RPI: 2017 Drilling Market Brings Optimism

In late 2016, Russia signed up to the OPEC deal to limit oil production. Last year, it was extended twice with its term covering the entire 2018. One might think that production curbs would have led to less production drilling activity in the country. However, this did not happen. Last year, according to CDU TEK, Russia’s production drilling figures didn’t shrink, but actually grew by about 11% year-on-year. This rather curious trend is the aftermath of the ongoing reserves’ depletion at mature fields in Western Siberia and the Volga-Urals region, characterized by an accompanying drop in production rather than an increase despite the higher drilling activity. The coerced increase in drilling, which may well continue in the short term, has the potential to become a driving force for growth for the whole Russian oilfield services market.

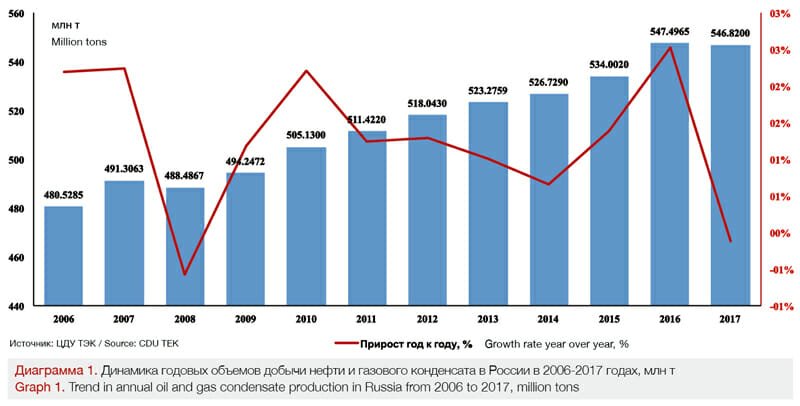

From 2015 to 2016, the global oil market was marked by an extensive production growth by the major producers aimed at boosting their market share at the expense of their US shale oil peers. Russia also played its role in the process, reaching a historic high in production at 547.5 million tons of oil and gas condensate in 2016 exceeding the previous year’s production by 2.5% (see Graph 1).

In 2017, along with other major oil producing countries, Russia made a commitment not to increase production, in order to support falling global oil prices. Accordingly, in 2017, oil production in Russia approximated the 2016 figure.

As of early 2018, the trend in production for Russian oil producing companies within the next two years will be largely driven by the extension (or non-extension) of the deal to artificially curb production inside the country.

According to the RPI research, following the expiry of the deal to curb output, total production in Russia may increase up to 574-575 million tons per annum before 2024 and remain at this level up to 2030. Strong oil production can be achieved by:

• Putting new fields in operation (for example, in Evenkiya, Irkutsk region, and Yamal Peninsula, as well as by stepping up offshore operations)

• Increased new production drilling

• Wider application of a range of technologies aimed at enhancing oil recovery and stimulating wells

Decreasing Impact

This said, based on the CDU TEK data, production drilling at the mature exhausted fields, in the legacy oil production areas alone, does not maintain or increase oil production efficiently. To quote one example, from 2014 to 2016, the increase in meters drilled by RN-Stavropolneftegaz was 21.4%, while production rose by 7.8%; an increase in drilling by RN-Vareganneftegaz of 25.8% led to an increase in production of only 1.9%; the meters drilled by RN-Purneftegaz grew by 96.8% while production contracted 13.2%, and an increase in drilling by RN Yuganskneftegaz of 136.9% was accompanied by a drop in production of 1.3%.This trend continued in 2017.

Under these circumstances, the companies had to employ all available enhanced oil recovery and well stimulation methods, expand drilling, and increase the number of well workovers just to keep production at its current level.

Enhanced oil recovery and well stimulation methods include sidetracking, including horizontal laterals, hydraulic fracturing (involving increasingly more multistage hydraulic fracturing), hydrochloride acid bottom hole treatment, etc. However, they are lagging behind new well drilling in terms of the efficiency which propelled production drilling forward both in 2016 and 2017.

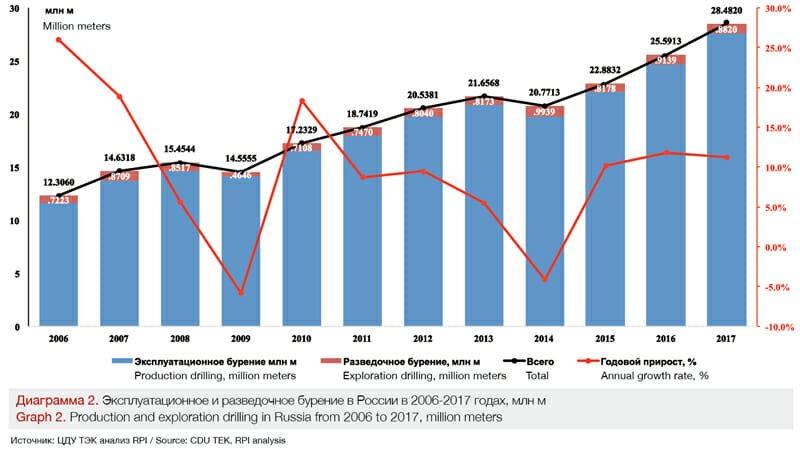

According to the CDU TEK data, production drilling growth remained strong in 2017. Compared to 2016, total drilling (production and exploration drilling combined) increased by 11.3% and reached a historic high at 28.5 million meters. In total, over the last 10 years, drilling increased by 84% (see Graph 2) with a corresponding increase in production of 11.9% or from 488.5 million tons in 2008 to 546.8 million tons in 2017.

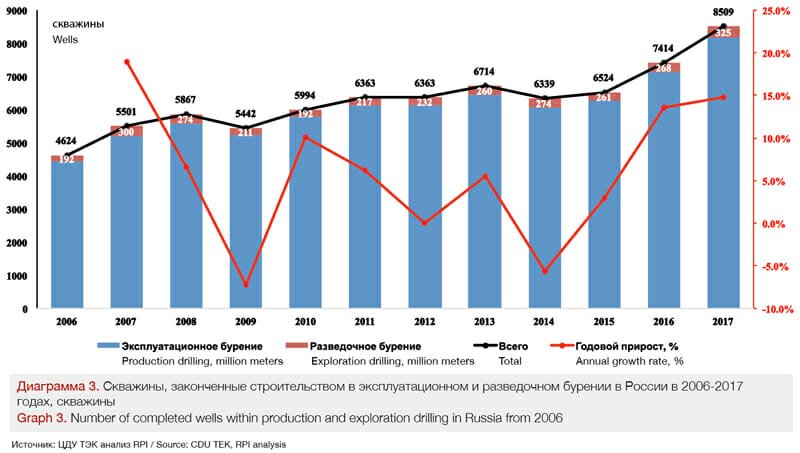

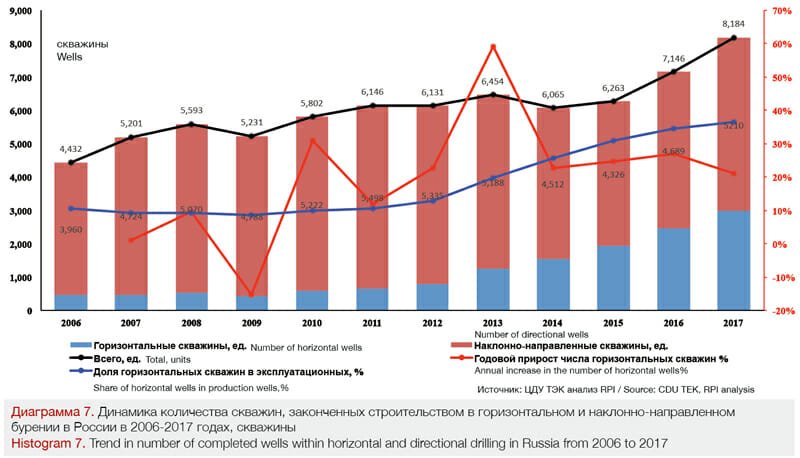

In 2017, the number of completed production wells reached 8,184, an increase of 14.5% over the 2016 level, and the number of exploration wells amounted to 325 (a 21.2% year-on-year increase).The total number of constructed wells increased by 84% from 2006 to 2017 (see Graph 3).

In 2006-2017, due to a spike in well depth, the number of completed production and exploration drilling wells grew on average at a slower pace than drilling. The average depth of a production well rose by 12.9% between 2006 and 2017, eventually totaling about 2,900 meters.

In 2017, the average depth of an exploration well was about 2,600 meters, representing a 12.3% increase over 2006.

Production Drilling Is the Largest Market Segment

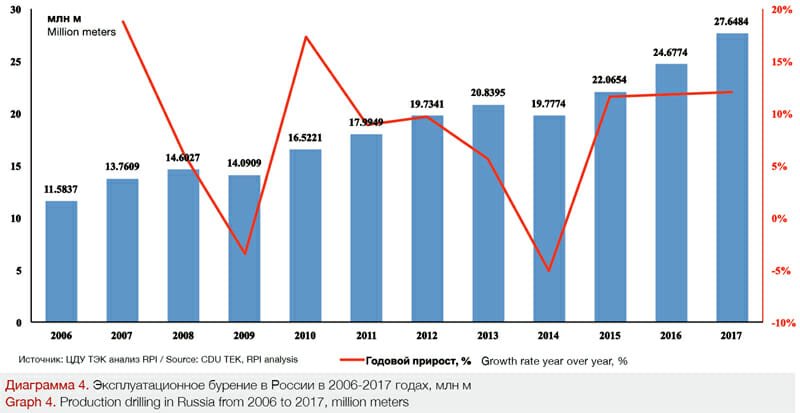

In 2017, production drilling grew by nearly 3 million meters (+11.7% to the 2016 level when drilling growth was 11.8%) up to 27.6 million meters (see Graph 4). Regionally, Western Siberia accounted for 82% of the total production drilling in 2017.

Production drilling growth in Russia was largely achieved thanks to the drilling performed in Western and Eastern Siberia.

In 2017, production drilling growth in Western Siberia proceeded at a rate of 13.4% and reached 2.65 million meters, remaining on the 2015-2016 upward trend.

Production drilling growth resulted from increased drilling activity of the big vertically integrated oil companies at 2.5 million meters, especially, in the Rosneft fields (+2.4 million meters with the bulk of this growth coming from the RN-Yuganskneftegaz fields: +1.7 million meters). That being the case, drilling growth in Western Siberia appears closely linked to Rosneft’s aim of maintaining production by placing new wells into operation in the context of depleting producing fields.

Between 2015 and 2016, production drilling in Eastern Siberia grew at an even higher rate: drilling in the region increased by 40.3% and reached 1.7 million meters in 2016, with 2015 growth at 38.1%. This was supported by higher drilling at the Surgutneftegaz (+0.4 million meters) and Rosneft (+0.1 million meters) fields. In 2017, the growth trajectory was nearly interrupted.

In 2016, production drilling in the Timan-Pechora and Volga-Urals provinces declined by 0.1 million meters (-15.3%) and 0.3 million meters (-10.6%), respectively. The fall in drilling was mainly caused by less drilling at the LUKOIL fields (-0.2 million meters) in the Timan-Pechora and the Rosneft fields in the Orenburg and Samara regions (-0.2 million meters) in the Volga-Urals region. At the same time, these regions experienced an upward trend in drilling in 2017.

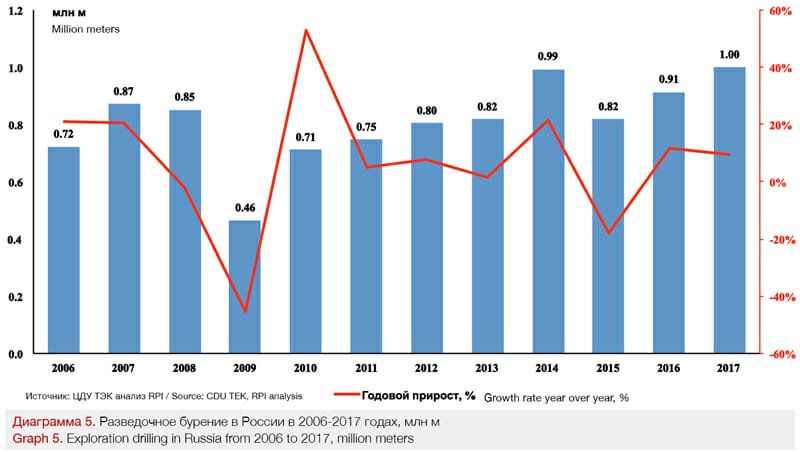

Last year, exploration drilling in Russia rose by 0.9 million meters (+9.8% over the 2016 level) and reached 1 million meters. Western Siberia still leads exploration drilling with a 50% share of total Russian drilling. However, growth in exploration drilling resulted from higher drilling activity in the Volga-Urals and Eastern Siberia (see Graph 5).

Horizontal Drilling Plays a Vital Part in the Market

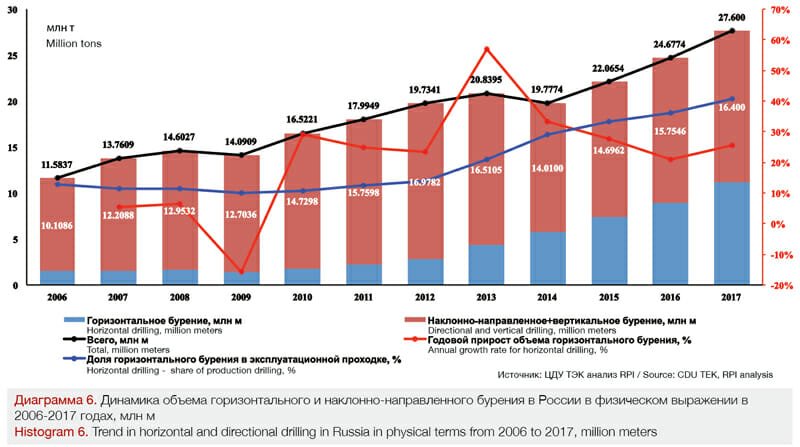

Since 2010, the field of drilling has undergone a paradigm shift in terms of technology. The share of horizontal drilling within total production drilling has skyrocketed. This is due to progress in technology to support drilling such as oil well telemetry and logging solutions.

In 2017, horizontal drilling reached 11.2 million meters having increased by 26% year-on-year (see Graph 6).

At the end of 2017, horizontal drilling exceeded 40% of the total production drilling. The increase in horizontal drilling (+2.3 million meters) was 79% of the total growth in production drilling (+2.9 million meters).

In 2017, the number of completed horizontal wells reached 2,974, which is a 21% increase in a single year (see Graph 7).

Horizontal wells accounted for 36% of all completed production wells. The increase in the number of horizontal wells (+517 wells) accounted for 49% of the total growth in the number of constructed production wells (+1,047 wells).

The average completed well depth was 3,546 meters for horizontal wells and 2,727 meters for directional wells.

In 2016, the deepest well was a 3,922-meter horizontal well constructed in Western Siberia, while the shallowest well was a 2,449-meter well in Timan-Pechora.

Among the directional wells constructed in 2016, the largest depth measured was 3,322 meters in the other areas and 2,991 meters in Western Siberia, while the shallowest well was 896 meters in the Volga-Urals region.

The increasing trend in the average length of the horizontal section of a well, which emerged between 2010 and 2016, continued into 2017. In 2010, when Russia was experiencing a robust increase in horizontal drilling, the average horizontal section was about 300 meters. Between 2011 and 2017, the value increased to 750-800 meters for onshore wells. However, it has now reached 1,000 meters, for example, for the Evenkiya wells. According to industry experts and RPI research, the average length of the horizontal section of an onshore well will be 1,300 meters in the next 5 to 7 years. It may go up to 1,500-1,700 meters by 2030.

It is also worth pointing out that the length of the horizontal section of an offshore well may now exceed this figure. As an illustration, it is sufficient to mention that it exceeds 4,000 meters for some wells in the Korchagin field off the Russian coast of the Caspian Sea (the Northern Block, LUKOIL).

The longest horizontal sections are observed in the production wells drilled from shore and aimed at developing offshore potential. For example, in the Sakhalin 1 project, when drilling from the shore of the Chayvo field with the Yastreb land drilling rig, the length of the horizontal section of the wells was about 11,000 meters.

Another trend, which continued into 2017, was the growing application of multi-stage hydraulic fracturing when constructing horizontal wells. Multi-stage hydraulic fracturing operations stand apart in terms of their technology sophistication level, as expressed in the number of stages. In 2017, a weighted average for the hydraulic fracturing stages was about 6. The average stages per operation for horizontal wells and horizontal laterals were different: there were about 7 stages on average for horizontal wells and about 3 stages for horizontal laterals. In a few cases, a 20-stage hydraulic fracturing was carried out. For example, such hydraulic fractures were occasionally conducted by Rosneft and Gazpromneft. In the future, from 2025 to 2030, a 18 to 20-stage hydraulic fracturing will be typical for the shale oil reserves and the Bazhenov formation deposits.

Growth Potential

Even though the physical and, as a result, financial drilling market performance has been impressive over the previous two years, especially in terms of production drilling, there is still considerable potential for growth. Between 2018 and 2030, development will be largely driven by drilling in the exhausted Western Siberia fields to combat a drop in production.

Research has shown that annual production drilling growth rate may remain within the 5-9% band. Between 2018 and 2023, new fields in Eastern Siberia will develop vibrantly and lead to an increase in production drilling in the region. This will further spur growth in production drilling.

After 2022, the annual drilling growth rate will gradually fall to about 1% in 2030. By then, a fall in drilling at the new major fields will be coupled with tighter restrictions on mature field drilling.

We expect the horizontal drilling share to grow and reach 46% of production drilling as early as 2020 to 2025, due to dynamic development of new fields in Eastern Siberia. The horizontal drilling share will exceed 50% by 2030 and stay firm upon its growth trajectory.

2006-2016 RPI research shows that annual exploration drilling is crucially dependent on production drilling (a follow-up appraisal drilling in the operating fields) as well oil company’s investment campaigns, relying heavily on the existing economy.

The 2009 and 2014 crises demonstrated that a cutback on investment spending is linked to a significant fall in exploration drilling.

If no additional new fields are discovered, exploration drilling in Russia will in general terms fall steadily from 2020 onwards, due to falling exploration in Western Siberia. Growth may occur in some other regions. This is especially the case with Eastern Siberia.

RPI research shows that the vigorously growing drilling market in years to come may propel the forward movement of all related oilfield services market segments and, virtually, the entire market.

The Russian Oil Drilling Market research report was published by RPI. For any information on the issues raised in this article and report, please call:

+7 495 502 5433, +7 495 778 9332

e-mail: research@rpi-research.com

www.rpi-consult.ru

Vadim Arkadievich Kravets, Lead Analyst for RPI Research & Consulting