Gazprom & Russian Gas Production Overview & Future Developments

In the first part of this article, we look at reserves and major projects for the Russian upstream gas sector. In part 2, to be published in the next issue of ROGTEC Magazine, the article will conclude by looking at the production outlook, including market risks.

One of the conundrums of 2014 has been lower Gazprom production over the first eight months of the year, down by some 24 bcm (-7.7%) y/y. The reduction comes as total Russian production is down by 14 bcm (-3%), which points to Gazprom losing both output and market share to its rivals. While exports are up by 2.4 bcm, the underlying weakness in production raises questions, given the recent extensive capital spending by Gazprom.

In this Insight, we look at developments in the Russian upstream and find that Gazprom’s reserve picture still looks healthy, with a reserves/production ratio of over 70 years, and little need to chase complex areas (such as the offshore Arctic circle) or develop shale.

Gazprom’s production picture also looks better than it has for a while. The decline in traditional production areas has been moderated by investments in new production areas, as well as improved gas extraction processes. Gazprom also benefits from its largest field (Zapolyarny) having just reached design capacity production, while the flagship field (Bovanenkovo) of its existing mega-project in the Yamal started producing gas only two years ago, and will continue to ramp up for most of this decade. Its other major project, the Eastern Corridor Project, will allow the development of its Eastern Siberian conventional fields. The current investment climate in Russia, together with western sanctions on Russian companies, creates financing challenges. But we still think much of this investment programme will be delivered—albeit with higher risks of delays. Taking conservative assumptions on new project ramp rates and existing field decline rates, we estimate Gazprom production will be higher in 2020 by 55-90 bcm of gas.

With Eastern Siberia taking care of its exports to Asia, the growth in Yamal production will be looking to Western Europe for a market. The deteriorating relationship between the EU and Russia, and the inherent weakness of the current EU gas market, poses specific marketing problems for Gazprom. Overall, marketing all of that gas in Europe comes down to price. The growing question for Gazprom will be whether it locks in production when hub prices fall below target prices, or if it simply flows the gas and sells it at the hub—which could push gas prices down to fuel switching levels in power. As long term spectators of Gazprom, we find it hard to accept the latter as a realistic outcome.

Overview

The key to Russian gas is Gazprom, which owns around 18% of global, and 70% of Russian natural gas reserves. In 2013, Gazprom group companies produced 490 bcm of gas, almost three quarters of total Russian gas production of 670 bcm. Over the first eight months of 2014, Gazprom production is down by 24 bcm (-7.7%) y/y. The share of Gazprom Russian production has fallen from 77% in 2011 to 70% so far this year, as other producers have been able to expand their own production.

Gazprom’s reserve base spans Russia, but the biggest share of reserves (63%) and current production (93%) is located in the Urals federal region.

Reserves

Gazprom

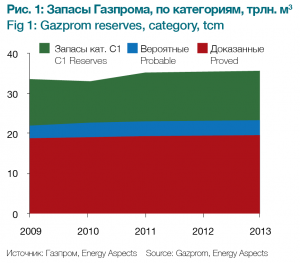

Gazprom reserves have been growing as the company engaged in considerable exploration and field development over the last five years. The total reserves of Gazprom (including the ‘possible’ (C1 category) at the end of 2013, sat at 35.7 tcm (around a 72-year reserves/production ratio), up from the 33.6 tcm level in 2009.

Both proved and probable levels of reserves have increased at the Gazprom Group level, going up by 1.2 tcm since 2009 to reach 22.5 tcm. It has also seen expansion in the reserves basis of its 96% owned Gazprom Neft subsidiary, although its overall gas reserves of 0.2 tcm are relatively low. In terms of its production sharing agreements with Purgaz and Severneftegazprom, both of these have seen a reduction in proved and probable reserves. Possible reserves (C1) have increased by 0.8 tcm in the last five years.

In terms of regional make-up of Gazprom reserves, since 2009:

» Urals reserves have eroded due to it being the most mature of the Russian basins. Gas production has reduced the reserve base by almost 2 tcm (-8%).

» Reserves have grown the most in the offshore region (up by 1.9 tcm, 38%), the Siberian fields (up by 1.5 tcm, +500%), and in the Far East (up by 0.8 tcm, 200%).

» Other, smaller regions have generally seen a decline in their estimated reserves.

In its production strategy, Gazprom indicated it expected to produce between 650–670 bcm/y of natural gas by 2020. The forecast growth in production is expected to come from the development of a number of strategic regions: the Yamal Peninsula, Eastern Siberia, the Far East and the Russian continental shelf. In this Insight, we look in greater detail at this claim and expectations for the coming years.

Non-Gazprom Reserves

While Gazprom dominates the Russian gas market, other companies also have reserves, with most of these held by the oil companies. Non-Gazprom gas reserves (proven and probable) sit at 8 tcm, or about 30% of the Russian reserves base. Much of the exploration and production of gas by these companies is done on an associated gas basis.

In terms of non-Gazprom natural gas production, the three largest producers are Novatek, Rosneft and Lukoil. We note that the sharp increase in Rosneft volumes in July 2013 are because TNK-BP started to be included from that date, rather than in the “other” category.

Gas associated with oil production makes an important contribution to Russian gas volumes, although much of it is still being flared rather than captured and marketed. Russian oil production has risen from 9.9 mb/d in 2009 to over 10.5 mb/d in 2014, mainly driven by increases in the Western Siberian region, leading to more associated gas production. In addition, Russia introduced fines for oil companies flaring more than 5% of associated gas in 2012. However, remote locations and limited infrastructure continue to limit how much gas is captured. Conventional oil fields in West Siberia are facing the declines associated with a mature basin, meaning they will also produce less associated gas in future. However, the government continues to press for reductions in gas flaring and companies may invest in more gas capturing and transport infrastructure, potentially resulting in higher amounts of associated gas reaching the market.

Main Projects Under Development

Yamal Mega-Project

The Yamal megaproject, located on the Yamal Peninsula and in its adjacent offshore areas, is made up of 11 gas and 15 oil, gas and condensate fields, with approximately 16 tcm of explored and preliminary estimated gas reserves and nearly 22 tcm of in place and forecast gas resources.

Gazprom holds the development licenses for eight fields in the Yamal project including: Bovanenkovskoye, Kharasaveyskoye, Novoportovskoye, Kruzenshternskoye, Severo-Tambeyskoye, Zapadno-Tambeyskoye, Tasiyskoye and the Malyginskoye fields.

In terms of gas reserves (ABC1+C2) the Bovanenkovskoye field is the most significant one on the Yamal Peninsula (4.9 tcm). The initial gas reserves of the Kharasaveyskoye, Kruzenshternskoye and Yuzhno-Tambeyskoye fields amount to about 3.3 tcm. Gazprom’s Yamal onshore fields are being developed in three production zones:

» The Bovanenkovo production zone includes three basic fields: Bovanenkovskoye, Kharasaveyskoye and Kruzenshternskoye. Total annual production is projected to reach 220 bcm of gas, and up to 4 Mt of condensate at peak.

» The Tambey production zone involves six fields of which four licences are held by Gazprom: Severo-Tambeyskoye, Zapadno-Tambeyskoye, Tasiyskoye, Malyginskoye (the licenses are held by Gazprom Group). Total annual production of the zone is projected to reach 65 bcm of gas and up to 2.8 Mt of condensate.

» The Southern production zone involves nine fields, although just one field licence is held by the Gazprom group: Novoportovskoye. Total annual production is projected to reach 30 bcm of gas.

The development of areas offshore Yamal in the Kara Sea are projected to start after 2025.

With project peak production of the three current development zones put at 315 bcm, the maximum annual gas production on Yamal is more than twice the volume of current gas exports to Western Europe. Forecast peak production levels for the Yamal Peninsula is significant, reaching 75–115 bcm by 2017 and 135–175 bcm by 2020. Not all of this is under licence to Gazprom, but much of the Bovanenkovo region is. It is this development that is key to the company’s expansion. By 2020, over 60% of new gas production will be coming from this one region.

The giant Bovanenkovo field began production in 2012, and while Gazprom total production was up in 2013, it is back down in 2014. Given ramp rates we would expect for the field, we believe it should produce around 28 bcm in 2014—although there is a question about whether sufficient pipeline capacity has been in place to move this gas. Gazprom’s stated intention is for the 115 bcm/y peak production from the cenomanian deposits to be reached by 2019-2020 and for the full 135 bcm/y from this field to be reached a couple of years later when the Neocomian-Jur deposit levels are tapped.

The Kharasaveyskoye field is also being developed and its 44 bcm/y is expected to be ramping up production between 2020 and 2027 while the Kruzenshternskoye fields 32 bcm/y is expected to be ramping up in the 2025 to 2028 period

Debottlenecking the Yamal

A key issue for the Yamal, as a new production area, has been providing enough transportation to move the gas to major demand centres. A new gas transmission system is being built with an eventual capacity of 300 bcm/y of gas from the Yamal Peninsula fields. The transport system includes 27 modern compressor stations with the aggregate capacity of 8,600–11,600 MW. At the same time, the total length of pipelines will be 12,000–15,000 km.

Specific projects the 1,200 km long Yamal (Bovanenkovo)–Ukhta section which will have an annual capacity of 120-140 bcm when finished. The first line, operational from 2012, is scheduled to be completed in 2014, with all compression stations with an annual capacity of 60 bcm/y. The second line will be operational from 2016 and fully completed by 2019. The timing of Gazprom’s new transportation capacity suggests that the ramping of the Yamal to target will be only moderately constrained by the availability of transportation capacity. At Ukhta, the pipeline will link into the wider Russian gas transportation system, including:

» The Ukhta–Gryazovets–Torzhok gas pipeline of 1,300 km with a design capacity of some 90 bcm/y over two lines. Both lines are expected to be operational by 2017.

» Gryazovets–Pochinki–South Stream pipeline which involves considerable upgrading of existing UGSS (Unified Gas Supply System) infrastructure that will facilitate a link to the 63 bcm/y South Stream.

» Gryazovets–Vyborg expansion to provide feedstock to the proposed Baltic LNG terminal.

The overall distance of Yamal gas transportation will be in excess of 2,500 km.

Eastern Gas Corridor

Gazprom is developing new gas production centres in eastern Russia as part of the eastern gas corridor: including the Krasnoyarsk Territory, the Irkutsk Region, the Republic of Sakha (Yakutia), the Sakhalin Region (the Sakhalin Island offshore area) and the Kamchatka Territory. The fields in the eastern gas corridor are targeting Asian markets, and are ear-marked for supporting the first 38 bcm/y contract with China.

The fields in the Irkutsk and Yakutia are the first ones being developed in the eastern corridor.

Gazprom has been developing:

» The Chayandinskoye field (Yakutia), with the oil rim online from 2014 and gas deposits to start producing from 2017-2018. Geological exploration of the field, its deposits geometry and the degree of pay zones saturation are being explored. More than half of the reserves have already been classified as proven. Gazprom intends to finish geological exploration work in 2015. Peak production from this field is put at 25 bcm/y and is expected to be reached in 2022.

» The Irkutsk fields of Kovyktinskoye and Chikanskoye which together are expected to have plateau production of 35 bcm/y. They are expected to start producing from 2022.

Debottlenecking Eastern Siberia

As with the Yamal, the development of the eastern Siberian fields requires substantial development of infrastructure to get gas to market.

For the Irkutsk and Yakutia fields, the Power of Siberia pipeline is being constructed, running for over 3,000 km from Yakutia to Khabarovsk, and then to Vladivostok and China. The gas pipeline route will run in parallel with the operating Eastern Siberia–Pacific Ocean (ESPO) oil trunkline. A 2,200-km pipeline section is scheduled to be built to connect the Yakutia Chayandinskoye field to the city of Blagoveshchensk on the Russian-Chinese border. Sections are also being built from the Kovyktinskoye field in the Irkutsk Region to the Chayandinskoye field (around

800 km), and from the town of Svobodny in the Amur Region to the city of Khabarovsk (around 1,000 km).

The annual throughput of the pipeline will be 61 bcm and it is scheduled to become operational in late 2018. In late July 2014, the first pipes were delivered to Yakutia and the section from the Chayandinskoye field to Lensk has been started. Over 120,000 tons of pipes will be delivered in 2014. Between 2014 and 2018 the project will need over 1.7 Mt of pipes.

Along with gas transmission and production facilities, Gazprom is building gas processing of the multicomponent gas from the eastern fields. The first train of the Amur Gas processing plant (to remove condensates like helium and ethane from natural gas) will be commissioned in 2018 near Svobodny.

Gazprom highlights the Power of Siberia’s routing features complex geological and climatic conditions, which pose technological problems. As a result, Gazprom will need to employ longitudinally welded pipes made of cold resistant steel K60, with external anti-corrosion. And in the areas of tectonic faults and intense seismic activity higher than eight points, they will need to use high strength pipes.

Nadym-Pur-Tazovsky

Although not a major development project, the Nadym-Pur-Tazovsky region has been an important production region for Gazprom, having accounted for around a quarter of its production as recently as 2010. Production in the region had been in decline because of a drop in seam pressure at the fields’ productive layer. The fields are more than two-thirds depleted, but Gazprom has had a programme of developing new fields near the larger deposits. A number of these fields are still ramping up, with the most important ones being the Urengoy fields, with blocks 3-5 still in the process of commissioning. All of these projects could add some 38 bcm/y back to production of this region, which is in overall decline.

In addition to the field additions, Gazprom has had a programme of upgrading existing equipment including: replacement of BCS replaceable flow parts, upgrading BCS blowers, upgrading gas pumping units (GPU), replacement of wellhead equipment and well tubing, work over of wells by side-tracking, and installation of production control systems on wells and flow lines. Gazporm reported the programme enhanced production by 15 bcm/y in 2013.

Russian Offshore Developments

In addition to the eastern Siberian fields mentioned above, the eastern corridor also includes the country’s main current offshore gas project, the Sakhalin III project in the Sea of Okhotsk. The Sakhalin III project is operated in three blocks: Kirinsky, Ayashsky and Vostochno-Odoptinsky. The Kirinsky block comprises:

» The Kirinskoye field which produced its first gas in October 2013;

» The Yuzhno-Kirinskoye and Mynginskoye fields. Between 2013 and 2014, four exploratory wells are to be built in the Yuzhno-Kirinskoye field with the view of preparing it for commercial development.

The gas will feed the Sakhalin–Khabarovsk–Vladivostok gas transmission system (GTS), which will supply gas to Far Eastern regions of Russia and the Vladivostok LNG project.

Gazprom’s other major gas project on the Russian continental shelf is the Shtokman field in the Barents Sea. The Shtokman gas and condensate field is located in the central part of the Russian sector of the Barents Sea shelf, about 600 km northeast of Murmansk, where sea depth varies between 320 and 340 meters. C1 reserves of the field make up 3.9 tcm and 56 Mt of gas condensate. The Shtokman field development has been divided into three phases with each phase providing around 24 bcm/y of annual production to a maximum design capacity of 71 bcm/y. The final investment decision on Phase 1 was expected in 2011 and 2012, but the project has yet to progress.

Generally, Gazprom’s offshore activities are relatively limited, and with onshore costs generally lower than offshore costs, the focus on Eastern Siberian gas, rather than a tricky project like Shtokman, appears sensible.

Non-conventional Resources

Shale gas

With considerable conventional reserves to develop, Gazprom has done relatively little work exploring gas shale. The EIA/ARI 2013 report put estimated shale resources of Russia at 8 tcm—around 20% of Russia’s current reserve base but only 3% of its current resource base. We do not expect Gazprom to commercially develop shale gas in the current time frame.

Coal Bed Methane (CBM)

Gazprom has forecast methane resources of the major coal basins in Russia to contain 83.7 tcm, making up approximately 30% of the country’s forecast natural gas resources. The coal producing Kuzbass region is the centre of attention and Gazprom considers this to be the world’s largest explored CBM basin. The basin’s forecasted methane resources are estimated at over 13 tcm. Gazprom forecasts annual CBM production in Kuzbass will peak at 4 bcm/y, although no timetable is given, and we do not expect this to be a priority project for the company in the coming years.

LNG Projects

While a midstream rather than an upstream activity, LNG projects often have associated upstream activities. LNG is particularly important in facilitating some of the upstream developments for producers other than Gazprom. This has been the case since the Russian Parliament in late 2013 removed Gazprom’s LNG export monopoly, allowing other entities to receive export licences. The removal of the export monopoly via LNG came after Gazprom’s high-profile LNG project focused on the Shtokman field collapsed. This was after the main partners pulled out following technical set-backs and significant cost overruns. Following that, some of the largest associated gas producers, Novatek and Rosneft, started developing their own LNG projects. Both projects have international partners and have sales agreements with LNG buyers. The main issue for both of these projects is now the potential impact of sanctions.

With both of these projects advancing, Gazprom rushed through two projects in 2013. It took the FID on the Vladivostok LNG project (underpinned by Sakhalin III production), which benefits from its proximity to the main northeast Asian LNG markets. It also announced the Baltic LNG project that seems to have a less strong investment rationale, targeting a western European market intent on using LNG to diversify its supplies away from Russia. Gazprom announced it is looking for an investor to take 49% of this project, although it has had success with this during 2014.

Gazprom is also considering a capacity expansion at its Sakhalin II LNG plant, with Shell to add a third train. The pre-FEED work is already completed and the FEED stage is ongoing.

Click here for Part 2