RPI: Rapid Growth Expected in Russia’s Horizontal Directional Drilling Services Market

Despite two major economic downturns, the Russian oilfield services market grew by 370% to 1.14 trillion rubles from 2006 to 2016. In this period, HD and sidetracking were in many respects the key market drivers, as it will be for the next ten years. As a result, this will lead the development of HD service market, particularly for rotary steerable systems and LWD.

HD Services Market

The Russian HD services market is a significant part of the large oil service market in Russia and takes third place after drilling and well workover in monetary terms. The sector has grown from 7.1 to 9.5% in the past ten years.

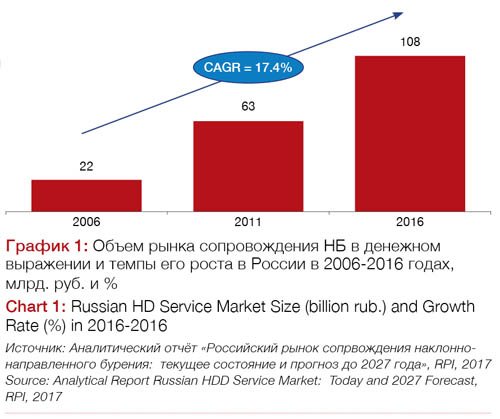

In 2006-2016, the HD service market increased by 5 times with an average annual growth rate 17.4% (see Chart 1). At the same time, Russian oil service market increased by 3.7 times with average annual growth rate 13.9%.

HD Service Market Drivers

The key factors for outpacing growth of the HD service market in 2006-2016 are the increased HD output and an increased number of sidetracking operations.

According to industry statistics, in 2006-2016 exploration drilling meterage increased by 2.1 times to 24.7 million meters. Among all completed wells the horizontal wells portion increased from 12% in 2006 to 31% in 2016 (see Chart 2).

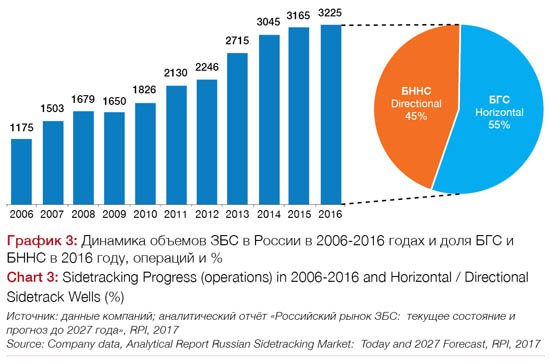

Sidetracking operations in 2006-2016 increased by 2.7 times (see Chart 3). In this period, the horizontal sidetrack wells portion among sidetracking operations significantly increased and reached 55% in 2016.

HD Service Market Sectors

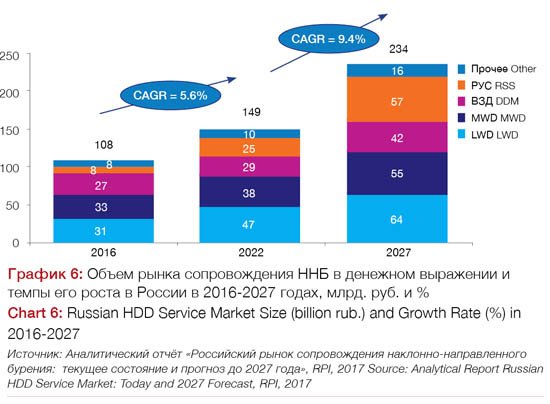

In 2016, Russian HD service market reached the 108 billion rubles level. The market consists of five main sectors:

• MWD

• LWD

• Downhole drilling motors (DDM)

• Rotary steerable system (RSS)

• Other services, equipment and tools.

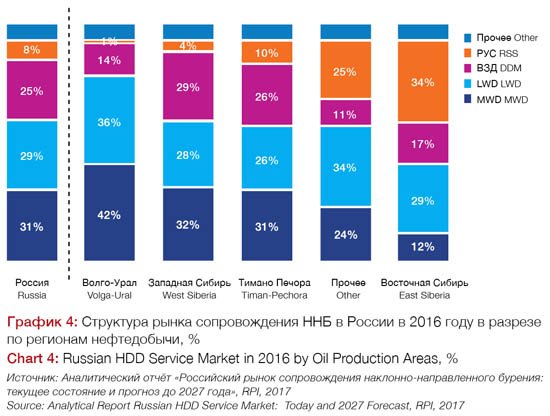

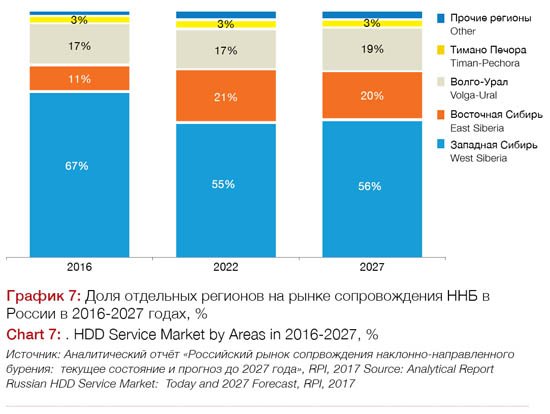

In 2016, MWD, LWD and DDM were the main sectors with 31%, 29% and 25% respectively (see Chart 4). The HD service market structure is mainly determined by oil production areas due to geological peculiarities and applied technology. For example, in the Volga-Ural and Timan-Pechora areas the dominating sectors are MWD (42% and 31 % respectively) and LWD (36% and 26 % respectively). In West Siberia, the major sectors are MWD (32%) and DDM (29%). In East Siberia, the major sectors are RSS (34%) and LWD (29%).

HD Service Market Growth Forecast

In 2017-2027 the key drivers will be:

• Development of new fields in the West and East Siberia, Volga-Ural area and with it increased drilling meterage and the construction of new wells;

• Increased number of horizontal well sidetracking operations due to decreased flowrate of operating wells and demand for increased oil recovery (especially in the West Siberia);

• Increased depth of new wells and length of horizontal sections of sidetracks.

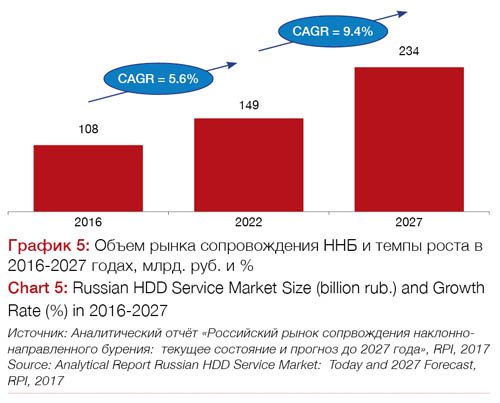

By 2027, the HD service market will grow by 2.2 times to 234 billion rubles in current prices (see Chart 5). HD service portion in Russian oil service market will grow to 11.1%.

The market average annual growth rate will be 7.3%. The average annual growth rate will increase from 5.6% in 2017-2022 to 9.4% in 2023-2027 due to increased drilling in the West Siberia.

The forecast considers a 4% yearly inflation between 2018-2027 as well as a service price increase due to added complexity of the work. Hence, between 2017-2027 the HD service market will grow to 126 billion rubles, mainly due to an oil service price increase by 78 billion rubles. While the increased service scope will constitute 48 billion rubles.

In terms of HD service market sectors, between 2017-2027 the growth will mainly be determined by RSS (+ 49 billion rub.) and LWD (+ 33 billion rub.). MWD and DDM sectors increase will be 21 billion and 15 billion rubles respectively (see Chart 6).

The sectors growth will differ. RSS will display the biggest average annual growth 19.4% vs. MWD (4.6%) and DDM (4.2%) (see Table 1).

The RSS sector growth is mainly determined by its increased utilization in the East Siberia fields. Another important factor is that Russian manufacturers’ RSS will be used: Provided the price is competitive and they are capable to occupy the market, also in terms of DDM.

The LWD sector growth is determined by its increased utilization in the West Siberia and Volga-Ural area and the introduction of more sophisticated LWD, including azimuth-guidance logging.

The Growth of MWD and DDM sectors is expected to be moderate until 2022 due to the development of the East Siberia fields where more sophisticated RSS will be extensively used. However between 2022-2027 these two sectors will grow faster due to expected increased drilling in the West Siberia.

The sectors growth peculiarities will by 2027 determine HD service market with increased RSS 24% and lowered MWD 23% and DDM 18%.

In geographic terms, all regional markets are expected to grow with West Siberia dominating. The second large market area will be the East Siberia that will replace Volga-Ural (see Chart 7). By 2027 HD service market will be represented by West Siberia 56%, East Siberia 20% and Volga-Ural 19% giving 94% in total.

Analytical Report Russian HD Service Market: Today and 2027 Forecast, RPI, 2017. For any questions to the Article and Reports please contact Daria Ivantsova +7(495) 7784597,

+7 (495)7789332, mail: daria@rpi-inc.ru.