RPI: Forecasted Production Targets Unachievable Without Intensive New Drilling

Decree No. 2914-p “On Approval of the Strategy for Development of the Mineral Raw Material Base of the Russian Federation until 2035” was issued by the Government of Russia on December 22, 2018. This document obliged the Ministry of Natural Resources “To develop and approve an action plan to implement the Strategy with the participation of interested federal executive authorities within 3 months and ensure its implementation.” The Strategy pays special attention to strategic types of mineral raw materials, including oil and natural gas.

However, the difference between natural gas and oil by quality and quantity of reserves is huge. If natural gas reserves, as noted in the Strategy, “meet the needs under any scenarios of economic development until 2035,” oil reserves will not meet the output targets from now until 2035.

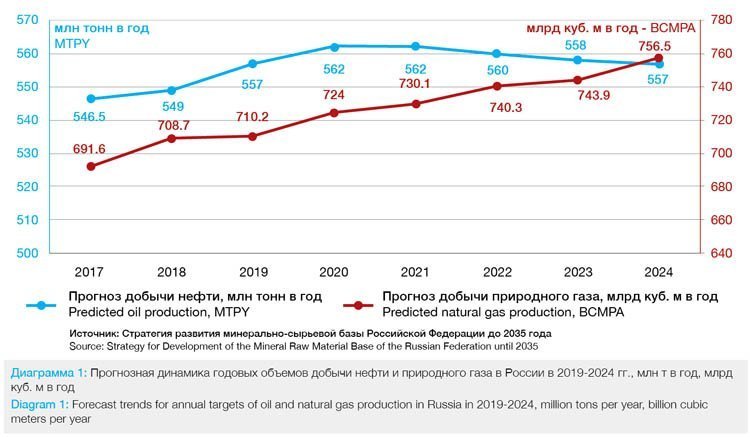

The Strategy also provides forecasts of oil and gas production targets, considering replacement rates of the mineral raw material base and all technologies to support oil and gas production (see Diagram 1).

Even through the Strategy was made public at the end of 2018, statistics show that the forecast for last year was underestimated — in fact, 555.8 million tons of oil and gas condensate were produced in Russia.

Geological exploration activities are indicated as the main tool to replace reserves as part of the Strategy.

Priority areas for geological exploration activities of prospecting and subsequent stages from now until 2035 will be:

• prospecting in new prospective areas;

• assessment and reactivation of previously discovered, explored, but undeveloped deposits and fields with hard-to-recover oil associated with the Bazhenov Formation, the Domaniс Horizon and their analogues.

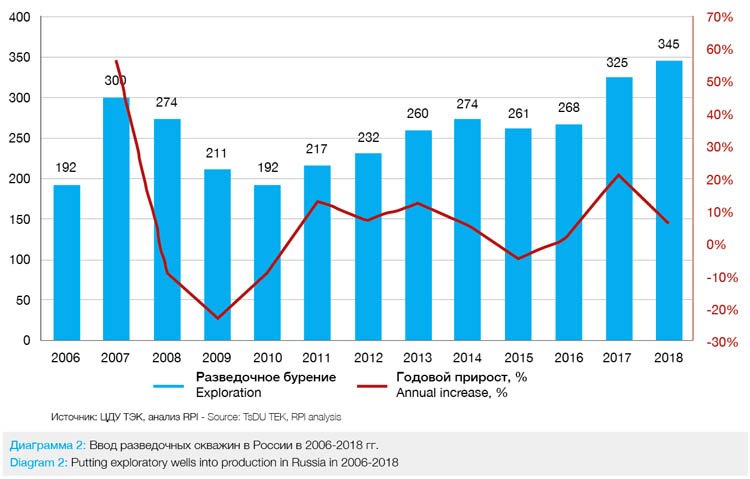

This means increased attention to properly maintaining the penetration meterage in exploration drilling, which was residually funded over the last 10 years, resulting in its meterage fluctuated greatly from year to year (see Diagram 2).

From this diagram, the annual increase in exploratory wells that were converted into production in 2006–2018 ranged from -23% to + 56%, which proves that exploratory drilling during this period of time was not a priority for oil companies, which held down the increase in replacement of the Mineral Raw Material Base, especially in the period of financial and economic crises of 2009 and 2014-2015. In 2017 and 2019, the situation, putting exploratory wells into production, began to improve, the annual increase was 21.3% and 6.2% respectively (Note: a preliminary assessment was given for 2018). The state intends to change this order, as judged by the statements contained in the Strategy.

Temporary Stabilisation

However, geological exploration activities and exploratory drilling are not enough to achieve the production targets shown in Diagram 1. They usually have a positive effect on the production targets with a time lag of about five years.

At the same time, it is necessary to maintain production targets at the existing fields by all available production methods, the most effective of which is a new production drilling.

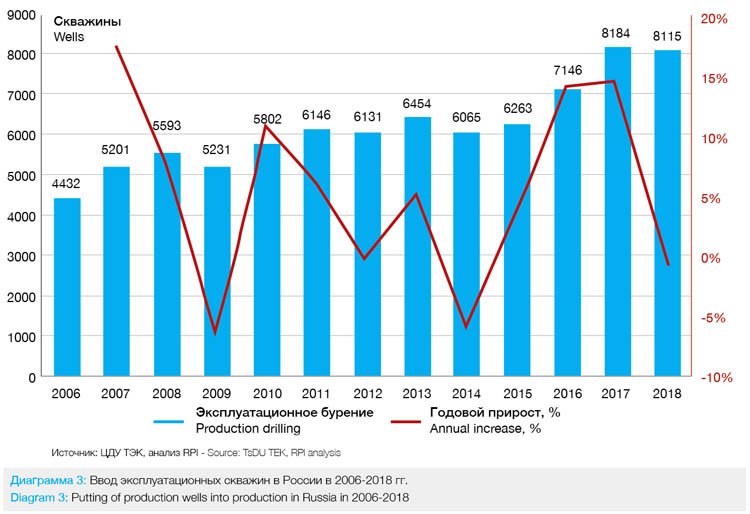

Diagram 3 shows the volume of putting new production wells into production. From this diagram it follows that in the period of 2016-2017, putting new production wells into production almost always had a positive trend, with the exception of 2009 and 2014, when this indicator decreased by 7% and 6% compared with the previous year respectively, which is much less than the failures in exploratory drilling. This goes to prove the attention that oil companies pay to the production drilling, which directly affects oil production targets in the short term.

However, in 2018, the trend changed. According to preliminary estimates, about 8115 production wells were put into production the last year, which is 0.8% lower than the same indicator for 2017.

At the same time, oil production did not decrease, but surprisingly increased by 1.7%. Unlike previous years, the stabilization of production drilling did not result it a drop in production targets, but, on the contrary, was accompanied by an increase in this indicator.

This result was achieved through a combination of the following factors:

• big drilling meterage in past years;

• Increase in horizontal drilling meterage;

• widespread use of multi-stage hydraulic fracturing when putting horizontal wells into production;

• carrying out cheaper side-tracking operations in some enterprises.

The question is: how long will the stagnation of production drilling meterage last? The answer to it can be obtained by analyzing the situation on the drilling market.

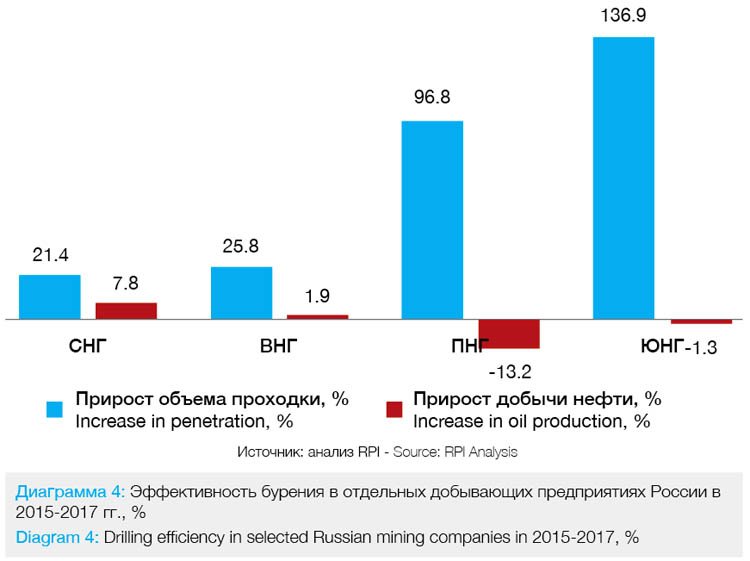

In recent years, a very unpleasant trend has emerged in the field of production drilling – a drop in its efficiency, which can be estimated as the ratio of the increase in penetration and the increase in oil production, or the increase in production from a single operation. For example, during 2015-2017, RN-Stavropolneftegaz (SNG) penetration increased by 21.4%, and production — by 7.8%, while RN-Varioganneftegaz (VNG) increased drilling by 25, 8% led to an increase in production by only 1.9%, in RN-Purneftegaz (PNG), the penetration increased by 96.8%, and production decreased by 13.2%; in RN-Yuganskneftegaz (YNG), an increase in penetration by 136.9% was accompanied by a decline in production by 1.3%. This pattern remained true for 2018 (see Diagram 4). And not only for drilling, but also for sidetracking, hydraulic fracturing operations and well workover.

The specific efficiency of operations for oil recovery enhancement and production stimulation for the period of 2007-2018 decreased: new drilling — by 21%; sidetracking — by 35%; hydraulic fracturing — by 100%; well workover — by 28% (see Diagram 4).

In order to prevent the decline in oil production in combination with the replacement of the Mineral Raw Material Base, there are the following ways:

• increase the number of operations for oil recovery enhancement and production stimulation in all the diversity, including new drilling;

• technologically improve operations in order to fully increase their specific efficiency.

With reference to drilling, this means:

• absolute and relative increase in horizontal drilling in the total production drilling meterage;

• increase in the length of horizontal sections;

• wider use of multi-stage hydraulic fracturing operations;

• if the multi-stage hydraulic fracturing is used, an increase in the number of stages, an increase in the share of use of controlled assemblies and hydraulic fracturing monitoring.

Trends in 2018

Indeed, qualitative technological changes in drilling have taken place since 2010. The share of horizontal drilling in the total operational penetration began to grow rapidly due to the improvement of the technical equipment for drilling support, such as measuring and logging while drilling.

In 2018, the horizontal drilling meterage reached a level of about 12.8 mln m (preliminary estimate – note), having increased by 14% over the year (see Diagram 5).

Horizontal drilling exceeded a 45% share of the total production drilling by the end of the year.

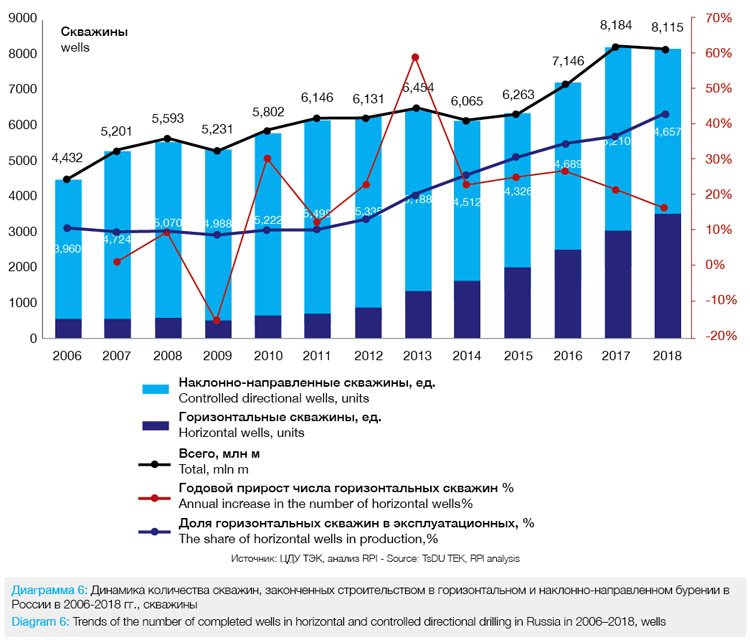

In 2018, the number of completed horizontal wells reached approximately 3458 pieces, having increased by 16% over the year (Diagram 6).

The share of horizontal wells reached 43% of the total completed production wells.

In 2018, the trend of increasing the average length of the horizontal sections of wells, emerging in 2010-2018, continued. In 2010, when the dynamic increase in horizontal drilling began in Russia, the average length of horizontal sections was approximately 300 m. In 2011-2018, this figure reached 750-850 m for onshore wells (see Diagram 7). According to estimates of industry experts and RPI analysis, the average length of horizontal onshore sections will reach about 1.3 thousand meters in the next 5-7 years. By 2030, this indicator may increase to 1.5-1.7 thousand meters.

It should be noted that the length of the horizontal sections of offshore wells can even now reach even further. For example, in certain wells in the Yu. Korchagin field within the Russian sector of the Caspian Sea (Northern block, «LUKOIL») exceeds 4 thousand meters.

Production wells that are drilled from the shore and intended to develop coastal offshore fields have the greatest lengths of horizontal sections. For example, within the framework of the Sakhalin-1 project implementation, wells with a horizontal section length of about 11 thousand meters were drilled using the Yastreb drilling rig during drilling from the shore of the Chayvo field.

Another trend, which continued in 2018, was the increasing use of multi-stage hydraulic fracturing (MSHF) in the construction of horizontal wells. A feature of MSHF operations is the constant increase in their processing complexity expressed primarily in the number of stages carried out. In 2018, the weighted average number of stages of MSHF operations was approximately 6.5 units. In this case, the average number of stages during operations at horizontal wells and sidetracks differed: about 7 stages per operation were averagely carried out at horizontal wells, and about 3 stages per operation — at horizontal sidetracks. In the perspective of the years 2025–2030, the MSHF with the number of stages per operation equal to 18–20 units will be characteristic of shale oil deposits and Bazhenov Formation fields.

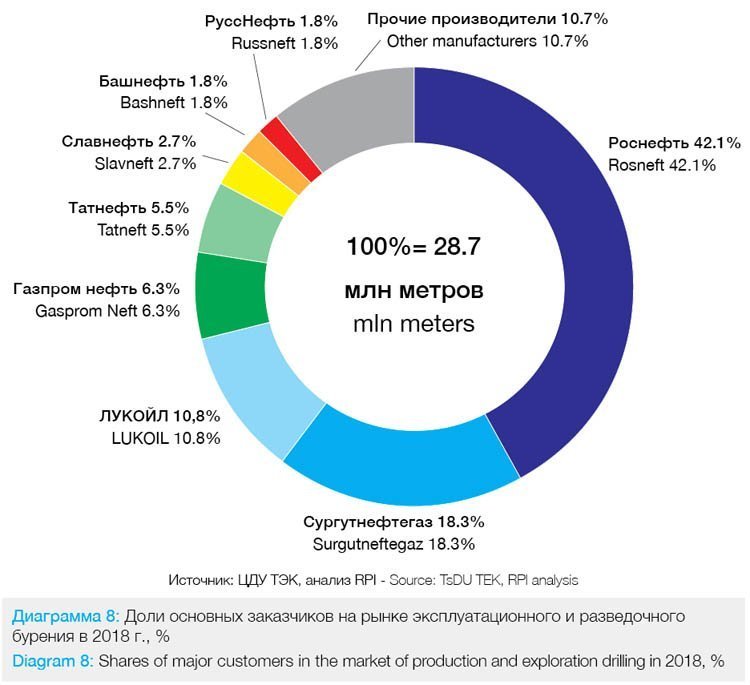

In 2018, the alignment of forces in the drilling market by customers did not qualitatively change compared to 2017. Rosneft and Surgutneftegaz (42.2% and 18.3% of the entire Russian penetration in 2018, see Diagram 8), respectively, ranked first and second in terms of penetration in total drilling (production plus exploration). Rosneft somewhat reduced its share in the drilling market, while its separation from Surgutneftegaz decreased from 24.1% to 23.8%.

The share of the remaining VINKs accounted for 28.9% of the total penetration meterage in total drilling.

How Long will Stagnation Last?

According to our estimates, penetration meterage in exploration drilling, currently slightly exceeding 1 million meters per year, is unlikely to overcome the 1.25 million meters mark by 2024 (unless, of course, the Russian authorities introduce any tax or other incentive measures for oil companies in the field of exploration drilling in the light of the approved Strategy for Development of the Mineral Raw Material Base of the Russian Federation).

However, the stagnation of production drilling meterage cannot extend to 2019, as this will lead to a decline in production, and not to its growth, as stated in the Strategy.

In order to meet the forecast oil production indicators formulated by the Government, the production drilling meterage should reach approximately 41-43 million meters per year by 2024.

At the same time, according to our calculations, about 77% of the total penetration in production drilling will fall on mature fields by 2024, in order to maintain their production. The remaining meterage of production drilling will fall on new fields which will come online after 2018. However, the results of exploration drilling carried out in 2019-2024, will begin to influence the production targets already after 2024.

The total share of production and exploration drilling currently exceeds 27% of the total oilfield service market volume, and will not change significantly in the coming years. If the share of drilling support, well completion, drilling mud services, bit services and primary cementing services directly related to drilling is added to this figure, their total share will be close to 50% of the total oilfield service market volume.

Approximately the same share will be occupied by the drilling segment in the more distant period of 2022-2024. Otherwise, all the forecasts described in the Strategy will turn out to be only good wishes.

Vadim Kravets, Lead Analyst, RPI Research & Consulting

The analytical report “Russian Market of Oil Drilling” was issued by RPI. For questions related to the article and report, please call: +7(495) 5025433, +7 (495)7789332, e-mail: research@rpi-research.com.

www.rpi-consult.ru