International Experience of Shale Oil Production: Implications for the Bazhenov Formation and Russian Equipment Manufacturers

1. Shale Oil in Russia and the Bazhenov Formation

In Russia, the main volume of shale oil (LTO*) resources is located in the Bazhenov, Domanik, and Khadum formations, of which the first is the most promising. The Bazhenov formation is a group of mature source rocks found over an area of about 1 million sq. km in Western Siberia. The formation lies at depths of 2-4 km, has small thickness (20 to 60m) and a unique geological structure. The geological potential of the formation has been studied since the 1960s (at least 800 wells were drilled in total). Currently, the hydrocarbons geological reserves volume in the Bazhenov reaches, according to various estimates, from 18 to 60 billion tons. This indicates the lack of a unified approach to the development and technological availability of the Bazhenov.

*Shale oil is considered to be oil produced from shale formations, as well as light tight oil (LTO) that is produced from reservoirs with low and ulatra-low permeability. LTO accounts for over 90% of shale oil produced globally, thus generally LTO is the term of choice throughout the article.

Current production at the Bazhenov is estimated at 600 thousand tons per year. The main contribution is made by wells that successfully penetrated ‘sweet spots’; their production profile is similar to wells at fields with traditional reserves. All major Russian oil companies, with systemic support from the government, are engaged in geological research of the Bazhenov formation and development of technologies that allow for effective commercial exploitation.

Russia’s official Energy Strategy to 2035 (adopted in 2020), includes «introduction into the economic cycle […] of unconventional reserves (including the Bazhenov formation), as well as creation of conditions for development of small and medium enterprises in this field mainly on the basis of innovative domestic technologies and equipment» among the «key actions aimed at ensuring a stable, and under favorable conditions –growing, level of oil production».

Forecasts for shale oil production in Russia vary greatly. According to the OPEC forecast*, production is expected at the level of 7-10 million tons per year in the medium term (2025-2027) and up to 12-15 million tons per year in the long term (2030-2035). LUKOIL** forecasts that the level of 32 million tons/year is reached by 2030, and of 40 million tons/year by 2035. Gazprom Neft plans to produce 10 million tons per year in the Bazhenov formation by 2025***.

*World Oil Outlook report (2020)

**Key Trends in the Global Liquid Hydrocarbons Market to 2035 report (2035)

***For details see https://www.gazprom-neft.ru/files/journal/SN175.pdf

2. LTO Production Experience

Global LTO production currently consists of production in the United States, Canada, Argentina, and Russia. LTO commercial production in China has not yet begun, R&D and pilot operations are underway.

Full-scale LTO production is based on the application of technologies in the areas of directional (horizontal) drilling and well completion with multi-stage hydraulic fracturing (MSHF) systems.

The bulk of LTO production comes from the USA, where LTO’s share of total oil production was 57% in 2019. In Canada and Argentina, the share of LTO in domestic oil production was 10% and 16% respectively; in Russia – about 0.1%. LTO production in China is expected to start after 2020.

Development Stages and Production Strategies

The development of LTO production can be divided into two stages, each characterized by its own production strategy: (a) stage of intensive development in 2012-2018 (in the U.S. and Canada) and (b) stage of extensive development, which began in 2018-2019 and continues at the moment.

Intensive Development Stage

The stage covers the period from the start of full-scale production in the U.S. in 2012-13 (a similar process in Canada began later) until the transition to extensive strategy in 2018-19.

Over this stage, the U.S. LTO industry was formed and tested for strength during the 2015-16 crisis. One of the key drivers at this stage was the availability of cheap finance (credit and equity) for production operators. The industry was developed by a large number of medium- and small-sized companies, for which a high risk/high reward approach is organic. Major oil companies joined the process at a later stage, with the exception of ExxonMobil, which acquired leading LTO producer,

in 2009.

Production strategy for this stage was aimed at maximizing production volume at the early stage (i.e., maximizing initial production rates).

The technological potential of the U.S. oil and gas industry (primarily the oilfield equipment and services sector) provided for the strong growth in initial production rates, especially in response to the low oil price crisis of 2015-16 (see Chart 2), through innovation in drilling and completion (increasing the size of the artificial reservoir due to growth of interrelated parameters – length of well’s horizontal section, number of stages of MSHF, and volume of proppant).

Intensive production shaped trends in well operation and artificial lift (AL).

At the initial stage, the most widely used methods of artificial lift were those transferred from ‘conventional’ oil production – primarily, ESP as the most effective method for the high-rate stage of production.

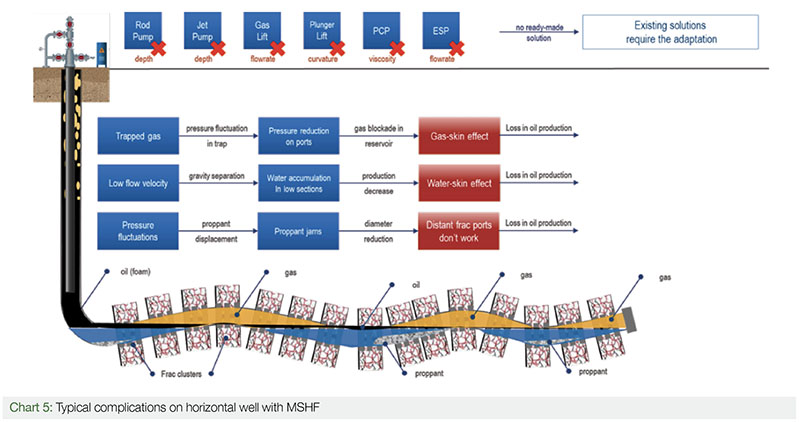

The growth in the average length of horizontal well sections and the average number of MSHF stages led to an increase in complications associated with multiphase flow distribution and flow turbulence in the well. As a result, the operating time (time to failure) of pumping equipment has significantly decreased. This led to solid growth in the use of gas lift due to its stronger resistance to such kind of complications.

Gas lift has developed into the priority AL method in U.S. LTO production under the conditions of availability of inexpensive gas, which varies significantly by formation. The crisis of 2015-16 was a powerful impetus for the use of gas lift. At the same time, artificial lift generally played a secondary role in the cost-cutting response to the crisis, as well as for some time after it had been overcome.

By 2018, the selection of AL method on LTO formations in the U.S. and Canada was based on (a) the level of initial flow rates and (b) gas availability.

In 2018-19 gas lift and ESP had comparable market shares (by well stock) – 38 and 34 percent respectively. Each AL method has its own ‘incumbent’ niches based on restrictions on gas availability, ultra-high flowrates and other parameters. Rod pumps continued to be used in the traditional way – for operating the well from the low-rate stage to the end of the life cycle.

This stage is characterized by use of several AL methods throughout the well’s life cycle (WLC), which involved changing equipment, shutting the well and doing workovers (up to six per the WLC). The level of operating costs (which include AL costs) increased significantly, while also forming a resource for managing the cost of production.

Well operation and AL at this stage had not yet had enough grounds for large-scale effective implementation in the logic of the full life cycle of the well.

Extensive Development Stage

The transition to this stage took place in 2018-19, and it is ongoing at present. In addition to the U.S. and Canada, Argentina has emerged as a new important LTO player with its own characteristic features.

A paradigmatic shift has been under way in LTO production in U.S./Canada, with the key priority becoming financial health and discipline on the part of the LTO operators, with the ultimate goal being an acceptable level of return on capital. As a result, the production strategy has been modified to focus on operating profitability and sustainable medium-term development. An important factor shaping this strategy is the significantly lesser ability of drilling and completion technologies to bring down production costs. Thus, managing operational costs becomes a higher priority.

This production strategy started being implemented prior to the fall in oil prices in March 2020, and presently its relevance has only increased.

In Argentina, this stage has seen the flagship LTO production project in the Vaca Muerta basin, operated by Argentinian company YPF, enter the commercial production phase. YPF’s partner in the project is Chevron, which holds extensive technological and managerial competencies.

The project’s production strategy takes into account the global experience (primarily from the U.S.) of LTO production and focuses on maximizing the long-term financial and economic result (NPV). The project has been implementing a comprehensive plan of developing all parts of the LTO production industry within a high- efficiency ‘industrial’ approach (factory model), following which lLarge-scale drilling of horizontal wells began in 2018-19. Production at the early stage of the WLC is not forced; the well at the stage of natural flow production is brought to maximum flow rate very gradually using choking. As of 2019, Vaca Muerta had 18% of the well stock operating at natural flow, compared with only 1% in the U.S.

Current Trends in Artificial Lift

At the current stage, LTO operators give higher priority to operating expenses as a resource for improving efficiency compared to the previous period.

As a result, during the period preceding the crisis that struck in the spring of 2020, there was a decrease in demand for «bandage technologies” (to use the expression of SPE President Shauna Noonan)* and stronger technological development of AL for LTO. A range of innovative solutions has been developed with an important role played by Russian manufacturers (see more details below).

*Shauna Noonan, “There Is No Silver Bullet: Strengthening the Fundamentals”, Journal of Petroleum Technology, April 2020

New technologies have overcome the key limitations that previously formed ‘protected niches’ for certain AL methods. Crucially, new solutions can cover the full (or close to it) life cycle of an LTO well.

Electric submersible pumps (ESP) have become more resistant to complications (gas, solids etc.) and have expanded their use at the low-rate stage of the WLC, due to innovation in equipment design and new materials, as well as to application of auxiliary equipment (gas separators, frequency regulators).

Gas lift has expanded its application possibilities throughout the full WLC due to engineering solutions that reduce per-unit gas consumption, as well as through emergence of the gas compressor rental market.

Rod pumps expanded application at the higher rate stage due to long-stroke solutions.

Hybrid solutions are being used wider (for example, gas lift + plunger lift) or are on their way to commercial application (for example, positive displacement pump with a submersible linear drive).

Consequently, competition between AL methods has changed qualitatively, since some of them are increasingly claiming to be applied as the primary or even single AL method for the full life cycle of a well.

However, there is no dominant leader among AL methods applied on LTO. Each geological formation and each application segment (operational conditions, stage of WLC) has its own specific competitive situation, which ensures market demand for each of the main methods.

AL Methods Across the Well Life Cycle

In LTO production, the choice of AL method is largely influenced by the design of the well (extended horizontal section, multi-stage hydraulic fracturing completion) and the production profile, which is characterized by a rapid decrease in production rates: after the first 6 months – by 50% to 65%, after the first 12 months – by 65% to 80%. A large number of frac stages requires so-called «high-speed» frac jobs, which in turn requires an increased diameter of the horizontal borehole. As a result, there are typical complications: low flow rate following the first month of operation that is insufficient for removal of the heavy phases (water, solids and proppant); gas and liquid plugs and slugging in the well.

Almost all LTO wells require the consecutive use of two or more AL methods, since at present there is no equipment available on the market that as part of a single complex could work efficiently throughout the life cycle of the wells of this kind. Consequently, an upstream operator is faced with the task of planning out AL methods configurations, which requires taking into account the technical applicability of the equipment, as well as the cost of operating and replacing the equipment.

Table 1 compares the main AL methods used on LTO by key operating conditions and technical characteristics of standard (mass-used) equipment.

Several stages can be distinguished on the basis of flow rate within the LTO well life cycle.

Initial: from flowback of frac fluid to maximum flow rate.

Typical production and AL methods: natural flow, jet pump.

Primary: from maximum flow rate to about 30 cub. m/day. Typical time frame (for LTO well in U.S.) is 9-12 months, over which flow rate decreases from maximum level by 65-80%.

Typical production and AL methods: natural flow (first 3-6 months), ESP, gas lift, rod pump (under relatively low initial flow rate).

Secondary: until the end of well operation. WLC of LTO well in the U.S. and Canada is typically 5-7 years (at the Bazhenov, WLC is estimated to reach up to 10 years for some wells), by which time flow rate decreases by 90-95% or more.

Well maximum flow rate establishes the possibility of using equipment pertaining to a single AL method to cover the fullest range of the well’s life cycle.

Solutions based on jet and plunger lift pumps cannot cover the WLC of a LTO well due to their limited functionality and application range.

3. Markets and Commercialization

Demand for AL equipment in the LTO segment amounted to about $ 2.4 billion in 2019, which is 22% of the total AL equipment market. The main country markets are the USA, Canada, and Argentina. The largest and most important segments of the LTO artificial lift market are ESP and gas lift, which together account for 83% of the market in monetary terms.

Equipment applied on LTO formations is largely not ‘exclusive’ to LTO. It is used in conventional oil production by means of long-reach horizontal wells and MSHF. Globally, almost half (47%) of wells of this type were drilled outside of LTO in 2019, including about 3,700 horizontal wells in Russia, most of which had MSHF. This market should also be considered as a target one when developing technologies and equipment for the Bazhenov. The largest foreign markets are USA, Canada, and China.

In monetary terms, ESP accounts for the largest share of the global AL equipment market with 46%, which corresponds to $4.6 billion. In physical terms, its market share is 16%, which corresponds to about 150 thousand wells.

In physical terms, the global market is dominated by rod pumps, which is due to them operating on a huge accumulated low-rate stock of wells, where rod pumps account for 67% (640 thousand wells) in physical terms and 42% ($4.2 billion) in monetary terms.

Gas lift solutions (not including surface compressor equipment) and hydraulic lift account for 6% ($660 million) of the market in monetary terms; an equal share is held by equipment for other AL methods (plunger lift, PCP).

Methods other than ESP, rod pumps and gas lift account for a relatively small share of the global market – less than 16% of the well stock (under 160 thousand).

4. Opportunities for Russian Suppliers of AL Solutions

Russian equipment manufacturers hold very different positions in the two AL fields that jointly dominate (with a share of more than 80%) the LTO market.

On the one hand, they have strong or leading positions in a number of key innovative areas in the field of ESP, in particular in permanent magnet motors (PMM), high-speed units. The weakest positions are in the field of gas lift, due to its insignificant current use in Russian oil upstream. Innovative solutions in the field of positive displacement pumps (in particular, applying PMM) have serious potential.

However, at present the domestic market offers no ‘off-the-shelf’ solutions that specifically address the particularities of Russian shale oil.

ESP

The market position of Russian suppliers is strongest in the field of ESP. Global production of ESPs in 2019 is amounted to about 45 thousand units. Of these, 42% were supplied by leading Russian manufacturers (Borets, ALNAS, Novomet), 38% – by international oilfield service majors (Baker Hughes, Halliburton, Schlumberger). The total output of all Russian manufacturers is estimated at about 21 thousand ESP units per year (Chart 8).

The global ESP market was estimated at $4.5-5 billion in 2019, the Russian market at $1.5 billion. The U.S. and Canada are most attractive international markets in terms of both size and potential for diverse forms of commercialization.

The technological level of Russian manufacturers (in particular, Borets, Lepse, Novomet, among others) can be assessed as very competitive on a global level.

One of the most promising solutions for use in the conditions of the Bazhenov is the high-speed ESP unit with extended working range (8,000-12,000 rpm, rate of 8 to 300 cub. m/day, three standard sizes). Based on this solution, the unit allows to cover a very significant part of the WLC by a single AL method with the possibility of low-cost transition at the final stage of well operation to another AL method (for example, plunger lift).

Units developed and manufactured by «LEPSE» (Kirov) are presently in the pilot testing stage. The technological capabilities of other leading Russian ESP players (Borets, Novomet, and others) to develop similar solutions are assessed by industry experts as high; their implementation depends to a key extent on confidence in commercial prospects.

The potential of this particular ESP solutions, as well as other, to contribute to the development of oil production from the Bazhenov are supported by a well-developed ESP sector in Western Siberia, including huge application experience, a large pumping services market, and a well-developed service infrastructure.

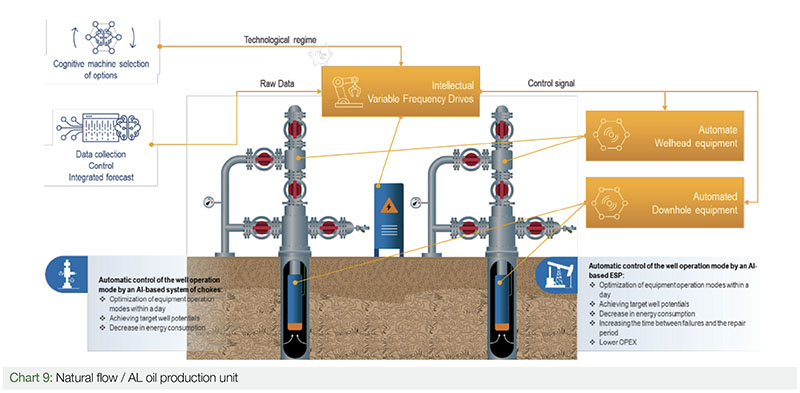

The digital transformation of the oil industry and the technological strategy of Gazprom Neft provide additional grounds to predict the introduction of a well pad natural flow/artificial lift unit (complex) in the near term. This unit will combine downhole equipment with intellectual control and Industry 4.0 achievements, which will allow to test the well, bring it to optimal flow with minimal degradation of the fractures and to maximize production efficiency by switching from natural flow to artificial lift without having to stop and re-complete the well (Chart 9).

ESP with extended working range is an example of a solution that suits commercialization based on the WLC not only through sale or lease of equipment, but also through selling a technological service of lifting the production fluid, with the requirement that the customer operate the equipment according to supplier’s guidelines, while the supplier has the ability to remotely control the operation of the equipment. This represents a qualitatively new consumption format similar to ‘plug and play’ that minimizes the involvement of the consumer in the operation and maintenance of equipment.

The readiness of customers (upstream operators) to accept this form of interaction with solution providers will vary significantly for specific country markets and companies.

Gas Lift

The global market for gas lift equipment and services amounts to $0.6 billion, of which LTO accounts for $ 0.5 billion (2019).

The experience of LTO production in the U.S., Canada and Argentina underscores the key role of gas lift, and therefore potentially the high significance for LTO production at the Bazhenov, given the inherent variety of operating conditions across the vast territory of Western Siberia.

Use of gas lift in Russia may have prospects in the regions of Western Siberia where mixed-type (oil, natural gas, gas condensate) fields are common: northern part of KhMAO, YaNAO, northern part of the Krasnoyarsk region.

Due to the very limited current use of gas lift in oil production in Russia (the eastern part of the Orenburg oil field, developed by Gazprom Neft – Orenburg, is the only significant project on land), the market for equipment and services (engineering) in the field of gas lift is very narrow at present time.

Global experience points to the maturity of the gas lift method as a source of solutions for a complete WLC system with low unit costs and the possibility of implementation as an integrated project. Such solutions can be commercialized through a project implemented by the contractor for the full life cycle of the production target, or by the operator assuming the function of integrated project management.

Mobile gas lift solutions for well pads with gas sourced from a main pipeline and excess associated petroleum gas is utilized by being returned to the main pipeline, may be a promising direction for developing gas lift in Russia. A key element for this approach is mobile compressor stations, which are increasingly used by gas transportation companies*.

* For details see https://mks.gazprom.ru/about/working/

In order to form the technological and production base for the use of gas lift at the Bazhenov, it is advisable to form a Russian center of competence for gas lift, as well as to develop opportunities for technology transfer to the Russian market.

Innovative Methods of Artificial Lift

The submersible linear electric pump (SLEP; also called positive displacement pump with submersible drive) is one of the prospective innovative AL solutions for shale oil production. It combines the advantages of a linear submersible motor and a standard plunger pump used in rod pumps – compactness, ease of installation and maintenance. SLEP was designed for use in low-rate, highly deviated, unconventional wells.

SLEP’s operating parameters overcome a number of key technical and economic limitations for using AL on the Bazhenov, including depth of reservoir (up to 3000 m), casing diameter, dogleg severity, gas and solids.

SLEP’s operating parameters overcome a number of key technical and economic limitations for using AL on the Bazhenov, including depth of reservoir (up to 3000 m), casing diameter, dogleg severity, gas and solids.

Manufacturing of this type of equipment has been set up in Russia by Oil Avtomatika and Triol companies. Gazprom Neft is pursuing a SLEP technology development project, based on its own patented solutions.

Conclusions

• The global oil industry is witnessing conditions for qualitative changes in the field of artificial lift for LTO production, including development of technical and technological solutions for the full life cycle of the well. This is expected to have serious impact on reduction of operating costs.

• One solution of this kind that can be expected in the near term is an ESP-based natural flow/artificial lift oil production unit.

• Augmented with digital technologies, such solutions have the potential to create new customer value and new business models for oil production – for example, a technological service for the full life cycle of the well.

• Several Russian manufacturers of artificial lift equipment have proven capability to create advanced technological solutions (in particular, in the areas of ESP and SLEP).

• The Bazhenov formation is expected to become a promising market for the manufacturers in the medium term, while in the short term market demand will come from fields with low-permeable reservoirs in the Russian Federation. LTO production can serve as a ‘springboard’ market with mature and growing demand for highly efficient solutions for artificial lift.

• Russian suppliers of artificial lift solutions need to be prepared to assume and maintain leadership positions. The role of oil companies is extremely important in forming constructive win-win interaction with technology developers. А cross-industry framework for consultation and coordination is required, particularly in the fields of standards, scientific studies, R&D, and development of technological competencies.

This article is based on the results of the study «Analysis of the global market for downhole equipment for shale oil production», commissioned by Gazprom Neft.

Sergei Rudnitsky, Oil and Gas Industry Consultant

Artyom Zatsepin, Analyst, Gazpromneft-Digital Solutions

Eugene Demin, Chief Specialist, Gazpromneft STC

Taras Yushchenko, Head of PVT and Well Operation, Gazpromneft-Technological Partnerships