Explore the Ever-Changing Aspects of the Oil and Gas EPC Market

With new technologies, ever-rising demand, and renewed sustainable spree, the EPC market is changing its landscape. Explore how recent technological changes and sustainable demand support the expansion of the oil and gas EPC market.

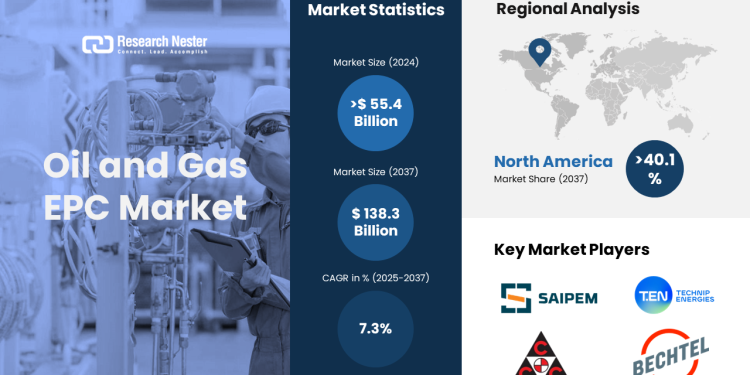

In the ever-changing world of the oil and gas EPC market, upgradation and exploration are not just buzzwords but a bottom line. From the deserts of the Middle East to offshore rigs in Brazil, engineering and construction giants are working on billion-dollar projects that shape how the world powers itself. The global oil and gas EPC market was more than USD 55.4 billion in 2024, and the reports from Research Nester say it could reach over USD 138.3 billion by 2037. Digital tools like AI, 3D modelling, and modular builds are becoming the norm in today’s oil and gas world. So much is happening worldwide, including a green energy mix, carbon capture talk, and more offshore projects. It’s a space full of hustle, change, and risk. In this blog, let’s explore how this industry keeps reshaping itself, step by step.

Top Trends Supporting the Transformation of the Oil and Gas EPC Market

It’s already the middle of 2025, and there are loads of changes happening in the EPC market. With new technologies, ever-rising demand, and renewed sustainable spree, the EPC market is adapting fast. Here’s a look at the latest trends shaping the industry and what to expect soon.

- LNG Tanking and Petrochemical – the Real Expansion of Hybrid Energy

LNG tanking and petrochemical expansion are turning into real growth engines, and in the future, there is a huge prospect for these energies. In 2024, global LNG trade hit over 401 million metric tons, and Asia’s demand supported the development of new regasification terminals and shipping hubs. With China and North America adding millions of tons of annual capacity, many bigger projects are sprouting too. A big example is Lotte Chemical Titan’s Indonesian arm’s newly commissioned cracker in Banten province. Starting in September 2025, it’ll supply 350,000 tonnes of ethylene per year to Lotte Chemical Indonesia Nusantara over 10 years, backed by a USD 3 billion agreement. Another one is India’s ₹61,077 crore (over USD 7.4 billion) investment in Indian Oil’s project in Odisha. It includes refinery, polypropylene, MEG, PX, PTA plants, and a textile park, and is projected to support over 15,000 jobs and boost Odisha’s industrial growth. All these expansions demonstrate that the demand for LNG and petrochemicals is rising, and it’ll boom in the coming years.

- Automation & Technology Play a Huge Role

EPC is no longer about manual blueprints and slow approvals. Digitalization and automation are everywhere. Digital twins, AI, IoT, 3D‑BIM tools, and modular construction are taking over the EPC industry, too. More than 48% of EPC jobs now use modular build, 36% digital engineering, and 29% AI‑based systems. For instance, Shell and ADNOC companies are using digital twins to watch their plants in real-time, spotting pressure changes before they create trouble. These tools help manage risk, tighten delivery, and save money. In fact, companies are having 37% gains through digital twins, and 33% safety improvements using robotics.

Drones can survey a field in just a few hours and increasing time efficiency. Sensors on equipment predict failures before they happen. Sensors and IoT on platforms are cutting budgets by 20%, downtime by 25%, and equipment mishaps by almost 40%. At CERAWeek in March 2025, operators showed off AI-driven drilling wins such as BP guiding drill bits automatically, Devon boosting efficiency 15%, and Chevron flying drones over shale to flag issues early. Moreover, around 50% of oil and gas firms see digital tools boosting safety and decarbonization, and at least 85% of companies said that automation is important for the expansion of the oil and gas EPC sector.

- Sustainability – A Non-Negotiable Aspect

The oil and gas industry is constantly adapting new technologies to comply with the recent sustainable changes. Many new EPC contracts now include carbon capture, hydrogen production, or biofuels. In Europe, projects like Norway’s Northern Lights CO2 storage are blending traditional oil expertise with green tech. In the U.S., public-type projects made up around 60% of EPC revenue in 2023, with the private side growing fast, gas‑related EPC projects up by at least 8% annually. McDermott, for example, has been working on offshore wind installations alongside its oil and gas work. This shift completely depends on changing client preferences and stricter regulations. Some giant producers have set “net-zero” targets by 2050. TotalEnergies, for one, cut methane emissions by 55% between 2020 and 2024, hitting its goals a year ahead. Oil and Gas Climate Initiative (OGCI) members slashed upstream methane intensity almost 50% since 2017, aiming for near-zero by 2030.

Top 5 Nations in Oil & Gas EPC (Engineering, Procurement, and Construction) Market

| Country | Key Latest Developments | Estimated EPC Spending | State-backed Investment |

| UAE | ADNOC Gas finalized $5 bn contracts for its Rich Gas Development Project (first phase) | ~$17 bn (Hail & Ghasha offshore) + $5 bn RGD | State energy firm ADNOC (via ADNOC Gas subsidiary) leading funding |

| Saudi Arabia | Saudi Aramco awarded ~$10 bn in EPC for second phase of Jafurah unconventional gas | ~$15 bn+ | Direct through Saudi Aramco |

| Qatar | QatarEnergy’s North Field East EPC (~$28.7 bn) | ~$29 bn | QatarEnergy (state-owned) |

| USA (North America) | Big EPC pipeline: U.S. capex forecast ~$195 bn in 2024 across oil & gas | Estimated ~$20 bn via projects | Federal + state; tax incentives |

| Canada | Commissioning of LNG Canada (~C$40 bn) plant in Kitimat to export LNG to Asia | ~$40 bn | Federal and provincial support (expedited reforms by PM Mark Carney) |

Wrapping Up

The next five years will see more hybrid projects, oil and gas mixed with hydrogen or carbon capture. Digital tools will keep cutting costs, and labor shortages might push more automation. One thing is apparent, and that is EPC in oil and gas isn’t fading. It’s upgrading itself. Companies that accept this flow faster, using tech, going green, and managing risks, will lead the market. The rest will struggle to keep up. For now, the oil and gas EPC market remains a high-stakes game, where only the smartest players win. And with energy demand still strong, the race is far from over.