Drilled Uncompleted Wells in the Context of Energy Strategy

The agreement on limiting oil production (OPEC+), reached in April this year, clearly indicated the need to improve the systems for managing the volumes of hydrocarbon production and supply. To address this task a decision has been initiated, at the highest State levels, for composing an inventory of drilled uncompleted well stock (DUCs) and developing a corresponding Government Assistance Program for DUCs (GAP).

At the time of writing this article the GAP was still being developed therefore it should be only judged on a basis of statements released by government officials and other organizations that have been involved in its discussion and preparation (i.e. banks, Chamber of Commerce and Industry). Right around the same time as the decision for development of GAP, the Russian Government issued a regulation that adopted the latest version of the Energy Strategy 2035 (ES-2035) which includes priorities for the development of the oil industry and related economy sectors.

The juxtaposition between ES-2035 and GAP (in its current unapproved state) considers, from a fresh perspective, a few key challenges and tasks which the Russian oil industry is currently facing as well as suggesting some approaches to developing solutions

for discussion.

DUC’s: General Program Outline

The Program to produce inventories on all of the DUC wells was announced in an instruction from the Russian President dated May 21st which followed on from the results of a conference related to the development of the Fuel and Energy complex which was held on April 29th. After this, it was reviewed by a State Sub Commission for Sustainable Economic Development (headed by First Deputy Prime Minister A. Belousov) and handed over to the Russian Ministry of Energy to produce the corresponding draft law.

At government level the following goals for GAP have been established:

• To ensure the ability to quickly restore production after the expiration of the restrictions agreed to within the OPEC+ agreement (April 2022).

• To support the oilfield service companies (OFS companies) in order to maintain their financial and production stability; to support equipment

manufacturers in order to keep their workforce and technological capacity.

Among the goals of GAP is to limit any shortfalls in the OFS company’s revenue to about 80% of their 2019 financial results while a 40-50% drop is expected if demand stimulation activities are not implemented.

To solve this problem, it is planned to provide preferential targeted lending (through subsidizing the interest rate) in the amount of 400 billion rubles. The loan terms are 1.5 – 2 years i.e. a deadline is about April 2022.

A strict legal definition of a DUC well is still to be agreed upon. In our opinion, wells that have not been fully completed and are in a condition that ensures the safety of the well in relation to the environment and maintenance personnel, it can be classified as uncompleted. In particular, the well construction process can be suspended after the completion of running and cementing of the intermediate or production casing, before perforating and performing hydraulic fracturing (hydraulic fracturing). It is expedient to interrupt the well construction cycle at this stage, which allows the contractor to replace some of the major CAPEX equipment (for example, using a drilling rig with a lower lifting capacity).

Strategic Context: ES-2035

On one hand GAP has the characteristics of response to an external circumstance and is particularly aimed at the recovery of oil production i.e. it’s intended to provide the flexibility required to prevent any risks from a decline in oil revenues. On the other hand, GAP is capable, and is probably meant to play a much wider strategic role as it reflects the key trends and goals related to Russian oil industry that have been indicated in ES-2035.

ES-2035 considers the following trends as its main points:

• The oversupply of hydrocarbons as a cause of low price levels

• The high uncertainty and often unpredictability of external conditions and factors affecting the development of the energy sector.

Thereby an increase in competition is forecasted which is based on an optimization of production costs along with an acceleration in trends which are fraught with sudden disruptions (various outcomes of geopolitics, alternate sources of energy and energy transition, ‘green agenda’ etc).

In this context ES-2035 sets the tasks to ensure the Russian oil industry’s: (a) sustainability (the minimal objective) and (b) innovativeness (optimal objective). Constraints and barriers that are blocking these accomplishments have been clearly drawn out, in particular – that the “current and anticipated domestic demand level for core products of the Russian fuel and energy is not sufficient for its innovation development.”

One of the main factors hindering the desired objectives is an absence in the Russian oil industry of a comprehensive mechanism for responding to a sharp change in market conditions (overproduction of oil). The whole crude oil supply system (from wellbore to marketing) lacks the flexibility demanded by the current economic environment, while determining this required level of flexibility amidst uncertainty and unpredictability is no simple task.

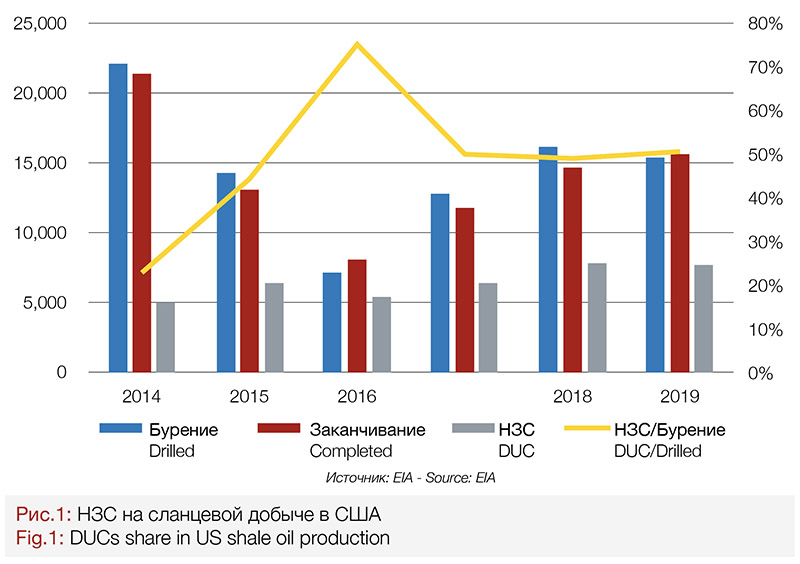

From this perspective GAP is meant to become one of the primary measures developed as a response to the major changes in the economic environment after a period of continuous oil production growth in Russia starting since 1998 (except slight declines in 2008 and 2017 – by 0.6% and 0.3% respectively). Referring to international oil production practice – most notably considering shale oil production (LTO) in US – it may be found that over a long period of time that DUCs in the US are already considered as an important part of a set of instruments intended to ensure system flexibility. As a response to oil prices downturn in 2014-2016 DUC´s share in US sharply increased from 23% to 75% and then stabilized at around 50% (Fig. 1).

For Russia it’s the first time in its history that she has had to face the necessity to control production, export and import volumes of crude oil and oil products, most major producers including KSA, Iran and US have continually coped with these issues. As a response to similar challenges these countries systematically developed mechanisms that provide significant systemic flexibility and stability in stressful conditions. Amongst them the most important are facilities for a long-term storage of crude oil and products (including at international locations) and high-tech export-oriented crude oil refining and petrochemical industries.

In comparison with the above-mentioned countries, Russia’s oil storage capabilities are much less developed. Capacities intended for oil storage and especially for an advanced oil refining require conspicuous CAPEX and significant time expenditures that pose a significant investment risk in the context of poorly predicted, long term, demand dynamics. This emphasizes the necessity to implement a wide range of available measures including the ones directly related to oil production.

As one of the key measures for providing sustainability and flexibility in oil production ES-2035 intends for the ¨commercialization of small oilfields, depleted and high water cut wells, hard-to-recover reserves (including the Bazhenov formation)¨, along with the ¨creation of favorable conditions for the development of small- and medium-sized oil production enterprises preferably on the basis of national innovative technologies and equipment¨ – i.e. the Strategy stipulates for development of small innovative enterprises within the national oil business. Beyond that the Strategy attaches a great deal of importance to a ¨Digital transformation of Fuel and Energy complex¨ including implementation of ¨industry digital platform-based solutions¨. Both above-mentioned trends will be further reviewed by their relationship to GAP.

Implications for the Drilling Market

The influence of GAP on the oil well drilling market could be estimated on its volume and structure.

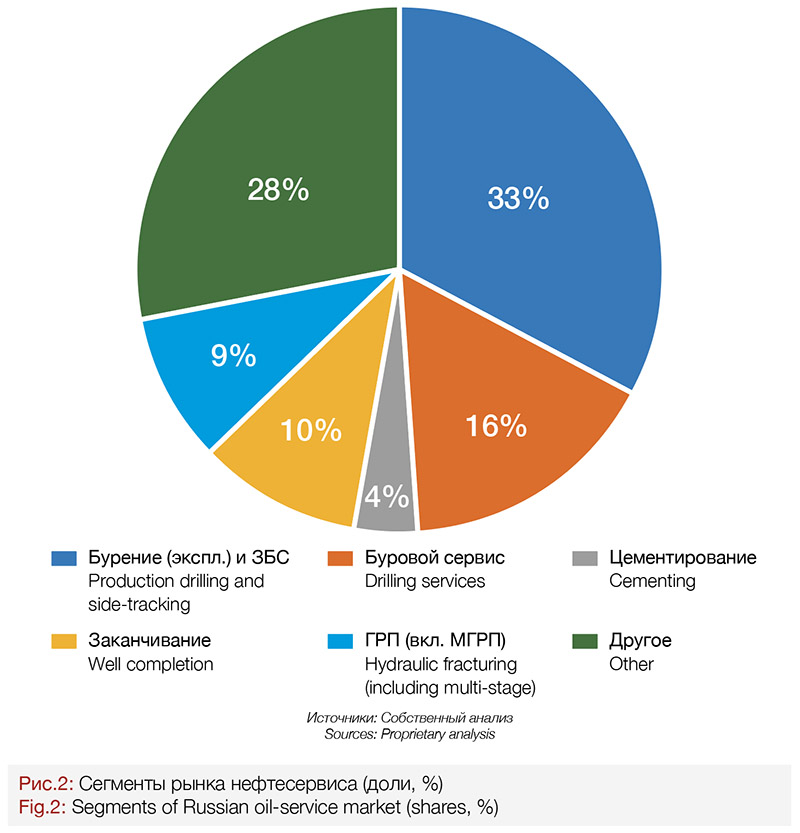

The financial scope of GAP (400 bln RUR) is equal to 27% of oil service sector’s annual revenue (estimated by RF Ministry of Energy at 1.5 tn RUR total) or roughly 50% of the annual drilling market (including services of drilling contractors, technological drilling services and cementing). Sidetracking is also regarded as a drilling operation in this context as the equipment used and the technological operations are similar (financing items are different).

The Russian drilling market can be subdivided into the following segments:

• by service profile: (a) drilling contractor’s services (drilling rigs and rig crews), (b) drilling technology services.

• by type of relationship with a contracting entity: (a) affiliated drilling companies, (b) independent drilling companies subdivided into large and medium & small-sized.

Market size of drilling contractors’ services (rental of a drilling rig with a crew) comprises roughly 33% of total oil services market.

Drilling technology services are represented with a set of high-technology products out of which services for realtime directional drilling (MWD,

LWD), drilling muds and drilling bits are the priciest ones. This segment comprises roughly 16% of total drilling market (the share is higher if horizontal drilling market is particularly considered). It is of importance that drilling technology services are the main source of innovations directly influencing drilling efficiency.

Suppliers of the two above-mentioned service types are usually represented by separate companies. GAP will support both groups of OFS companies as well as contractors for well casing and well cementing services (this segment comprises about 4% of total oil services market volume).

In the longer term when DUC´s undergo stages of completion and stimulation (by means of fracking and multi-stage fracking) prior to putting them on production, a massive involvement of frac fleets is required which will be a task of its own. Completions and fracking (including multi-stage fracking) services comprise about 20% of the total oil services market.

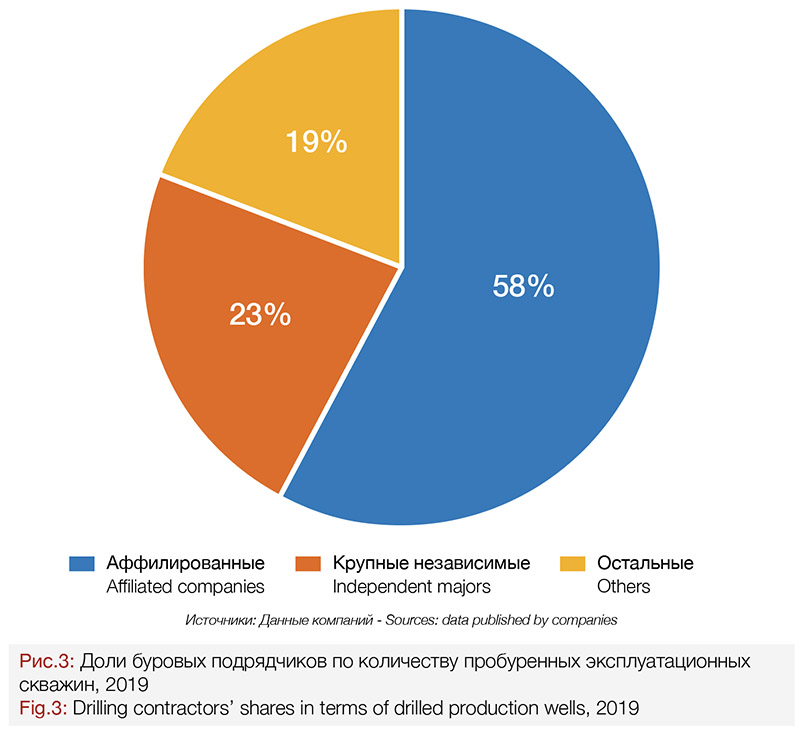

Considering the various types of relationships between the Customers and contractors, the affiliated drilling companies dominate the market. For this analysis the contractors who have a significantly close relationship with their key customers are being considered as they account for the largest percentage (58%) of the development wells put into production in 2019. This group, with different business organizational and legal structures, includes the drilling units of Surgutneftegaz, RN-Burenie (a Rosneft subsidiary), Megion Drilling Directorate (a Slavneft-Megionneftegaz subsidiary) and independently owned contractors that have most of their business (> 75%) derived from a single customer.

Large independent companies include BKE, SSK and Eriell with an annual meterage of more than 1 million meters (for oil wells) on the Russian market.

In summary the affiliated companies and independent major drilling contractors accrue more than 80% of the total production wells (about 6300) drilled in Russia in 2019. The corresponding monetary value is similarly shared (with the market share of Surgutneftegaz drilling units taken into account).

As stated above, during the discussion on GAP the Russian Ministry of Energy set a target to limit the shortfalls in OFS company’s revenue to at about 80% of their 2019 financial results. The economic forecast published in July 2020 by Rystad Energy estimates the expected shortfall in the Russian oil-service market at 27%.

From this perspective it is of the utmost importance which drilling-related companies are to be supported by GAP. A high probability exists that a major portion of 20% shortfall is going to be associated with small to medium sized drilling companies. Companies in this group should expect a severe weakening of their financial position, resulting in assets buyouts with further consolidation of the Russian drilling market. Only highly efficiency companies possessing modern drilling equipment with a stable customer base have a solid chance to maintain their independent status.

At the same time global experience in the oil industry demonstrates that small and middle sized companies are essential in driving and developing innovations, penetrating the market, because these companies to a much greater extent, are open to undertaking significant business-risks inherent with the innovation-based development. It is particularly important to take this into account within the GAP project scope.

ES-2035 also directly points to this aspect: ‘due to the deterioration of hydrocarbon reserves structure and the necessity to improve innovation-driven activity, flexibility and adaptability, and changes in the market environment, the value of small and middle sized oil and gas companies is steadily growing’. It should be noted that this group comprised 12% in 2019 (vs 9% in 2013) of total oil production. As mentioned above, the task is to develop such companies by utilizing domestic innovative solutions.

Based on the above statements one can deduce an inference of the priorities of the government’s support for oil services and oil production: the key function of major drilling companies (in conjunction with vertically integrated oil companies) is to provide stable oil production; the key role of medium and small sized companies is to provide innovation driven development.

It should be noted that within the oil production process various core participants of the oil industry have different target functions and performance criteria. Budget revenues are of the main priority for the state, cost of production plays a vital role for the operators, profit is essential for oil service companies. In order to increase the overall efficiency of the Russian oil producing industry it is mandatory to account for all the interests of all the groups and to harmonize them based on in-depth understanding of challenges, risks and inputs from each of the involved players. (For more information regarding approaches for harmonization of interests please refer to the article ‘Russian drilling market: prospects and management challenges’ – ROGTEC Issue 48, 2018).

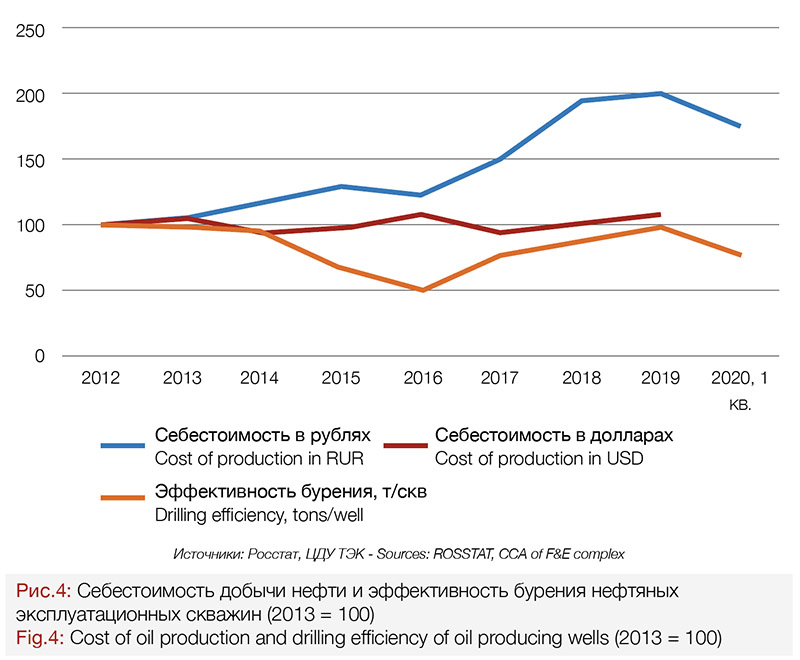

It can be said that within the existing framework of relationships between the major participants, the objective of efficiently increasing oil production hasn’t been achieved to sufficiently provide strategic stability in the oil production industry. Despite significant progress in drilling and completion technologies, drilling efficiency being expressed in the form of new well oil production hasn’t exceeded the level reached in 2012 while the production cost (in RUR) has almost doubled (Fig. 4).

Since 2014, the devaluation in the RUR has been one of the most important resources for improving the sustainability of Russian oil industry (Fig. 4). As estimated by Rystad Energy OPEX of the Russian O&G companies in 2020 are expected to decrease by approximately 350 bln RUR (based on June exchange rate) due to the devaluation. At the same time in the context of current State priorities for social and economic policy based on the internal (national) demand it can be suggested that a further implementation of this resource is considerably limited.

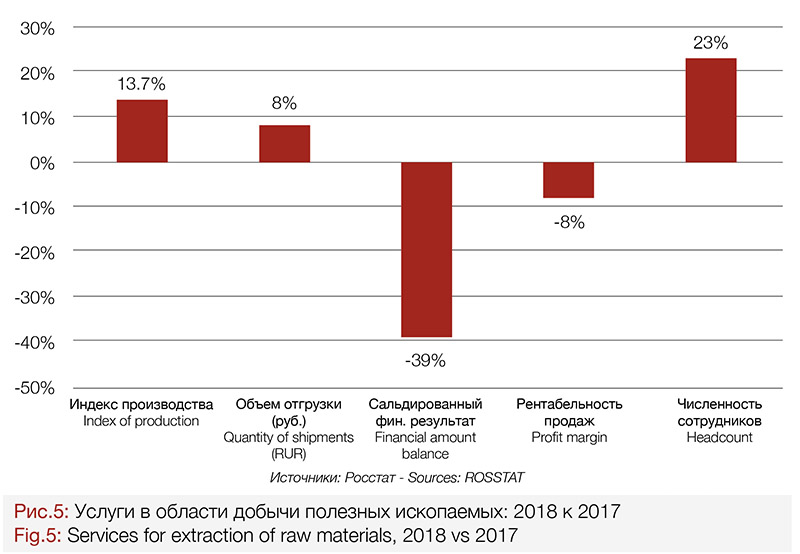

A number of other key sources of increasing the efficiency of oil production have also been largely exhausted. The development resources of the oil-service companies have been significantly weakened: as per Rosstat, in 2019 the sector ‘services for extraction of raw materials’ (in which a 70-75% share is attributed to oil production services) demonstrated a record-breaking reduction of fixed capital expenditures by 30% (equal to 300 bln RUR). This followed a decrease in the total net result of companies in this sector by 39% in 2018 compared to the previous year, against the background of an increase in world oil prices in the same year by 34%.

Wells ‘Decomposed’: New Opportunities

At the time of publishing this article there is not a legislative definition of a DUC well. The goal has been set to implement the corresponding changes into the national regulatory and legislative framework.

A legislative definition of DUC conceptually decomposes a production well into several stages: drilling of the main borehole (which in turn can be subdivided into stages), penetration of a reservoir, oil recovery stimulation, well testing and bringing the well on the production. On one hand this approach is inconsistent with some key regulatory norms currently implemented; on the other hand, this approach fits in with important trends for efficiency control.

The current rules and regulations prescribe the construction of production wells based on the design documentation. This documentation should include a justification of the well design, well profile, methods of penetrating a reservoir and approaches for a well stimulation. The well should be included in a field-development program in order to obtain a well permit.

Well drilling and related operations (including drilling services) are performed on the grounds of working documentation which is usually included into an integrated work program for the well’s construction. This program is usually composed during the tender bidding stage. The program is further refined to provide a steady growth of the process efficiency. This approach to well construction planning is most typical for split services and integrated services.

To provide more decision-making flexibility and adaptability to any changes in market demand a substantial alteration of the above-mentioned core propositions may be required as per ES-2035. It seems reasonable to keep procedures related to the first design stage – working out of a design documentation – in their current form. Particularly as this type of the design documentation provides a realization of the objectives for the field development system, it also includes parameters ensuring operating safety and long-term operation of the well The execution of certain stages and types of work can be carried out on the basis of separate work programs, formed, in particular, during tenders for the provision of services. This approach would allow for a prompt adjustment of completed well’s parameters in accordance with any changes found subsurface, targets and parameters of the field development system.

The practical value of this approach can be assessed through the example of recent partial relaxation of regulations for well design and construction. In 2013 several alterations were made to the ¨Oil and Gas Industry Safety Regulations¨. In 2015 the government expert examination of the planning documentation for well construction is now not mandatory. As a result, more favorable conditions have been created for operators to enable a risk-oriented approach for well construction especially in horizontal wells. Oil producers have gained broad capabilities to achieve an optimum trade-off between acceptable risks during drilling and economic efficiency (cost reduction).

In particular, this development made it possible to widely use simplified well designs, which, in turn, led to a significant reduction in cost and construction times. (For more information refer to the article ‘Cementing: market under pressure’ – ROGTEC Issue 59, 2019).

The potential for a phased well construction process presumed by GAP can become an important incentive for increasing the efficiency for drilling and production through production and management innovations. Areas within which efficiency gains could potentially be achieved include the following:

• Optimum usage of drilling rigs with different parameters (load capacity, equipment etc);

• Smooth workload of service companies regardless of demand level for raw hydrocarbons;

• Developing of new investment opportunities for the financial sector.

Oilfield Services: Dual and Secondary

During discussions for GAP it became apparent there was a lack of clarity (even a duality) when it comes to the OFS industry’s relations with the customers and the state, as well as a secondary status of oilfield services when it comes to government policy. It emerged that the estimates of the workforce in OFS related companies used by federal interagency committee, Ministry of Energy and Chamber of Commerce and Industry vary by 4 times (from 150k to 600k). This indicates that this term does not have the same meaning to all the different government departments.

This difference could be explained by the fact that from the first half of the 2000’s, a significant part of the oil and gas equipment market moved to the service business model, which caused a blurring of boundaries between suppliers of oilfield services and oilfield equipment.

Significant technological complexity increased after the broad implementation of horizontal drilling which also increased well construction costs. This in turn has resulted in necessity to increase drilling contractor’s efficiency, which was mostly achieved through the implementation of separated and integrated service models. The split service model assumes the direct management of the well construction process by the customer with separate tendering for the different technical and service operations. Despite a necessity for significant investments into developing these forms of management and the inevitable increase in risks and responsibilities for decisions to the customer, overall this new approach allowed operators to gain a significant improvements in the contractor’s operational efficiency. According to an example from RN-Yuganskneftegaz, within 5 years after switching over to separate services, its operational drilling performance indicators increased by almost 50%.

An important consequence of implementing the split service model is a change towards the commercialization of a wide selection of equipment via valuing its operating capabilities based on the rate (time, length or any other parameter). This kind of interaction strengthened the role of oil and gas equipment manufacturers as a key source of scientific and technical solutions and a driver of technological innovation.

The processes described above are completely in line with global experiences. Global service majors employ business models that combining service products and equipment manufacturing. The profitability of these companies is mainly defined by the solutions unique selling points in both the equipment and its usage. As a rule, their equipment is mostly (regarding some types of equipment – exclusively) commercialized via services i.e. it’s not sold to customers. Several Russian oil-service middle-sized companies implemented a similar business model.

In Russia, from the government regulation point of view, the ambiguous content and blurred boundaries of the oilfield service sector put it figuratively between two seats.

On one hand the Ministry of Energy whose area of responsibility is oil production, regards the OFS industry as ¨services sector¨ for oil producers i.e. it doesn’t consider who is manufacturing the corresponding equipment. Consequently, referring to GAP the priority of the Ministry of Energy has emphasized the importance of a fast production recovery after the restrictions are lifted. From this point of view the most reasonable package of measures is to focus on is well drilling and construction. On the other hand, producers of O&G equipment as part of the equipment manufacturing industry are in the area of responsibility of Russian Ministry for Industry and Trade.

Oil service segments such as workover, fracking, mud services, cementing and others are normally equipment with purchased or rented (not self-produced) equipment.

It’s quite remarkable that current program documents for the Russian fuel and energy complex contain very seldom references to concept of “oilfield service” and “services for oil production”. Thus, in ES-2035 ‘services’ is mentioned only 3 times (while ‘oilfield service’ is not mentioned at all), at the same time “equipment” is mentioned more than 80 times. The forecast for Russian Fuel and Energy complex technological development till 2035 includes only 2 references to “oilfield service” and both aren’t directly related to Russia, while “equipment” is mentioned for more than 100 times.

Drilling: Time for Digital Platforms?

As has been mentioned above, in the government strategy for oil production a distinction line can be inferred to have been drawn between the areas of responsibility: vertically integrated oil companies in joint with suppliers of wide-scale services that are most suitable for digitalization should ensure sustainability of oil production. At the same time companies best-adapted for ‘high risk-high profit’ paradigm should implement technological innovations. Creating favorable and efficient public policy and drivers for all the market players becomes a key objective for government regulations.

Amongst other measures addressing goals of technological and innovation activity development, ES-2035 mentions ¨development of mechanisms for Government support of innovative projects including the ones for implementation of end-to-end digital technologies (including digital platform solutions) in the sectors of fuel and energy complex.¨

The implementation of digital platform solutions to drill wells in Russia can have a significant impact on increasing oil production efficiency (by lowering production costs). GAP can become an important step on that direction as it presumes subdivision of the well construction process and creates thecorresponding legal and regulatory framework while considering short timeframes at the same time.

The prerequisites for the effective use of platforms in the drilling segment in Russia are as follows:

• Large volume of drilling: about 8000 wells per year

• Challenging geological environments, complex well designs, intervals with widely different drilling conditions

• Prevalence of cluster drilling

• Large and varied drilling fleet

An example of a digital platform is the integrated well construction platform developed by Schlumberger’s Rig of the Future program. This platform based solution is applicable not only to high-technological drilling rigs developed by Schlumberger but also to other drilling contractor’s rigs. A Schlumberger manager put it the following way in an interview: “We’re designing the system to be completely open, not a closed system that will only work with our rig. Our software architecture allows us to bring other drilling contractors’ rigs into the program and still provide a level of integration and automation.” *

A concept of “open” system essentially contradicts with overall close-nature environment of the Russian oil patch. This is based on the mismatch of interests of the main players, which was mentioned above in this article.

At the same time expanding digital solutions (including implementation of digital platform solutions) by Russian oil companies is expected to create powerful incentives for development of framework for prompt information interchange and collaboration between customers and contractors. This is required because the economic effect of implementing digital platform solutions critically depends on the ability to leverage the maximum usage of all resources which in turn is based on maximum volume of data available. A significant potential is attributed to the predictive analytics, realtime monitoring and operating control over equipment.

The examples seem to indicate that in a highly digitized economy owners and operators of digital platforms have an opportunity to gain a significant share of added value which makes it important to ensure the necessary level of competition.

Sberbank’s participation in GAP appears to be a bit of a landmark event. Sberbank implements a development strategy that covers not only banking but also diversified digital businesses, and several digital platform-based solutions have been in operation. In its official statement dated July 2020 Sberbank announced its ‘very active participance in the development of the concept’ regarding GAP which can indicate its role, exceeding the scope of standard banking services.

Conclusions and Prospects

• The governmental program for forming a stock of drilled uncompleted wells (GAP) aims to particularly provide a fast recovery of oil production in 2022 and to improve the ability of the oil industry to efficiently respond to accelerating changes, unpredictability of external factors and attributed risks

• Along with this GAP captures the priorities of the government policy regarding oil production stated in the Energy Strategy for the period until 2035 (ES-2035): sustainability and innovation.

• The sustainability objective is assigned to vertically integrated oil companies and major drilling enterprises – for which GAP guarantees market

demand. At the same time the potential for supporting medium and small drilling companies appears to be very limited.

• Implementation of technological innovations in oil production is to a considerable extent the role of medium and small oilfield service (including drilling services) companies. As per ES-2035 the key areas for development are ‘the small forms’: small-size and depleted fields, independent oil operators. Most part of investment incentives and regulations for the development for this sector are yet to be developed.

• ‘Decomposition’ of wells into stages which has been regulatory and legally implemented within GAP can become an important driver of innovation and efficiency increase of oil production; it can also break new grounds for trade-offs between efficiency and risks.

• It is highly probable that the GAP program is likely to stimulate large-scale introduction of digital platform-based solutions within the oilfield service market. This will entail further changes (to business-models, etc.). For vertically integrated oil companies this is a continuation of “digitalization” trends and the key point for managing production costs.

* Drilling Contractor Magazine, IADC, Jan/Feb 2017

https://www.drillingcontractor.org/2017/janfeb2017

Author:

Victor Gnibidin, Samara State Technical University, gnibidin@gmail.com

Sergei Rudnitsky, Oil & Gas Industry Consultant, sergeir2001@mail.ru