Global Trends in Well Drilling and Completion Market: Rystad Energy’s Outlook by 2025

After a challenging 20 months for drillers, including pandemic outbreak and a slower-than-anticipated post-pandemic recovery in the drilling and completions market in the oil and gas sector, are finally seeing light at the end of the tunnel. As the number of Covid-19 vaccinations increase worldwide and travel restrictions ease, oil demand is expected to bounce back swiftly, giving E&Ps much-needed confidence to scale up investment in oil and gas. Rystad Energy’s analysis of key activity indicators such as rig activity and contract awards coupled with our discussions with operators and suppliers, makes us optimistic that industry will drill almost 5,000 additional development wells this year compared to 2020, raising the total tally for 2021 close to 54,000 (figure 1).

Development Well Drilling Outlook

The analysis shows that there will be regional variation in E&P activity as the sector recovers, with some areas rebounding back faster and stronger than others. For example, North America looks likely to emerge stronger this year despite being one of the region’s hardest hit by Covid-19 last year. A short cyclic shale industry is what is set to drive this growth in the US, though it still depends on how oil prices pan out. In longer term, the share of tight oil wells in the worldwide drilled development well count is expected to increase from around 20% to 29% in the 2021-2025 period. While the US accounts for the lion’s share of these unconventional wells, Canada’s share is expected to rise to 17% of all tight oil wells drilled by 2025. However, the conventional wells market is expected to continue being a key driver in the drilling market where China is set to lead the way with around 85,000 wells to be drilled in the 2021-2025 period.

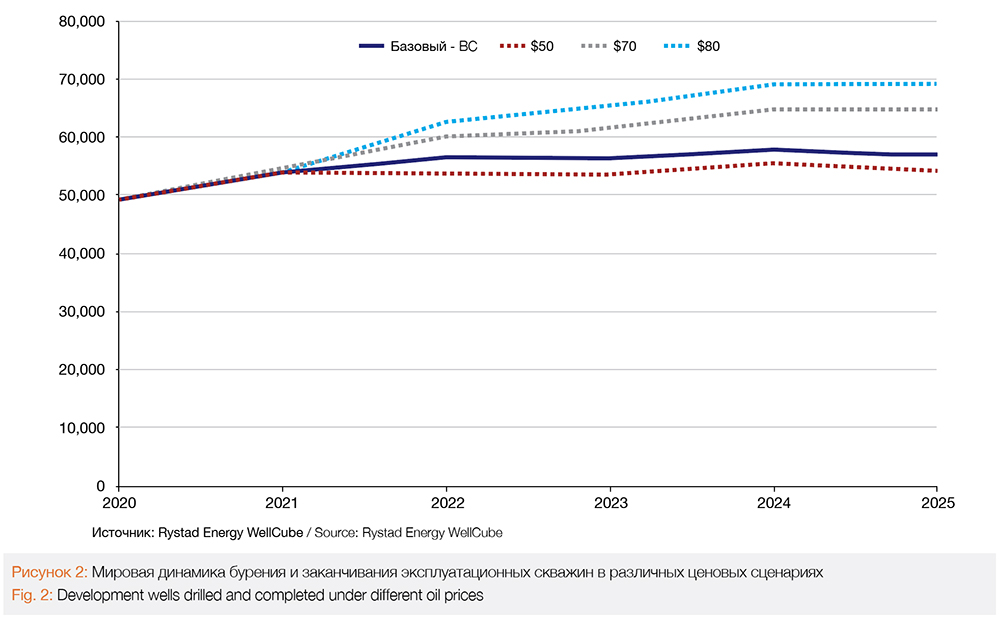

Figure 2 shows our estimates of the way in which global development drilling and completion activity could be impacted through to 2025 under different oil prices. In the base case, after further growth anticipated next year, number of drilled and completed wells is averaging around 57,000-58,000 wells per year in 2022-2025. Under an optimistic scenario, if oil prices manage to stay at $80 per barrel for long enough, E&Ps could drill an additional 40,000 wells through 2025 compared to our base case. Favourable oil prices will encourage operators to step up drilling activity as an increasing number of projects becomes profitable.

Figure 3 splits the total number of wells to be completed into different reservoir pressure and temperature groups – key influencers for both drilling and well completion designs. We expect that the majority of wells to be drilled and completed up to 2025 will be in reservoirs with pressures between 3,000 and 6,000 pounds per square inch (psi) and temperatures between 60⁰ and 100⁰C. We expect fewer than 10% of wells will be drilled in reservoirs where pressure exceeds 10,000 psi, with the US and China likely to be the largest markets for high-pressure drilling. Similarly, from a reservoir temperature standpoint, around 15% of wells will potentially be drilled in a high temperature environment (temperatures exceeding 100⁰C).

Oilfield Service Sector Rebounds After Last Year’s Downturn

A recovery in global drilling demand would translate into increased spending for well-related services as well as growing service companies’ revenues from this segment, although 2021 still looks to be a challenging year both for upstream operators and service providers. In 2021, service companies are expected to earn $105 billion from drilling activities. These numbers are still 30% lower than what we saw in 2019, but service providers are battling their way out of the previous year’s downturn and are expected to have an average of 4% year-over-year (YoY) growth in revenue, a trend that is expected to continue through to 2023 before stabilizing.

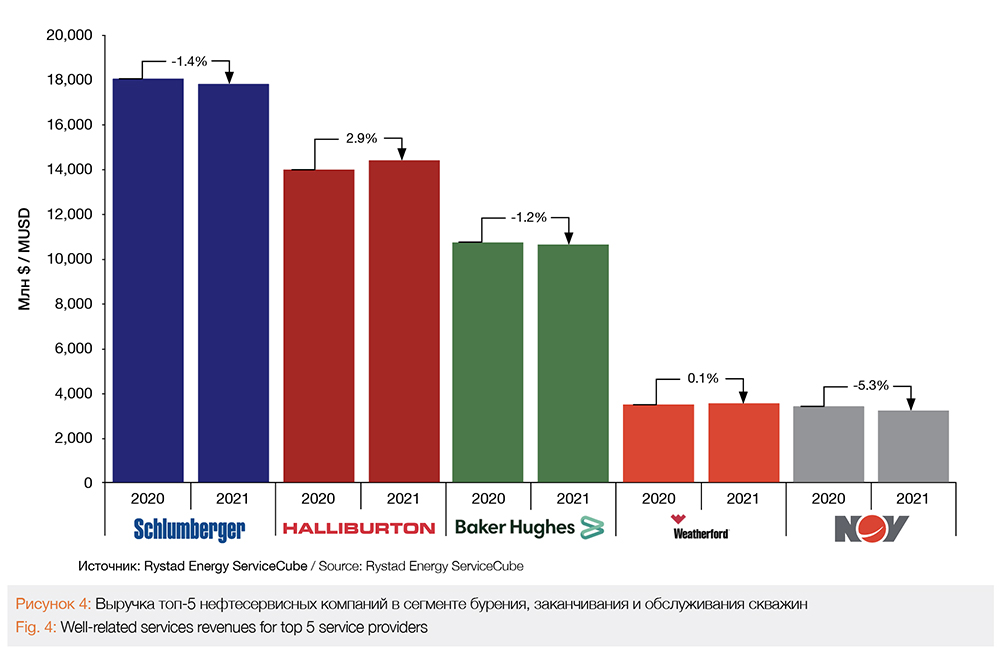

Oilfield service (OFS) giants Schlumberger, Halliburton and Baker Hughes together reported significant revenue growth in 3Q21 of about 11% since this year’s first quarter, however in comparison to the previous year’s numbers, Schlumberger and Baker Hughes are expected to see a 1.3% decline in revenues for well-related services this year (figure 4). The expected decline for Schlumberger comes after the company sold off its pressure pumping business to Liberty Oilfield Services at the beginning of the year. However, the OFS major is still leading the way in terms of revenue for well-related services with around $18 billion expected in 2021. This is primarily driven by operations in the US, Saudi Arabia and Russia, which together account for roughly half of its total revenue. On the other hand, North America (primarily the US) and the Middle East are together expected to account for more than half of Baker Hughes’ revenues in 2021.

Halliburton is expected to bounce back from the previous year with a 3% growth in revenue for well-related services in 2021. This growth is set to be driven by the completion and production as well as the drilling and evaluation divisions posting sequential increases due to improved drilling-related services and wireline activity across all regions.

E&P Sector Expenditures are Going Up

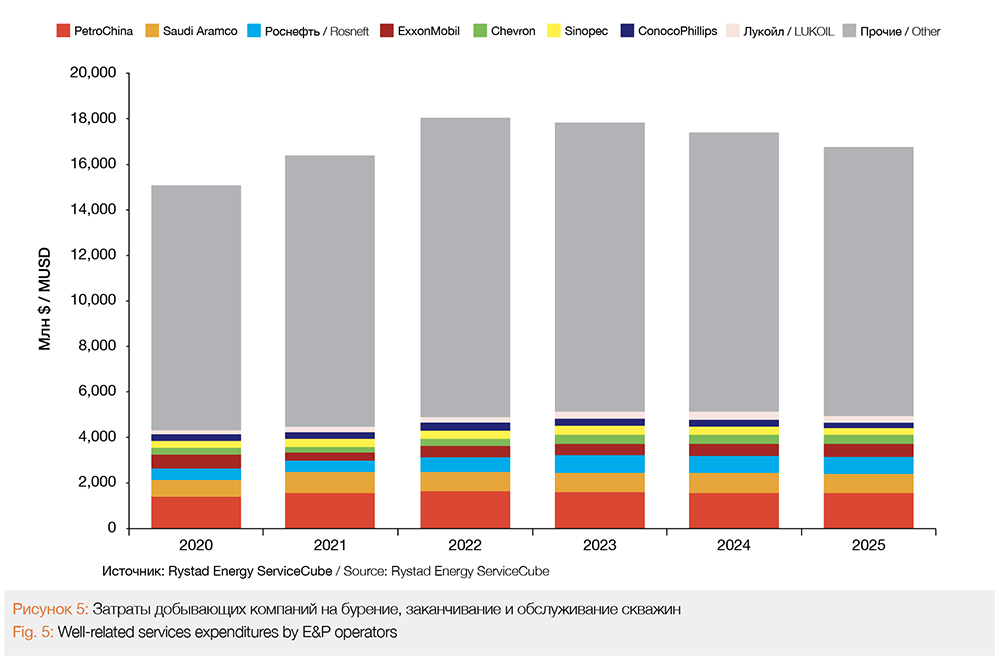

The total spend on well-related services is made up of spend from following categories: wellbore completion and intervention, well stimulation, drilling tools and services, and oil country tubular goods (OCTG). Global E&P expenditure for well-related services is expected to stand at around $164 billion for the full year of 2021, $14 billion higher as was seen in 2020 (figure 5). Chinese state-owned company PetroChina continues to be the biggest spender on well services and is expected to spend around $16 billion in the industry this year and $17 billion next year. However, we expect a decline in spending by the company by 2025 as compared to 2022, before stabilizing and increasing to current levels in 2030 outlook. Saudi state giant Saudi Aramco is expected to follow stable trend with no significant growth expected in the 2021-2025 period. Rosneft, on the contrary, is forecasted to increase spending in well-related services by 20% in 2022 as compared to 2020 before stabilizing at the level of $7.5 billion for the next five years. Rosneft’s investments may be higher as the current outlook doesn’t fully account for extensive drilling activities planned within the Vostok Oil project as Rystad Energy is waiting for the results of further exploration programs on key Payyakhskoye and Zapadno-Irkinskoye fields needed to prove announced resource estimates (1.2 billion tons and 500 million tons, respectively).

US supermajors ExxonMobil and Chevron have each recorded a decline of around 30% from 2020 levels, with close to $6 billion combined in well services expenditure in 2021. While Chevron’s expenditure is expected to ramp up in 2022-2023 and then hold steady at around $3.7 billion annually in next two years, ExxonMobil is poised for 14% growth on average in spending by 2025 as compared to the $3.5 billion in 2021, driven mainly by well stimulation services such as hydraulic fracturing, chemical stimulation and coiled tubing, all primarily in the US.

Rystad Energy expects that almost $864 billion will be spent on well-related services between 2021 and 2025, with the bulk (40%) going to wellbore completion and intervention services. In terms of specific markets, we expect the average market size for well-related services to be around $65 billion in North America, followed by Asia & Australia with $29 billion and the Middle East with $21 billion.

In North America, around 50% of the amount of wellbore completion and intervention spending will be aimed at unconventional shale with the bulk of this going to complete (frack) shale wells. Apart from Europe where almost 80% of the planned amount will be spent offshore (primarily the Norwegian and UK continental shelves), conventional onshore will remain as the largest market for wellbore completion and intervention services in other regions.

Comparing total expenditure between 2021 and 2025 with the previous five-year period (2016-2020), we do not see a significant drop in the coming period. A total of $976 billion was spent on well-related services in the past five years, which indicates that total spending will fall by $112 billion in the next five years. While upcoming expenditure would have been higher without the Covid-19 pandemic impacting the sector, the drop is still not especially dramatic. Although operators are starting to invest outside the oil and gas sector, including into renewable energy technologies, this indicates that demand for drilling and completing oil and gas wells is likely to remain strong, at least in the short to medium term.

This outlook resonates with industry sentiment, with a number of major E&P and oilfield service companies recently stressing that the sector must maintain a balance between cutting emissions and meeting global energy demand. To meet rising demand for wellbore completion and intervention services, this means suppliers will need to maintain sufficient capacity in terms of people, equipment and technology going forwards.

E&P Operators Eyeing Energy Transition

While spending on well services for upstream operations is expected to continue to make up a major share of expenditure for E&P operators, companies such as ExxonMobil, Shell and Chevron are ramping up their energy transition efforts to cut emissions. ExxonMobil has invested $10 billion over the past two decades on low-carbon solutions such as carbon capture and storage and plans to invest $3 billion more through 2025. Chevron has allocated $300 million for investments to advance its energy transition goals in 2021, although this represents just 2% of the total budget and significantly trails the company’s European peers. Chevron is also exploring alternative power sources, such as advanced geothermal, which is emerging technology with reduced intermittencies compared to other renewable sources.

Although these new markets (CCS and geothermal) are significantly more niche than oil and gas operations, they present an exciting and rapidly growing avenue for well services players and an opportunity to further diversify their portfolios amid a drive among industries and countries to reach net-zero emissions targets.

Authors

Reza Hassan Kazmi,

Melnik Daria