RPI: Offshore Field Development in Russia: Are the Sanctions an Opportunity for Russian Companies to Fill the Void?

Vadim Kravets

In mid-February 2015, the third round of EU sanctions targted a number of Russian officials and nine new companies were introduced. Previously, in late summer and early autumn 2014, the U.S., EU, Japan and Canada introduced, in two rounds, sanctions againstw certain individuals and sectors of Russia’s economy including the Russian oil and gas sector. For domestic oil production companies, oilfield service companies and equipment manufacturers these sanctions pose a challenge which needs to be met with shifts in technology, and the re-organisation of their activities.

The sanctions against Russian economic sectors, including the oil and gas sector, were introduced by the EU, U.S. and Canada in two rounds. The first round applied to equipment deliveries and took effect in late July – early August 2014. The second round was introduced in September 2014. It expanded the sanctions so that they now included not only equipment deliveries but provision of services, information exchanges with Russian partners, and engagement of Western companies in the most technologically challenging projects.

Forbidden

The U.S. sanctions against Russian economy are more strict than the ones imposed by the EU and Canada. They apply to licensing of Russia-bound supplies of equipment for deepwater (over 500 feet, or 152.4 m) hydrocarbon production, development of the Arctic shelf and shale oil and gas deposits. The EU sanctions apply to deepwater hydrocarbon production, but do not specify the minimum depth of production.

For deepwater, Arctic and shale projects the following equipment is prohibited by the U.S. for import into Russia:

» drilling rigs;

» parts for horizontal drilling;

» drilling equipment and well completion equipment;

» offshore equipment for Arctic operations;

» well logging equipment;

» well pumps;

» drill pipes and casing pipes;

» software for hydraulic fracturing;

» high pressure pumps;

» seismic exploration equipment;

» remotely controlled underwater vehicles;

» compressors;

» tube expanders;

» distribution cocks;

» risers.

The list of equipment prohibited by the EU for import into Russia includes equipment for offshore projects, deep water drilling and exploration of hydrocarbon fields in the Arctic, equipment for shale hydrocarbons projects, various types of pipes, and pumps for liquids.

The EU also introduced a pre-approval procedure for deals involving equipment supply to the Russian Federation. Such approvals must be granted by the authorised government bodies of the countries in which the exporting companies are registered.

The U.S. restrictions do not provide any exemptions for contracts executed before 6 August 2014. However, the European authorities may issue a permit for delivery if the export is related to a commitment arising from a contract or agreement executed before 1 August 2014, i.e. before the EU sanctions effective date.

The sanctions are not limited to equipment deliveries only – they apply to the financial sphere and, therefore, the investment opportunities of Russian companies.

In mid-July 2014, the U.S. Department of the Treasury prohibited American companies, banks and private individuals, and also all those who operate in the USA from granting Rosneft, NOVATEK, Gasprombank and Vnesheconombank credits and loans for more than 90 days, and also from financing by stockholders. Although the sanctions were imposed by the U.S. only, European banks and investors have de facto supported them, as many of them operate in the American market and don’t want to have any problems with the U.S. authorities.

Moreover, Western companies are prohibited from continuing their cooperation with Rosneft, Gasprom, Gasprom Neft, LUKoil, and Surgutneftegas in joint projects of Arctic, shale and deepwater exploration

and production.

All these measures should, according to the prior estimates made by Western experts, considerable slow down or make it impossible to develop the Russian sea shelf and shale hydrocarbon fields, which would inevitably result in a production drop of approximately 3-5% by as early as 2020. In particular, according to the forecasts by Bank of America Merrill Lynch, the Russian oil industry could miss out on up to US$ one trillion of investments during 2015-2045. This will bring about considerable State budget losses – the lost profit may be as high as US$ 27-65 billion for the period ending in 2020.

Gaps in Russian Production Capacities

Immediately after the introduction of the sanctions, experts in Russian production and oilfield service companies and equipment manufacturing plants started to estimate what were the most vulnerable points in the domestic oil and gas production industry.

According to the RPI analysis carried out with a number of industry experts and summarised in the report “ Outlook for Import Substitution of Oilfield Services Equipment in Russia: No Easy Way Out”, the critical types of oil and gas equipment for the energy sector, that most depend on imports, are:

» geophysical, drilling and pipeline equipment for offshore and sea shelf fields;

» subsea production systems;

» vessels for sea shelf operations;

» equipment for horizontal drilling, development of shale oil deposits and reserves in the Bazhenov formation;

» equipment for hydraulic fracturing including multistage;

» drilling rigs for offshore platforms;

» top drives for drilling rigs;

» advanced automatic drilling tongs, first of all robotic tongs;

» equipment for MWD/LWD operations;

» systems of drilling mud treatment (screen shakers, centrifuges, mud cleaners, sludge pumps).

During the period when no restrictions were imposed on the import of equipment, many Russian companies, even when they had sufficient advanced technologies in stock, clearly did not want to set up manufacturing of equipment for the development of offshore hydrocarbon deposits saying that the engineering costs are too high against the low manufacturing quantities of such equipment. Now they’ll have to pay for their mistake, working in the environment of time shortage and very high interest on loans.

Most Foreign Companies Will Stay, But not All

In terms of services, it remains to be seen if it’s possible to continue cooperation with major international oil production and oilfield service companies.

As of the end of 2014, foreign companies are continuing to analyse the situation in terms of sanctions, and indeed some have already made a decision to leave Russian production projects, including the offshore.

For example, as noted in the RPI report “Future of Offshore Oil and Gas Production in Russia And FSU Countries. Outlook through 2025”, it was in May last year when Halliburton announced a “relationship freeze” with Gasprom Burenie, with who Halliburton had worked in the Prirazlomnoye field. Last summer, Weatherford, having referred to the sanctions, also elected not to participate in operations on the Russian shelf.

In September 2014, ExxonMobil withdrew from all its projects in Russia including geological exploration and Russian sea shelf development in the Black Sea and the Arctic, with the exception of Sakhalin-1.

Last autumn, it became known of the delay, if not total collapse of Rosneft’s deal with North Atlantic Drilling that amounted to $925m. Within the framework of the agreement, the Russian company and its foreign partner entered into long-term agreements on offshore operations, under which six “North Atlantic” offshore drilling rigs were expected to be delivered through 2022. One of these rigs, the West Alpha, had been drilling the Universitetskaya-1 well in the Kara Sea up until the end of October 2014. At the end of September 2014 it became known that the drilling of this well, due to the imposed sanctions, had been stopped, and all the North Atlantic offshore drilling rigs would not be operated any more in the Russian Arctic. Exploration drilling in the Kara Sea, as per Rosneft’s official information, has been suspended until 2016.

The participation of Eni and Statoil in the sea shelf projects remains to be seen, though as of the end of 2014 these companies, unlike ExxonMobil, have not officially announced their withdrawal from the Russian sea shelf projects.

Thus, we can see a common pattern in the approaches of Western companies to the work in Russia – they either have refused or are likely to refuse in the near future from the development of the Russian sea shelf fields because of the sanctions imposed on the Russian Federation. Only old and existing projects are exceptions, under which hydrocarbon production is already ongoing.

Window of Opportunity

The situation around the arctic shelf projects may be seen in two ways. On the one hand, the sanctions have de facto complicated the implementation of the promising production projects. On the other hand, they have opened the window of opportunities for Russian manufacturers and oilfield service companies that enable them to enter the market. The problem is how the interested companies will react to the new market preferences they have gained. Unfortunately, the preliminary results of the analysis have shown that in the manufacturing sphere there are only a few positive examples of the efforts aimed at entering the market of arctic shelf equipment.

In Russia there are previous examples of companies manufacturing offshore drilling rigs and production platforms, but none are fit for operations at depths exceeding 700-800 metres. Therefore, it remains to be seen how to develop large water areas in the Black Sea (near Tuapse).

“Uralmash NGO Holding” is as such the only large plant declaring that their 600-ton drilling rig may be used, following certain retrofits, on offshore platforms.

There is just one top drive system manufacturer in the Russian Federation. ZAO “PromTechInvest” is capable of supplying top drive systems of 160-320 ton capacity and providing their maintenance and post-warranty service. Of late, “Uralmash NGO Holding” have also made efforts on this front. In June 2014, a presentation of the “SVP 320 ECR” 320-ton electric top drive, a new product to be manufactured by this company, was held in Yekaterinburg. The company will start supplying these drives to the market as early as 2016.

OAO “Izhneftemash” are currently implementing a project to manufacturing domestic robotic pipe tongs capable of replacing the imported robotic pipe tongs originating from the West. The pilot sample should be available for testing in the first half of 2015. However, this company is the leader in its market segment and the results of the effort should be judged only once the full round of tests has been completed.

If we look at the segment of subsea systems capable of working at large depths, or equipment for measuring/logging while drilling (MWD/LWD), the prospects of manufacturing of machinery comparable to Western counterparts are quite clouded at best.

It’s no better if we look at innovative, breakthrough solutions. RPI has collected the information on innovative solutions in the oil and gas sector from the Skolkovo foundation. These projects are carried out in order to be implemented, so even patented devices or technological methods are represented by real life samples.

At present, the Skolkovo foundation has funded several dozen projects in the energy sphere, but only one of them, “Integrated systems of well completion and monitoring”, is specifically intended for future offshore operations. The developer is OOO “WORMHOLES Vnedrenie”. In 2012-2014, the developer, together with OOO “LUKoil-Nizhnevolzhskneft” conducted the complete cycle of field testing of the influx control system for prevention of gas breakthroughs in the Yuri Korchagin field. The commercial product is expected to hit the market in 2016.

In the oilfield services sector, the situation is about the same. While in the drilling segment for relatively small depths there are drilling companies such as EDC or Gazprom Burenie, the situation in terms of quality support of offshore drilling is very alarming.

Our Forecasts

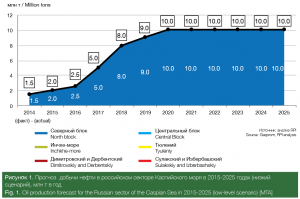

If the situation continues to develop in the same fashion as in the second half of 2014 – early 2015, the production dynamics in the Russian offshore fields is going to develop in accordance with the low-level (worst-case) scenario described in the RPI report “Future of Offshore Oil And Gas Production in Russia And FSU Countries. Outlook through 2025”.

This low-level, worst case scenario takes into account the following risks:

» no more confirmed resources in already licensed blocks;

» lack of funds for continuation of the work;

» absence of the required process equipment for field development or exploration of license blocks.

All the three above-listed risks, separately and similarly, fully block the process of field development. Therefore, there is no need to rank them by significance. As a result, the low-level (worst-case) scenario is based on the assumption of the occurrence of at least one of the above-listed risks.

The worst case scenario assumes that the oil and gas production volumes in the Russian sector of the Caspian Sea are going to be fully determined by the production volumes for the Yuri Korchagin field, V. Filanovsky field and Sarmat (Y. Kuvykin) field, which are all developed by LUKoil. All these fields are within the North Block area. Then the production volume in the Russian Caspian for the period up to 2025 is not likely to exceed 10m tons of oil and 14bn cubic metres of gas.

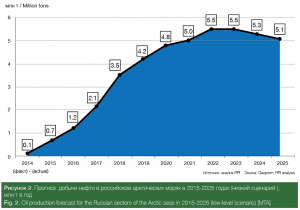

In the Russian sectors of the Black Sea and Azov Sea (within their boundaries as of early 2014), only exploration drilling is going to be carried out from 2015-2025. In the Arctic, all the 5.0-5.5m tons of oil production will be concentrated in the Prirazlomnoye field, and natural gas production – in Gazprom’s gas fields of the Ob-Tazov Gulf in the 23-25 bcm volume.

In the Far East, at the turn of 2015, hydrocarbons will be commercially produced by Sakhalin-1, 2, 3 projects, roughly. 9-10m tons of oil and 26-28bn cubic metres of gas.

If we assume that by 2025 the volumes of oil and gas production in most of the Russian onshore fields will decrease against the current level by 12-15%, arctic shelf production described in the worst case scenario will not be able to compensate for dropping onshore production. As a result, total Russian production by 2023-2025 will at best stagnate or at worst drop year after year.

The only way to avoid the above scenario of events in the Russian oil and gas industry is full acceleration of developing new offshore machinery, equipment and materials combined with their immediate commercial manufacturing. These measures must be complemented by a quick entrance of the leading Russian oilfield service companies to the offshore sector.

To this effect, full support must be provided to domestic manufacturers of equipment, to production and oilfield service companies by the government, which is the only party that can establish favourable taxation conditions for them and ensure easy access to low-interest loans.

For details please contact Daria Ivantsova on:

Tel.: +7 (495) 502 5433 / 778-9332

or via e-mail: Daria@rpi-inc.ru