Deloitte: Challenges and Opportunities for the Russian Oilfield Services Market

Factors Shaping the Industry

Russian oilfield service companies operate in one of the world’s largest oil markets. This inevitably requires additional focus on external drivers, i.e. on how customers impact the nature of the oil market. Understanding these factors and how they affect the oil industry could help comprehend how the oilfield market in Russia is going to develop.

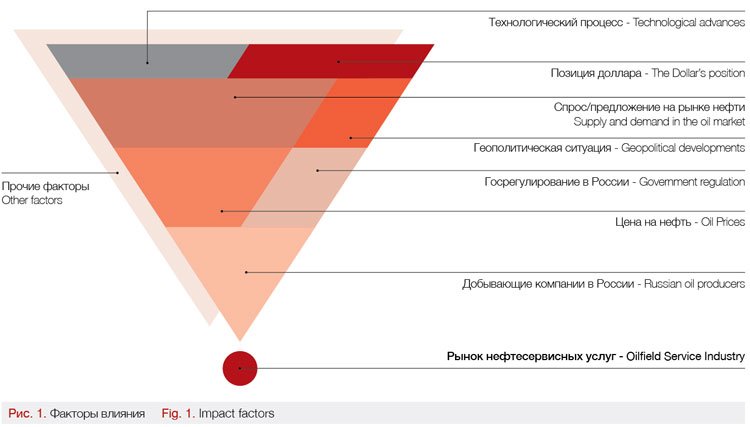

On figure 1 you can see a diagram of industry drivers, showing four key levels of external influences on the oilfield services market.

Russian oil producers represent the first level. This chiefly refers to vertically integrated oil companies (VIOC) that act as a consolidating force for the market, generate key trends and account for the bulk of demand in the oilfield service segment. Oil prices and government regulation are the key factors affecting VIOCs.

Existing geopolitical situation, which, in turn, influences commodity prices and government regulation, are obviously not the most optimal for the Russian oil and gas industry. The balance between supply and demand also play a role and can be influenced by technology development. One can mention shale oil boom as an example. The dollar’s rate is a critical factor as well because it is the dominant currency on the commodity markets.

Current State in Key Segments

Analysis of the current situation in key oilfield services’ segments allows to take a look at the industry drivers and barriers.

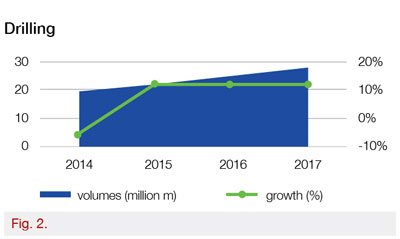

Drilling

To achieve production growth of 4 percent over 2014-17 an increase of 39 percent in production drilling was required. 2017 results are telling: to pretty much keep oil output at last year’s levels production drilling had to be boosted by 12 percent. This can only mean that for every tonne of oil extracted Russia needs to drill more and more.

In Russia, the OPEC+ agreement remains a key force limiting short-term growth in oil output. In the longer term, the competitiveness of Russian oil, especially in the context of low prices, suggests that the country has the potential to retain, or even strengthen its position on the global market, which will have positive effect on oil production volumes and production drilling.

Production drilling meterage data shows that Western Siberia is the place where companies are actively tapping into existing deposits. This region is also seeing an increase in horizontal drilling, enabling higher output from mature deposits.

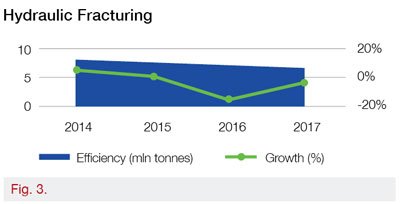

Hydraulic Fracturing

Following the sanctions and the exit of foreign providers, the market for hydraulic fracturing has seen a drop in efficiency. Unlike in 2013, when each hydraulic fracturing operation generated 1,430 tonnes of oil, in 2017 the figure was only 1,120 tonnes. This is probably due to technological gap that Russian providers are facing.

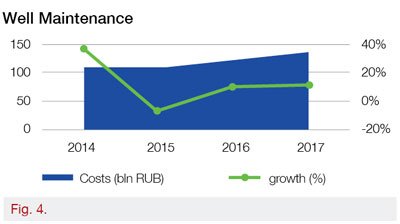

Well Maintenance

In 2017, well maintenance grew by 14 percent to 61 thousand operations, in monetary terms it increased by 13 percent. This can be explained by new Western Siberian exploration and injection wells that need maintenance operations.

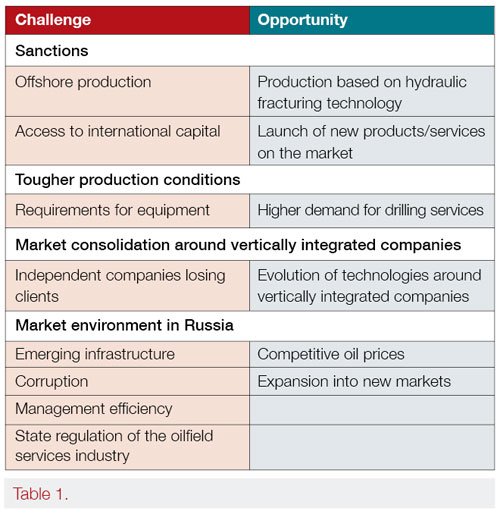

Table 1 shows key challenges and opportunities our experts have identified for the oilfield service industry. These challenges and opportunities stem from the factors that have the highest impact on the industry.

This includes sanctions, industry consolidation, production conditions (especially in Western Siberia) and local market specificities.

Many items in this table require specific technology solutions that are either nonexistent or to which companies have limited access, such as solutions

for offshore operations, hydraulic fracturing chemicals, etc.

It is interesting to note that the “Local market specificities” section includes “Expansion into new markets” as an opportunity (greater geographic reach, new products and services). We can actually see that many large independent service providers are increasingly taking steps to expand their geographic presence and offer non-core services. However, this may be a necessity resulting from the current market situation, rather than an indicator of growth.

Industry Outlook

In the medium term, our experts suggest three traditional scenarios: negative, neutral and optimistic.

The negative scenario is based on the following assumptions: technological advances lead to lower production costs in the shale oil segment, and bring prices down to a critical level; trade barriers between the United States and China lead to lower demand for Russian oil from China; sanctions get another boost consolidation continues in the Russian oil industry, As the result, similar consolidation developments happen in the oilfield service market, with oilfield service facing a choice to either go to new markets or to merge with one of the VIOCs. Many smaller providers could face bankruptcy, mergers, or search for new opportunities elsewhere, including in other industries.

Under this scenario, the market could shrink by 20 – 40 percent.

The neutral scenario involves the same factors. However, some of these will not act as barriers to the evolution of the oilfield service industry: technology advances would enable Russian companies to resume some of the suspended operations by leveraging local technology solutions; oil prices continue at the same level as there is no shale oil boom; sanctions continuing in force but there are negotiations underway to lift them; there is also no consolidation going on among the VIOCs.

That means that the market for services from independent providers would remain at the current level while its growth would be 10 percent lower than in the past four years.

This is a rather upbeat scenario where almost all the factors become growth drivers.

In this scenario, the sanctions are gradually lifted; oil prices grow, production limits are lifted or adjusted to a comfortable level; international players come back to the market; VIOCs award a lot of contracts to independent providers, with Russian independent service providers evolving in technological cooperation with international partners. The market is shared proportionally, there is healthy competition. Strategic investment projects become a priority.

Under this scenario, oilfield services market could grow by about 25-45%.

The most realistic scenario is the neutral one, other scenarios were designed by our experts to highlight risks and opportunities that could affect oilfield services companies.