Kazakhstan: A Market of Possibilities for Russian Oilfield Service Companies

In August, 2016 the Ministry of Energy of Kazakhstan shared its plans for abandonment of 126 offshore Caspian wells before 2019. And this is just the tip of the issue. The majority of the countries land wells are out-of-date and their rate of decline is accelerating. In Kazakhstan, it is now critical to maintain the current oil and gas production output at old land fields. This can be achieved only by large-scale introducing of advanced drilling techniques, HF jobs and increasing reservoir recovery and well workover. Today, when the countries oilfield service market is under technological transformation, Russian companies are challenged to occupy a part of it.

Oil production in Kazakhstan started in 1912, with a production peak in the end of 80’s, which constituted 26.6 MTPA. After the collapse of the USSR, the production dropped to 20.3 MTPA in 1994. However, starting from 1995 the oil production started growing again. In 2001-2011, Kazakhstan’s yearly oil production increased from 39.9 to 80.3 MTPA (10% per year). Yet, in 2005 the production rate slowed considerably.

In the past years, Kazakhstan’s oil and condensate production rate has dropped: by 1% in 2014 vs. 2013 and 1.7% in 2015 when the oil and condensate production was approx. 79.5 MTPA.

The leading oil producing area is, as before, Atyrau, which gained a total of 32.3 MTPA (over 40% of the total country production output). Atyrau is followed by: Zhambyl (18.6 MTPA), Mangistau (18.5 MTPA), Western-Kazakhstan (12.7 MTPA), Kozyl-Ordin (8.9 MTPA), Aktubinsk (6.9 MTPA) and Eastern-Kazakhstan (0.9 MTPA).

The main Kazakhstan onshore projects are:

- Tengiz oil field (Western-Kazakhstan). Tengiz is the world deepest field, 19×21 km in size, with its top petroleum deposit at approx. 4000m depth and 1.6km of reservoir pay zone.

- Karachaganak oil-gas-condensate field in Western Kazakhstan is one of the world largest fields with over 1.2 billion t of liquid hydrocarbons and over 1.3 trillion cu m of gas.

- Kumkol fields. Akshabulak was opened in 1987 and first tested in 1989. It is 60km south from existing large Kymkol oil field. It is a major field by reserves and

production output and occupies 251sqkm. - Embin fields comprise 39 oil fields in the Northern and Western Caspian. 37 fields are under operation while the other two, Sagyz and Tazhygali were shut after they were declined and flooded.

- Imashev field. It is 60km north-east from Astrakhan (RF) and 250km south-west from Atyrau in Kurmangazin region (Kazakhstan).

- Uzen fields. Their geological structure is complicated and oil properties are unique: high content of paraffin (to 29%) and asphaltenes (to 20%) which make the pour point high (+32C).

Over half of Kazakhstan’s oil reservoirs (52%) are concentrated in three fields: Tengiz, Karachaganak and Kashagan. The first two fields are under commercial development by consortiums with leading trans-national companies involved.

The oil & gas condensate production leaders are: the Kazakhstani-American JV Tengizchevroil that gained 27.1 MTPA. Karachaganak Petroleum Operating B.V. Consortium that gained 12 MTPA of oil and condensate at Karachaganak field in 2015. AMGZp with 4.6 MTPA, Kazgermunai with 3.0 MTPA, Karazhanbasmunai with 2.1 MTPA and PetroKazakhstan Kumkol Resources with 1.9 MTPA. Their summarized share is approx. 87% of the total oil and gas condensate production output in Kazakhstan.

Kazakhstan gas production takes place at land fields only and constitutes 45.3 BCM in 2015 (105% in 2014 and 103% of 2015 plan). By 2030 the optimal forecast is max. 102-105 BCM of gas.

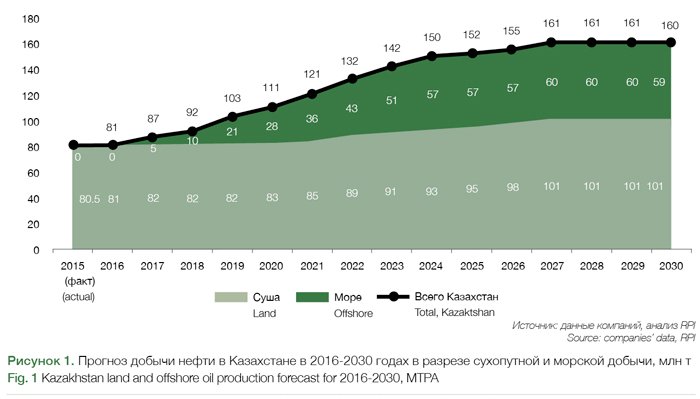

Offshore is the Future

Kazakhstan’s oil production is distinctive of the country government’s expectations from developing offshore projects. 2025 forecast is 36% of the total country offshore fields output. According to 2015 results, there has been no offshore oil production and as soon as Kashagan development is launched at the end of 2016 as planned, the production will grow to 152-155 MTPA by 2025.

the countries attempts to develop offshore fields have hit many challenges. In 2011-2014 many investors left Kazakhstan Caspian sector. The main issues were that often research showed that the actual reserves were well below initial forecasts – and exploration drilling showed no major hydrocarbon reserves. This was the case on Kurmangazy, Tub-Karagan and Atash projects. Another reason was work suspension due to lack of offshore rigs in the Caspian Sea.

In 2011-2014, Statoil, Eni and Total left the Abai, Shagala and Zhenis projects respectively and works at Southern Zhambai and Southern Zaburunye (LUKOIL, Sinopec, Repsol) were suspended.

Land Reservoirs

In future, the main oil production gain in Kazakhstan will be offshore fields, with the gigantic Kashagan field in the first place with a forecast over 95% of the offshore production by 2025. According to the operator’s forecast, the operation will be launched at the end of 2016 and approx. 35 thousand t will be extracted by the New Year holidays. The total project investments will constitute up to $136 billion, wuth $50 billion have already been invested.

Moreover, 2017 plans include the launching of Rozhkov field operation in Western Kazakhstan (10 million t of oil resources, Ural Oil&Gas and KazMunaiGas) and pilot operation of Zharkum in Zhambyl region (KazTransGas).

The prospects are the development of pre-salt fields in the Caspian Lowland and the launching of development of much deeper hydrocarbon reservoirs. Here, the leader is the Eurasia project where an international consortium is going to be formed for drilling wells, including wells to over 15km depth. The government believes the project will, in long-term, allow land oil production to approx. 100 MTPA due to newly commissioned hydrocarbon fields. For the purpose of the project, investment advantages and tax privileges are under consideration and the formation of a KazMunayGas owned company is planned. It is planned to collect and study the data in 2016 and start seismic research and pre-drilling studies in 2017.

Karachaganak and Tengiz are the main gas production growth sources until 2022. Karachaganak’s 3rd development phase may give gas production buildup by 20-23 BCMA. Another source for approx. 38-48 BCM is Tengiz production enhancement. Gas production growth is also expected from Khvalyn and Central offshore fields. With the above projects taken into account, Kazakhstan’s gas production prospect by 2030 is 102-105 BCMA.

Market Opportunities for Oilfield Service Companies

New projects and maintaining production at old fields should be supported by the oilfield service market. For example, over 50% of Western Kazakhstani oil wells have been in operation for more than 20 years and require more frequent and complicated workover.

Consequently, according to 2015 results Kazakhstan oilfield service market, capacity was approx. $2.2 billion. According to Kazakhstan Union of Oilfield Service Companies, Kazakhstan has over 1,000 OFS companies with over 170,000 employees. Their market is estimated to be between 40% and 50%. The oilfield service share was approx. 40-50% of the total mineral developers’ purchases.

In the Kazakh oilfield service market, there are three dominating players: international, Chinese and local companies.

Their power relation is not constant. In particular, in view of the current economic crisis and tenge-dollar rate drop, the service market situation is more favourable for Kazakh companies. The current market trend demonstrates increased share of Kazakhstan’s oilfield services and equipment suppliers on account of foreign companies’ share.

The current global slowdown and oil price rout has made the Kazakh oil and gas sector vulnerable, and has resulted in the slowdown of current projects, and the delay of planned ones. The OFS market has contracted by 25%.

However, according RPI forecast, by 2020 Kazakhstan’s oilfield service market will grow to $2.6 billion/year. This growth will be compensatory to some extent. In 2017-2020, the main oilfield service market drives will be exploitation and exploration drilling to give approx. 34% of the forecast growth. Approx. 12% is expected from well service and workover, 10% from well cementing and 2% from mud services.

By 2020, the major oilfield service market segments will be drilling, drilling support and cementing totaling approx. 39% of the total market volume. These segments will, by their size, be most attractive for Russian drilling companies.

Time of Opportunities

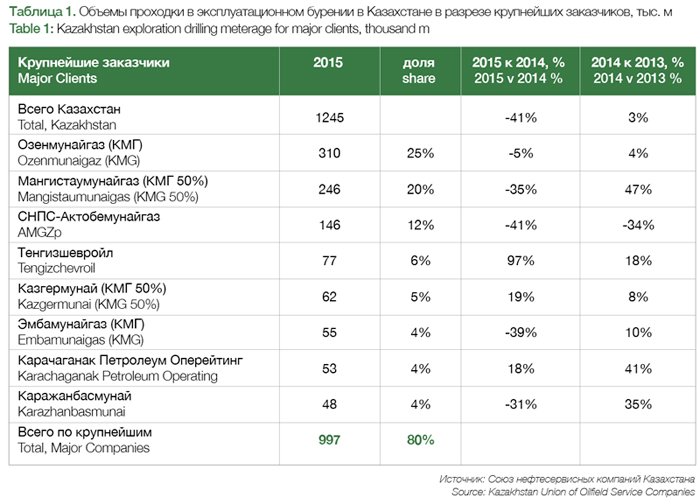

In 2015, Kazakhstan drilled 1.41 million lm where 1.25 million m were in development drilling. Hence, the exploitation drilling volume was 41% comparing to 2014 (2.12 million m). According to the official statistics, 2015 targets were exceeded by 53 thousand meters. This means that initially the operators planned to reduce drilling by approx. 44% in 2015. However, this was enough to maintain the production output at the previous year level, hence the 1.7% drop.

In 2015, the exploration drilling level dropped by approx. 2.5 times, i.e. 412 thousand m in 2014 vs 164 thousand m in 2015 (vs target 205 thousand m).

The major eight clients’ share was approx. 80% of the total exploration drilling meterage in the country (ref. Table 1). In 2014-2015, they changed the drilling trends two times. In 2014, most of them increased orders scope vs the previous year while in 2015, the trend became negative. Exceptions were Tengizchevroil and Kazgermunai.

The exploration drilling included, in the first place, research in Kyzyl-Orda region, where approx. 90 thousand m (54.9% of the total volume in Kazakhstan) were drilled at Kumkol offshore fields. The following Mangistau region hardly gained 26 thousand m (15.9%) and Atyrau region with approx. 12.8 m (7.8%). In addition, 1-5 thousand m was achieved in several oil & gas regions but there was no exploration drilling in most of the regions.

By 2025, the forecast is to increase drilling output through development of new fields, e.g. Rozhkov and Zharkum, and intensified drilling growth in old depleting fields aimed at maintaining their production output. In particular, in 2016-2017 the drilling output growth is expected through of development of new oil reservoirs at the north-east Nurzhanov, Liman and Akkuduk wing. It will result in growth of drilling service volume and drilling equipment procurement and speed up the replacement of out-of-date and obsolete drilling rigs. What is important is that it will lead to enhanced use of horizontal drilling technique and sidetracking (including horizontal) and eventually increase demand for the entire range of drilling support services.

According to Kazakhstan Union of Oilfield Service Companies, in Kazakhstan there are 50 companies including minor market players involved in well drilling and support. Approx. 36% of drilling rigs belong to six companies. Their shares are:

- 10.5% (of total drilling monetary volume) Burgylau (Kazakhstan)

- 5.8% Halliburton (USA)

- 5.6% Saipem (Italy)

- 5.2% KazMunayGas-Burenie (Kazakhstan)

- 4.7% Baker Hughes (USA)

- 4.3% Oil Services Company (Kazakhstan)

The drilling market is not completely open. Most of the major mineral developers usually only cooperates with their drilling affiliates. For example, Ozenmunaigas drilling contractor is its former drilling division, now Burgylau. KMG-Burenie that drills most of the wells for the country leading KazMunayGas is its affiliate.

Great Wall, XiBu and Sinopec from China perform drilling for Chinese drilling companies.

In 2015, the crisis caused significant drop of drilling prices in dollar terms right after oil price drop. Drilling rigs, pumps, construction and erection services, steel and even manpower are cheaper now. Moreover, reduced orders volume has made a buyers market.

The Kazakhstan drilling market differs from the Russian market by a small, less than 4%, horizontal drilling share (vs. 30% in Russia).

The history shows that technology innovations in Kazakhstan’s oilfield service market are 7-10 years behind Russia. Applying this trend to horizontal drilling gives a hope that in the nearest years Kazakhstan horizontal drilling will intensively grow up to15-20%. Hence, the Russian horizontal drilling oriented companies have a unique chance to enter the developing market with competitive service prices. The first candidates are Russian drilling companies that operate in the domestic, ever collapsing, open drilling market.

Exploration drilling perspectives are associated with short-term plans of KazMunayGas for combined exploration and production at Isatai and Usturt offshore fields and researches at Eastern Bektyrly, Samtyr and Pribrezhnoe land fields.

Today’s well site construction trends are: geomechanical modeling, horizontal drilling, drilling through AHRP areas, optimization of mud parameters, cementing improving, deep well construction and improving terms.

Generally speaking, Kazakhstan’s oilfield service market with drilling as its drive represents a promising field for Kazakhstan oilfield service companies operating in open market.

Please contact Dariya Ivantsova for more information on RPI reports. +7 (495) 502 5433 / 778 9332,

e-mail: Daria@rpi-inc.ru

www.rpi-consult.com

www.rpi-research.com