RPI: Downhole and Wellhead Equipment: Market Prospects, New Technologies & Impact of Sanctions

On the one hand, the market for downhole and wellhead equipment is quite a ‘mainstream’ affair with a large presence of domestic players, but on the other hand, some of its cutting-edge segments, such as MSHF equipment, as well as digital oilfield equipment, are generally manufactured by foreign companies. Demand in these segments is expected to increase at double-digit rates in the medium to long term due to the growing share of hard-to-recover reserves, as well as the growing number of horizontal wells. At the same time, the Western sanctions, if retained for a long time, will have a dampening effect.

Between 2011 and 2017, the downhole equipment market was on an upward trend showing a growth rate of 12.7%. Market volume projections for 2030 show figures upwards of RUB 300 billion, with the most significant contributions to that growth being from the MSHF equipment and liner hanger equipment segments (see Fig 1).

The wellhead equipment market will show a similar trend: it expanded by 7.4% in 2017, and current growth rate projections have it landing at RUB 25 billion by 2030.

The key factors influencing the development of downhole and wellhead equipment markets are:

• Growth in well construction by more than 70%, spearheaded by a 3.7-fold growth in horizontal well projects (see Fig 1), whose share will exceed 69%. Meanwhile, projections beyond 2027 contemplate a slowdown in drilling activity, which will be due to the lack of new projects based on large conventional deposits as well as the technological and economic difficulties involved in the development of offshore fields and hard-to-recover reserves. The expansion in horizontal drilling activity concurrently drives the growth of HF and MSHF operations, which accompany more than 80% of new horizontal well projects today.

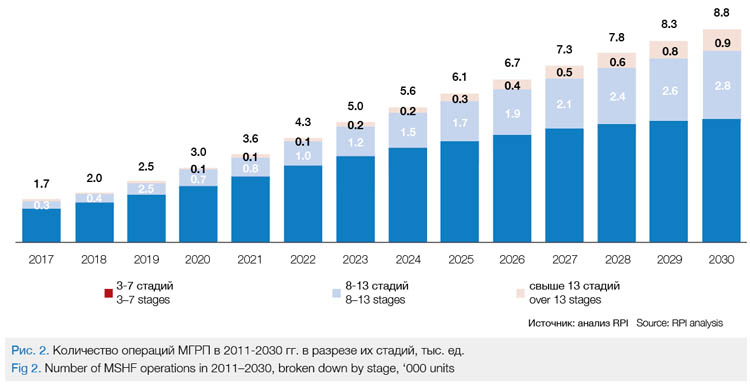

• The 5.2-fold growth in the number of MSHF operations by 2030 (see Fig 2) will, on the one hand, be supported by an increase in horizontal drilling activity, while on the other hand, it will also be constrained by the restrictions on technology transfer due to sanctions from the West.

• Increase in the number of MSHF stages for conventional reservoir deposits.

The factors listed above will affect the market growth both physically, i.e. in terms of the growing fleet of equipment to support the expanding drilling industry, and monetarily, i.e.. due to the ever-wider use of expensive equipment for MSHF and liner hangers. At the same time, the proliferation of intelligent production systems on land deposits will be limited by their high cost, so those systems will only be used for key projects with super-high capital intensity, as well as on a number of offshore fields in the Caspian Sea and Sakhalin.

Downhole Equipment

In 2017, the downhole equipment market almost doubled in volume compared to its level in 2011. The fastest growing segment was the MSHF equipmentmarket, whose overall share increased from 2% to 11% between 2011 and 2017.

Packers

Packers can be used in cased-hole as well as open-hole projects. Open-hole packers are used in well tests and various well interventions, as well as in MSHF projects. Cased-hole packers can be retrievable or non-retrievable.

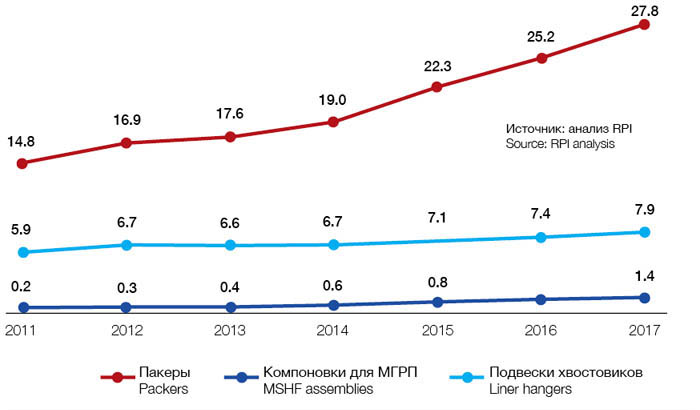

Between 2011 and 2017, our national packer market grew by 94%, reaching a level of 28,700 units (see Fig 3). The key driver of this growth was the expanding number of well construction and sidetracking projects, which, since 2011, have increased by 44% and 67%, respectively. The fastest growing region in terms of packer use is Eastern Siberia, boasting a 7-fold increase since 2011, which has been due to the overall expansion of drilling activity there.

Fig 3. The market for packers, MHSF equipment, and liners hangers in Russia between 2011 and 2017

Dominating the market, with a share greater than 45%, is the non-retrievable cased-hole packer segment, featuring packers used for well construction and sidetracking projects as well as for re-completion and commingling projects. That notwithstanding, the open-hole packer segment is the most rapidly developing one – their use has increased 4.7 times thanks to the growing number of MSHF operations coupled with the increase in the average number of MSHF stages.

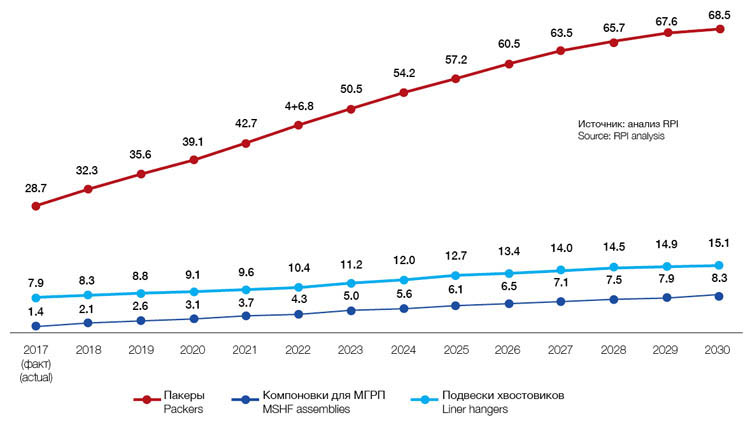

Due to the growth in well drilling and sidetracking activities, as well as the increase in the number of MSHF operations (5.2 times by 2030), the long-term growth of the packer market is expected to show continued stability until the market has more than doubled in size. That way, by 2030 its size may reach some 68,500 units (see Fig 4), which covers both the demand for new equipment and the projected equipment upgrades on active well stock.

Fig 4. The market for packers, MHSF equipment, and liners hangers in Russia, projected for 2017-2030

It is the open-hole packer segment, instrumental in well construction and MSHF operations, that will spearhead the market growth. According to RPI experts, the open-hole packer market share will keep growing to land at 46% by 2030, which will be due to the expansion of drilling and MSHF activities and the increase in the average number of MSHF stages from 6, in 2017, to 12, in 2030.

It is expected that the increase in total number of packers in operation will be accompanied with technological improvements to the packer fleet, e. g. introducing packers that are capable of withstanding high annular pressure, or packers with a smaller diameter swellable packer.

In addition, development work is in progress to implement swellable packers designed to isolate cased as well as uncased borehole sections, particularly during multi-stage HF operations. In this case, the sealing of the annulus occurs after the packer has been bathed in oil or water for a certain period of time. Due to the relatively great length of the rubber elastomer (as compared to hydraulic and hydro-mechanical packers), swellable packers can be used in wells with above-average open-hole washout ratios. The specific areas of application of this type of packers are zonal isolation for hydraulic fracturing jobs (especially in horizontal shafts), wellbore segmentation, constant pressure isolation in the tubing-casing annulus, ensuring the integrity of the cement layer (in micro-annuli, and while forming slurry channels), straddle systems, zonal isolation for gravel packing and sand screens.

In addition to various types of packers and all kinds of packer assemblies, work is in progress toward developing and implementing plug-type packer systems with float valves. These plugs, deployed in the wellbore using a hydraulic deployment assembly by creating excess pressure in standard or coiled tubing, provide solutions to address the possible failures of reservoir shut-off valves, or the killing of gas or gas condensate wells for workover operations without damaging the wellbore zone (without injecting slurry into the reservoir). Such packer plugs are designed for autonomous operation (without connection to the tubing) and allow the user to install/remove the float valve using wireline equipment.

Multi-Stage HF Equipment

The market for multi-stage HF equipmentis one of the more popular segments of the downhole equipment market, demonstrating positive dynamics from year to year. e.g., since 2011 it has grown 6.6 times, hitting 1,400 units in 2017 (see Chart 4). This market is mainly driven by the high growth rates in MSHF operations. In 2017, uncontrolled MSHF equipment typesstill occupied the larger share in the marketplace, but looking back, we can see that controlled equipment typeshave been gaining ground between 2011 and 2017, eventually increasing by more than 25%.

The MSHF equipmentmarket has a great potential for growth in the long run and is one of the fastest growing segments in the downhole equipment market – by 2030, it is expected to grow almost 6-fold. As was the case in prior periods, the key factor driving this growth will be the increase in the number of MSHF operations, and the number of stages involved, which should exceed 400% in 13 years. It is Eastern Siberia that is expected to show the most significant, more than24-fold growth in MSHF operations, which will help this region gain a bigger share in the MSHF equipmentmarket.

Liner Hangers Equipment

The liner hanger equipmentmarket has grown by more than a third since 2011, landing at 7,900 units in 2017 (see Chart 4). As the equipment fleet kept expanding, so did its average unit price, which has increased by several hundred rubles per unitsince 2011.

Experts say that due to the growth in well construction and sidetrack drilling, the size of the liner hanger equipmentmarket will increase by 92% by 2030 and will amount to 15,100 units (see Fig 4). In addition, it is projected that the share of rotating-while-cementing equipment as well as hangers designed for the more difficult and deeper wells will go up. However, this market still lags behind the oilfield service market in terms of growth rates due to the fact that liner hangers are not used for all types of completion operations, but only in 50% of directional drilling projects and about 90% of horizontal drilling projects.

Summarizing our analysis of the downhole equipment market, we would like to highlight the pronounced changes that are expected to occur in the market structure by 2030 compared to 2017 – in the long run, it is the multi-stage HF equipmentthat will play big in the market, taking up more than one-third of its volume.

Wellhead Equipment

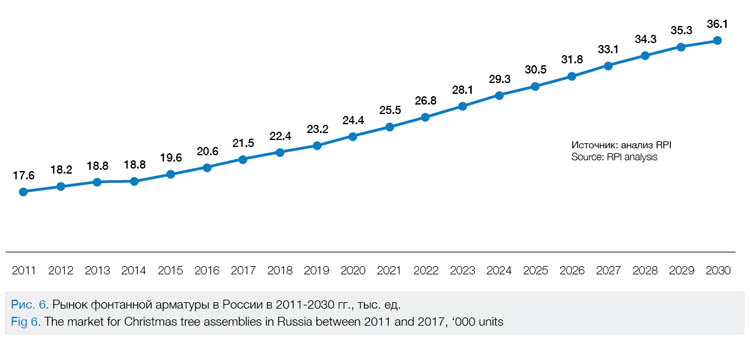

As the number of well construction projects kept increasing between 2011 and 2017, resulting in 2,700 new wells by the end of the period, the market for Christmas tree assemblies demonstrated an upward trend, landing at 21,500 units in 2017, and this trend is expected to continue in the long term until 2030 (see Chart 6). By 2030, the Christmas tree market will increase by 68% and will amount to 36,100 units. This growth will be due to the 74-percent increase in well construction by 2030.

Considering the Christmas tree market broken down into segments, classified based on corrosion resistance categories, it has been noted that this equipment can be manufactured without the designation of specific corrosion resistance categories and can be used in ordinary environments. For example, Christmas tree assemblies of category K1 are used in environments containing up to 6% CO2. Equipment of category K2 is manufactured using high-alloy steel and is resistant to hydrogen sulfide – it is used in environments containing up to 6% CO2 and up to 6% H2S. Christmas tree assemblies of category K3 are used in environments containing up to 25% each of CO2 and H2S. The equipment of high corrosion resistance categories is used mainly for deposits of heavy, sulphurous oil – such as those found in the Volga-Ural region, or in some parts of Western Siberia, e g, the Van Yoganskoye field in the Khanty-Mansi Autonomous Okrug.

Considering the structure of Christmas tree market broken down by corrosion resistance category, only about 15–20% of the overall supply are categories K2 and higher. This is primarily due to the high cost of the more corrosion-resistant categories, making it the most efficient solution for companies to use the cheaper equipment with shorter operating lives (in those fields where the composition of fluids allows for the use of category K1).

Considering this breakdown by corrosion resistance category, 67% of the market, in monetary terms, is occupied by K1-type Christmas tree equipment, and this share is lower (by 15 p. p) than that calculated in terms of physical volumes due to the relatively low cost of this type of equipment; for comparison: the average price of K2 assemblies is 2.2 times higher than that of the simplest Christmas tree equipment in terms of corrosion resistance.

Equipment Manufacturers

About 80% of the Russian downhole equipment market is controlled by domestic companies, the largest of which are Rimera and PetroGazTech, holding 33% and 12%, respectively. However, domestic manufacturers are focused mainly on the relatively simple, mass-market equipment. The foreign manufacturers with a presence in the market – Schlumberger, Halliburton, TAM International, and others – enjoy good demand in high-tech equipment segments, e. g., sophisticated controlled MSHF assemblies, swellable packers. Those are predominantly applied in the most complex projects (in particular, the Messoyakha and Meretoyakha fields), often as part of comprehensive drilling support and completion solutions.

In aggregate, the largest foreign companies occupy 15% of the Russian market, the leader among them being Schlumberger, at 7%, followed by Halliburton and TAM International, at ca. 4% each; while the remaining market is divided between Borets, Yugson-Servis, NG Technology, Sibneftemash, TMS Group, et al. The segment of Other companies mainly includes Russian companies that that are not exclusively engaged in production of downhole equipment, their share being more than 20%. Advanced packers from foreign manufacturers are mainly used for multi-zone completions, multi-stage hydraulic fracturing, as well as for bottom-hole treatment operations with high injection rates and large proppant volumes.

Russian manufacturers of downhole equipment are mainly focused on manufacturing packers, and are currently unable to meet the domestic demand for MSHF equipment. This segment is predominantly represented by foreign manufacturers (Schlumberger, Halliburton, other companies) servicing a large number of end-users in the oilfield services sector that are involved in MSHF operations. At the same time, these companies are forced to adopt a very careful approach to their equipment supplies, especially for projects involving hard-to-recover reserves that fall under supply restrictions because of Western sanctions.

Key positions in the market for Christmas tree assemblies in Russia are occupied by domestic companies – more than 85% of the market, which is due to relatively simple equipment manufacturing technologies – shut-off valves from Russian manufacturers also being substantially cheaper than their foreign analogues. The remaining share is mainly distributed among Chinese manufacturers and a limited number of other non-Russian companies. The largest manufacturers that are active in the Christmas tree market are Uralneftemash and Korvet, occupying 23% and 19%, respectively.

The analytical report entitled “Downhole and wellhead equipment: a comprehensive market analysis, key players, outlook until 2030” has been published by RPI. For questions related to this article and the said report, please call:

+7 (495) 5025433, +7 (495) 7789332;

e-mail: research@rpi-research.com. www.rpi-consult.ru