Identifying the Real Structure of an Oil and Gas Reservoir and its Effect on Recoverable Hydrocarbon Reserves Part 2

Yuri A. Limberger, Independent Expert

The first part of this article (ROGTEC Issue 40) focused on the rationale, structure and proof of the actual existence of a fundamentally different model for the accurate estimation of an oil and gas reservoir. The second part focuses on the practical results using the new model adopted by the author with respect to today’s models. We prove the advantages of the new model to solve problems in the calculation of the estimation of recoverable reserves within oil and gas.

Accuracy of Reserves Estimation

Irrespective of the method used to estimate the reserves, the main issue remains, the accuracy of the estimate.

In the Russian Federation the criteria for accuracy are protocols of the state authorities, stating approved volumes of geological and recoverable reserves in a specific deposit or field. In the West the accuracy criterion is a conclusion made by an internal or an external auditor, an independent estimator or an expert. Do we have something in common here? We do. In both cases the accuracy criterion is an opinion and essentially it does not matter who produced this opinion – a state, a specialised company or a private individual. Any opinion is a subjective perception and reflection of reality. It is not, and can never be, a criterion for accuracy.

The accuracy of estimation of discovered reserves is determined not by the protocols of the State Reserves Committee (GKZ) and the Central Development Commission (CDC) and not by the conclusions of international auditors but by real facts. There is nothing more accurate, objective and reliable than the volumes of minerals produced from subsurface, to be specific, the cumulative oil produced before the start of full water encroachment in the field and the cumulative gas produced by the time when the gas pressure in the well becomes equal to the pressure on the surface plus the pressure of the gas column from the surface to the pool. By comparing the estimate with fact we find out the real accuracy of the estimation.

In this respect the following attracts attention: Oil and gas companies throughout the world regularly produce reports on the dynamics of their reserves. However, not a single company has ever published data comparing their approved hydrocarbon reserves to the hydrocarbons which were actually produced from specific field. The reason for the above is significant over-estimation of reserves compared to actual production. Publishing this kind of data could seriously damage a company’s reputation and lead to financial losses.

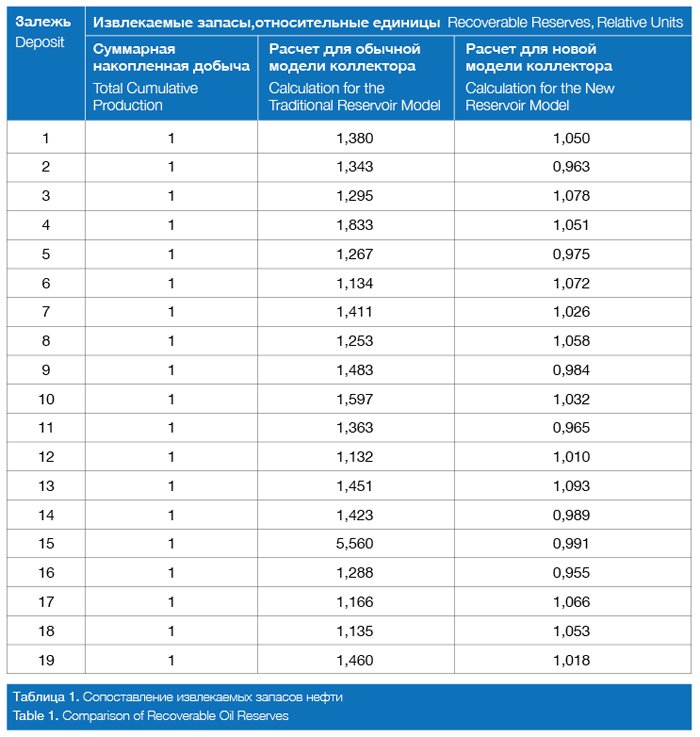

Table 1 shows comparison of recoverable oil reserves estimated by the standard method (calculation of geological reserves and multiplication by an oil recovery factor) and reserves estimated on the basis of the new reservoir model. In the latter case, effective (saturated by hydrocarbons) porosity and direct determination of the oil saturation were used. For ease of comparison, relative indicators were used. Cumulative production is assumed as 1. In all the fields for which recoverable reserves were estimated by the usual method only the over-estimation of cumulative production is observed. The over-estimation range is +(13-556%). If we assume that cumulative production from each deposit comes from a hypothetical single deposit, the over-estimation is 63%. In absolute terms this exceeds 400 million tonnes of oil. Excessive discrepancy between the estimate and actual production is due to the use of over-estimated porosity factor (void volume) (by a factor of 3 – 14) and over-estimated oil saturation factor (by a factor of 2 – 5).

Discrepancy between reserves estimated for the same deposits on the basis of the new reservoir model and cumulative production was in the range of -4,5% to +9,3%; for the hypothetical deposit it was ±2%. Thus, estimating recoverable oil reserves using the new reservoir model automatically ensures that the estimate accuracy does not exceed ±10%.

When estimating free gas geological reserves by using the volumetric method the same formula is used as with oil. However, similarly to estimating geological oil reserves,

in this case porosity factor and gas saturation were over-estimated which resulted in over-estimation of reserves. Notably, free gas reserves are over-estimated considerably more than oil reserves.

The latter is due to the following: The major part of estimated geological oil and gas reserves are virtual reserves which do not actually exist. Multiplying geological reserve by an oil recovery factor is absurd as mathematical operations should not be performed on something which does not exist. Arithmetical multiplication of a number by a value lower than 1 reduces this number. For this reason recoverable oil reserves are always considerably lower than geological reserves. Free gas recovery factor is close to 1 and one could put an “equal” sign between geological and recoverable reserves. But as geological reserves of free gas are initially significantly over-estimated, recoverable reserves are repeatedly overestimated.

The comparative data shown in Table 1 prove the over-estimation of reserves around the world as the result of methodological errors in the practical use of the formula in the volumetric method. But the current reservoir model adopted and used for calculation of reserves could not possibly produce any other result.

On 3.8.2009 The Independent newspaper published an interview with Mr. Fatih Birol, the Head Economist of the International Energy Agency. He stated that a detailed assessment was made of over 800 oil fields where recoverable reserves account for three quarters of the world’s oil reserves. Production drop in these fields which are past their production peak is 6.7% annually compared to the annual rate of 3.7%, forecast in 2007. The Agency admitted that the earlier forecast was wrong. An almost two times increase in production drop rate is the direct result of considerable over-estimation of reserves in the producing fields. Thus, the conclusion made by the author of this article regarding over-estimation of reserves all over the world, based on his personal studies and using the new reservoir model, is confirmed by a recognised international agency.

Residual Oil

In one of the countries, with over a century of oil production history, a special drilling programme was implemented in one of the oldest fields. The purpose of this drilling was to identify and determine the residual oil saturation of previously producing formations. As the result of the drilling no evidence of oil in previously depleted oil-saturated formations was found.

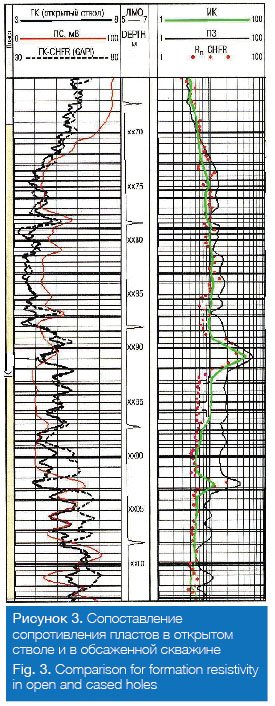

The absence of any residual oil in pay formations could also be noted in well logs in the fields which had been in development for a long time. Technical achievements and advances in methods and technology of subsurface exploration enable monitoring of hydrocarbon saturation in formations at any stage of field development. In particular, it is possible to measure formation resistivity in a cased well which enables the measurement of the current oil saturation.

Fig. 3 compares resistivities measured in open hole and casing. In the course of the initial reservoir development in the хх85-хх97 m interval water-free oil was produced at a rate exceeding 80 m3/day. 25 years after the start of production, measured resistivity corresponded to design formation resistivity at 100% water saturation. In fact, the well produced water was injected to support formation pressure. (The overlying reservoir where resistivities measured in open and cased holes were equal, later produced water-free flow of oil to the surface).

In the currently assumed reservoir model this is not acceptable because of the axiom that full recovery of geological reserves is impossible. In the new model that is how it should be because the oil filled only parts of the reservoir with effective porosity and was completely displaced by the injected water. The example confirms the absence of residual oil in formation (So=0), which had been displaced by water for a long time. Any unbiased specialist – a geologist, a geophysicist or an engineer could himself observe the same by carefully analysing similar information after having performed respective borehole investigations.

The above facts confirm that, even with the modern, supposedly very low technological standard of developing oil production, the latter is completely recovered from subsurface and delivered to the surface. The established and widely spread ideas that a large part of oil reserves could not be produced “today”, remains subsurface, and that our descendants will be able to use it “tomorrow” are based on conjectures, assumptions, logical constructions, complete denial of actual facts and lack of desire to take reality into account.

In this respect let us mention errors in comparing oil recovery factors in Russia and other countries in the media, presentations delivered by experts, by consultants and officials (it normally is presented like this: the average oil recovery factor in the Russian Federation is approximately 0.3, and say, in Norway – 0.48). Differences in oil recovery factors in different countries compared to the Russian Federation are caused not by Russia lagging behind in production but the fundamental difference in reserve estimation methods used in the Russian Federation and the PRSM system. The actual oil recoverability is the same in all countries. However, in the currently assumed reservoir model such differences in recovery factors are inevitable.

The given data confirm, once again, that the oil recovery factor, the way it is understood and used now, does not have any valid substantiation but is a flexible manoeuvring tool to justify errors in reserve estimation and oil recovery.

What is offered by the new reservoir

structure model?

The proven new model of a reservoir structure, firstly, enables estimation of reserves with an accuracy which could not be achieved in principle by the current reservoir model. It happens automatically, just by using the model itself. In this model, oil and gas saturation is determined directly and no knowledge is required of the Archie equation, formation resistivity and rock wettability. The new model enables, straight away, calculation of recoverable reserves. And, such calculation does not require geological reserves, oil recovery factors, well pattern and hydrodynamic calculation.

Taking into account the new reservoir structure enables confident forecasting of oil price and future developments of hydrocarbon pools.

Article [1] published in 2006 contains an explanation of an oil barrel price increase. I would like to remind you that in 2008 the price of a barrel more than doubled compared to that in 2006 and reached almost 150 US Dollars. The same article described conditions which would lead to oil price reduction: (1) industrial collapse; (2) appearance of new energy sources. We can currently observe a combination of both conditions: recession, stagnation, very insignificant economic growth in some industrially developed countries, on the one hand, and successes of the “shale revolution”, on the other hand. This combination resulted in the price of a barrel of oil being more than halved. However, if annual economic gross in developed countries reaches 3-3,5%, the oil price will break a new record. It is very important to bear in mind that numerous agencies, experts and consultants in their forever changing forecasts never take into account a considerable over-estimation of reserves by all companies in the world which reduces the actual drop in production rate in those fields which are no longer at peak of production.

Publication [2] shows production forecasts for some oil fields by different companies. The article had not even been published when the operator publically declared that there was a substantial over-estimation of reserves for one of the fields referred to in the article. Thus, it confirmed the forecast given by the author of this article. The production never reached the planned level in three years from the start of the development and the company had to write off 70% of their reserves, i.e. the estimate was more than three times higher than the actual production.

The race to continuously increase reserves became absurd. In 2014 the State Committee for Reserves (GKZ) recommended that, based on the results of drilling a single appraisal well in the northern shelf in the Russian Federation (without knowing the oil- or gas-bearing area or any average pool parameters) over 100 million tonnes of oil and almost 500 billion cubic metres of gas should be recorded in the state books as assets. Based on the new reservoir model it is possible to forecast that most of the indicated reserves will turn out to be non-existent.

Conclusion

The structure of a reservoir containing oil or gas as currently presented is too simple, i.e. all interconnected porosity contains hydrocarbons with a film of residual water. Such a simplified view of a reservoir structure leads to serious errors particularly when estimating oil and gas reserves.

The source of these errors is merely method-related mis-calculations leading to over-estimation of rock volume in a pool and the degree to which it is filled with hydrocarbons. The root of the errors is an incorrect reservoir structure model. The actual reservoir structure is considerably more complicated than it is presented. Interconnected porosity consists of two parts one of which ensures rock permeability and fluid flow. It is precisely this part and only this part of the reservoir which contains hydrocarbons together with a residual water film. The other part of the reservoir with interconnected porosity is not permeable and does not allow fluid movement; this part of reservoir is filled with residual water.

The methods of processing geological and geophysical data which take into account the new reservoir structure model make it possible to avoid miscalculations related to the old calculation methods. The application of these methods provides the possibility to achieve an accuracy of reserve estimation by the volumetric methods which could not be possibly achieved by the reservoir model used currently.

Further use of the new reservoir model will require revision of the theory, processing methods and interpretation of some types of logging, as well as re-consideration of the methods of building geological and hydrodynamic pool models. The requirements of the essence of a reservoir engineer’s work would also have to be changed. Using the current reservoir structure a reservoir engineer first calculates the geological oil reserves and then substantiates a recovery factor for well pattern. In fact, the recoverable reserves are estimated in two stages and require lengthy and expensive core studies and computer calculations. Using the new structure, recoverable reserves are estimated straight away while there is no need to know geological reserves, oil recovery factor, well pattern and hydrodynamic calculation. Knowing these reserves in advance and having a geological model of pool, the main objective of the reservoir engineer would be to use such well pattern and technical equipment and technology which would enable the extraction of recoverable reserves within a reasonable time period and with the lowest cost.

The new reservoir model does not only mean radical change in the requirements to the work of a developer but is also a fundamentally new technology for oil production and field development.

References:

1. Limberger Yu.A.. False Mirror. Oil and Gas Vertical Magazine, Issue 11, 2006, p.18-22.

2. Limberger Yu.A.. Why do companies overestimate oil and gas reserves? Exploration and Production Magazine, Issue 10, 2011, p. 45-49.

3. Grattoni C.A., Dawe R.A. The Effect of Differences of Multiphase Spatial Distributions on the Electrical Properties of Porous Media. The Log Analyst, July – August 1998, vol.39, №4, p.47-59.