Petrosibir: Q1 Results

Starting 2016 Petrosibir publish so called interim management statements per 31 March and 30 September instead of quarterly interim reports prepared in accordance with IAS 34. Petrosibir will continue to publish half yearly interim reports prepared in accordance with IAS 34.The consolidated financial information in this statement has been prepared in accordance with the same accounting principles, IFRS, that were applied for the financial year 2015 and as they are described in the annual report for 2015.

In December 2015 Petrosibir distributed its Ukrainian operations to its shareholders. The comparative income statement and cash flow statement for the period January – March 2015 have been recalculated to reflect the Ukrainian operations as discontinued operations.

Highlights January – March 2016

(all numbers relates to continued operations)

- Revenue for the period SEK 4 (6) million

- Operating result SEK -4 (-1) million

- Net profit SEK 1 (-1) million

- Result from equity investments SEK 6 (-) million

- Earnings per share SEK 0.02 (-0.04)

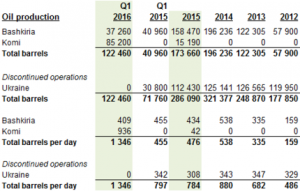

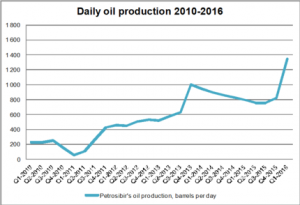

The production numbers above for Komi and Ukraine for 2015 have been recalculated compared to what has been disclosed earlier. In the table and graph above the production for 2015 has been divided by 365 days whereas it previously was divided by the actual number of days that the operations were owned by Petrosibir.

Comments from the CEO

I have recently been appointed CEO of Petrosibir. I come from and have a long experience from the oil and gas industry in Russia.

Since the end of 2015 Petrosibir has focused mainly on two Russian regions, Bashkiria and Komi, and no longer on Ukraine. The distribution of the Ukrainian operations to the shareholders and the acquisition of 49% of the Komi operations have had a significant impact on production numbers and further plans of development. The three license blocks in Komi currently provide more than 2/3 of Petrosibir’s total oil production. In my view the license blocks in both Bashkiria and Komi have great potential but require additional investments and development.

The company has very strong operational teams in Ufa (Bashkiria) and Ukhta (Komi). The recent results prove that the operations are profitable even at relatively low oil prices. It is very important to note that the oil production has been stable over the period or even increased without drilling and other large investments. At the same time it is very important to continue preparations for a drilling campaign and further development of the license blocks.

I look forward to working with the local teams in Russia and developing the promising assets of Petrosibir.

Nikolay Millionshchikov

CEO

Financial information January- March 2016

Consolidated information

During the first quarter 2016 revenue amounted to SEK 4,433 (6,324) thousand. The company’s operating costs amounted to SEK -9,082 (-7,557) thousand and the company shows an operating result of SEK -4,214 (-823) thousand. A lower Brent oil price compared to 2015 led to lower revenue as well as lower production taxes. In the end of January 2016 the Board, in accordance with the agreement with Petrogrand, appointed Dmitry Zubatyuk CEO of Petrosibir and the previous CEO stepped down. As a result of this the first quarter includes personnel costs for the new CEO as well as the severance payment to the previous CEO and hence the operating costs are higher than in the same quarter 2015.

The company held a consolidated cash position of SEK 24,752 thousand at the end of the quarter compared to SEK 36,134 thousand at 31 December 2015. During the quarter the company repaid a short term loan of SEK 4,000 thousand from a credit institution and invested SEK 880 thousand in infrastructure and exploration in Bashkiria. The negative cash flow in the period is also due to payment of accounts payable from 2015.

On 31 December 2015 the company’s shares in Petrogrand were valued at SEK 9,616 thousand or SEK 0.83 per share. The last day for trading the Petrogrand share on Nasdaq First North was 4 February 2016 and the closing price was SEK 0.45 per share. In May 2016 Petrosibir announced that the Petrogrand shares had been sold at a price of SEK 0.70 per share. Petrosibir consider this to be the fair value and has therefore adjusted the value of the Petrogrand shares to SEK 0.70 per share or SEK 8,029 thousand as of 31 March 2016 and the writedown of SEK 1,587 is included in financial items in the statement of comprehensive income.

Shareholders’ equity per share at 31 March 2015 was SEK 8.62 (8.55) and the equity to assets ratio was 96 (94) %.

Change of number of shares

In December 2015 Petrosibir received 6,387,385 shares of series B in Petrosibir as a result of a dividend from Petrogrand. These shares were cancelled in January 2016. Following the cancellation of shares the total number of shares of series A amount to 761,900 and the total number of shares of series B amount to 29,011,962. The total number of votes amounts to 36,630,962.

Significant events occurring after the reporting period

On 1 April 2016 Petrosibir announced that Dmitry Zubatyuk had informed the board that he resigned as CEO and on 6 May 2016 Petrosibir announced that the Board had appointed Nikolayi Millionshchikov acting CEO. Nikolay Millionshchikov assumed the position on 9 May 2016.

On 11 May 2016 Petrosibir announced that it had sold all of its shares in Petrogrand which strengthened the cash position by SEK 8 million.

Due to a breach of a warranty in the Share and Purchase Agreement entered into between Petrosibir and Petrogrand in October 2015 Petrosibir has agreed to pay SEK 4,395 thousand to Petrogrand. The payment will be added to the cost of the acquisition of Sonoyta Ltd.

Russian operations

Bashkiria

Revenue in the period amounted to SEK 4,312 (6,324) thousand. The lower revenue is due to lower production as well as a lower oil price. During the quarter 37,800 (41,200) barrels of oil were sold in Bashkiria. The average Brent price of oil was $34 per barrel compared $54 per barrel in the first quarter 2015. The production in the first quarter amounted to 37,260 (40,960) barrels which corresponds to an average daily production of 409 (455) barrels.

The operating costs amounted to SEK -3,712 (-5,459) thousand. The largest item in operating costs is the production tax and since the production volumes and the oil prices were lower in 2016 compared to 2015 the production taxes were lower.

The operating margin in the operations in Bashkiria amounted to 24% (20%). Below are the income statements for the operations in Bashkiria for the period January – March 2016 and 2015, amounts in SEK thousand.

The production in the first quarter 2016 increased somewhat compared to the fourth quarter of 2015 due to adjusting the pumping regimes on the wells. The company will continue to work with production increasing measures as well as stabilizing the oil pressure by converting one of the wells into a water injection well.

During the first quarter the company completed the interpretation of the seismic data collected in 2015 on Ayazovskoye and Suyanovskoye. The company has gained a more detailed perspective on future drilling locations on Ayazovskoye and also identified four different possible drilling structures on Suyanovskoye. Under the license agreement exploration wells have to be drilled initially on Suyanovskoye. The exact timing of this has not been set yet.

The oil treatment center which was constructed during 2015 has been inspected and approved by the authorities and a permission to launch the equipment has been received.

Going forward the company is reviewing the possibilities of drilling new production wells and in the long term an exploration well on Suyanovskoye. Investments will however continue to be balanced against the company’s financial situation.

Komi

In mid-December 2015 Petrosibir acquired 49% of Ripiano Holdings Ltd which in turn owns 100% of certain oil and gas assets in the Russian republic of Komi. January – March 2016 is therefore the first full quarter that the Komi operations are included in Petrosibir’s financial statements.

Revenue in the period amounted to SEK 25,827 thousand and the operating costs to SEK -24,405 thousand which resulted in an operating profit of SEK 1,422 which corresponds to an operating margin of 6%. Petrosibir’s 49% share of the operating profit amounts to SEK 697.

Ripiano Holdings showed a net profit for the first quarter of SEK 12,969 thousand and Petrosibir’s 49% share of the net profit is SEK 6,355 thousand. Ripiano Holdings’ Russian subsidiaries has loans denominated in USD and during the quarter the ruble appreciated against the USD which resulted in significant unrealized exchange gains on the USD loans which in turn resulted in the net profit of SEK 12,969 thousand.

The production in the first quarter in Komi amounted to 173,900 barrrels which corresponds to an average daily production of 1,910 barrels. Petrosibir’s 49% share of total production and average daily production amounts to 85,200 barrels and 936 barrels respectively.