RPI: Drilling Quality, Not Quantity

In the Russian Federation 2014 became very significant in respect of qualitative change in the situation in the local drilling market.

Firstly, the forecasts, only recently predicting fast growth of the open drilling market, did not come true. On the contrary, starting from spring of 2014 Rosneft built up its portfolio of drilling assets, thus reducing the share of the free market.

Secondly, in 2014 the rising trend of increasing total drilling footage gave way to decreasing drilling footage compared to the previous year.

Thirdly, sectoral sanctions, which are directly aimed at constraining increase in hydrocarbon production and suspension of future production projects, were imposed on Russia.

The above events make the current situation dramatically different from the tendencies of the last 10 years and form a new environment in the drilling market for the next few years.

In practical terms, drilling makes up 30% of the oilfield services market in Russia and is the main driver in many other sectors (such as fracking, MWD, cementing, etc.). The change in the development thrust of the drilling market will have a significant effect on all related sectors. Development of horizontal drilling, sanctions, decline in investment activity, low oil prices – these are the factors to which both Russian oil companies and drilling contractors will have to adjust.

Living with the Sanctions

During the summer of 2014 the United States, the European Union, Canada and Japan imposed sectoral sanctions on Russia. The sanctions consist of making the financing of Russian companies more difficult, restricting the activities of foreign companies engaged in the production and provision of oilfield services and the banning of importation of advanced plant and equipment. The sanctions were introduced in several stages, becoming progressively stricter. Quite possibly, sanction pressure on the Russian Federation, at least in the next few years, will continue to increase.

The list of equipment banned by the USA for importing to Russia includes:

» Drilling rigs;

» Components for horizontal drilling;

» Drilling and completion equipment;

» Offshore equipment for operations in Arctic conditions,;

» Other equipment

The combination of sanctions and the dramatic drop in world oil prices may result, in the next few years, in Russian producers losing access to the most advanced technologies for enhanced recovery, in shelf field development becoming considerably more difficult and in obtaining spares for previously purchased Western equipment becoming an issue. Meanwhile, high-tech drilling companies remaining in the market will be forced, as the sanctions, to provide services using equipment which has already been imported into the country, giving up further import of equipment and participation in the most attractive projects, including offshore ones.

If we were to analyse the market in general, the sanctions will not affect development drilling until 2017. Should foreign companies, for whatever reason, decide to leave the Russian market in 2017, this would be followed by a rapid fall in 2018 and gradual recovery up to 2020 (reaching approximately 20 million metres) which will continue.

Drill Less, but More Efficiently

Year 2014 became the second year (after 2009) in the last decade when drilling footage decreased. Thus, before the start of the economic crisis of 2008-2009, during 2002-2008, total annual footage of development drilling increased by 75%. Particularly high annual increases in total drilling footage in Russia were seen in 2006 and 2007 – 25.8% and 19.1% respectively. The fast increase in development drilling was due to the fact that in 2002-2013 drilling remained one of the most effective ways for Russian oil and gas companies to increase their oil production.

The reduction in drilling footage in 2014 was 4.1% compared to 2013. This process had started already in the first half of 2014, i. e. before the introduction of sectoral sanctions by the West and the world oil price decline. The main factor impacting the falling drilling footage was a very fast increase in more effective horizontal drilling which enables an increase in the flow rates 3-8 times higher than when compared to conventional directional wells. This resulted in the companies being able to drill less development wells to achieve the same target production profiles. In the second half of 2014 the decline in producers’ investment activity was added to this factor due to the crash in world oil prices and the introduction of sanctions in the finance sector.

Already in 2014, horizontal drilling constituted almost 30% of all footage, whereas in 2012 it was below 20% (see the graph). This tendency is hugely important for the whole of the RF oilfield service sector, as horizontal drilling, due to its complexity, determines technological and managerial solutions in many other market sectors (e.g. fracking, logging and drilling support markets).

In the next few years, the increase in horizontal drilling footage may continue up to 2017, until almost simultaneously planned bringing into production large new oil fields in Western and Eastern Siberia. Then, in 2018, should co-operation of foreign equipment makers stop, horizontal drilling footage would be likely to fall by some 7.8%. In 2019-2020 horizontal drilling footage is likely to stabilise as the result of increased attention paid by the investment sector to this technology and the introduction of import-substituting equipment and consumables.

Alignment of Forces

The drilling market in Russia, in respect of contractors, is characterised by the presence of several dominating companies – 67% of total footage was drilled by three companies:

» EDC (30% of all footage drilled in the country in 2014);

» Surgutneftegas (drilling divisions of the Vertically Integrated Oil Company?), 21%);

» Drilling subsidiaries of Rosneft (16%).

In spring 2014 Rosneft started to increase its oilfield service assets by buying the drilling and workover divisions of Weatherford as well as those of Orenbourgskaya Drilling Company (Orenbourg Drilling Company), having thus considerably increased the share of a market sector closed to competition. Apart from this, information appeared at the beginning of 2015 that the largest international oilfield service company – Schlumberger – intends to buy the largest independent drilling contractor Eurasia Drilling Company (EDC).

In 2013 one more subsidiary of the Vertically Integrated Oil Company (ВИНК) – Bashneft-Burenie – was removed from OJSC Bashneft and included into a new oilfield service holding – Bashneft-Servisniye Aktivy (Service Assets). In 2014 this Holding came into possession of AFK (Joint Stock Financial Corporation) Sistema having undergone their re-branding in the summer of the same year. It was named Targin, while the former Bashneft-Burenie was named Targin Burenie. Targin Boureniye is not currently part of Bashneft and AFK Sistema remains its major shareholder.

Alongside the closed part of the market, a captive market continues to exist in Russia. Apart from EDC, this market partially includes Targin, which continues to implement the majority of Bashneft contracts in spite of working for other third-party companies.

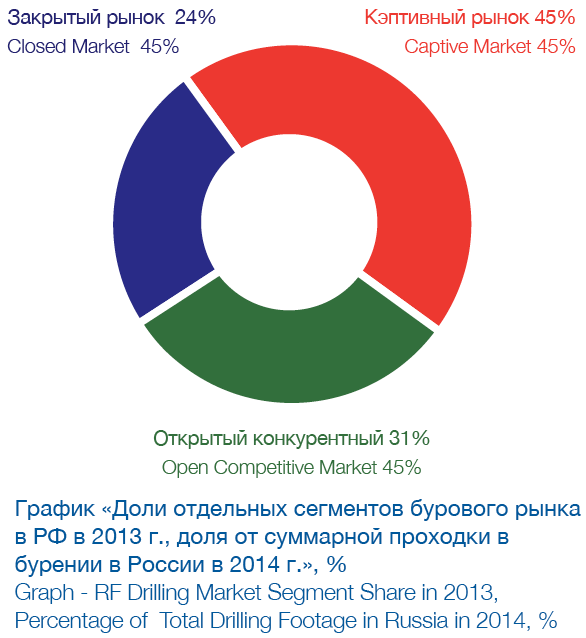

We believe that, based on the above, the closed market by the end of 2014 constituted approximately 24% of the whole drilling market with some 45% representing the captive market.

Thus, it is possible to conclude that the assumptions (of the type made in 2013) that the share of the closed market in total drilling footage would most likely decrease, did not come true in 2014.

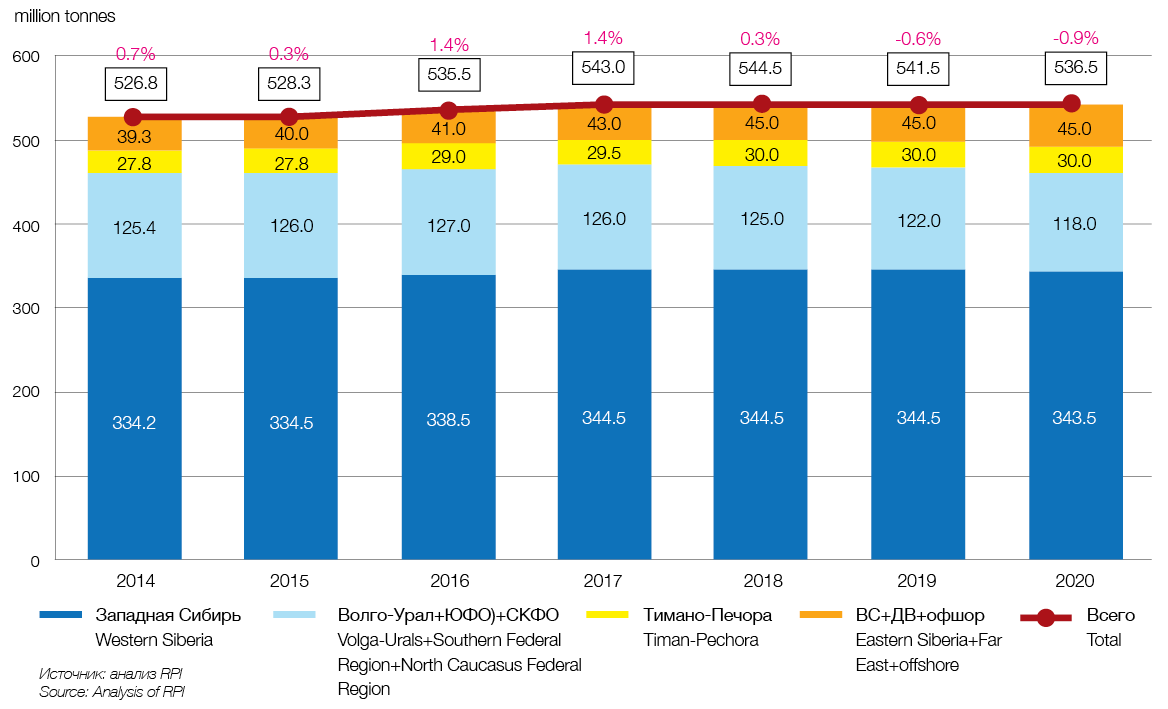

Based on this forecast, in 2018 Russia will essentially reach the annual peak production of oil and condensate of approximately 545 million tonnes per year. This will be followed by gradual reduction due to depletion of operating fields and delays in bringing new fields into production.

Western Siberia remains the main oil-producing region in Russia (see the areas composing this Region above). Increase in production in Western Siberia may occur as the result of bringing the following large fields into production:

» Souzounskoye;

» Tagoulskoye;

» Roussko-Rechenskoye;

» Rousskoye;

» Goup of Messoyakhskiy fields on Bolshekhetskaya Depression.

Production increases in Eastern Siberia, the Far East and offshore fields of up to 45 million tonnes per year will be based on bringing the following fields into development:

» Chayandinskoye (Oil Rims);

» Fields in Youroubchenko-Tokhomskaya area (Evenkiya Territory);

» Oilfields of Irkoutskaya Neftyanaya Kompaniya (Irkoutsk Oil Company) located within Potapovskiy, Severo-Mogdinskiy, Bolshetirskiy and Zapadno-Yaraktinskiy License Areas;

» Sanarskoye and im. Lisovskogo Fields in Irkoutsk Oblast;

» Fields to the north of the Talakanskoye Field (Yakoutiya);

» Prirazlomnoye Field (the Pechora Sea);

» Im. You. Filanovskogo Field (Russian Sector of the Caspian Sea).

After 2018, total annual oil and condensate production will start to decline for the following reasons:

» Slow pace of development of offshore fields and the Bazhenov Suite;

» Absence of new large promising explored fields;

» Depletion of old fields;

» Decreasing efficiency of reservoir treatment and production stimulation in old fields

Russian oil industry experts became familiar with horizontal drilling as a production stimulation method back in the 1990s of the last century. However, by the beginning of the 2000s interest decreased as the result of insufficient development of horizontal drilling support methods such as MWD/LWD.

A new surge of interest in horizontal drilling occurred, approximately in 2004-2005. During this period new advanced drilling service technologies began to be introduced as the result of which limitations on horizontal drilling were removed.

In 2010-2011 horizontal drilling annual growth rates throughout Russia increased by 29% in 2010 and by 25% in 2011 (compared to the previous year). In 2012 the annual, absolute increment in horizontal drilling was 21%, and in 2013 it exceeded 60%, having reached 4.3 million metres.

An increase in horizontal drilling footage of 33% signified a trend opposite to the general negative trend.