Gazprom Neft: Production Line, Production Drivers and Prospective Assets

Having launched two major projects, Messoyakha and Novy Port, Gazprom Neft has created a solid basis for development in the north of YNAO, and for production growth in the coming years. However, today the Company is focusing on other regions and trends. This includes both of the projects in the underexplored East Siberia, where the geological surveys and pilot operations have been in progress for several years,

and the new assets within traditional regions of presence. In the future, Gazprom Neft is likely to have offshore projects as the basis for the company growth, together with the development of the Bazhenov suite and Achimov deposits.

Northern Oil

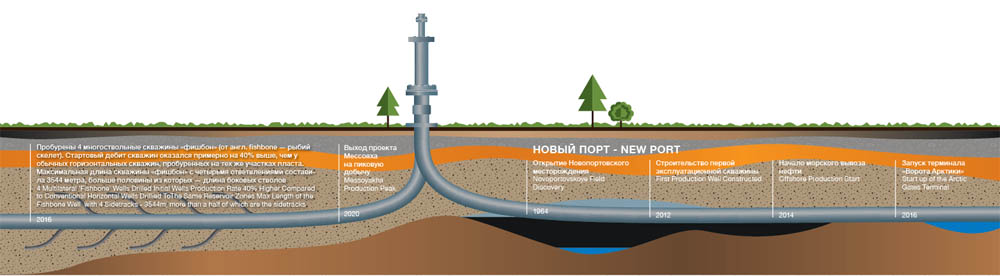

In 2016 Gazprom Neft put into operation the first phase of the East-Messoyakha Oil and Gas Condensate Field. Today it is the northernmost active onshore field in Russia. The license for the asset exploration and development is held by a joint venture between Gazprom Neft (Operations Management) and Rosneft.

Though the Messoyakha group of fields was explored back in 1980’s, its development was postponed as the area was lacking the transport infrastructure. The preparations for the development started actively once the decision to build the Zapolarye-Purpe oil pipeline was made, this pipeline connects the fields in the North of Tyumen Oblast with the East Siberia-Pacific Ocean Oil Pipelines System.

The East-Messoyakha Field has a complicated geological structure: thick gas caps; split deposits without hydrodynamic connectivity; reservoirs with variable properties – which has all caused many difficulties in building the geological model and creating the asset development concept. Indeed, the first exploration wells were dry. The new understanding of the field’s geology meant reconsidering the drilling and infrastructure development plans.

For Gazprom Neft, the Messoyakha field is one of its most hi-tech assets, the development of which would have been impossible had it not been for the application of new technologies. The only producers in this field are the horizontal wells, with the horizontal legs about 1km long. In order to increase the oil recovery and cover as many pay zones as possibles, fishbone wells were drilled – horizontal wells with several sidetracks.

The Messoyakha oil is viscous and cold, nevertheless the concerns about the difficulties related with this fact were groundless. Despite the air temperature in the winter period, which drops down to -50-60°C, conventional oil treatment and transport methods are applied here for the most part. Only some sections of the small diameter infield lines required additional heat tracing. As for the 98-km long flow line that connects the field with the Transneft transport system – the required temperature is maintained thanks to the heat insulation.

However, High Arctic Tundra is a permafrost area, which does demand a special approach to infrastructure arrangement: all units are installed on piles, to avoid soil thawing. 50 tons of piles had to be delivered to the site, which took almost 18 months.

Another challenge was the delivery of all required materials and equipment within an area that lacks permanent roads. The shipment was arranged by winter roads, but due to the global warming these roads’ availability window is getting shorter. In the winter period, blizzards, which often happen in these latitudes, interrupt the operation of these roads. Nevertheless, the freight flow was impressive. If in 2014, 32 tons of cargo were delivered on site, then in 2015 it was 176 tons, and in 2016 – the whole 215 tons.

The flow line design and construction concepts considered not only the severe climate and complicated landscape with lots of rivers and brooks, but also the local’s sanctuaries and reindeer pastures. Special crossovers were arranged on the reindeer herds migration paths. To avoid damaging the arctic basin’s ecosystem while crossing the rivers, the pipelines were laid under the waterways using horizontal directional drilling (HDD).

By 2018, the oil production rate at the East Messoyakha Field is expected to be about 4M tons per year. To achieve the production peak of 6.5M tons per year by 2020, a second train will be constructed. This train will also serve the West Messoyakha field, which will be developed later.

Yamal Oil and Gas Cluster

Besides Messoyakha and Novy Port, there are several new Gazprom Neft assets in development in the YNAO oil and gas province. These are: the Kamennomyssk oil and gas field (onshore) with 34.4MM cubic meters of gas reserves, when Gazprom Neft won the bid for its development in 2016; Tazovskoye (72M tons of oil, 4.6M tons of condensate, 183.3MM m3 of free gas) and North-Samburgskoye fields, the license for which were obtained by the Company in 2017.

As an Operator, Gazprom Neft re-tested two Tazovskoye wells in Q1 2017 and started preparing the pad drilling. On North-Samburgsky LA the Company re-activated and re-tested two oil wells; carried our 3D seismic acquisition. The pilot drilling is scheduled on winter 2017-2018. The development of these fields will help use the regional infrastructure more efficiently.

Aim Towards Novy Port

Development of the Novoportovskoye Field is another strategic project of Gazprom Neft in Yamal. In 2016, after commissioning of the Arctic Gates offshore loading terminal, the Company started year-round shipments of Novy Port oil.

Novoportovskoye Field is the first hydrocarbons field discovered in the Yamal Peninsula. The presence of significant amounts of the oil and gas reserves was proven as far back as in 1964, but the lack of transport infrastructure was a roadblock for a long time. By 1987, 117 exploration wells were drilled in the field, but active development only started after 2010, the year when Gazprom made a decision to hand the asset over to Gazprom Neft. Today, Gazprom Neft-Yamal is the Field Operator.

The geological survey and pilot operations were ongoing up to 2014. Then, the production drilling started. A total of 186 bln rubles have been invested in development of the Novoportovskoye Field; the expected tax revenue will exceed 1.5 trillion rubles.

The Novoportovskaya suite includes several reservoirs; the best pay reservoir is NP-4. To date, most of the hydrocarbons are produced from this formation. In 2017, a new oil reservoir, NP-8, was put into production. This is the second formation in the field in terms of the productivity; within the next three years it will deliver about 25% of total production, and throughout the field cycle it will produce over 10% of the entire Novy Port oil reserves. By late 2017, 14 oil producers are planned to be drilled to NP-8; and by late 2019 – 50 oil wells.

For a long time the crude transport difficulties remained the main challenge in development of Novy Port. At the end of the day, the marine oil shipment via Mys Kamenny was acknowledged as the best option. In 2011, the pilot escorting a nuclear ice-breaker from the port of Sabetta to Mys Kamenny confirmed it was possible to ship the oil by sea in winter period. In the summer of 2014, the tanker transported the first Yamal oil to Europe by the Northern Sea Route.

Bazhenov Suite Prospect

One of the strategic Gazprom Neft tasks is to develop the Bazhenov suite, This is a 2-3K meters deep geological formation in West Siberia with huge oil resources: from 100 to 170MM tons. But it would be extremely difficult to extract them, as the Bazhenov suite formations have low permeability.

In 2013, Gazprom Neft launched the first targeted study of this formation in the Palyanovskaya Area of the Krasnoleninskoye field to evaluate its production potential. The Project came up with the set of technologies that has already had great success: two horizontal wells drilled in 2016 gave significant oil inflow, which proved the anticipations, right.

In May 2017, The Ministry of Energy of Russia granted the Gazprom Neft Bazhenov Suite Study Project national status. The follow-up development and improvement of this approach will continue at the Research Centre, which is organised together with KhMAO-Yugra Administration in KhMAO area. In case of success, the rate of production from the Bazhenov suite that Gazprom Neft might achieve about 2.5M tons per year by 2025.

Starting in 2016, the oil is loaded into tankers from the Arctic Gate oil loading terminal, installed in the Ob Bay area, 3.5km offshore. This is a unique facility designed to operate under extreme conditions. The terminal has a two-tier protection system and complies with the most stringent requirements for industrial safety and environmental protection. The zero discharge technology prevents foreign substances from getting into the Ob Bay. The subsea pipeline is additionally protected with a concrete shell.

A full-scale development of the Novoportovskoye field was hindered not only by oil shipment difficulties, but also by imperfect recovery methods. Low-permeable reservoirs, divided deposits and thick gas cap required the construction of horizontal and multilateral wells, together with the multistage hydrofracs. In 2016, a well with 2000m long horizontal leg was drilled in Novoportovskoye field, which is a Company record. In 2017, a 20-stage hydrofrac was conducted here, applying the hi-end ‘ball-less’ technique.

A significant GOR is a feature of the Novoportovskoye field. Some of the produced associated gas will be injected back into the gas cap to maintain the reservoir pressure and increase the oil recovery. For this, the biggest Russian gas injection unit is being constructed in the field; its startup is scheduled in summer 2017. At the same time it will be decided if it is feasible to run the gas line on the Ob Bay mudline, which would help monetize part of the produced Novoportovskoye gas.

Now 85 wells are operating in the field, with the rate from 50 to 1100 tons of oil per day, including 19 wells constructed in 2017, with the total rate of 5163 tons of oil per day. By May this year, the cumulative production had reached a value of 5M tons. In total, at least 6M tons of oil are planned to be recovered in 2017.

Old Assets. New Development

Noyabrsk is the region Gazprom Neft has operated in the longest. The majority of the operating fields here are mature. But a 2016 discovery makes this region a new promising point of development for the Group of Companies in general, and ensures a stable production growth for Gazprom Neft-Noyabrskneftegas until 2025.

Until recently, the Remote Fields Group included five fields: Kholmistoye, Chatylkinskoye, Vorgenskoye, South-Udmurtskoye and Ravninnoye. Their proven recoverable resources were about 16M tons of oil. Three of the five (Kholmistoye, Chatylkinskoye and Vorgenskoye) were in operation; the other two were too small for commercial production.

In 2016, two previously unknown oil deposits were discovered in West-Chatylkinsky LA, where the 3D seismic lasted for two years. The preliminary evaluation says the recoverable reserves of all deposits in West-Chatylkinskoye field and the adjacent areas might vary from 40 to 70 mln tons. At this, the total reserves of the Remote Fields will grow 4-5 times.

The discovery has significantly changed the situation on the entire production asset: a synergistic effect of created common infrastructure will allow putting previously non-commercial stock into production. As result, the Remote Fields Project production might peak at around 3 mln tons of oil per year. The short time required to put the stock into production is a big advantage: the first oil from the newly discovered field is expected in 2018; and in 2023 the field will be on commercial production.

Progressing to the East

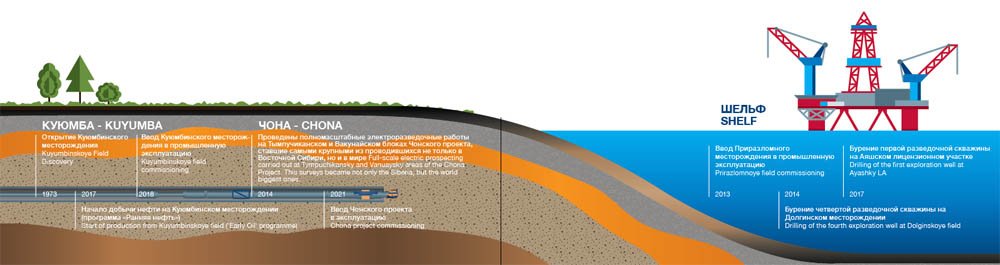

The Kuyumba fields cluster in the Evenkinsky District of Krasnoyarsk Region is one of the largest prospective Gazprom Neft projects. Licenses for these fields belong to Slavneft-Krasnoyarskneftegas Company, a joint venture co-owned by Gazpromneft and Rosneft. The biggest Project fields are Kuyumbinskoye and Yurubcheno-Tokhomskoye.

The Kuyumbinskoye field was discovered in 1973, but it remained suspended for a long time: the region was lacking the infrastructure to allow for the oil shipment to consumers. The East-Siberia – Pacific Ocean pipeline system startup and Transneft’s decision to build 700 km long Kuyumba – Taishet pipeline branch have changed the situation.

Activities on production infrastructure development and preparation of hydrocarbon reservoirs development have been performed at the Kuyumba field since 2010. So far, it has been decided to start developing two areas where recently the pilot operations were carried out. The production level is expected to be 1.6MM tons of oil per year, but it might increase should the geological surveys be successful. In early 2017 the Kuyumba-Taishet pipeline was hooked up, and the ‘Early Oil’ program introduction campaign deployed at the Kuyumbinskoye field. Total expected annual production is 295K tons of oil. The field is planned to be fully hooked up in late 2018.

Achimov Approaching

A huge potential of future growth is related with the development of the Achimov deposits, which are spread almost all over the entire West Siberia. The Gazprom Neft resources of this type count more than 10 bln tons of oil. Almost the same quantity is on stock of the joint ventures and Gazprom.

The biggest part of the Achimov oil is under production at the moment, but mostly these resources are yet non-recoverable due to low permeability. The commercial production of these resources depends on development of the horizontal drilling and reservoir stimulation techniques. But just like the Bazhenov suite, the Achimov deposits differ in their properties depending on the region. To determine the most promising areas and test the recovery techniques, the Company established a Project office called ‘Bolshaya Achimov’.

Chonsky is another major project in East Siberia, at the border of Irkutsk Oblast and Sakha Republic (Yakutia), 100km of the East Siberia-Pacific Ocean pipeline. In Soviet times, the Chonsky fields, just like other East Siberia resources, was beyond the active production area, though the geological surveys were carried out here. The survey results became needed only in 2000s, when the government made a decision to deploy a full-scale development of Siberia platform and construct the East Siberia-Pacific Ocean pipeline system.

In 2011, the Gazprom Neft’s Research Center studied all the available data on the Project’s license areas and built an integrated seismic and geological model, which was later proved by drilling. This comprehensive job helped justify the significant project resources increment.

Today the Chonsky Project operations include exploration drilling and pilot operations for determination of optimal development method. Planned fields commissioning date – 2021.

Going Offshore

Apart from the Prirazlomnoye field, which was hooked up in 2013, Gazprom Neft posses licenses for several shelf areas, where the geosurveys are ongoing at the moment. Commercial production from these fields is not an immediate concern. But given how complicated these projects are, the preparation has already started.

Ayashsky LA in the Sea of Okhotsk is located close to the Sakhalin-1 and Sakhalin-2 fields. The area is over 4Km2, and about the half of it has already been covered by 3D seismic prospecting. In 2016, based on geological and geophysical data, the most promising prospects were selected for exploration drilling. The construction of the first well is set on June 2017.

There is an oil field called Dolinskoye just 60km away from the Prirazlomnoye field, in the central part of Pechora Sea. 2D and 3D seismic work have already been done in the area, and four exploration wells have been drilled. During 2017 it is planned to continue with the 3D acquisition here. The obtained data will allow to update the geological model, and by 2018-2019 to start the appraisal well drilling to the Devonian horizons.

The North-West Area is another LA in Pechora Sea. 2D seismic acquisitions, which covered 12.8K running meters, helped discover several prospective structure groups. In 2017, the Company is planning to perform a feasibility study of the promising fields, and in 2018 the plan is to run 3D surveying.

Kheisovsky LA is in the northern part of Barents Sea, The sea depth here reaches 500 m, and the climate is extremely severe: the ice may stay the whole year round NE and NW to the LA. The area is not well surveyed yet. In 2017, it is planned to finish building a regional basin model, and in 2018-2020 to continue with the 2D seismic.

In June 2014, Gazprom Neft Sakhalin were also granted permission to survey, explore and produce hydrocarbons within North-Vrangelevsky LA, which occupies 117K km2 in NE of the East Siberian and NW of the Chukchi Sea. In 2017 the plan is to forecast the production rates and parameters of the promising fields and start preparing to the 2D seismic campaign in 2018-2020.

Published with thanks to Gazprom Neft & Sibirskaya Neft MAGAZINE

Text: Alexander Alexeev

Infographics: Alexey Stolyarov