Gazprom Neft: The Drilling Map of Russia, Russian Drilling Market Overview

Drilling activity in Russia has fully recovered following the 2014-2015 crisis when the falling price of oil and sanctions caused an investment slump in the Russian domestic oil sector. However, as drilling becomes increasingly more technology-driven and costly, many experts believe that today’s peak drilling level will not last for long. The Siberian Oil overview discusses the developments in the Russian drilling service market.

The article uses market research on oil industry services, provided by the Techart company.

Rises and Falls

Following the 2009 crisis, Russia experienced a robust increase in the meters drilled by the drilling sector. During this time, production from directional drilling was used most extensively. The growth back then reached 26.1% in production drilling and 14.9% in exploration drilling.

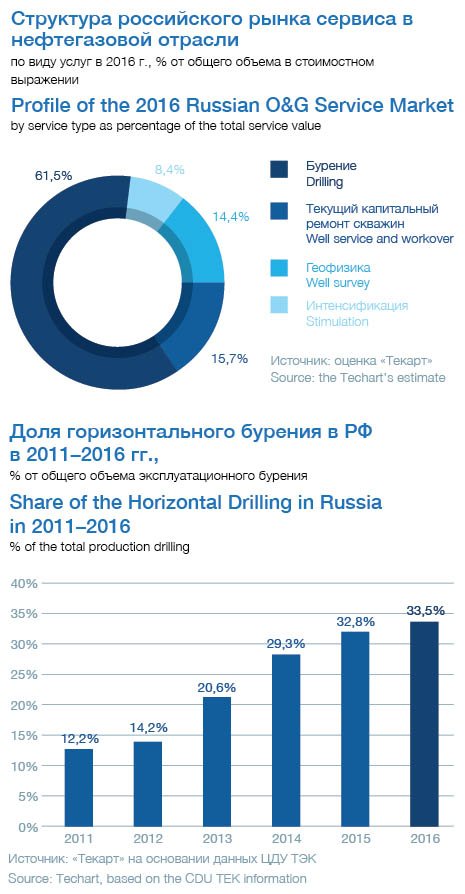

The situation changed in 2014: the oil priced dropped; Russia was placed under sanctions by the EU and US that caused a decrease in investments and a reduction in the meters drilled. But this indicator was affected by yet another circumstance: an increase in horizontal drilling that resulted higher producing wells compared to that of directional drilling. The activity in this area increased by 4.3 times between 2008 and 2015. According to the Techart’s estimate, the share of horizontal drilling in the total production drilling was 33.5% (8.3 million m) in 2016. As a result, a decrease in the total meters drilled in 2014 was 4.1% from 2013. At the same time, exploration drilling grew by 21.6%. A year later the situation was just the opposite: the production drilling recovered from a decline while exploration drilling shrank. 2016 marked an increase both in production drilling and exploration drilling. 24.8 million meters (+14.5%) were drilled within production drilling and 910.0 thousand meters (+6.1%) were drilled within exploration drilling.

However, the market changes in monetary terms looked different. During the last few years, growing production complexities and depletion of the conventional fields are picking up demands for tech intensive services such as sidetracking and horizontal drilling with an increased average well depth and, as a result, a heightened investment per the meter drilled.

As activity increases in the new areas with more challenging conditions (when developing the new fields in the Eastern Siberia, the Timan-Pechora area, etc.) also implies higher costs. The lack of infrastructure in these areas and rugged environmental conditions call for special machinery and equipment that drives the prices and an average well cost upwards.

According to the CDU TEK information, the 2016 total investment in production and exploration drilling for all the companies producing oil in Russia was 673.5 billion rubles (11.1 billion dollars). An investment growth in production drilling is estimated at 19.4% from 2015. Investment in the exploration drilling increased to 9%.

The compound annual growth rate (CAGR) for drilling investment between 2011 and 2016 was 13.4%. And an average dollar value for the same time period due to an exchange rate change exhibited a negative trend (–1.9%).

In 2016 an average meter drilled cost in production drilling, which is calculated as a ratio of investment to

the total meters drilled, increased by 4.2% (in rubles). Exploration drilling followed suit. An average drilled meter cost displayed a continuous growth during 2011–2016 and hit 57.9 thousand rubles/meter for production drilling and 25 thousand rubles/meter for exploration drilling in 2016.

Major Players

The analysts roughly classify all the oil service companies that are now present in the Russian market into three groups.

The first one includes the service units within the big vertically integrated oil companies: NK Rosneft, the service units of Surgutneftegaz, Bashneft, Slavneft, etc. It should also be mentioned that if the service unit spin-off was in fashion among the big vertically integrated oil companies in 2009–2013, today’s trend is the development by the O&G companies of their own or affiliated service.

The second group is comprised of the foreign service companies: Schlumberger, Weatherford (its Russian and Venezuela assets were acquired by Rosneft in August 2014), Baker Hughes, and a number of the second tier companies (KCA Deutag, Nabors Drilling, Eriell, etc.).

The third group is made up of the large independent Russian companies with a turnover exceeding 100 million dollars. They emerged as a result of acquiring the service units from the oil producing companies or owing to the mergers between the smaller service companies. These include BK Eurasia, the Siberian Service Company, and Gazprom Burenie (sold to the A. Rotenberg owned businesses in 2011).

These days the large independent companies and the business units of the big vertically integrated oil companies lead the Russian drilling market in the O&G sector. In 2016, the top 3 market leaders based on meters drilled were (highest to lowest) EDC (BK Eurasia and SGK Burenie that was previously owned by Schlumberger), and the service units of the NK and RN Burenie. In total, these three companies drilled about 49% of all meters.

The technology level of the independent Russian service companies is considered by the experts as intermediate. Right now they can offer the standard services at an optimal price quality ratio compared to the acknowledged global market champions.

The service units of the big vertically integrated oil companies are also, from the point of view of their technological capabilities, at an intermediate level. They normally maintain closer relations with the industrial science institutes and possess an array of one-of-a-kind patents. Their major advantage is a large financial headroom and access to the parent company’s resources to fund the purchases of the expensive capital assets.

The foreign service companies, the leaders of the global service sector, were the key source of technology in Russia in the early 2000s. At present, such players as Schlumberger and Halliburton have about 14% of the Russian service market within the O&G sector in monetary terms. However, they are not among the largest participants in the drilling service market.

The major advantage of the large foreign companies is their cutting edge service technology. The foreign companies were among the first in Russia to perform the complex fracking jobs, move the cementing services, drilling mud preparation, and other drilling support services to a whole new level, use the coiled tubing technology, and offer the innovative software.

Their major handicap is their high service prices. This is the reason why the activity of the foreign market players in Russia is going down these days. In fact, the Russian oil producing companies opt for the Russian domestic contracts to do the ordinary drilling. They use the foreign company services mainly on the challenging projects where the integrated project management technology and expertise are in high demand.

It is worthwhile to note that, following the 2016 record highs, the 2015–2016 global oil service leaders ran out of luck in the entire global market as well. The annual turnover of Schlumberger, Halliburton, Baker Hughes, and Weatherford declined by 50-60%, down to its 2010 level.

Drilling Companies Brought Into the Trend

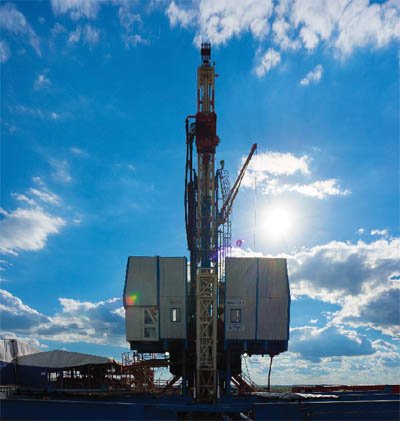

The Russian drilling companies are not public and do not post any information about their fleet, so it is difficult to assess their capacity. The number of the Russian drilling rigs of all hook load classes is estimated between 1,000 to 1,900 units. And, as the Techart experts believe, the number of the rigs in operation was about 900 in 2016.

Considering the equipment operated, each group of companies has its own drilling rig use patterns. Leaning on the parent company’s reputation and the generally generous investment programs, the service units of the big vertically integrated oil companies often, at their own discretion, set the requirements for their procured units. The manufacturers develop new designs for them. The foreign contractors prefer to partner with the European or US equipment vendors. The independent companies choose a particular vendor based on their specific needs, easy procurement, and equipment operation.

While very few drilling rigs made abroad were supplied to Russia in the early 2000s, starting from 2006, the imported products gradually gained traction with the Russian market. The European and US yards (Bentec, Drillmec, National Oil Well Varco, etc.) were the manufacturers of choice.

However, the 2006–2008 demand for drilling equipment was high all around the world, which led to an increased utilization of all key global manufacturers and benefited the Chinese companies that had a considerable capacity underutilization.

As a result, as soon as in 2008, the share of the Chinese drilling rigs in the Russian market, according to the Techart’s information, was over 60% in physical terms.

The market was struck by fundamental changes in 2011 and 2012: the import content went down. It was related to both the production recovery in the Uralmash plant and introduction of an import duty (10% but not less than 2.5 Euros/kg) in 2012. It led to a 30–40% increase in the Chinese drilling rig prices.

The ratio of the Russian domestic and foreign (mainly Chinese) products has been relatively stable in the last four years. The Russian equipment is in the first place (from 46% to 61%). It is followed by the equipment imported from China (up to 39%). 4 rigs made in the US were brought to Russia between 2015 and 2016.

At the moment, the Russian players capable of producing the popular drilling rigs with a hook load capacity of 225-320 t can construct up to 76 drilling rigs per year with 40 of them being made by the Uralmash plant.

Forecast

The drilling and support service market prospects are largely linked to the service market expansion in the entire O&G industry.

Despite the falling oil prices, the drilling market still has its appeal for investors. It is connected to the need to maintain the current production level and develop new fields.

Contrary to the previous prognosis, the drilling peak, according to the Techart’s estimate, occurred in 2016. Based on a preliminary estimate, the meters drilled will somewhat increase in 2017, since the Bolshekhetskaya Depression project (the Yamal Nenets Autonomous District) and the Yurubcheno-Tokhomskoye Area project (the Eastern Siberia) are contemplated for this year. No large field development projects with an extensive drilling activity are scheduled for the immediate future, so the meters drilled are expected to drop in 2018–2020 back to their 2016 level.

Besides a minor increase in the meters drilled, the market is anticipated to grow in monetary terms at an accelerated rate. It is brought about by the daunting challenges of sustaining production in the existing fields, and the oil producing companies shift to developing new fields in such areas as the Eastern Siberia and the Timan-Pechora area that implies higher costs.

Alexei Cherepanov, In-House Oil Service Efficiency Program Manager for Gazprom Neft:

“Considering the introduction of the new big data technology that reaches out to nearly every domain of human activity, drilling efficiency will grow significantly driving margin of profitability for many fields. As drilling efficiency rises, like it happened in the US during the “shale revolution”, the correlation between the number of the meters drilled and the number of the drilling rigs will change or completely vanish in its explicit form. Russia has already got the ball rolling on its shift to high technology drilling, so, if no general economic shock occurs, we should expect to see at least the quantitative changes in the functional relations and trends in the next few years.”

Photos: Ruslan Shamukov

Infographics by: Daria Gashek

Published with thanks to Gazprom Neft & Sibirskaya Neft MAGAZINE