Cementing: A Market Under Pressure

The outlook for the well cementing market within the oil and gas production industry in Russia has been impacted by several factors including fundamental sectoral trends, technological conservatism, competition between oilfield services, and specific management challenges. This article briefly reviews all these factors, with a focus on the key aspects of management.

(А) The Current State of the Well Cementing Market

Well casing is an integral part of the well construction process. The difference with most other kinds of service is, well casing is a non-renewable final stage of joint activity with multiple service companies. Poor-quality well casing hamstrings all other efforts in a well. Cementing is one of the technological elements of the well casing process which, depending on the function it performs, is to a varying degree, indispensable.

Due to the changing the structure of recoverable oil reserves has been changing, the production wells have undergone considerable changes as well. These changes are driven by the intention to significantly increase the wellbore contact area with the productive reservoir. This explains the considerable growth of the share of directional drilling (directional wells, wells with horizontal section in a productive reservoir, multilateral wells and sidetracks) within the total number of wells under construction (see Chart 1), as well widespread use of hydraulic fracturing.

Growing technological complexity and longer wells have naturally resulted in the increase of higher drilling costs. Such conditions naturally urge operators to achieve an acceptable level of the efficiency in their drilling operations that is expressed in the volume of expenditures per unit of produced oil. This goal is achieved via two routes:

• By achieving greater production yields due to a larger wellbore contact area with the productive reservoir;

• By reducing well construction costs.

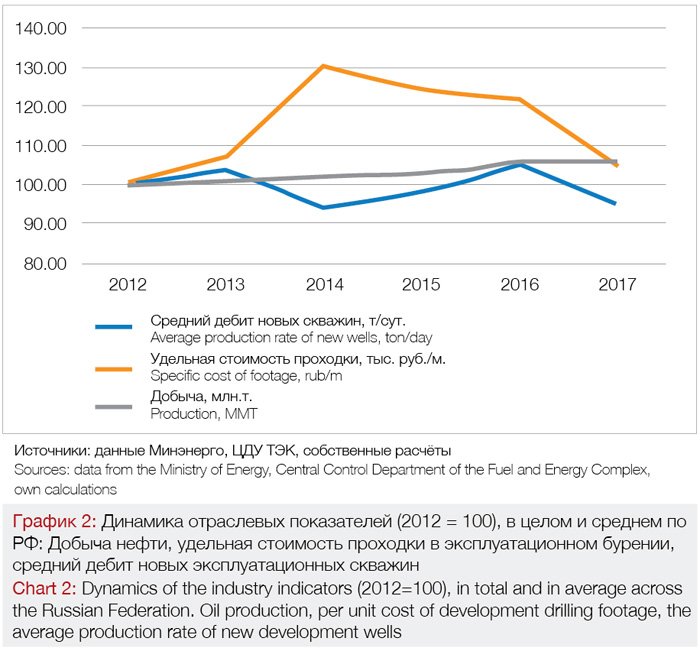

Beginning in 2015, the trend of increasing well construction costs was replaced with the trend in a reduction of well construction costs. By 2017 this indicator dropped down to 2012 cost levels, according to the industry statistics. The flow rate of new development wells demonstrated different dynamics during the same period, but by the end of 2017 it was lower than in 2012 by 5% (see Chart 2), in spite of the fact that the number of horizontal wells during the same period increased more than 3.5 times.

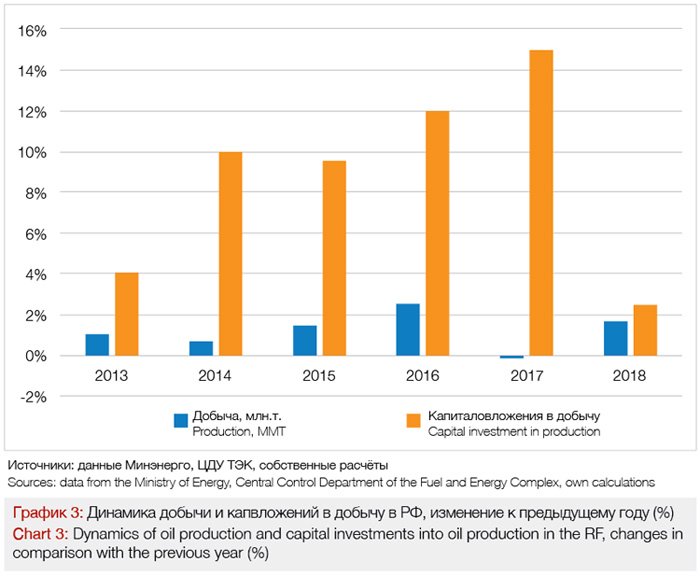

As a result of this over the 2012-2017 period, to maintain annual oil production growth at 1.2% the required increase in capital investments, into production, (in rubles) is more than 10% per year.

Consequently, the above-mentioned factors have had their impact on such an important aspect of well construction as well casing. Given this, it is important to look at the causes and characteristics of the changing requirements of well casing quality, the balance of primary and secondary cementing methods, and the dynamics of demand for these services.

Analyzing the trends in the well cementing market follows the fact that cementing is designed to perform these two major functions:

• to provide conditions for safe and long-term well operation;

• to seal the annular space between the wellbore and the casing.

The fulfillment of the first condition, basically, presumes preservation of stability of wellbore walls. Sealing guarantees prevention of annular migrations and cross-flows between different-pressure formations.

In present-day conditions of large-scale construction of directional wells their functions have underdone considerable changes. The tasks of well casing cementing in the intervals that are not meant for interaction between the production reservoir and downhole area have remained the same. Sealing of the annulus in the area of productive reservoir can be carried out without cementing – in those cases when the well is completed with an open hole or with uncemented bottom-hole assemblies.

The Market Structure and Parameters

The well cementing market, for the last 10 years (from 2009 to 2018) demonstrated growth rates that were lower than those of the oilfield service market in general. The shortfall compared to the drilling market, expressed in monetary terms, was nearly twofold, and just slightly lower in physical terms. The gap in the growth rate when compared with the drilling services, was considerably higher, which can be explained by their rapid technological development and expansion of the spectrum of their services. Cementing, as a whole, remains a stable segment both by structure of jobs, and by their volume.

The two major spheres of the well cementing, have different objectives, and demonstrate different trends of their development (a) where the task is to preserve the stability of the well bore (beyond productive reservoirs) the number of jobs is reduced due to simplified well design whereas (b) with the task of preventing leaks or migration (in the area of productive reservoirs) the number of jobs falls and is reduced due to changes in the well completion design.

The volume of the Russian well cementing market is estimated to be between 58 and 60 bln. rubles. 55% falls on the cementing jobs performed at the well operation stage (secondary cementing) which is basically applied during workover jobs and when preparing for hydraulic fracturing operations. This segment demonstrates a much higher growth rate compared with the well cementing during the well construction stage (primary cementing).

A fundamental factor for the growth rate of the secondary cementing market is the ageing of the operating well stock. The absolute number of jobs comprises of various types of remedial cementing. This segment is featured with high level of processing complexity, the jobs are carried out with a shortage of reliable well data, and, as a result of this, the level of success of such operations is low.

The increase in the costs for the secondary cementing is related to the operating stock of wells with high production rate and value, due to their more complex design and configuration of their equipment.

In general, the percentage cost of cementing wells, is in line with the worldwide average of 5 to 7%, but it is approximately twice lower than that in the USA – which is explained by high proportion of their wells having complex design, difference in the standards of cementing jobs, the level and value of applied equipment (especially, gears), the level of payroll expenses and some other associated factors.

Technology Trends

One of the differential features of well cementing as an oilfield service is its progressive technologic development without any signs of the breakthrough or revolutionary technological changes of the scale that has happend in some other services involved in the well construction process.

The key element, that contributes to the competitiveness and economic efficiency on the Russian market, is the elaboration and application of cementing blends. As for the rest of the constituents (cementing equipment, software, gears), there is pronounced technological dominance of the international service companies in the solutions for offshore production and, especially, for production in the most complex geological conditions.

Expandable and non-shrinking cements should be noted among the new technological solutions of the past decade, which find their application in the zones of productive reservoirs, to achieve better annular seal. Expandable cements found their mass application in approximately 40% of the cementing operations, according to today’s expert opinions. The importance of this technology is the fact that it protects the cementing market against the partial demand loss caused by the displacement by packers.

Light-weight cements are applied in the intervals located beyond the zones of productive (isolated) reservoirs, and they help to simplify the cementing process without loss in the continuity of production strings. Application of these cements have a long history, and the progressive development of the technology has led to the growing application of light-weight cements to the level where they are becoming the most demanded type of cementing blends: they are used in practically all of the operations of primary cementing and in the major part of cementing jobs generally.

Among the prospective hi-tech solutions having their niche applications, one could name microcements and self-healing cement blends.

The key technological challenge for cementing is the application of the modern completion systems in complex designed wells (long-reach horizontal wells with extended horizontal section, downhole splitters, multilateral wells). This raises the demands on well casing which, to a considerable degree, cannot be achieved by way of conventional cementing, which entails changing the provided services in their structure and volume. Nevertheless, it is a multidirectional process: for instance, recent experience indicates that the share of wells deploying cemented liner casing has been growing. This is because it makes the well operation easier and facilitates the repairability of wells.

In general, well cementing services is predominantly a market of standardized services, with a highly competitive environment of suppliers who have a sufficiently stable level of comparable technical and technological equipment level. Technological innovations are a key factor for differentiating the competitiveness of suppliers, although innovations, as a rule, create mostly short-term (rather than long-term) advantages for the market players. This determines the importance of continuous systematic technological development, where understanding of the customer’s needs and wants is very important.

Making full use of the potential of cementing as a factor of enhancing the efficiency of oil production has to do with further technological development, which, in its turn, depends on addressing a number of certain management challenges – this issue shall be more closely reviewed in section “Relations between customers and contractors”.

(B) The Market Development Factors

The well cementing market develops under the impact of the whole range of diverse and multidirectional factors which makes it more difficult to forecast the rate of its development.

Horizontal Drilling

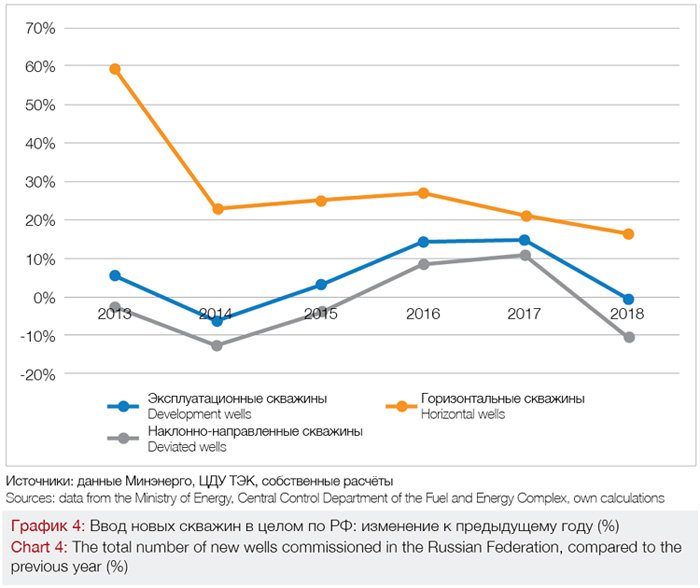

The growth in horizontal drilling has been one of the most important trending factors in the industry: the share of horizontal wells in the total number of new development wells has grown from 20 % in 2013 to 43% in 2018; and their share by footage has already grown to 49%.

The increased volume of drilling and commissioning of new wells has been a key supporting factor for the growth of the cementing market. At the end of 2018, the volume of footage in development drilling practically did not change, compared to 2017, which showed difference from the dynamics of the three previous years (2015 to 2017) when the total footage was growing by 12% yearly. That said, the footage in horizontal drilling grew by 19%, compared to the previous year, while the directional drilling contracted by 13% (for the first time since 2014) and reduced by 14% below the level of the pre-crisis year of 2013 (see Chart 4).

The design features of horizontal wells created serious downward pressure on the demand in the primary cementing market. Cemented liners have been used at the minimum number of horizontal wells, compared to an almost full sweep of directional wells. As a result, a decrease in the number of directional wells and the increased number of horizontal wells, at the end of 2018, in 2018 meant a decrease in the primary cementing market by about 4% in physical terms.

As for those horizontal wells where the liner is cemented, it is performed with the view to provide the stability (integrity) of the wellbore walls. The task of formation isolation and achieving leak tightness is not actually there, which affects the requirements and the quality of jobs.

With horizontal wells, the task of formation isolation and preventing wellbore collapse is, for the most part, solved through the use of solutions in the field of well completions – in particular, through the use of swellable packers, completion fluids, sand screens, gravel packs, as well as other equipment and materials.

As the length of the horizontal sections grows, the solutions from the field of well completion will, more and more, replace the solutions from the field of well cementing, which creates opportunities for suppliers of the corresponding equipment and services. Such diversification in well completion operations would be problematic for the companies specializing on the cementing services, due to great differences in the equipment and technologies.

In total, the above mentioned factors tend to reduced the physical volumes and per-unit prices in primary cementing, and raised the issue of the requirements for well cementing equipment as well. This results in serious stress on the earnings and profit of the industry service companies.

Well Design Simplification

As was mentioned above, the acceptable level of efficiency in drilling operations is mainly achieved through increased production rates and reduced well construction costs. Any simplification in the design of horizontal wells has become a highly efficient measure in this sense. The essence of the technology is in the application of a number of innovative processing methods which eventually make it possible to conduct open hole drilling in intervals that were previously considered incompatible. Those techniques include, first of all, the application of drilling fluids which provide stable against the aggressive impact of highly mineralized brine and do not disturb the stability of clays, and they do not interfere with the necessary logging while drilling surveys.

The latter measure makes it possible to considerably reduce the time for an open hole well, waiting for the running of the casing string and it reduces the probability of complications which could hinder the landing and cementing of that string. This set of measures results in reduction of the number of casing strings, as well as makes it possible to reduce them in diameter.

Between 2014 and 2019 the simplification of the design of horizontal wells has been successfully approved for evaluation and testing, at Rosneft, LUKOIL, Gazprom Neft, Slavneft, and Surgutneftegaz. This resulted in an average twofold reduction in the well construction period, which, coupled with the use of hydraulic fracturing, made it possible to increase the efficiency of drilling. Enabling the development of the reserves that were considered economically inefficient before.

In 2018, Rosneft launched widespread implementation of two-string horizontal wells at Priobskoye field (over 40 wells), in combination with the practice of separately contracting services on a day-rate basis. 2019 is promising to be a milestone in their commercial use: according to Rosneft’s data, the number of two-string horizontal wells in RN-Yuganskneftegaz shall, according to plan, increase almost 4 times, and their share in the total number of horizontal wells is targeted to be 1/3.

In terms of management, the result was achieved due to the optimal balance between (a) the level of tolerated risk during construction and (b) economic efficiency. Such optimization became possible after a number of amendments had been made in the “Safety Rules in the Oil and Gas Industry”, as well as after the suspension in 2015 of the compulsory approval of well design documentation by government authorization agency. These changes actually meant the transfer of the center of responsibility for decision making from the regulating authorities, acting in accordance with the “binary” logics of “non-observance is possible/impossible” – to oil production companies which obtained significantly wider possibilities to work out optimal balance between the levels of risk and efficiency.

In case, the mass application of the simplified well design is successful, one more serious motivation would be formed for further expansion of the use of horizontal drilling. This, in its turn, would lead to changes in the structure of demand for well cementing services. The increase of the share of the simplified design wells would lower the demand for cementing operations both at the intermediate and the production casing strings located beyond the perforation or the screen installation intervals, as well as at the gross intervals of productive reservoirs (the production strings and liners).

In the first instance, the reduction of the volume of cementing jobs is due to the reduction of the number of casing strings, and in the second case, it has to do with application of the well completion systems, where either non-cemented liners are used, or wells are operated in the open-hole mode.

Apart from the downward pressure on the volume and cost of works, the requirements to the quality of jobs on sealing the annulus in the zone of productive reservoir are changing. Combined with the technology of multizone hydraulic fracturing, the required level of wellbore integraity can be achieved not through the use of plugging materials but by means of packers.

The range of the problems related to the balance of risks and efficiency during well construction, if we take it across the global oil production industry, is particularly evident by the example of the shale and tight oil production in the USA. The results of the recent research of the Permian basin, carried out by Deloitte, indicate that 67% of wells were over or under-engineered (borehole length, completion configuration, etc) which resulted in the loss of economic efficiency (this also being the potential for its enhancement)

Production Capacity

The supply side of the cementing market demonstrates excess of production capacity of an adequate level of quality (as related to equipment and the production software), as well through wide availability of new cementing equipment – mainly Chinese in origin – with its attractive cost/quality ratio. In order to address incremental demand are expeditiously (3 to 4 months) form new cementing fleets meeting the arising additional demands, which makes the supply of cementing services very flexible.

Jointly, these factors make an additional pressure on the behavior of the market pricing.

Relations between Customers and Contractors

A whole range of factors in the development of the cementing market relates to the practice of relations between customers and contractors.

First, a few words about the key factors that are characteristic for the market of oilfield services on the whole.

The practice of separately contracting services is more and more broadly used in Russia’s oil industry, and is becoming a industry standard, including with those vertically-integrated oil companies that have oilfield service companies within their structure. The services of cementing, as part of that practice and among a number of other services, are subject to separate contracts – which, in its turn, creates additional opportunities for a broader range of suppliers, but this also increases the competitive pressures on the service purchasing price of service being purchased. Such an approach creates the optimal conditions for vertically-integrated oil companies, enjoying powerful systems of supply management, and allows them to restrain the purchasing price.

The present-day practice of tenders, practiced by the vertically-integrated oil companies, is to a large extent aimed at contracting at the lowest price, which creates strong pressure on the quality of the jobs – and inevitably leads to serious losses in quality in dumping cases when the price of service falls lower than its actual cost.

The key specific feature of the cementing market is the fact that the interests, and as their result, the commercial relations between the customer and contractor are greatly disbalanced.

On one side, the risks of the parties are asymmetric: the customer’s risks are related to the consequences of low quality cementing jobs, that are mostly revealed after a well is commissioned for operation, i.e. when the contractual relations are fulfilled (the payment made), while the contractor’s risks have to do with partial or complete failure to receive non-payment, as well as with arrears of payment (including those caused by litigation) following customer’s claims regarding the quality of jobs performed by the contractors.

On the other hand, the requirements and parameters used in contracts for assessment of the quality of jobs (the quality scale) are adequate to the requirements and risks related to the well construction stage, but they are hardly related to the risks that emerge at the stage of well completion and operation. This, especially, is particularly relevant to well stimulation jobs (hydraulic fracturing jobs, including acidizing jobs etc.), the actual parameters of which may exceed the design values and overlook the cement stone set strength, resulting in its crushing and loss of its seal.

Beyond the stage of well construction, a contractor, as a rule, has no information about the resulting quality of the performed cementing job which is not only expressed in the contractual requirements met but in the performance of the well as well (the dynamics of flow rate and water cut, the volume and frequency of remedial cementing jobs), especially at the initial stage.

The lack of mutual understanding between the customer and contractor regarding the well’s peformance makes it more difficult for a contractor to develop its technological potential and elaborate more efficient and tailored solutions for a customer.

As a result of the impact of the above mentioned number of factors, a service company is often left without means and motivation for its development, while an oil company finds itself without the full extent of quality, which transfers its potential losses to an indefinite future period (see section “Risks” for more details).

In general, the above mentioned organizational factors hinder the formation of stimuli and resources for technological development of Russian suppliers of the cementing services. As a result of this, the problem boomerangs to the customer companies, as, technologically, they decisively depend on elaborations of the equipment vendors, on their service and materials. Such solutions are in sufficiently full measures with the international oilfield service companies due to their significant investments into R&D sphere, although the account for the reliance on their technologies may encounter limitations due to the high level of their prices, and political risks, which are in particular expressed through sanctions. Besides, insufficient technological development of Russian vendors results in the conservation of high prices.

(C) Risks

The key challenges and threats facing cementing as a service-and-production segment involving service and manufacturing – this mostly affects the Russian cementing service co’s and contractors – is that it continues losing its profitability and competitive ability compared to other services and technologies which have a stronger impact on efficiency in well construction (muds, completions and other). As a result of this, these segments would expand their share in the drilling cost structure at the expense of the cementers and lower the attractiveness of the capital investments into development of new cementing technologies.

It was considered above how the application of drilling muds and directional drilling services are making it possible to leave out the intermediate casing and, thus, reduce some part of the cementing market value. With regards to horizontal wells, the role of casing (including the integrity of the wellbore) is taken by alternative completions solutions, including swellable packers, gravel packs, completion fluids and some other solutions. The remedial cementing jobs are, as before, continue to be predominantly based on the use of cement in their absolute majority, although a number of techniques based on other materials (resins, gels, etc) are applied as well.

Globally, the mutually interrelated oilfield service segments – (a) casing running and cementing, (b) process fluids for drilling and completion and (c) equipment and services for completion – are balanced in their volume, they have commensurate market size for each of these is in the range of 8.5 to 9 bln. US dollars per year.

“The Price of the Issue”

One of the key strategic risks for oil production companies is in the loss of their product (produced oil) and short-term profit. On the other side, this is also a resource for enhancement of efficiency. The main operational risk, related to cementing, is in the loss of well integrity, which would be followed by a drop in production performance.

The losses from new wells (foregone income) due to their increased water cut following the loss of well integrity can be evaluated based on the data and assessments of production from the new wells, the operating expenditures of production and an increase in water cut due to loss of well integrity and water influx. Prudent estimates of the volume of losses on the all-Russian oil production amounts to not less than 15 bln. rubles per year, which corresponds to approximately half of the size of the Russian first cementing market.

Losses from old wells (in the process of their operation) following the loss of their integrity takes place through complications and downhole incidents, the reduction in the average life of a well, a larger number of corresponding workovers (traditionally have a low level of effectiveness), impaired efficiency of formation pressure maintenance system (waterflooding).

It is possible to apply an integral estimate, as a case study, characterizing the state of operating well stock, which was formed in Surgutneftegaz during the period before the system changes in the quality management (at the end of the last decade) were launched: the number of wells with serious loss of integrity, having significant consequences for their production performance, ranged from 40% to 80% spread among different subdivisions, that is, it was not less than 50% as an average.

An example of how high the cost can be, for mistakes in risk management, with regards to the loss of well integrity, is the accident at the drilling platform Deepwater Horizon (2010). According to the estimates of experts, the amount of financial harm for the BP, the Macondo field operator and the well construction service companies exceeded the amount of savings during cementing for not less than half million times, ignoring the cost to life that occurred.

(D) Opportunities and Development Options

The cementing market size forecast (in monetary terms) requires a multi-factor case-based analysis which is beyond the objectives of this article. The market growth rates would reflect the fundamental trends of Russia’s oil production industry, including the expansion of the drilling volumes and the increasing complexity of it, the ageing of the well stock, as well as the potential of cementing, as a technological operation, to compete with other technology solutions. Technological competencies and managerial approaches of oil production companies would play a very important role..

The outlook for the future dynamics of the number of operations displays a high degree of uncertainty in primary cementing, although it is possible to more definitely forecast the growth of the operation cost while the increase in the cost of jobs is a much more substantiated forecast. This is possible due to the use of more high-tech and costly solutions for well cementing implemented under complicated conditions, as well as due to transition to the development of the hard-to-recover reserves.

Those complicated conditions include, on the one side, geological and technical conditions: abnormal pressure, temperatures, high sulphur content, close location of formations which causes cross-flows, increased pressure between different-pressure formations and some other factors. On the other side, the impact of climatic conditions gets stronger (permafrost, increasing level of temperatures, which creates the problem of melting permafrost), if we take into account the location of the new and perspective areas of oil production in the arctic conditions.

The realization of the potential contained within the secondary cementing market, in many ways, depends on the changes in the oil production companies’ management systems which would allow, in a technically and economically correct way, to justify the use and development of both the standard and high-tech solutions in the field of squeeze cementing jobs.

The dynamic development of the cementing market largely depends on the inclusion of this technological operation into the “logics and mathematics” of the capital investment efficiency enhancement in well construction (with account of the primary period of well operation, including the squeeze cementing jobs performed at this stage), it also depends on its functioning as a factor of the cost reduction in production (not only in the the supply prices). This requires the use of a mathematical apparatus of risk analysis, with regard to well casing, as well as the refinement of the criteria making it possible to quantitively estimate the performed jobs, with account of all of the well operation cycle. As a result of this, vendors of equipment and services in the field of cementing, because of their understanding of the customer’s specific, digitized priorities and objectives, would gain a chance to more accurately and effectively propose their solutions contributing to the enhancement of the efficiency during the stages of well construction and operation.

The fundamental truth has been in the fact that, fundamentally the development of technologies for Russia’s oil producing industry – as well as for that in the rest of the world – remains the basic business of the supplier companies.

Digitalization is one of the current priorities for oil companies today. Technologies of this kind have been actively used or approbated with regard to a number of production processes and technological operations. The spheres of well casing and cementing face serious challenges in terms of the information support of digitalization and very unequal data quality seriously hinders the application of solutions from the sphere of machine learning. The authors and some experts interviewed by us are unaware of the implementation of such kinds of projects at present.

Synergies and Business Models

The use of business models, based on the integration of various oilfield services, having synergetic potential due to reduction of cost, growing sales and development of technologies etc., can be a perspective way to enhance the economic efficiency of cementing as a business.

The above mentioned trends of the cementing market development create conditions for the Russian oil service companies to develop their business through inclusion of the services of cementing (first of all, primary cementing) into the line of oilfield services, would provide the efficiency during well construction. Such an approach has been conventionally practiced by the international oil service companies worldwide, and has been applied at the regional markets as well: an example to that is the PetroAliance company (owned by Schlumberger), operates the largest number of cementing fleets in Russia, and provides the directional drilling services, drilling motors, drilling muds and the drilling bit services alongside that. Cementing is a part of the service portfolio of Integra, if we look at the Russian companies dealing within the range of oilfield services.

The approach, which is mainly applied for in primary cementing, is making a proposal to develop a full-cycle cementing services portfolio, that is a complex (integrated) service for well casing, which includes cement injection, rigging and cement jobs equipment, cementing blends from domestic development and production, services and tools for landing casing strings, for supervision. Similar models, with various degree of completeness, are demonstrated by Weatherford on the Russian market, as well as several middle-size Russian contractors of cementing services.

The approach that is applicable for primary, and especially for the secondary cementing market, is logically in the business model which the services related to pressure pumping are grouped together, namely, the hydraulic fracturing and cementing (in preparation for hydraulic fracturing). The focus of this model is on the efficient application of equipment. This approach, among the major international oil service companies, is demonstrated by Halliburton (the world leader in hydraulic fracturing and cementing), and in the Russia – is PeWeTe, a company with international reach but is focused on the markets of Russia and the countries of the CIS (hydraulic fracturing and secondary cementing).

As for those business models where the synergetic potential between the services is unavailable or limited, oilfield service companies are likely to dispose of their cementing businesses in the future, especially under conditions of a broader use of separately contracting services in the process of well construction (as for the customer companies, their approaches significantly vary here so far). This refers to drilling companies, first of all, where revenues from cementing services income amounts to single percentage points of their revenues (BKE, SSK, Tatburneft).

Conclusions

1. The need to enhance the efficiency of drilling operations led to considerable changes in the cost structure of well construction costs. Most of the growth in investment went to the types of services that offer their innovative solutions that contribute most to the performance indicators. The well cementing segment does not refer to the leaders of that growth, due to relative conservatism of the technological solutions, applied there.

2. One of the main reasons for this situation is the absence of the practical use of criteria for evaluating the quality of cementing jobs that take into consideration the well’s operation during the stages of completion and production. This causes a systemic problem to justify the economic effect of using a technological solution and thus it causes a lack of opportunity and stimuli for cementing technological development in the oil service companies.

3. The current changes in the design and construction of wells (in particular, the growing use of horizontal wells and of two-string constructions) make it possible to more effectively manage the balance of risks and economic efficiency. In a mid-term perspective, this may boost demand for highly effective technology solutions in cementing, and, as a result of this, increase the attractiveness of this segment for developers and vendors of innovative technologies, services, equipment and materials.

4. The dynamics of demand will be determined by a number of different factors. The fundamental factors comprise of: the growth of drilling volumes, the increase in the cost of jobs and the ageing of the operating well stock. Competition with other oilfield services and some certain aspects of well management become the key risk factors.

5. Russian oilfield service companies need to seriously increase their competitive ability to hold onto and increase their share of the cementing market, which is going to be under growing pressure from the international oilfield service companies. One way to raise competitiveness lies in the application of business models, that unlock synergies from different technological services (ie fracking).

6. The field of well construction contains great potential for management-related solutions to enhance efficiency and performance. To release the potential, it requires all the professional stakeholders to have a comprehensive discussion of these issues. The authors will plan to cover the management-related range of issues specificlly for well casing and cementing in our second part of this article in the next issue of ROGTEC.

Author:

Victor Gnibidin, Samara State Technical University, gnibidin@gmail.com

Sergei. Rudnitsky, Oil & Gas Industry Consultant, sergeir2001@mail.ru