Oil and Gas Assets Investment Attractiveness: Fair Market Value, Capitalization Management and Credit Rating

FAIR MARKET VALUE (FMV)

What Is FMV?

Fair market value is defined as the price according to which a property can be sold, if desired by a Seller to a Buyer, if it is desired by the latter, without coercion to buy or sell, whereby they are both legally competent for their actions and well cognizant of these facts.

What Does the General Procedure for Determining the FMV Consist of?

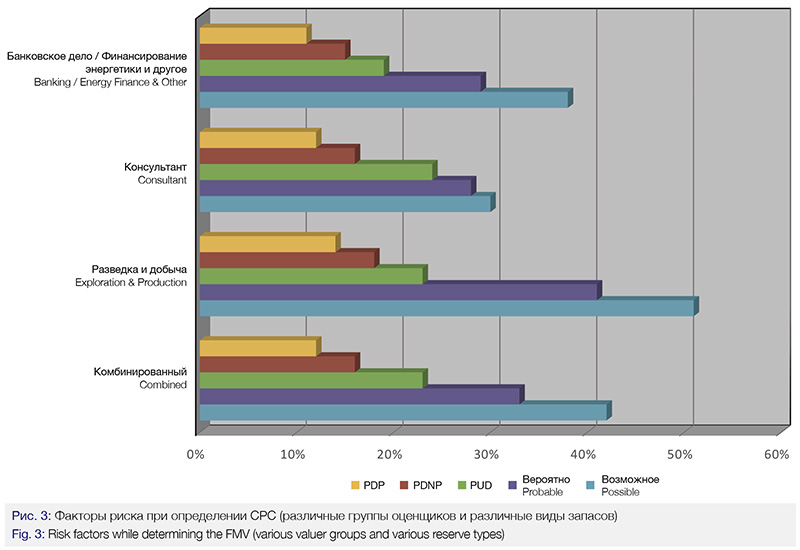

The application of the reserves adjustment factor by the reserve categories while determining the undiscounted and discounted cash flows, thus obtaining their risk-adjusted value.

There are two common procedures for determining the FMV: the Selling Price Analysis and the Comparative Profitability Analysis.

1. Selling price comparative analysis is a price assessment method applied to the preceding transactions on the selling licenses, or for the properties, which were used for the eligibility evaluation of the licenses/properties being put up for leasing, trade-off or for the settlement of other transactions. When the preceding transaction data is available, this is usually the preferred method, when compared with the comparative profitability analysis, since it is believed that the prices paid in the process of the previously committed transactions on similar oil and gas properties are the best possible costing. However, in the context of well developed oil and gas fields, specific tracks and extensive data arrays, the comparative profitability analysis should be applied. For the purpose of this method, the conformity of the oil and gas properties is defined using the geological structure similarity, the reservoir engineering techniques and the prospects for the marketing of the oil and gas produced within these properties. These parameters usually pretty much depend on a specific time period and the geographic remoteness of an area.

2. The profitability comparative analysis is an alternative to the selling price comparative analysis and it includes the definition of the net annual income as the balance of expected annual costs and revenues, associated with the development of oil and gas fields in real-life conditions. The net annual income expressed in monetary terms is the difference between the expected annual revenues and costs, discounted to their real value. Thus, when data is not available on similarly tracked selling prices, the net potential yield of a property, discounted to the existing value, is the existing tracked price.

What are the Other Methods for Determining the FMV?

1. The actual sale of a property after its actual appraisal date;

2. Bona fide offer of sale and purchase of a property after its actual appraisal date;

3. The actual sales of similar properties at the same oil and gas field or the neighboring ones after their actual appraisal date;

4. Assessments performed for the purposes, other than federal taxation, after the actual appraisal date;

5. Analytical evaluations;

6. Feedback from companies operating oil and gas fields.

What is Most Widely Used Method for the Economic Analysis with Subsequent Determining the FMV?

The discounted cash flows – used in 90% of companies;

Other methods: various forms of rendering cash flows, the comparative analysis of purchase and sale transactions, etc. are used by only 10% of companies.

What Initial Data is Required for Determining the FMV?

1. Undiscounted cash flows, broken down by the reserve categories;

2. Inflation forecast on the basis of the predicted Consumer Price Index;

3. Predicted prices;

4. Predicted cost;

5. Risk factors;

6. Discount rates.

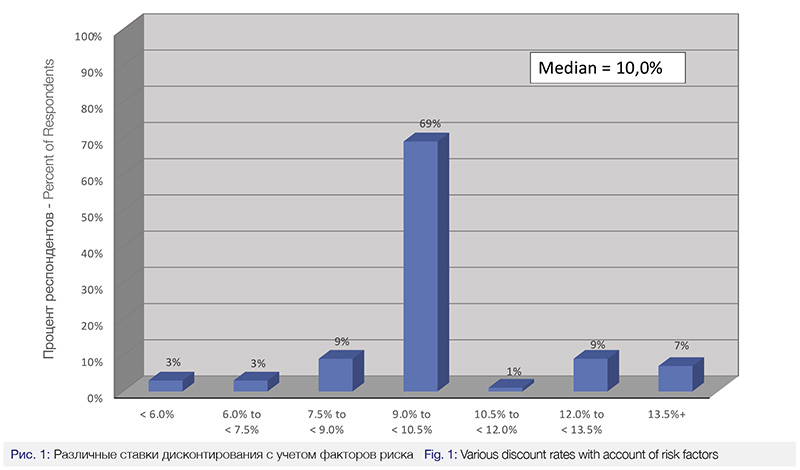

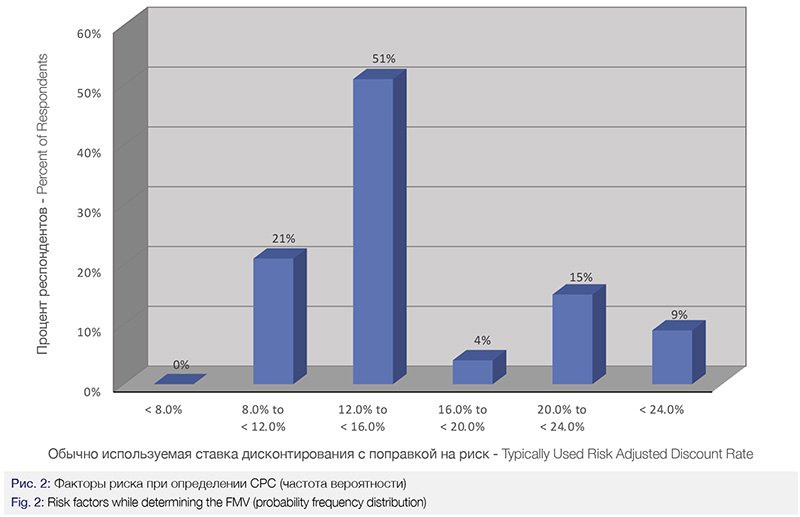

What is Discount Rate,Inclusive and Exclusive of Risk Factors?

The discount rate exclusive of risk factors is a revenue rate applied to determine the present value of future cash flows purely on the basis of the capital value.

The discount rate, inclusive of risk factors, is a rate of return applied while determining an oil and gas asset acquisition price or its value. This rate is defined with account of the capital value, profits or Buyer’s expected internal rate of return, as well as of any other risk or uncertainty factors, defined by an asset valuer. Since the “discount rate inclusive of risk factors” includes the Buyer’s profit margin (its expected value is higher than the “discount rate exclusive of risk factors”), some valuers allow that risk factors, while reserves are developed, may impact the discount rate value, while some other valuers prefer to take into account the risk factors, exceptionally, using the “reserve adjustment factors”.

When are the Reserve Adjustment Factors Used in the Total Procedure of Determining the FMV?

1. When determining the discounted cash flows;

2. When determining the amount of reserves prior to determining cash flows;

3. During the both of these phases.

What Kind of Risk Factors Should be Taken into Account while Determining the MFV?

1. The discount rates inclusive of risk factors

2. The adjustments for risk factors:

а) The discounted expected net revenue;

b) The risks of developing certain categories of reserves.

What are the Main Steps of Determining the FMV?

Determining the Fair Market Value (FMV) begins with gathering and analyzing all of the available information. The valuers should take into account the type, quantity and quality of the available data, since these parameters determine the approach to the assessment and the substantiation basis for the results obtained during this process. After the data is gathered and analyzed, it is necessary to select a FMV determination method.

A standard algorithm for determining the FMV is presented below:

1. Running the economic analysis of various reserve categories using the market variables;

2. Applying risk factors to the outcomes of the economic analysis;

3. Determining the selling price corresponding to discounted cash flows for conditions, adjusted by the risk factors used in the economic analysis;

4. Estimating the income and property tax amount for a previously determined selling price;

5. Determining the new selling price after deducting the amounts of the income and property tax from the cash flow values;

6. Revaluation of the income and property tax for a newly determined selling price and deduction of these values from the cash flow values;

7. The evaluation is continued until the selling price value is equal to the discounted flows value, exclusive of the income and property tax.

THE RESERVES MANAGEMENT WITH THE VIEW OF AN OIL AND GAS ASSET CAPITALIZATION GROWTH

What is Reserves Management?

1. It is an incorporated part of the economic and financial planning and reservoir engineering within a company; it’s actually an asset management and not reserves audit;

2. It is an active and continuous process of developing, evaluating and implementing of the corporate strategy for reserves, including the achievement of the reserves design targets and their growth value.

Why Should Reserves be Managed?

Reserves are assets or the “value” of a company:

• They are the basis for long and short term planning of a company;

• They optimize shareholders’ confidence and the value of a company to them;

• They provide a measurable replenishment of a wasting asset.

Due to What Influence Does a Reserve Growth Take Place?

A reserves growth takes place due to:

1. Implementation of a corporate strategy for a better categorization of reserves and resources;

2. Field and production development:

• Prospecting and exploration activities;

• The acquisition of or disposal of assets

Why Do Reserves Estimates Change?

1. Reserves are depleted;

2. Reserves structure (categorization) changes;

3. The uncertainty level decreases in the process of reserves estimation (new data becomes available, production history gets longer);

4. The economic and market factors change;

5. The status of property changes (property sales or transfers, production license term or contract term expires)

OIL AND GAS COMPANIES RESERVES AND CREDIT RATING

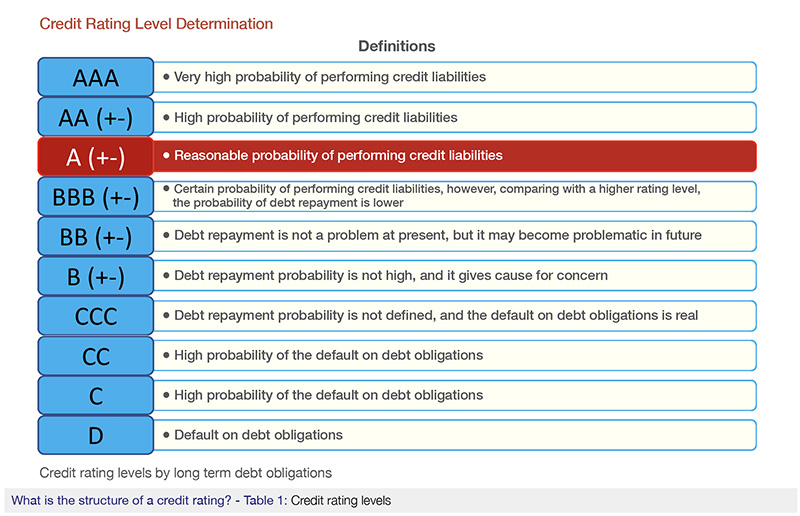

What is a Credit Rating?

1. Independent and objective analysis of a credit;

2. Credit characteristics comparative analysis in the international credit market;

3. An analytics product for every shareholder;

4. A tool for the evaluation of a credit/loan obligation’s default risk.

Credit rating is NOT

1. A tool for assessing an asset value;

2. Recommendation for buying/selling an asset;

3. Asset development forecast.

What is a Credit Rating Featured With?

1. Failure to perform credit liabilities (Borrower’s default from obligations for the timely payment of the principal amount or (and) interest payments of a loan);

2. Financial losses caused by the failure to pay credit liabilities (or the difference between Borrower’s financial obligations and the final amount received by Creditor)

What are other reserve characteristics which determine the credit rating level?

Qualitative Characteristics

1. Scope of exploration and production operations

Geographic diversification (or concentration, quite the opposite);

Stages of exploration and the development of prospective targets.

2. Reserves estimation and accounting practice

• Independent estimation of reserves;

• Estimation of reserves accounting for the changing prices of raw materials and other factors of uncertainty;

• Periodicity of estimation;

• Facts and frequency of “writing-off” of reserves;

• Records of new scopes of drilling operations, and oil recovery enhancement methods.

3. Reserve locations and qualitative differentiation

• Raw materials sales markets;

• Regional prices and costs;

• Oil and gas physical properties (the price differentials between produced oil and the blends WTI, Brent, Urals, HenryHubGas);

• Company-wide level of experts;

• Company’s operating period in a given country or within the boundaries of an oil-and-gas basin;

• Application of brand new technologies (horizontal drilling, heavy oil recovery techniques);

• Upstream operator company status;

• Integration level (for vertically integrated companies).

Quantitative Characteristics

1. Asset security and reserve efficiency

• Total amount of reserves in barrels of oil equivalent (BOE);

• Proven reserves (including proven undeveloped reserves (PUD);

• Reserve life index (RLI) – time of development (in years) under current production rates until reserves are completely depleted;

• Production profile;

• Net present value (NPV) of reserve development using the SEC (Securities and Exchange Commission) methodology;

• Total debt / reserves volume in BOE;

• Cash flows / reserves volume in BOE

2. Reserves operational efficiency and structure

• The reserve replacement ration (must be no less than 100%);

• Reserve evolution – reserve estimation adjustment, reserve addition, discovered reserves, acquisitions, production and asset sales;

• Development / well success ratio – proportion of successfully drilled wells to the total number of newly drilled wells; (a more accurate indicator is the proportion of wells producing oil in commercially efficient quantities to the total well number);

• Reserve replacement prime cost / BOE (the reserve replacement cost comprises the cost of acquisitions, of prospecting and exploration, and of development). For vertically integrated companies and independent oil and gas companies this indicator amounts to $5 and 6.5-7$/BOE, correspondingly;

• Production prime cost / BOE;

• Total development prime cost / BOE;

• Recycle ratio is the difference between generated cash flow and reserve replacement prime cost (if this indicator is above 1, even in an era of low oil prices, it can be considered as a positive rating factor).

Author

Boris Aronstein, the founder and President of the TechInput company group, partner of the “Neftegasconsult” consulting company discusses methods to evaluate the economic fair market value (FMV) of oil and gas assets based on the valuation of their reserves as well as the methods of managing their capitalization and the credit rating of oil and gas companies based on their reserve evaluation. The article is written in the form of questions and answers, which contributes to better understanding of this complex issue on a conceptual level.

boris_aronstein@techinput.com