya

» Megiongeologiya

» Baikit Oil and Gas Exploration Expedition (BNGRE)

Throughout 2012 and early 2013, Slavneft held talks with a new potential buyer – RU-Energy Group. However, the deal fell through due to the bankruptcy of potential buyer, and plans to sell off these assets were abandoned. Thus, Slavneft’s refusal to offload its drilling units fits with a trend that is consistent with the industry as a whole.

As a result of the above-mentioned deals, both those that were executed and those that fell through, up to 45 percent of the nationwide scope of drilling in Russia was carried out on the closed market during the second half of 2014.

Targin Could be Next in Line

The events outlined above are not the only ones that in one way or another are associated with a further increase in the share of the closed drilling market.

The CEO of AFK Sistema, an integrated service conglomerate controlling Bashneft, was placed under house arrest in September 2014 in connection with criminal charges that the Bashkortostan-based company had been illicitly privatized.

AFK Sistema is currently the largest shareholder of this VIOC and also the owner of oilfield services holding Bashneft-Service Assets, which, in turn, was renamed Targin last year. As noted in RPI’s report Russian Oilfield Services Companies: New Opportunities and Challenges in Light of the Current Geopolitical Environment, Bashneft-Service Assets was formed in 2010 on the basis of 11 former oilfield services companies of Bashneft. These companies were initially assigned to a new legal entity, and then spun off from the VIOC. In autumn 2013, AFK Sistema became the sole owner of Bashneft-Service Assets.

If, in the course of the criminal case, it is proven that Bashneft was privatized in violation of the law and should be returned to the state, then there is a high degree of probability that not Bashneft in its current state, but all of its assets that were part of the VIOC at the time of its privatization would have to be returned to the state. Under this logic, Targin oilfield services holding would also be given back to the state. And if this is the case, the share of the closed drilling market could approach the 50 percent mark within the next few years.

For more information please contact Ms. Daria Ivantsova: Telephone: (+7 495) 502-5433 / 778-9332;

E-mail: Daria@rpi-inc.ru

Vadim Kravets