Kazakhstan Oil & Gas. 2014 Results and 2015 Industry Development Outlook

Introduction

Among the FSU (former Soviet Union) countries, Kazakhstan has the second largest liquid hydrocarbon fields after Russia. According to the Republic of Kazakhstan State Commission for Mineral Reserves, the recoverable oil reserves in the country are estimated at 4.1 billion tonnes (30 billion barrels) including onshore fields (more than 4 billion tonnes). Gas condensate reserves are estimated at 300 million tonnes.

As per the Ministry of Oil And Gas of the Republic of Kazakhstan, the proved oil and gas condensate reserves in the country are as large as 39.8 billion barrels (approximately 5.3 billion tonnes). If the current production level is maintained and the reserves volume does not change, the oil and gas production in Kazakhstan may continue for 70 years.

According to Oil & Gas Journal, as of January 2014 Kazakhstan was the 12th country in the world in terms of oil reserves. Oil reserves in Kazakhstan were 30 billion barrels, or 4.1 billion tonnes, which makes 1.8% of the world reserves.

As per the Ministry of Oil And Gas of the Republic of Kazakhstan, the country’s hydrocarbon reserves may double due to exploration of the deep horizons of the Peri-Caspian Depression. Until now, only the so-called pre-flank zones of this basin have been explored and surveyed.

There are 15 sedimentary basins in Kazakhstan, five of which are used for commercial purposes (more than 65% of recoverable oil reserves of the country are concentrated in them).

Further expansion of the RoK resource base may be implemented through the development of the offshore fields. The traditional oil producing regions of the country will not be able to compensate for the reduced production in the future.

Current Situation in the Industry

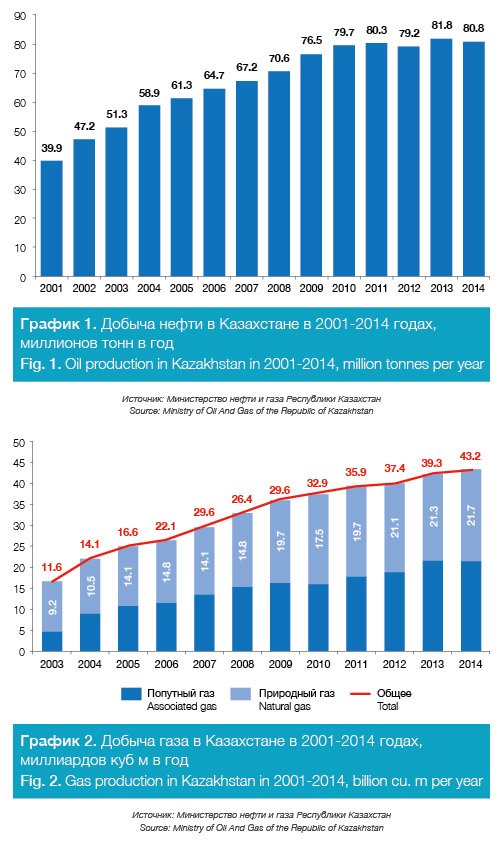

Starting from 2010, the oil production level in Kazakhstan has been around 80 million tonnes per year. In 2014, compared with the same period of 2013, the cumulative oil and gas condensate production has dropped by slightly more than 1 per cent.

Among oil producing companies, the three leaders are the same as a year ago. These companies has demonstrated a a variety of trends. While Karachaganak Petroleum Operating and KazMunaiGas have increased the production volumes by 5% and by 1%, the obvious leader, TengizChevroil, on the opposite, has reduced its indicators by around 1%.

The oil processing volume in 2014 was 14.9 million tonnes, which is 9% higher than in 2010 and is the maximum result for Kazakhstan.

The integrated development plan of the Kazakhstan oil processing sector provides for the upgrade of the three existing plants, which will result in increasing their capacities to 17.5 million tonnes per year, and also to the production of high-octane petrol and aviation fuel. It is planned that in the first half of 2016 the RoK oil refineries will see a transition to Euro-4 and Euro-5 fuel standards.

In 2014, Kazakhstan did not cover the demand of the domestic market for oil products. The RoK government has estimated that once the plants have been upgraded the Republic will become completely self-sufficient. Also, it is forecast that Kazakhstan will have the export potential of around 400 thousand tonnes in petrol and over 500 thousand tonnes in diesel fuel.

By the estimates of the Ministry of Energy, the surplus situation may exist until 2022-2023. After 2025, the growing fuel market of Kazakhstan may see a considerable shortage of petrol and diesel fuel.

The gas production volume in 2014 was 43.2 bcm, which is more than 31% higher than the 2010 volume.

The first place among the companies in terms of gas production is still held by Karachaganak Petroleum Operating, which demonstrated an over 4% increase against 2013. The second place is held by TengizChevroil that produced 14.54 bcm of gas, which is equal to the 2013 production level. CNPC-Aktobemunaigas ranks third among the leaders, having increased their gas production in 2014 by 8%.

In previous years it was expected that the oil production volume would increase from 2014 onwards due to the production from the Kashagan field. Oil production in this field started on 11 September 2013; however, on 24 September the field operation was suspended when leaks were identified from the onshore pipeline to the Bolashak onshore oil and gas processing facility. To eliminate the leak, the affected joints were replaced. The production was resumed after that, but on 9 October it was stopped when a new leak was found. After the damaged joint was repaired, the pipeline was hydrotested, and during the test other potential leak locations were identified.

The incidents resulted in the suspension of production operations. An investigation is currently in progress, which is planned to be finished in late 2015. It is projected to resume the production in the last quarter of 2016.

Among new potential sources for maintaining and increasing of the production level, special mention should be made of the Zhambyl field located in the northern part of the Caspian Sea. As per preliminary assessment, the anticipated reserves of the field are over 120 million tonnes.

Pipeline Projects – Current Status and Outlook

In 2014, over 40m tonnes were transported via the CPC (Caspian Pipeline Consortium) system, and commissioning of the new facilities in 2015 will make it possible to increase the throughput capacity of the system to 45-50m tonnes. After 2015, it is projected to increase the CPC capacity to 67m tonnes per year.

In 2014, the oil transportation volume in the Atyrau-Samara leg of the Uzen-Atyrau-Samara main oil pipeline was 14.6m tonnes, which is 734 thousand tonnes lower than the last year’s volume and 167 thousand tonnes more than the planned volume.

The Atyrau-Samara pipeline remains one of the key routes for Kazakhstan; however, it is not projected to increase the export for this destination.

Within the framework of the development of the Kazakhstan-China project, the construction of the Kumkol-Karakoin oil pipeline and the associated infrastructure was completed in late 2014. This oil pipeline is part of the Kazakhstan-China oil pipelines expansion project, and it’s required for increasing the export capacity and making it technically feasible to supply the Kazakhstan oil to the own domestic market, and also for providing energy independence and security of the Republic of Kazakhstan.

In 2014, the volume of oil transportation to China via Atasu-Alashankou pipeline was 11.8m tonnes including the transit of Russian oil via Kazakhstan to China.

As the process of implementation of such projects as KCPS (Kazakhstan Caspian Pipeline System) and, to a smaller degree, CPC (Caspian Pipeline Consortium), directly depends on the Kashagan production, the suspension of the latter’s operation brought about a revision of the execution dates for the KCPS. For the period of investigation of the leaks in Kashagan, no work for the KCPS is planned.

The project execution may continue not earlier than in 2016, when the production in the Kashagan field may be resumed.

In September 2014, the construction of the Turkmenistan–Uzbekistan–Tajikistan–Kyrgyzstan–China transit gas pipeline (Line D) began, and it’s projected to be completed in 2016. This gas pipeline currently includes three parallel lines, A, B, and C, the total length of each being 1830 km. Lines A and B were started up in 2009 and 2010, and in May 2014 first gas from Turkmenistan to China was transported via Line C.

Gas from the fields in Turkmenistan and Uzbekistan is transported via Kazakhstan to China. In future, the pipeline section running across Kazakhstan is going to become part of the Kazakhstan–China export pipeline.

Near-term Outlook

The drafted law “On the budget of the Republic for 2015-2017” contains forecasts of oil production for 2015-2019. According to the document narrative, where the Brent price of oil was assumed at $50/barrel, the forecast oil production level will be 80.5m tonnes in 2015 and 80.8m tonnes in 2016.

From 2017 onwards the increase will be more noticeable due to the start of oil production in Kashagan. In 2017, it is planned to produce 86m tonnes, in 2018 – 90m tonnes, and in 2019 – 93m tonnes.

This is lower than the forecasts made by the Ministry of Oil And Gas of the Republic of Kazakhstan announced in 2013, according to which the planned oil production level by 2019 was expected to be 96m tonnes.

The planned oil export level, as per forecasts made by the RoK government, is expected to be 60m tonnes in 2015. In 2014, the oil export volume was 62.4m tonnes, of which over 50% were exported via the CPC pipeline. After the re-start of production in the Kashagan field, the CPC capacities will also be used for oil transportation to international markets.

According to the RoK government’s plans, by 2025 the oil export will reach the peak at 90m tonnes per year.

As per RoK Ministry of Energy’s forecasts, the gas production in 2015 is expected at 42.2 bcm, which is slightly less than in 2014. In 2015 it is planned to start up the third section of the Kazakhstan–China gas pipeline, which will allow to increase the gas transportation capacities from the current 30 bcm to 55 bcm per year.

The RoK government expects the gas shortage at the domestic market after 2015 – first of all, due to a higher demand within Kazakhstan. The start-up of the third phase of the Karachaganak field will allow to resolve this problem in the short term.

Based on the RoK Ministry of Energy’s data, the largest oil producer, TengizChevroil, plans to increase the oil production by 2021 due to expansion of the Tengiz field production to 38m tonnes, which exceeds the 2014 value by more than 40%. By the company’s estimate, as a result of implementation of a number of activities, the recoverable reserves of Tengiz may be increased by more than 100m tonnes. To realise these plans, the second tranche of the Tengiz project needs to be started. After the failed start of Kashagan field production, the RoK government expects to make up the oil production through TengizChevroil and other oil producing companies. At present, various options of the Tengiz expansion are being considered; the previous option presented in late 2014 provided an almost 2-fold increase of expenditure (from $23m to $40m) and was not supported by the government.

Despite the government’s plans to substitute for non-produced Kashagan volumes, a number of oil producers, in view of the sudden oil price drop, consider the options of Kazakhstan production projects freeze and suspension. Currently, only comparatively small companies consider such scenarios.

The largest impact on the oil and gas production volumes and, consequently, on the speed of execution of infrastructure projects related to the oil and gas pipeline construction projects, oil refineries upgrades, gas plant construction, and the Kazakhstan gasification system is made by the volatility in energy prices. Should the oil price in international markets rise, the existing forecasts may be adjusted upwards.

For details please contact Daria Ivantsova on:

Tel.: +7 (495) 502 5433 / 778-9332

or via e-mail: Daria@rpi-inc.ru