Gazprom Neft’s Future Development Stratagies

Gazprom Neft’s resource base development strategy determines the company’s strategic target – an increase in production to 100 mln t/y by 2020 and to maintain this level of production in future.

“A 100 mln t/y production is a strategic target that Gazprom Neft shall achieve by 2020”. This target has remained constant for more than five years already, regardless of repeated changes in the foreign economic climate, which have been fundamental and often adverse. This target served as basis for the planning of the portfolio of Gazprom Neft’s projects. The major part of this strategy is either at the commercial production stage already or will be launched to production in one or two years. The objective for the next five years, i.e. for the period up to 2025, is to maintain the production rates at the achieved level. The estimates, by the company specialists, show that the development of new fields, exploration and enhanced oil recovery of additional reserves will not help to achieve the objective. The company’s resource base development strategy determines the ways and areas for oil prospecting.

Prerequisites for Development

The assessment of the actual status and potential of Gazprom Neft’s resource base served as the basis for shaping the corporate strategy. Company specialists analyzed data on all reserves in existing fields and realised that these resources allow achievement of the strategic production target by 2020. However, the estimates showed that the required production levels cannot be obtained without an increase in the number of exploration projects.

Though the main problem is not the number but rather the gradual decline of the old field reserves. This process is inevitable and the only way to break the trend, proved by the foreign industry leaders, is the expansion of the project pool quality at the early stages of the fields life cycle. To ensure a stable production level and to also enhance production, the company portfolio will include a considerable number of exploration projects, though statistically only 10% of these will reach the development stage. At the same time, when new promising projects are identified, the most unprofitable ones will be sold. This will also improve the quality of the reserves.

Eight major sources of resource base development are part of the strategy: organic growth (further exploration in old company fields); inorganic growth in Russia through acquisition of new fields in the market and from the non-licensed stock; development of Gazprom oil fields; execution of projects abroad; exploration of new fields; offshore development; development in the Bazhenov formation and an increase in reserves due to implementation of state-of-the-art production technologies. All these opportunities are prioritized in the strategy considering, first of all, the efficiency of their implementation in current economic situation.

Maximum Effect

One of the most effective ways of resource base development, in the current economic, situation is organic growth. This includes the operations of the existing company fields: further exploration and reclassification of C2 / C3 reserves to C1 category. These reserves have the lowest unit cost – expenses for access, prospecting and exploration – and can be developed within 3-5 years. According to the preliminary estimates, the important part of the organic growth potential are major projects in the north of the Yamal-Nenets Autonomous District (Novoportovskoe field, Messoyakha Group of Fields) and fields in the Eastern Siberia (Kuyumbinskoe and Chonskaya Group of Fields). Traditional assets, among which are Gazpromneft-Noyabrskneftegas and Gazpromneft-Muravlenko – the oldest production companies – also have large opportunities.

Reserve Categories

Existing Russian classification of reserves and resources is based on geological knowledge. Proven reserves – categories A, B, C1. A and B reserves are currently recovered or prepared for recovery and C1 are sufficiently identified to commence recovery. C2 are reserves preliminary estimated based on geological and geophysical data. C3 – probable reserves (resources) not proven by drilling.

These categories are used by the State Committee for Mineral Reserves when licensing fields and allocating the licenses. However this classification does not account much for the economic constituent – profitability of development.

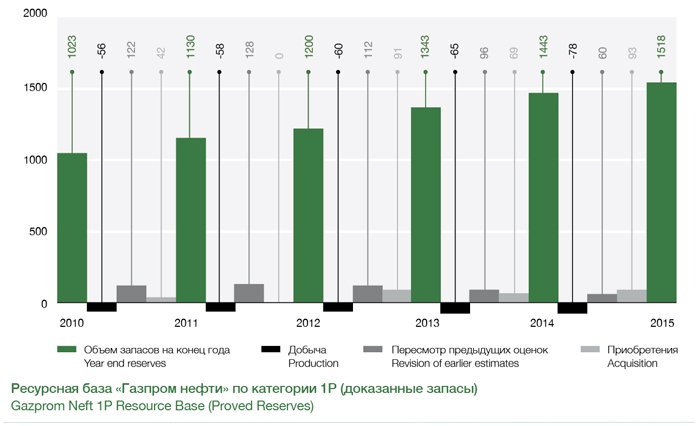

International oil companies apply SPE-PRMS classification which is more focused on the business needs. When determining the efficiency of reserve recovery, such factors as exploration and drilling, transportation, tax costs and oil price, etc are taken into account. This classification considers 1P, 2P and 3P categories. 1P – proved reserves that can be recovered with 90% probability. 2P – proved and possible reserves (the latter can be recovered with 50% probability). 3P – proved, probable and possible reserves (the latter can be recovered with 10% probability).

The forecast for the organic growth of the reserves in 2015-2020 shows that an increase in the proven reserves under major projects can materially compensate for the reduction in expected production from subsidiaries and joint ventures. By 2020 the share of major projects in the total proven reserves will double. However, the organic growth potential is limited and other resource base development sources should be utilized to achieve the strategic objectives, long-term.

Gazprom’s oil reserves are of special interest for the inorganic development of the Gazprom Neft resource base. The recovery of these oil reserves by the subsidiary of the global energy holding is the evident objective. The availability of the specialized oil subsidiary allows Gazprom not only to fulfill the license obligations in the sphere of liquid hydrocarbon handling but also efficiently develop the fields. For the last five years this approach allowed Gazprom Neft to materially enlarge the 1P reserves as the eastern part of the Orenburg oil and gas condensate field and Novoportovskoe and Prirazlomnoye fields, which are owned by the parent company. And this source is not “depleted” yet. The number of oil fields owned by the Gazprom group counts several tens. They are located in seven regions of Russia. Gazprom Neft operates in five of them.

Gazprom Neft, being an oil company, is interested in the Achimov deposits in the Western Siberia. These have no connectivity with gas but the oil is hard to recover, or unconventional: the oil is found deep and requires special approaches to drilling. The potential of the Eastern Siberia fields is also high, however, the deposits feature complex geology. The company specialists are studying the possibility of gas condensate field oil rim development.

Allocated – Unallocated

It is very hard to find a field which is really interesting for acquisition as the industry’s consolidation is almost completed. The collection of information on potential fields and its subsequent analysis show that the quality and quantity of offered reserves do not often meet the company’s criteria and the cost can be simply too prohibitive. This actually nullifies the economic value of such projects.

The unallocated subsoil reserve fund is rather poor. Suffice it to say that in 2015 50% of the areas put on auction were not of interest for the industry, i.e. the quality of reserve preparation was insufficient for the companies to venture and take the risks of development. Competitiveness, in terms of the promising deposits, is so high that the auction price makes the acquisition of a number of licenses economically unviable.

So the potential of the inorganic growth due to acquisition of fields or licenses is not very promising in the current situation. However when planning the strategy, a list of the most interesting fields and areas from the unallocated fund was formed and the company’s strategy is based, mostly, on the operation regions allowing certain production and commercial synergy.

In general, the company plans to adhere to “healthy” opportunistic principles as to the inorganic development of the resource base tracking the offers and making decisions based on current opportunities.

Gazprom Neft adheres to the same principles in respect of the foreign fields. The company currently operates in the Middle East developing the Badra field in central Iraq and exploring and developing several blocks in the Kurdistan Region of Iraq. The Middle East region is still of great interest as there are opportunities for development. However, at a relatively low cost of production, expenses for access, prospecting, exploration of the reserves and infrastructure construction are high.

The company remains open to the possibility of commencing operations in Iran, but Gazprom Neft specialists say that commercial effectiveness will largely depend on the contract terms and conditions.

In Search of New Opportunities

The prospecting of new areas involves mere geologic exploration, which is the most risky but the most promising way of development. The maximum value can be created in this sphere. Prospecting in the areas adjacent to the existing Gazprom Neft fields is the top priority but new regions are also under consideration. Operations in new areas will not yield quick results: even if the projects are commenced today, production would start in 2023-2025 at the earliest. These are the projects of the future. Just as the offshore field prospecting and Bazhenov formation reserve development projects are as well.

The offshore resource potential is high but the access is costly. Development of offshore projects requires material investments in preparation activities and upgrading of the production technologies. So the development of the offshore fields is planned, in cooperation with the process and investment partners. Their involvement depends on the reduction of the subsurface uncertainty and risk profile. The company continues to implement new technologies allowing to increase production efficiency and thus in recovered reserves. One of the ways is to enhance the production of the low productivity reservoirs. First of all we mean the Bazhenov formation featuring complex and costly oil recovery.

The potential of the Bazhenov formation is very high, however the profitable recovery of the resources requires upgrading of the drilling technologies. Every well here is a new challenge. But the Bazhenov formation needs development because it can be used for proving solutions that will be in demand in future: construction of wells capable to withstand extremely high pressures, utilization of new fracturing methods, implementation of new well completion technologies, etc.

Currently, Gazprom Neft continues operations in the Bazhenov formation in Palianovskoe field in Khanty-Mansiysk Autonomous District and Vyngayakhinskoe field in Yamal-Nenets Autonomous District. The project will also cover other company fields in future.

The intensity and completeness of activities in each of the strategic directions depend primarily on the external situation. The new strategy of resource base development includes several scenarios taking into account financial capabilities of the company and external factors, among which is the oil price. However the resource base development strategy provides for the effective implementation of the company opportunities whatever the scenario.

Published with thanks to Gazprom Neft & Sibirskaya Neft MAGAZINE

Text by: Alexander Alekseev

Graphics by: Anastasia Ukhina