MWD & LWD In Russia: Current Status and Development Outlook Through 2025

Significant changes have happened in the drilling industry in the last decade. Every year the operations become more complex and the production and environmental safety requirements become more stringent. That is why the application of measuring-while-drilling (MWD) systems is becoming more important in the oilfield services market – information acquired while using such systems allows plotting the current, and projected, wellbore paths. Eventually this impacts the rate of penetration and accuracy when targeting the reservoir which in turn directly influences the drilling costs and well flow rates.

Development of the horizontal drilling, as well as the complication of drilling conditions, serves as the key driver for development of MWD and LWD systems. Lengthy horizontal sections, especially those with dense well spacing in thin reservoirs or in areas of complex geology, require the application of precision MWD systems in order to rapidly and accurately make adjustments while drilling.

Horizontal drilling footage has increased more than 5 fold within the last 6 years and by 2025 – horizontal drilling is projected to make up more than 50% of all drilling.

The MWD/LWD market dynamics mirror the drilling dynamics in a qualitative manner with some anomalies. For instance, logging operations are not used very much in East Siberia due to the specific geological features (magmatics).

MWD Market Development

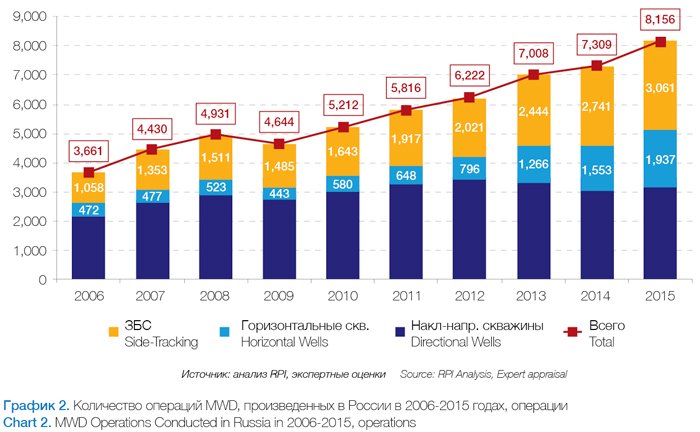

MWD operations are conducted in Russia in the following cases:

• Side-tracking;

• Horizontal well (HW) drilling;

• Directional well (DW) drilling.

In the course of the HW drilling and side-tracking the MWD operations are almost mandatory as the drilling costs incurred require the most precise and error-free drilling.

While drilling relatively low-rate directional wells in well-explored areas MWD is also generally applied because it is technically simpler and only includes a directional survey tool.

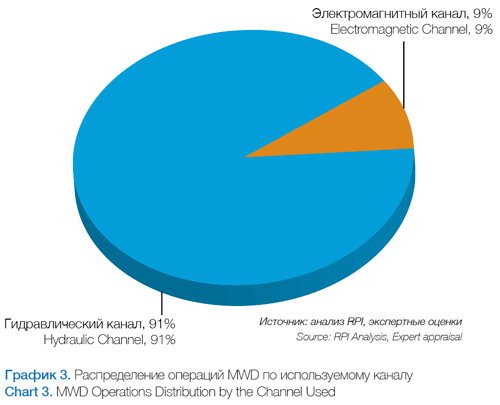

The hydraulic communication channels remain the most popular in the MWD operations as the most reliable solution. Some of the western companies apply tools with electromagnetic channels and while their quantity is significantly less, this trend is growing.

Current Situation of the LWD Market

From 2006 to 2015, LWD operations in Russia have been used while drilling horizontal wells and side tracking – generally similar to the use described above for MWD operations. In terms of quantity, the scope for LWD operations is smaller, and again is not widely used in western Siberia. In 2016, the use of LWD systems had increased threefold compared to 2006. This growth, in addition to sidetracking operations, was a direct result of the growing interest from national oil companies in horizontal drilling. In turn, that interest was driven by the improvement of LWD technologies during the period from 2007 to 2014, and the need to drill more complex wells to increase oil recovery.

The largest number of LWD operations (in total exceeding 80% of all LWD in Russia) from 2010 to 2014 happened in Western Siberia and the Volga Urals Region – which has the biggest level of drilling and sidetracking in Russia.

The maximum number of the LWD operations (in total exceeding 80% of the total quantity in Russia) in 2010-2014 happened in West Siberia and the Volga-Urals region with biggest portion of the well drilling and side-tracking in the country.

The most sought-after type of logging in Russia in 2014 was the gamma-ray logging (58% of the total number of operations) and resistivity logging (approximately 39%). The relative share of nuclear logging in 2011 did not exceed 3%. However based on expert opinion, from 2013 to 2014 the share of nuclear logging had grown to approximately 4-5% of all LWD operations in the country.

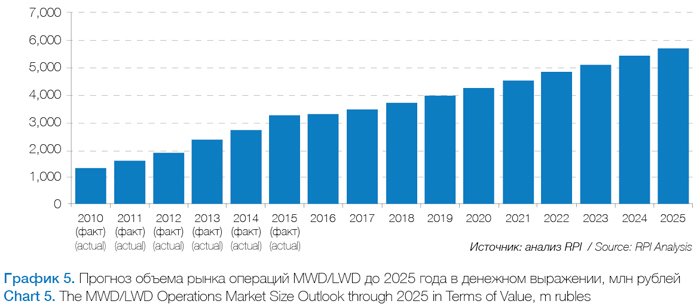

Market Outlook and Key Customers

In terms of value, the MWD and LWD market will grow rapidly – not only in terms of the amount of operations, but because of the growing demand for more complicated and expensive solutions within horizontal drilling. The increase of these projects in remote areas such as Yamal and east Siberia will also increase the cost of these operations.

MWD/LWD technology development will proceed in the following four directions:

• Improvement of the steering sensors and processing software. With the aim of enhanced wellbore targeting

• An increase in data transfer rate with the aim of reducing the time it takes to MWD.

• Expansion of the recorded and transferred data scope by measuring the dynamic parameters of drilling, downhole and annular pressure for selection of the

optimum modes for drilling, circulation and mud weight, reducing the well construction time and hazards associated with differential sticking and hydraulic fracturing.

• Downhole MWD equipment reliability improvement and reduction of the non-productive time caused by equipment failures.

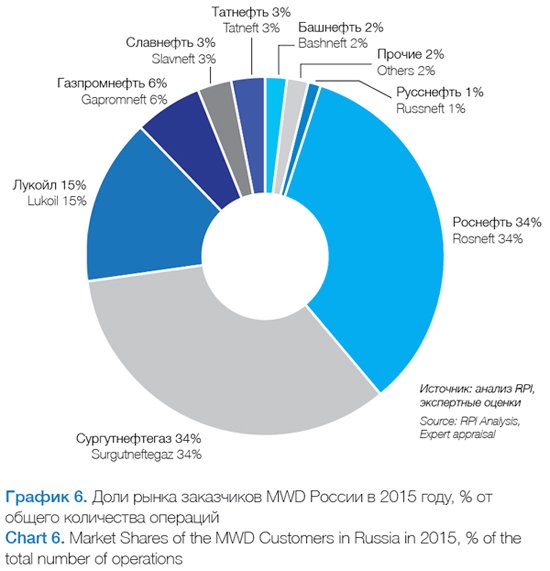

In 2015 the maximum number of the MWD operations in Russia was conducted by Rosneft (44%) — the clear leader in drilling operations among the oil companies.

The Bashneft and Slavneft share of the MWD market has not changed significantly between 2012-2013 and is steady at around 2% and 3% respectively.

LUKOIL stays among the top three companies

The company was striving to reduce the annual production decline rate by increasing meters drilled.

The biggest share within the big vertically-integrated oil companies is attributed to their substantial drilling meters and their demands for MWD/LWD due to more expensive and complex wells, primarily the horizontal wells in East Siberia and Yamal.

The Gaprom Neft share of the MWD market is not big in spite of its large drilling volumes. This is caused by them drilling horizontal wells where the need for MWD is minimal, but the operations are still expensive.

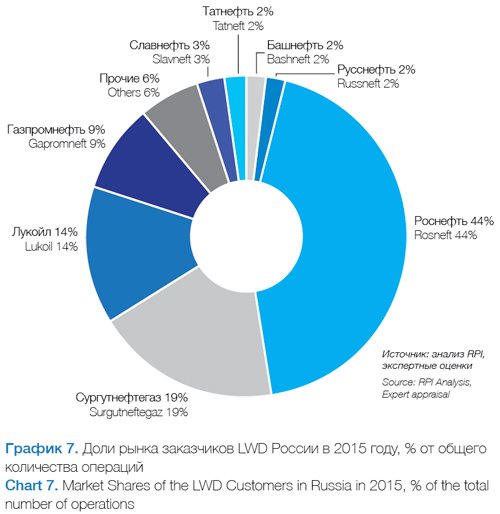

Rosneft and Surgutneftegas conducted the largest number of LWD operations in Russia in 2015 with a total share of 34%. The smaller Rosneft share in the LWD segment, compared to MWD, is due to the big scope of drilling conducted in East Siberia where the application of logging is complicated due to the geological conditions. Surgutneftegas applies LWD while drilling most of its wells for the purpose of saving on future well logging (this, in particular, explains the higher efficiency of the company workover and logging crews compared to its competitors).

LUKOIL is third on the list with its share of 15% and where an objective is set to raise the horizontal drilling share to 40% by 2017.

There Are Some Prospective Market Niches

The following market trends which are of key importance for contractors should be noted:

• Growing price pressure on contractors;

• Searching for simpler and cheaper MWD options;

• Sharp decrease in funding available for national OFS companies

• Appearance of small and mid-size players in the MWD and LWD service market which combine western equipment with national expertise in the field of software and data interpretation.

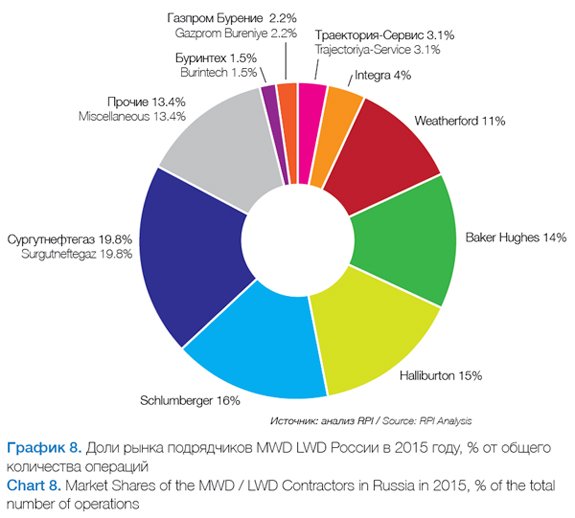

Three big international oilfield service companies were the leading LWD performers in 2014: Schlumberger (16%) and Halliburton (15%) and Baker Hughes (14%). The Surgutneftegas integrated companies hold 20% of the market.

The leading position of the foreign companies is aligned with the high quality of services they provide, as well as the big operating experience in the international oilfield services market. The main advantage here is the data processing, interpretation and fault free equipment performance. At this point all of the most challenging projects are being implemented using the MWD services of the key foreign players.

The MWD and LWD market is also under the influence of sanctions imposed by the Western countries and drop in the ruble exchange rate. It can be noticed primarily in some revival in the national MWD and LWD equipment and software development. There are many examples of new national startups in this area, set up by people who used to work for international OFS companies and so possessing the relevant know how.

If necessary, part of the equipment can be purchased by the national service companies through mediators, and there are no problems with the components and spare parts.

As the questioning of the industry players has shown, the biggest problem in the field of the MWD/LWD equipment fabrication is its quality, but a significant improvement of quality can be expected in the next few years. At this point many oil companies are willingly co-operating with national manufacturers and service companies to implement pilot projects. This is the most indicative trend in terms of opportunities for the Russian companies. In a mid-term outlook, it is the key niche and «takeoff ramp» for the majority of the national companies that will keep testing equipment and technologies, accumulate knowledge on many of the «typical projects» and gradually take the share of the foreign companies in this most sophisticated segment of the oilfield services industry.

Please contact Dariya Ivantsova for more information on RPI reports.

+7 (495) 502 5433 / 778 9332, e-mail: Daria@rpi-inc.ru

www.rpi-consult.com / www.rpi-research.com

Nikita V. Medvedev, Projects Director, RPI