Customer Centricity as a New Competitive Advantage for Russian Oilfield Services

The global and Russian oil production sector is undergoing profound changes and as these new challenges gain momentum, they will demand certain management transformation changes from all the industry players, including oilfield service companies. The article presents the summarized results of the application of customer-centric approaches within the oil services sector, as well as the experience of implementing customer centricity in Gazpromneft-Nefteservis.

1. Oilfield Services Sector in Russia

The Russian oilfield services sector (hereinafter referred to as OFS or oilfield services), in the context of this article, comprises of a range of technological services applied for oil and gas production in the field. The Russian and worldwide oil and gas industry, especially where onshore fields are concerned, has a prevailing business model where equipment and materials (for instance, bits, telemetry systems, drilling muds, pumps for artificial lift) are commercialized through service rates, based on footage, usage period or other parameters. Construction and maintenance of infrastructure (roads, well pads and other facilities) is considered beyond the scope of OFS.

Market Size and Dynamics

In the pre-crisis year of 2019, the size of the worldwide OFS market ranged from $220 to 270 bln USD, according to specialized expert agencies (Rystad Energy, Spears & Associates, Westwood Global Energy). The USA, China and Russia are comprised as the “big three” major OFS markets. In 2020, the worldwide OFS market went through a very steep decline: market volume declined about 33%. The US market nearly halved during this period (-48%).

The Russian market was valued in 2019 at between 1.5 trillion rubles (estimate by the Ministry of Energy) to 1.8 trillion rubles (estimates by Deloitte, Vygon Consulting). In 2020 the market fell, measured in rubles, by a range of 10 to 15%, according to different estimates. It is indicative that the decline in production drilling footage, which is the key OFS segment, amounted to 1.3% in 2020 compared to the previous pre-crisis year of 2019. Such dynamics, which are relatively favorable for the conditions ща crisis, took place in spite of the fact that the government program for drilled but uncompleted wells aimed at supporting oil production and oilfield services had not been implemented (for details, see article: Drilled Uncompleted Wells in the Context of Energy Strategy, ROGTEC, September 2020).

In the period to 2030 the worldwide OFS market the outlook for growth in monetary terms is CAGR (compound annual growth rate) of about 3%, according to a Rystad Energy estimate. The 2019 pre-crisis level is expected to be achieved from 2024 through to 2025.

In the medium-term, and especially in the long-term perspective, the OFS industry globally and in particular in Russia would have to find its own response to the challenges brought about by the global energy transition, including those coming as a chain effect from the oil and gas producers.

We follow with a discussion of the key structural features of the OFS market and related trends which are of most relevance to the core topic of this article.

Mass market and hi-tech segments

The mass market segment of OFS typically involves the use of high cost assets, such as drilling rigs, hydraulic fracturing and cementing fleets. Procurement in this segment is largely implemented according to tender procedures and uses design solutions presented through technical assignments. As a result, the service is usually standardized (‘commoditized’) and competition is to a high degree driven by price.

The share of hi-tech services is growing incrementally which suggests a more active role of the service supplier in the development of technical and economic solutions. This aspect has special significance for the practice of customer centricity which will be highlighted in the following parts of this article. Traditionally, major international OFS companies have been prevalent in this segment on the Russian market; the role of Russian suppliers has been increasing in the last several years.

Competitive Market and Internal Services

Alongside with the competitive segment of the OFS market which has opportunities open for every supplier that complies with uniform qualification requirements, another significant segment has market competition in various ways limited or adjusted through participation of affiliated service companies or units. Those of them that are controlled by vertically integrated oil companies (VIOCs) form the segment of internal service providers.

The VIOCs’ internal service companies are the strongest in drilling contractor services. In 2020, more than half of the industry’s total production oil wells were drilled collectively by the subsidiaries of Rosneft and drilling units of Surgutneftegaz. Rosneft, the largest drilling services client in the industry, has almost reached its stated goal of covering 70% of its drilling volumes through in-house drilling contractors.

Other OFS segments are far less penetrated by internal services and affiliated companies. Such segments include well logging, directional drilling services, hydraulic fracturing, workover services, among other.

Customer – Contractor Relationships

The Russian oil production industry widely applies the so-called split services model. Under the split services system the customer exercises direct control over the well construction process, which includes fully developing the well design, drafting the technical assignment, splitting the service components that are individually brought to a tender, and further controlling implementation (directly and/or through supervision contractors). By using this approach the customer aims to control and reduce well construction costs.

Split services involve an asymmetry of information where a contractor has very limited access to data and information on the technical and economic parameters, as well as on the results of the work performed. This can pose significant technical and motivational barriers for service and equipment suppliers to develop more efficient solutions. Considering the challenges faced by the Russian oil production industry, such a condition has the prerequisites for transforming the customer-supplier interaction model, while also driving introduction and application by OFS companies of advanced management practices, including customer centricity.

2. Development of Customer Centricity Worldwide

New realities and challenges

Presently, people routinely use convenient banking applications, services involving goods delivery, taxi, healthcare. Companies supplying all this have over many years been researching, creating and continuously improving service quality and delivery speed, but beyond that they aim to create the best customer experience for their clients. It is often the customer (client’s) experience that becomes a major competitive advantage.

At the same time, service users also find themselves involved in B2B relations, since they can be corporate employees, as well as buyers and users of products and services supplied by companies operating in the real economy. Increased expectations are transferred to the workplace and present a new challenge for companies of the real economy that traditionally have focused on developing production, improving workplace safety and enhancing sales operations – that is, to improve customer and employee satisfaction through improved customer (client’s) experience.

Such state of things presents to the real economy not only a challenge, but also an opportunity to optimize business processes and increase profit due to development of new products and services that fit the needs of clients and employees.

Definition of Customer Centricity

The central concept of the customer centricity (CC) is the need. Around its identification, satisfaction, monitoring and management the business model, tools and products are designed. In the focus of the customer-centric model is the ‘need holder’, who is not identical to the buyer (or client) that is part of the client-oriented (CO) system of relations. The CO approach sees priority in assuring quality of the product and aftermarket service, which is already a mastered stage for most managerially advanced companies.

In a customer-centric company those are customer needs that determine development priorities, business processes and the content of products and services. The internal resources of such organization are consolidated in order to create value for the customer, to meet his needs and deliver the best customer experience. The development and rework of products and services is based on researching the customer, iteratively testing changes with the users, continuously collecting data and feedback on how products and services are used, as well as collaboratively working with the customer on developing new services and modifying existing solutions.

Outlook for the Customer-Centric Approach in B2B

Currently the share of companies in the B2B segment which are introducing customer-centric principles in their business models is small. However, the experience of B2B companies points to areas, where advantages of applying CC could become significant:

1. The customer-centric approach helps optimize the workflow within the company: having identified the customer (user) and the value important for him, all of the involved units structure their work more effectively and are guided by a set of priorities.

2. Increased customer satisfaction allows to strengthen long-term partnership relationships and to obtain ahead of other companies information about the strategic goals of clients, planned projects and other important aspects.

3. Developing tools for collecting and processing customer feedback allows to identify problems in advance, reduce costs and increase customer loyalty, while also applying a predictive approach for developing solutions that are ahead of the market and have the potential for scaling.

4. Promoting CC principles and culture across a company allows employees with various roles to use feedback and knowledge of the counterparties’ needs for optimizing the company’s products and services, which in turn leads to development of new directions for business and to graeter competitiveness.

5. Customer centricity that is embedded in services focused on internal customers (employees, divisions, partners) has great importance for optimizing corporate processes and raising the attractiveness of the company for its employees.

The Customer Сentricity Toolkit

The customer-centric approach contains techniques aimed at defining, identifying and, as a result, satisfying the user’s needs. In international practice, the most important and widely used client-centered tools for measuring satisfaction that have proven to be effective and informative are the following:

• CSI, Customer Satisfaction Index, is an indicator that integrates evaluation of company in terms of its products/ services and interaction with customers.

• NPS, Net Promoter Score, is a customer loyalty index that is generated based on the customer’s readiness (appraised in points) to recommend a product/service to his/her professional or personal circuit.

Being quantitative instruments, the CSI and NPS indices aim at raising to a new level the reliability of service evaluation in terms of customer satisfaction and loyalty. They can be used as a basis for comparing various services, performance of corporate units, as well as the company’s position among competitors in terms of existing clients’ loyalty (benchmarking). These instruments display the current perception of a product or a service, although they do not point directly at the roots of identified problems. Quantitative research is like a thermometer: high temperature may point at a certain problem, but to understand its causes one needs more thorough diagnostics. Even having a broad list of ‘symptoms’ obtained from customers’ and employees’ comments, is not sufficient for understanding what must be changed, unless such comments are sharp and straightforward. Feedback from a single source often may be inconsistent, may relate to different touchpoints with a service, and at times even be self-contradictory. In order to develop and redesign products and services with focus on customer experience, multifaceted approaches are used that make it possible to understand barriers in place, identify customers’ underlying needs and expectations, which eventually allows to form a competitive advantage for the company.

Customer Centricity Methods (Frameworks)

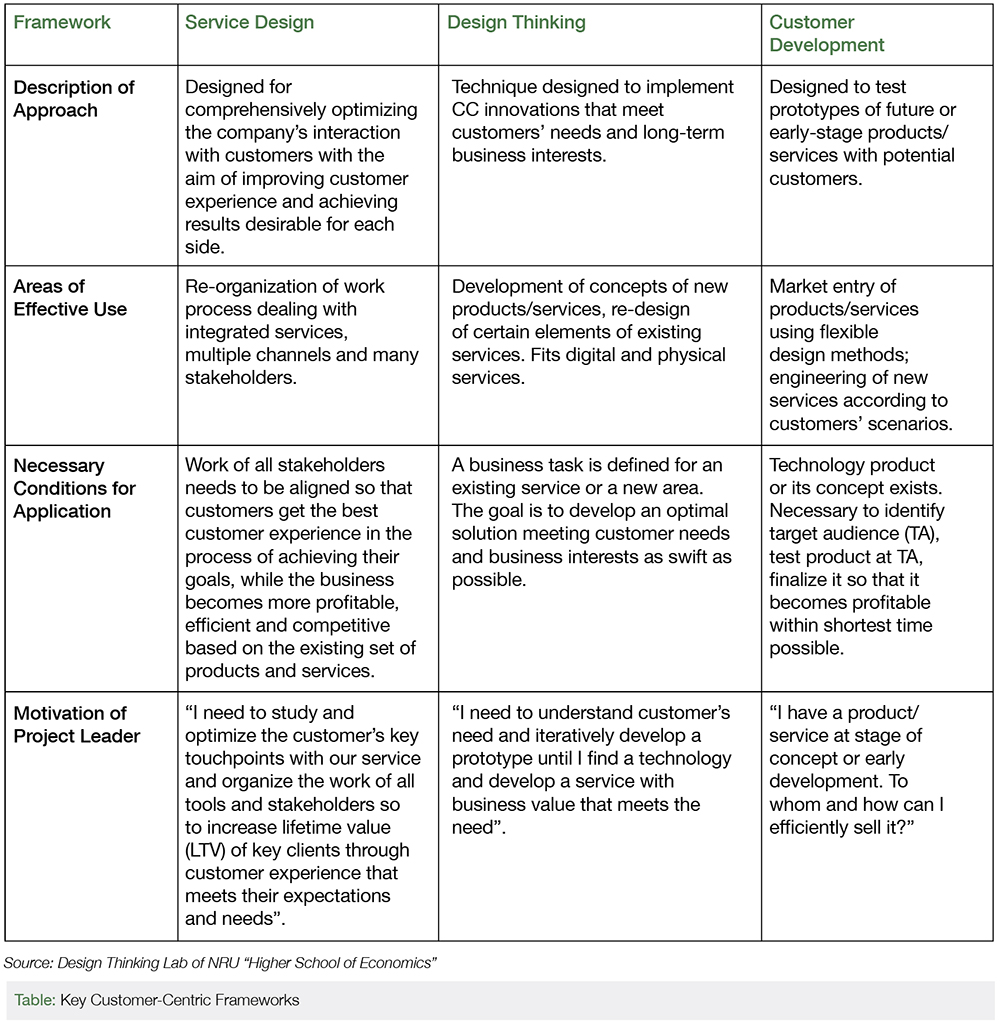

A large number of customer-centric practices and methods for dealing with products and services coexist on the market. Many approaches borrow practices and tools from each other, while some are in fact rebranded versions of mature approaches. The approaches that can be singled out as most developed and have the best track record are Design Thinking, Service Design and Customer Development. In fact, they have much in common and employ similar toolsets. At the same time, Service Design and Design Thinking differ from Customer Development in the following significant aspects: the first two aim at developing and perfecting services based on knowledge of customer’s needs and discovery of appropriate solutions, while Customer Development pays greater attention to finding the target audience for a product.

The table below illustrates how the approaches differ in their goals, conditions and areas of effective use.

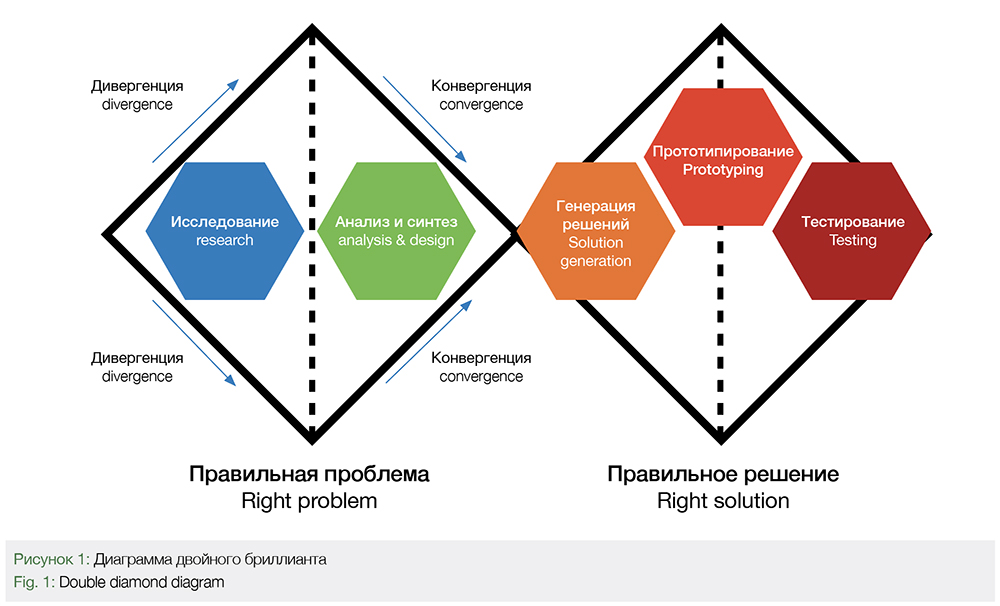

Development of Customer-Centric Innovations

Despite certain differences, the considered approaches use similar toolsets and structures in order to develop and introduce customer-centric solutions, as well as to ‘over-record’ customer experience so to accommodate the customers’ needs. The way work over customer-centric solutions is structured can be illustrated using a double diamond diagram below.

3. Developing Customer Centricity in the Russian OFS Sector

The following overview of how CC is practiced is based on research initiated by Gazpromneft-Nefteservis and conducted in 2021 by a team comprising experts from the Design-Thinking Lab of the Higher School of Economics and an oilfield services industry consultant. Over the course of research interviews were held with the representatives of Russian and international OFS companies active in the Russian market and comparative analysis (benchmarking) was performed based on the results of the interviews.

The Russian OFS companies that took part in the research have annual revenues ranging from several billion to several tens of billions of rubles. All these companies are private, except for the ones who are part of a VIOC. The interviews were held mainly with top managers of deputy general director level in charge of strategic and organizational development.

International companies were represented by all of the ‘Big Four’ OFS majors. Interviews were conducted with mid-level managers at Russian units with responsibility for developing CC – either in a dedicated role, or as part of their main function (e.g., marketing).

The research also relied on information received from several Russian OFS companies via written questionnaires.

The results presented below are grouped by several main topics. Quotes from the interviews were selected to illustrate certain key points, shown in quotation marks.

Who and how launches CC development in a company

In the Russian companies, the initiator of the development of the customer centric approach is nearly always the top executive supported by a team of top managers, who are often guided by their prior experience of mastering and introducing management approaches and practices. Such practices typically include lean manufacturing/management and quality management systems (especially where implementation of ISO-9001 was thoughtful and consistent), in a few individual cases it was the Toyota production system (TPS) and the product-based approach.

The experience of Gazpromneft-Nefteservis can serve as an example of the use of the latter, to be highlighted in a separate section of this article.

➣ “As the cornerstone approach we use ISO 9001-2015, which has the requirement for measuring customer satisfaction”

For those Russian OFS companies where top management has had previous experience of work and training at the ‘Big Four’, management practices mastered earlier serve as a foundation. However, it does not necessarily provide them with a greater edge over other Russian companies, since CC development among international OFS companies is a relatively recent thing, even at head office level. At the level of regional operations in Russia, CC practices started being introduced just a few years ago.

The leadership role of top management, especially if played by owners (co-owners) of the business, is an essential prerequisite for launching the CC process, and is also a key condition for its further successful development.

➣ “Without the leadership of top managers you really can’t count on success with customer centricity”

Introduction of the customer centric approach at the Russian units of international OFS companies is typically part of a corporate-wide process. Based on the methodology developed at the head office level and tested at both the corporate and local levels, a CC ‘foothold’ is being formed at a company’s regional business. Leaders come forward, followers join, and centers of competence are created. Further on, a learning process is organized, relevant KPIs start being introduced into incentive systems, and the process develops in scope and depth. Senior operational management may be or may be not heavily involved in this process, especially at its initial phase.

Prerequisites and drivers of CC development

At the personal (subjective) level, the situation substantially differs for the Russian and international companies.

Introduction of CC at the Russian OFS companies may be evolutional, backed by management experience (as mentioned above). It can also be launched due to a cardinal change in the managers’ thinking, as well as due to their rotation – as confirmed by some of the interviews. Such a change may result from a critical volume of insights being accumulated by a manager, backed by a growing acute awareness of the developing challenges ( unprecedented speed of change and related risks), limitations (among them, cognitive biases and information barriers) and opportunities (resilience, speed and flexibility as factors of efficiency).

Among the international OFS companies the process of introducing CC is centralized, and subjective factors do not play a significant role in decisions on launching it.

The objective prerequisites and drivers include the key industry factors, understanding the impact of which leaves no chance for companies to remain the same. Several of the most important factors were touched upon in section 1, above.

In the area of relations between oil & gas companies as customers and OFS companies (as contractors, one of the key factors is the typical information gap (asymmetry), which takes place when a customer, due to various reasons, does not provide the contractor with information on the results (performance) of his work, as well as with other essential information beyond the framework of the technical assignment. In essence, this represents a key barrier for the contractor to gain specific knowledge about the customer’s needs.

Another important barrier for identifying such needs is the system of managing procurement and contractors through so-called split services (see section 1), which focuses on managing pricing and is aimed at cost reduction (purchasing prices). Such a system puts a service provider in a very rigid execution framework and does not motivate him for development of integrated solutions.

➣ “Buyers don’t appreciate integration, they want to dig into the cost structure, pressure the contractor, so they take apart what’s integrated into components, and then the preferred way is to take each of them to tender. While initially we are capable of doing it in an integrated way – but this is not really in much demand in the current market conditions”.

➣ “Once you have a tender, it’s too hard to change or propose anything”.

The customer centric approach has a set of techniques that aim at identifying a need, including those when one literally “listens up to it”, and then “gets through to it”. In one of the interviews, it was described as the “listen up and react” approach.

Customer centricity in principles, values and documents

Reflecting the customer centric approach in documented values and principles is typical of the Russian OFS companies. Most often, the term “client-oriented approach” is used, which may be conveying a strong emphasis on values, while CC is seen as more instrumental, also being less familiar to players in the Russian OFS market.

International OFS companies have CC featured in the strategy of the parent companies, from where CC practices cascade down to the regional level, including Russian operations.

➣ “The head office is the customer centric center where our team is based along with those whom we hired to support it. It’s not easy to introduce this culture throughout the regions, which is why we need regional teams whom we coach”.

As CC develops further, it starts to be applied to the company’s units, the employees, and in some cases, even contractors.

➣ “The cooperation and collaboration approach extends to both the external clients and the internal divisions of the company”.

➣ “If the company’s management does not aim at keeping employees’ satisfaction at a proper level, it’s problematic to develop the external client-oriented approach of a business”.

Customer Centricity Practice

At the practical level, the customer centric approach presumes iterative work with the need by identifying it, satisfying (through delivery of value), measuring customer’s (stakeholders’) satisfaction on a regular basis, and further development on this basis.

The opportunity to identify the need is a key criterion by which OFS companies grade their clients by value. Differentiation is typically done by using the categories of “partner” and “buyer” (or “client”).

A partner is the client who provides the supplier with an opportunity to view the project through his (client’s) eyes, from the standpoint of his interest. In practice, this involves providing the supplier with knowledge about the operational goals and directions towards achieving them. Also, the supplier may be brought in – in various roles, from observer to advisor – to take part in developing solutions for specific objectives and projects. Different forms may be used for such work including joint technical consultations, pilot testing, collaboration with design institutions, as well as other activities aimed at designing solutions.

➣ “Now we are not putting everyone on the same shelf in the same manner. The purpose is to build up that experience with the customer through which he would become our partner – in case mutual reciprocal cooperation takes place”.

➣ “On an ongoing basis we have projects running that are at the juncture of us and the customer. It happens that the customer comes forward to tell us about our service, “Let’s improve it”, and together as a team, we work to enhance the efficiency of our operations. And both the customer and ourselves win”.

Partnering in this sense is considered by OFS companies to be a key factor of competitiveness. Developing partner relations systematically – through technological partnerships, as an option – represents a strategic advantage and a foundation for successful sustainable development.

➣ “If the customer is open for cooperation, there emerges the possibility to discuss how to make the work more cost-effective for us and faster and more efficient for him”.

An alternative way for a supplier towards understanding a customer’s need is to develop assumptions based on his strategic objectives. The research revealed that in practice this approach is often hardly reliable, since strategic guidelines may be far from real life, may be interpreted ambiguously or may manifest themselves in ways that the supplier is not able to predict.

However, the goal of providing an equally high level of service to every client – which is at the core of the client-oriented (CO) approach – remains fully in place.

The interviews with OFS companies show that the most frequently used CC techniques (frameworks) are Design Thinking (mentioned un 25% of responses) and Customer Development (11%). Such figures indicate that the OFS sector is at an early stage of adopting the customer-centric methodology.

Measuring customer (stakeholder) satisfaction from a supplied solution is, in essence, measuring the degree of ‘hitting the need’. The interviewed OFS company managers consistently demonstrate the approach that measuring customer satisfaction is viable predominantly with the clients who fit into the category of partners, which reflects the realities of the Russian OFS market. This approach takes into account that feedback-focused work is time-consuming and requires specialists with a rare skill profile.

The practice of conducting measurements and applying metrics for management goals is at an early stage at OFS companies, international ones included. The most broadly used method for obtaining information on customer satisfaction is face-to-face personal communication (interviews, one on one discussion, etc.). Surveys are also used, yet some respondents tend to view them critically: “we practiced it earlier, but then abandoned it because of the distortion caused by the ‘human factor’”.

The Customer Satisfaction Index and Net Promoter Score indices, widely used internationally, are very rarely applied on a regular basis on the Russian OFS market, mostly by international majors. However, certain Russian OFS companies use indicators that they have developed on their own, which in essence are similar to CSI. One of the Russian companies has a metric named Client Satisfaction Indicator (показатель «Удовлетворённость клиента») that integrates and evaluates the customer’s perception of the following: service quality, client relationship quality, degree of need satisfaction. Many OFS companies, both international and Russian, apply indicators that reflect the client’s readiness to provide written recommendations or share experience of successful cooperation through industry-focused media. As such, these indicators could be seen as more basic analogues of NPS, since they don’t reflect dynamics.

One of the most important tools for evaluating satisfaction and analyzing customer experience is the Customer Journey Map (CJM). CJM is both an analytical instrument and an interface for building relations with a client company and the customers (stakeholders) within it. CJM is very rarely used among OFS companies on the Russian market, yet there are known cases of pilot implementation, more details in section 4.

The Corporate Infrastructure of CC

Dedicated competence centers in one or another form – from individual employees to small units – are functioning within some international OFS companies where CC has been embedded into the parent company’s strategy. The interviewed Russian OFS companies have no competence centers for CC, while some do not see a need for them, since the prime drivers of CC (just like of COA earlier) are considered to be training and corporate culture, with some role for marketing.

4: Customer-Centric Business Model in Gazpromneft-Nefteservis

Current approaches for Implementing Initiatives in Gazprom Neft

Three key approaches, all of them complementary, are currently applied in Gazprom Neft and Gazpromneft-Nefteservis:

• Process based approach. The essence of this approach is in viewing the functioning of an enterprise as continuous execution of certain interconnected types of activities, viewed as processes. A process (business process) is understood as a consistent purposeful set of actions which follows a certain technology to transform inputs into outputs that contain value for a customer. Criteria for choosing this approach: low level of uncertainty, cyclical, part of current operations.

• Project based approach. Routinely used in most companies, the project approach rests on three pillars: timeframe, budget, and defined end result, usually formed at the start of project. Project implementation stages follow each other, while skipping stages or returning from later stages to previous ones in order to adjust the approved technical assignment is not permissible, since

any changes would pose a risk to the entire project. Criteria for choosing this approach: Medium level of uncertainty, time limitations (time to achieve goal is defined), initiative is not part of current operations.

• Product-based approach. Under this approach, the company’s entire activity is transformed into a given number of products that are managed in the logic of an assembly line – from emergence of business opportunity to transfer of implemented initiative into operations and its management as a process. When transferring from earlier product to next, the so-called incremental value is

measured; it should be reaching maximum target value at the end of the ‘assembly line’. Criteria for applying this approach: High level of uncertainty, time limitations (time to achieve goal is defined), initiative is not part of current operations, extensive scale and prerequisites for scalability of developed solutions1,2

The outlined approaches co-exist in Gazprom Neft and are applied according to how the initiative fits the criteria described above. However, several key questions emerge. How and on what basis is an initiative formed? Is implementation of an initiative according to a chosen format (approach) feasible for the end-customer? Does it fill the customer’s need?

Customer-Centric Business Model of Gazpromneft-Nefteservis

To address the questions posed, the decision made at Gazpromneft-Nefteservis was to “take a step back” and, prior to choosing one of the three approaches, introduce the fourth, customer-centric approach (see Figure 2). As a “zero-level approach”, it makes possible to identify customers’ needs and on this basis to design new products, re-design and develop the company’s existing products and services. Thus, the following sequence is structured: Customer (need) ➤ Product ➤ Technology ➤ Business.

As part of the customer-centric approach, Gazpromneft-Nefteservis conducts quarterly monitoring of CSI, runs training in Design Thinking and applies it for developing new products and services, and is in the process of introducing a new customer-centric tool – the Customer Journey Map, CJM.

CJM visualizes a stakeholder’s experience in achieving an important result. Such maps can reflect both a real and ideal journey for a customer. CJM makes it possible to decompose an integrated service, to see the significant elements or recurrent actions that form a general perception of the service, and to start making changes from there. Equally important is finding and removing critical barriers in interaction with the customer, and creating more positive experience.

CJM delivers most value when applied in a successive and systemic manner:

1. Product/service owners visualize through CJM their own notion of the current customer experience and of the sequence of events when interacting with the product/service – this way, the CJM “INSIDE OUT” map is formed.

2. Based on observations, interviews and other studies of the existing customer experience, the CJM “AS IS” map is drawn, which reflects interaction with a product/service from the standpoint of a customer.

3. Using all information obtained, the CJM “TO BE” is formed, which is the CJM of ideal interaction. On its basis a product/service owner jointly with his customers forms a strategy and a plan of corresponding actions aimed at implementing the ‘best customer journey’.

CJM “TO BE” maps can also be used in the process of developing new products/services. In such case the CJM «AS IS” is drawn based on the study of the customer’s current sequence of actions that are being undertaken in order to achieve a required result.

1 Organizational Transformation (https://www.gazprom-neft.ru/press-center/sibneft-online/archive/2020-february/4255115/)

2 Alexander Sitnikov: «Product-based approach helped us see the main things», “Siberian Oil” (Sibirskaya Neft) magazine, Issue №178 (January-February, 2021) (https://www.gazprom-neft.ru/press-center/sibneft-online/archive/2021-january-february/5287838/)

Authors:

S.V. Rudnitskiy, Partner, EnEx Consulting;

S.V. Manyugin, Strategy and Customer Solutions Chief Specialist, Gazpromneft-Nefteservis;

V.V. Chizhikov, Head of Strategy and Production Development Center, Gazpromneft-Nefteservis;

P.V. Voloshchuk, Head of Design Thinking Lab, Associate Professor, NRU Higher School of Economics;

A.S. Pligin, Project Leader, Design Thinking Lab, NRU Higher School of Economics