RPI: Difficult Times Ahead

Early in February 2016, the Central Dispatch Administration of Fuel and Energy Complex (CDAFEC) published official statistical data confirming the estimates of industry experts, who last autumn predicted a 3-4% decline in production in Western Siberia in 2015. This has affected virtually all vertically integrated oil companies in this traditional oil producing region, except for Bashneft that is not a big player anyway. Even Rosneft, whose management had previously promised to stabilise production in Khanty-Mansi Autonomous District through integrated introduction of new technologies, has not been able to keep its promise. According to the CDAFEC, the company’s major upstream asset, Yugansneftegaz has cut production by 3.3% to 62.4 million tons. The reasons for such a sharp drop in production include depletion of local deposits and production drilling declined drilled footage in 2014.

The end of 2015 brought some bad news for the oil and gas industry, predicting a life of hardship for the next 3-4 years. According to the figures that appeared in November and December, Russian oil and gas companies delayed completion for a total of 29 fields, including large ones. Rosneft, Gazprom and Novatek delayed completion of nine, three and two fields respectively. Here are some figures:

• Yurubcheno-Tokhomskoye field (Rosneft, Evenkia) – delayed from 2016 until 2018;

• Baikalovskoye, Vankorsky cluster (Rosneft) – delayed from 2019 until 2023;

• Urengoiskoye and Severo-Yubileinoye oil and gas condensate fields (Novatek) – delayed for about 9 years.

• West-Tambeiskoye – development postponed until 2023 (Gazprom)

It is very likely that completion of smaller fields in Evenkia will be delayed until at least 2022 or 2023. The fact that this might be true is indirectly confirmed by the official intention of Transneft to postpone entry into the commercial operation for Kutumba–Taishet main oil pipeline intended for transporting oil from Evenkia to the national pipeline system.

The picture becomes even more gloomy if we take into account offshore fields. In 2015, offshore exploratory drilling declined 50% compared to 2014, which will inevitably delay development of promising offshore sites until after 2025. For example, Gazprom postponed its exploratory drilling projects in the Kara Sea and in the Barents Sea until 2018 and 2019 respectively. Development of the proven Dolginskoye field in the Barents Sea was rescheduled by Gazprom from 2020 to 2030.

It is quite clear that delays in development of new oilfields will inevitably affect the Russian drilling market, which already faced some serious problems even before 2015.

Crisis Started in 2014

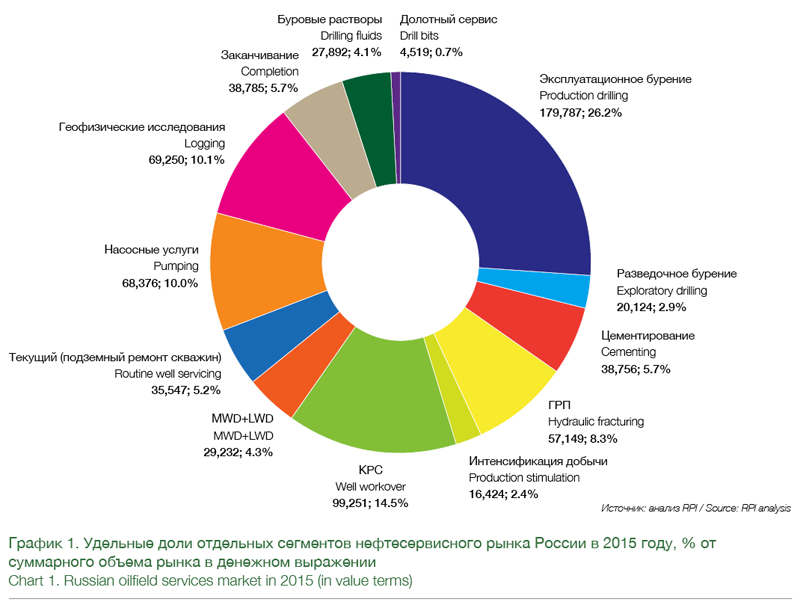

The drilling market can be considered a key segment of the oilfield services market as a whole. Suffice it to say that production and exploratory drilling account for 29.1% of the Russian oilfield services market in value terms. If we add drilling fluids, bit services, MWD/LWD, well completion and well cementing to some extent, the share will rise to 49.6%. Therefore, the slump of nearly half of the oilfield services market will definitely have an impact on the entire oil and gas industry.

Drilling was and is the main driver of the oilfield services market, a factor causing its slump or growth. In recent years, it was drilling that kept the oilfield services market growing.

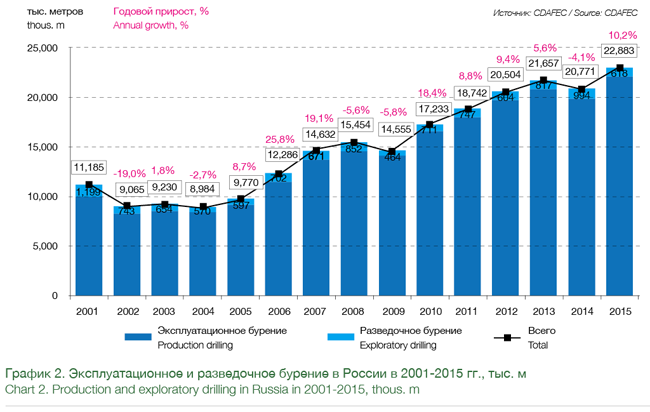

Since 2005, the booming drilling market, especially production drilling, was driving the oilfield services market as a whole, because starting from 2005 (except for the crisis year of 2009) drilling in Russia kept growing every year.

Before the economic crisis of 2008-2009, during 2002-2008, the total annual production drilling in Russia grew by 75%. 2006 and 2007 were particularly impressive, with growth rates reaching 25.8% and 19.1% respectively.

The reason for this rapid increase in production drilling was that during 2002-2013 it was the most effective way for Russian oil and gas companies to increase production.

In 2009, in the aftermath of the economic crisis, drilled footage in production drilling fell by 5.8% compared with the previous year. The main cause was that production companies were suspending their investment programs.

As the effects of the economic crisis became less severe, a 18.4% increase in drilling in Russia made up for the decline of 2009. In 2011, drilling throughout Russia increased 8.8% compared to 2010, approaching 18.7 million metres.

According to CDAFEC, in 2013 drilling in Russia totalled 21.7 million metres, or 5.6% more than in 2012. Therefore, drilling continued to grow in 2013, just as it did during 2010-2012.

The growth was mainly achieved by increased footage in production drilling, specifically an increase of 5.8% in 2013 compared to the previous year. At the same time, footage in exploratory drilling showed a modest growth of 1.6%.

2014 proved to be a turning point for the Russian drilling market. In 2014, total drilled footage declined 4.1% compared with the previous year. This slump started in the first half of 2014, i.e. even before the sectoral Western sanctions were imposed and before the oil prices fell.

The main cause of the declining drilling was a sharp increase in more efficient horizontal drilling, which allows to achieve flow rates 3-8 times higher compared with conventional directional wells. This allowed companies to drill fewer wells to achieve the same output.

Furthermore, in the second half of 2014, production companies began to reduce investment, mostly because of the falling oil prices and sectoral sanctions in the financial services sector. As a result, oil production in Western Siberia, the biggest oil-producing region, dropped significantly.

Obviously, in 2015 this pushed production companies to increase production drilling sharply, while cutting exploratory drilling which is typical for a period of economic crisis. However, this recovery could be temporary.

The fall in oil prices in 2014-2015 will force oil producers, at least in the short term, to reduce their investment programs, which is exactly what began to happen in the end of 2014. The current oil prices prove this conclusion.

Too Much Oil

In 2014-2015, the world oil market came to a point where supply exceeded demand. As a result, oil reserves in storage hit records. According to the United States Energy Information Administration (EIA), oil reserves in the United States exceeded 500 million barrels as of January 29, 2016, reaching an all-time high for the first time since 1930.

This happened due to intensive offshore field development, including deep water (for example, in the Gulf of Mexico at sea depth up to 3,000 m), as well as the start of shale and hard-to-recover oil extraction. As a result, the price of Brent crude oil dropped from roughly $100-110 per barrel in the middle of 2014 to $28-30 per barrel on some days in January 2016.

With these new prices, producing shale and hard-to-recover oil was no longer economically viable.

According to various estimates, shale oil costs $50-60 per barrel to produce. For Russian Arctic oil projects, this figure stands at $80 or more. And for Bazhen Formation, it’s $60 per barrel or more.

As a result, shale oil producers, mostly in the United States, began to file for bankruptcy in the second half of 2015. This, however, did not remove excess supply from the global oil market, as OPEC, Russia, Venezuela and other countries refused to cut production to protect their market shares. Another factor was the possible return of Iran on the world market, after the sanctions were lifted early in 2016. Yet, reduced supply of shale oil still means that oil prices may rise as soon as later in 2016. The price, however, will not go above $50 per barrel in the medium term, because otherwise shale oil projects would again become commercially viable.

So we are now witnessing a mixed direct-inverse relationship on the market, where higher prices make shale oil production possible, which eventually drives the prices down. The meaning of all this is that oil prices are unlikely to return to the level of $100-110, or in some years $140, per barrel in the medium term.

What’s next?

In this situation, the drilling market probably reached the ceiling above which it can hardly go,especially given the sanctions.

Obviously, sanctions against Russia will have a noticeable effect on the drilling market, especially production drilling. After the end of cooperation with European and US companies, there will be a buffer period of 2-4 years, during which the structure of suppliers of drilling equipment will change little, and the market will continue to work in new conditions.

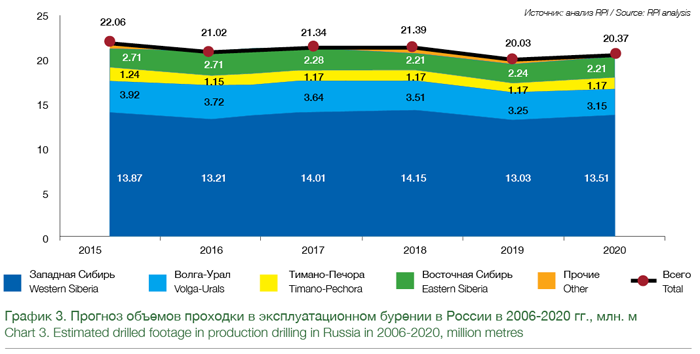

Until 2017, the sanctions will not have a significant impact on production drilling. If foreign companies, for whatever reason, decide to leave the Russian market in 2017, there might be a noticeable decline in drilled footage in 2018-2019 (5-7%) and gradual recovery up to 2020 (to 19-20 million metres), which will continue beyond the studied time period.

Given the increasing share of horizontal drilling, we expect that production drilling during 2016-2020 will be in the range between 20 and 21.5 million metres. And 2017 may become the biggest year in terms of drilling. In 2018, Russian companies plan to start industrial development of large oil and oil and gas condensate fields in Yamalo-Nenetsky Autonomous District, as well as the first part of the fields in the Yurubcheno-Tokhomskaya zone (Evenkia).

Drilling may decline a little in 2018-2019. Reducing the number of completed wells may be the result of the growing share of horizontal drilling.

Considering the adjusted plans of Russian producers, drilled footage may increase in 2022-2023, when the second part of local deposits will be put into service in Evenkia.

It is possible that continued sanctions against Russia would have a significant impact on the market of hi-tech horizontal drilling as well. The horizontal drilling equipment market is one of the youngest in Russia. It is dominated by foreign companies, with Russian drilling rigs of this type having mostly low or

medium power.

Still, rapid growth in horizontal drilled footage may continue up until 2018-2019. Then in 2019-2020, horizontal drilled footage will perhaps reach a plateau.

As for exploratory drilling, this is the first spending item to be cut during the crisis, but it is very hard to predict, as it depends heavily on how deep the economic recession is going to be. Looking back at the crisis of 2009, we can say for sure that the exploratory drilling market will have to face some tough challenges, with drilled footage probably declining by more than 40%.

Vadim Kravets, Senior Analyst, RPI

For additional information on PRI reports, please contact Daria Ivantsova: +7 (495) 502 5433 / 778 9332, e-mail: Daria@rpi-inc.ru