RPI Reports: Multi-Stage Hydraulic Fracturing – The Engine of the Fracturing Market

A significant event took place in the Russian oil and gas industry in 2018. For the first time since 2014, the number of development wells commissioned in the country did not grow compared with the previous year, just the other way round, it declined by over 3%. At the same time, the indicator of technologically more complex horizontal wells continued its growth and increased by nearly 21%, from 2974 wells in 2017 to 3587 wells in 2018. Meanwhile, the scope of commissioned directional wells decreased by nearly 14%, from 5955 wells in 2017 to 5104 in 2018. The hydraulic fracturing market was developing, following the same pattern last year. The number of cheap one-stage fracturing jobs decreased by 7.5%, compared with the previous year, just as the number of expensive multi-stage fracturing jobs (MSF) increased by 41%. The trend of cheap low efficient technologies being replaced with more expensive and efficient technologies, may become a long term trend in the Russian oil field service market.

The number of one-stage hydraulic fracturing jobs completed at new wells decreased by 11% in 2018, amounting to 5218 wells. This decline was caused with both the decreased aggregate quantity of new commissioned wells, and the increased number of efficient MSF jobs, which replaced the traditional one-stage fracturing jobs.

In spite of the fact that the number of new development wells commissioned in 2018, declined by 3%, the share of new directional wells, where one-stage fracturing jobs are being performed, has increased, and amounts to 79- 80% for now.

One of the main reasons for the demand for one-stage fracturing in new development wells is that a good deal of them are drilled in new oil reservoirs where traditional oil recovery methods are uneconomic due to low oil flow rates.

The number of one-stage fracturing jobs performed at new wells during the period from 2006 to 2017 has in an average increased by 9%, and achieved the record of 5858 wells in 2017.

Between 2009 and 2014 there was an exception to the rule as there was a reduction in one stage fracturing due to the decreased investments into the oil and gas industry which was caused by the economic crisis and the collapse in the world oil market.

Between 2006 and 2016 the regional demand for new well one-stage hydraulic fracturing generally matched the pattern of new wells commissioned across the country’s regions. The maximum number of jobs were performed in West Siberia, and the share of this region in the aggregate number of one-stage hydraulic fracturing jobs performed increased by 3% in 2018, which made up a 77% increase.

The high demand for jobs in Western Siberia is a result of the oil companies need have to produce from depleted hydrocarbon reservoirs with lower permeability. The region has a wide spread of new drilling, to help maintain the levels of production.

Outside of West Siberia, a considerable share of the one-stage hydraulic fracturing market falls in the Volga-Urals oil and gas province, however, compared to West Siberia, the one-stage hydraulic fracturing jobs are less common in this region. The share of the Volga-Urals aggregate number of one-stage fracturing jobs performed at new wells decreased by 4% in 2018, amounting to 12% of the total Russian production volume, owing to lower volume of well commissioning jobs, in comparison to West Siberia.

The Efficiency is Still Lower at Old Wells

In the period from 2006 to 2018 the number of hydraulic fracturing jobs, performed in the current declining well stock, displayed a variety of trends. The period before 2014, generally witnessed an increase in volume, owing to a larger number of successful jobs. However, in the years between 2009 and 2014 one could record a decline in number of one-stage hydraulic fracturing jobs, due to the lower investment into the service.

The declining trend in the hydraulic fracturing market sector began to show in 2018, amounting to 4.9% of the current declining well stock, compared with 2017.

Over 90% of one-stage hydraulic fracturing jobs, performed at the current declining well stock in the past year, were conducted in Western Siberia and the Volga-Urals province. West Siberia had 57%, of the market while the Volga-Urals province had 37%. This was due to the fact that these regions contain the largest stocks of mature and depleted wells.

Between 2006 to 2018 there was a trend towards the reduction of the overall and specific effectiveness of one-stage hydraulic fracturing, with an average rate of 3.7% and 6.1%, correspondingly.

This decline of the specific effectiveness was due to the increased number of repeated one-stage hydraulic fracturing jobs at wells that were not only unable to considerably increase their production rate, but they also produced a higher water cut. Besides running hydraulic fracturing jobs at the current declining stock, in relatively close distance to the wells where frac jobs had already been completed, and at the very same reservoirs, also resulted in the reduced specific effectiveness of one-stage hydraulic fracturing jobs.

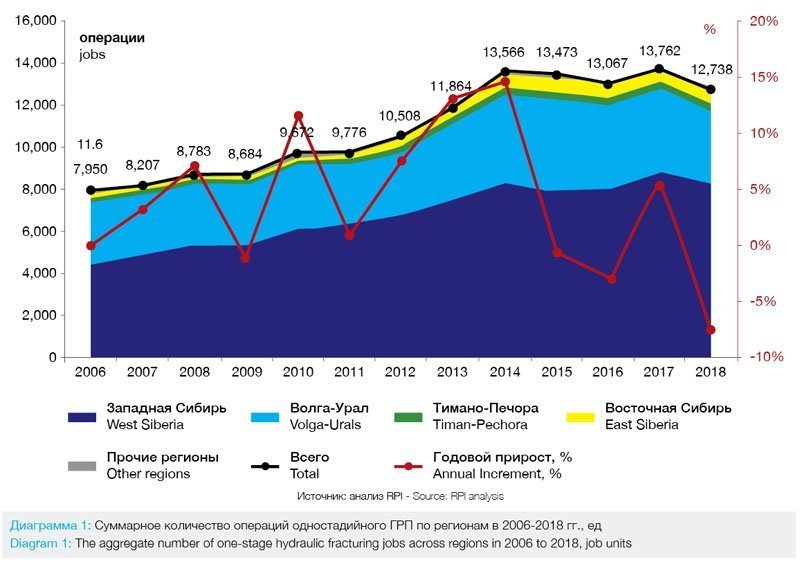

As a result of this, the aggregate number of one-stage hydraulic fracturing jobs performed in 2018, i.e. at new wells and the current declining well stock, decreased by 7,4%, compared to 2017 (see Diagram 1). This trend is related to the following factors:

• decrease of specific effectiveness of one-stage hydraulic fracturing jobs performed at the current declining well stock;

• reduced number of candidate wells for one-stage hydraulic fracturing jobs;

• the shift of demand towards the MSF job sector;

• a possibility to apply alternative methods to sustain production volumes.

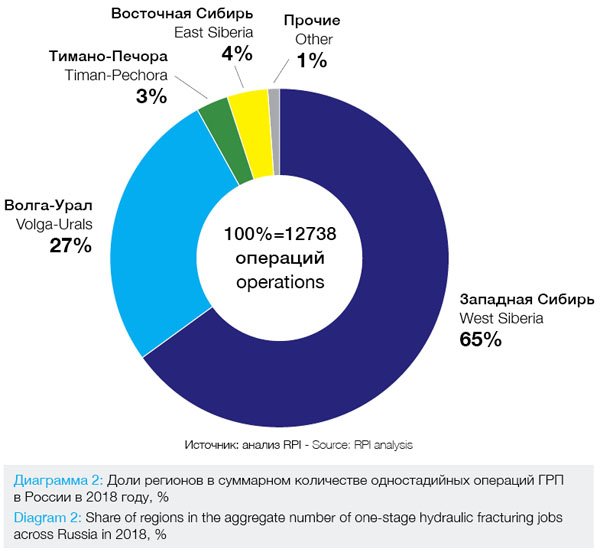

The regional demand for one-stage hydraulic fracturing jobs reflects the pattern of the oil well stock in Russia. The maximum number of one-stage hydraulic fracturing jobs fall on the West Siberia (65%) and the Volga-Urals (27%) (See Diagram 2). These regions have the accumulation of the largest and oldest producing well stock, and the maximum number of new well commissioning takes place here.

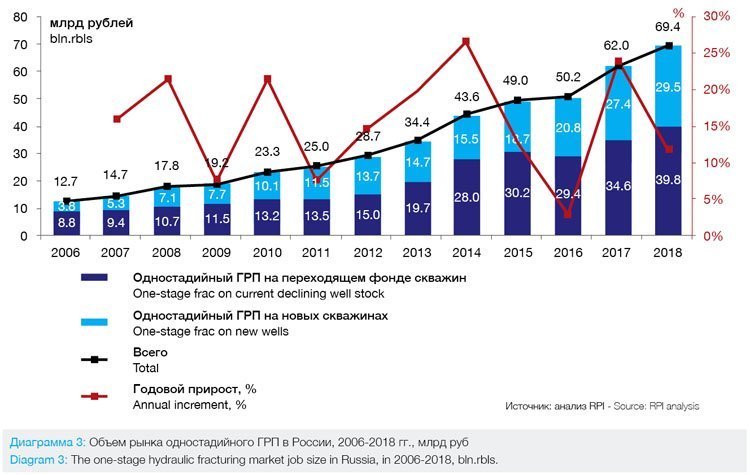

The market of the one-stage hydraulic fracturing, exhibited stable average annual growth of 15.2% from 2006 to 2018. The maximum rate of growth was observed in 2014, a 29% increase yoy. The increase is connected to the increased number of jobs and the cost of the service. From 2006 to 2018 the increased cost of the component parts and expendables required for a one-stage hydraulic fracturing job also increased, causing an increase in the service cost.

The one-stage frac market size, expressed in monetary terms, was estimated as 69.4 bln.rbls in 2018 (see Diagram 3), the annual increment, in relation to 2017, amounted to 11.9%. The one-stage frac market growth, expressed in monetary terms, against the reduced number of jobs, resulted from the increased cost per one job, which in its turn was influenced with the increased average weight of proppant and service rate per one job.

Where Is The Market Heading?

When making our forecast of the one-stage frac market, we looked to the following indicators:

• oil production volume forecast;

• plans announced by companies for development of fields and the volume of well commissioning related to them;

• the dynamics of oil well production decline at brown fields;

• the dynamics expected for the share of new wells where one-stage frac jobs would be performed;

• the dynamics of the producing well stock and retrospective dynamics of the number of jobs performed at wells of the current declining stock;

• the impact of technology trends on the hydraulic fracturing market.

We believe that a positive dynamics of the annual number of one-stage frac jobs will be observed at new wells in the period from 2019 to 2025, with the average annual increment rate of 1,6%, and this parameter is going to achieve the level of 5,9 thousand jobs in 2025. However, after 2026, it is expected that the number of one-stage frac jobs performed at new well stock will decrease with the average annual rate of 0,7%, due to more intensive demand for MSF jobs that become more and more sought after. By 2030 the predicted market demand will be 5700 jobs.

From 2019 to 2030 the annual growth of one-stage fracs in new well stock is expected to be in the average annual rate of 0,7%. This is owing, first of all, to the increase of such type of jobs performed at new horizontal wells, as well as the increased share of one-stage frac jobs performed at controlled directional wells, amounting to 90%. The increased share of one-stage frac jobs performed at controlled directional wells will be caused by the increased share of hard to recover (HTR) reserves.

The volume of one-stage frac jobs performed at the current depleting well stock in the period from 2018 to 2030 will be featured with negative dynamics, with the average annual decline of 1.4%, and by the year of 2030, it is going to achieve the level of 6.4 ths. jobs. The decreased number of jobs is related to reduction in effectiveness of one-stage hydraulic fracturing job, due to reduced number of candidate wells for one-stage frac jobs and the increased number of one-stage refrac jobs that would lead to the increased water cut.

In the medium-term perspective, the reduced number of jobs will not appear to be even – growth of one-stage frac jobs is expected after 2029, which is related to the increased number of successful one-stage frac jobs as a result of new technological solutions introduced into production, which is capable of raising the efficiency of the performed jobs (for instance, new methods of frac simulation).

By the year of 2030, the one-stage frac market size is going to achieve the level of 107.4 bln. rbls. The average annual growth of the one-stage frac market size, expressed in monetary terms, is going to amount to 3.7% in the period from 2019 to 2030. The main driver for the growth of one-stage frac jobs, expressed in monetary terms, will be the increased prime cost of such jobs.

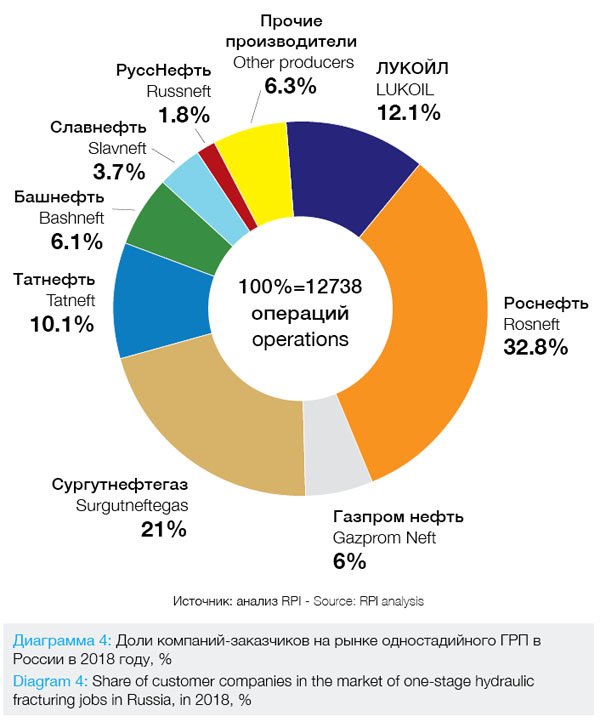

The maximum number of one-stage frac jobs, performed in 2018, falls on the following companies (see Diagram 4):

• «Rosneft» – 32.8% of total number of jobs performed in Russia;

• «Surgutneftegas» – 21.0%;

• «LUKOIL» – 12.1%.

These VIOC (vertically integrated oil companies), aggregately occupy 65.9% of the one-stage frac job market, in physical terms.

The growth of the overall effectiveness, that took place in 2018, was seen in «RussNeft» (53.6%), «Slavneft» (17.2%), «Tatneft» (6.5%), «Surgutneftegas» (5.8%). This was due to sufficient number of candidate wells, having potential of running one-stage frac jobs, as well as due to the use of modern technologies in hydraulic fracturing, capable of significant increasing the efficiency of the jobs.

The Engine of Growth

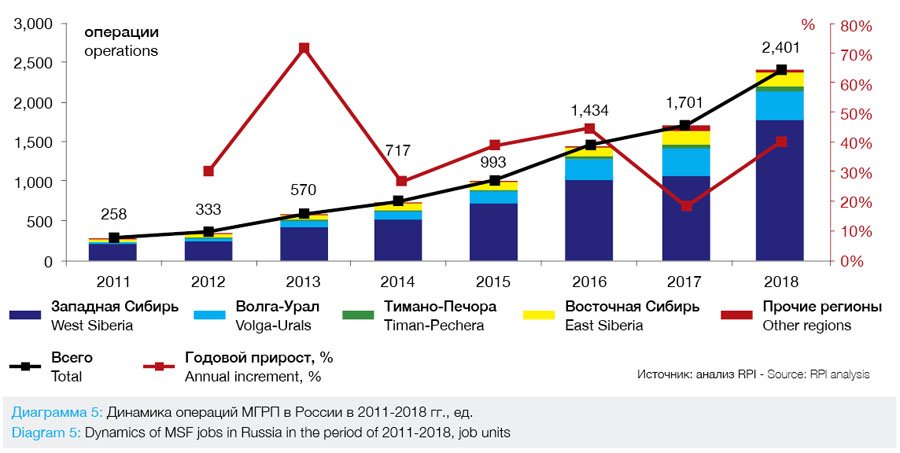

Multi-stage hydraulic fracturing (MSF) is a relatively new, fast-growing technology in the frac market. The widespread use of MSF jobs has been taking place since 2011. The number of MSF’s performed in Russia within the period from 2011 to 2018 grew constantly by 37.5% in an average of a year, and this parameter, in absolute terms, amounted to 2401 jobs in 2018 (see Diagram 5). This trend is related to the increased number of commissioned horizontal wells and horizontal sidetracking.

MSF’s is a constantly increasing complex technology. At present, the average- weighted number of stages is 6. The average number of stages in the jobs performed at horizontal wells and horizontal sidetracks, however, was different and made up seven and three stages, correspondingly.

The share of costly MSF jobs, with 8 to 13 stages, will increase between 2018 – 2030. The major ground for this growth would be caused by the increased length in horizontal wells and horizontal sidetracks, and the increasing production from HTR reserves.

Alongside that, a dynamic market penetration of expensive BHA’s will take place, the cost of which is three to four times higher than that of the standard BHA’s. Methods of MSF job monitoring will be widely conducted. These factors will lead to significant increases in the cost of an average-weighted job, and will the increase of the market size.

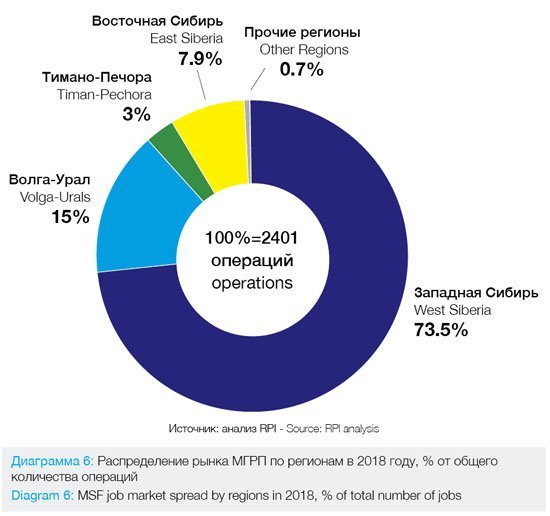

The maximum number of MSF jobs were performed in the West Siberia in 2018, predominantly in the KhMAD (Khanty-Mansiisk Autonomous District), the share of MSF jobs made up 73.5% in this region, of the total jobs across Russia (see Diagram 6). Beside West Siberia, the MSF jobs are widely spread in the Volga-Urals (15.0%), mainly in the Orenburg region.

The MSF market size, expressed in monetary terms, was growing with the average annual rate of 49.2% in the period from 2011 to 2018, and it was 63.7 bln. rbls by 2018. The growth of MSF job market size, was caused by the growing number of jobs, as well as by the increased average-weighted number of stages. As a result of this, the MSF job market sector amounted to 47.9% of the total hydraulic fracturing job market size, expressed in monetary terms.

The following indicators were taken into account when projecting the MSF job market size:

• the dynamics expected for commissioning of horizontal wells;

• the dynamics expected for drilling of horizontal sidetracks;

• the impact of technology trends on the MSF job market;

• anticipated inflation (for forecast, expressed in monetary terms).

The sector of multi-stage hydraulic fracturing jobs will demonstrate positive dynamics together with the further growing markets of horizontal drilling and horizontal sidetracking, with the increasing share of HTR reserves in the resource base and with design and engineering solutions getting more complex.

The commissioning of horizontal wells and horizontal sidetracking will be the drivers for developing MSF job sector in the period from 2019 to 2030. The dynamics of MSF jobs, in the whole, will reiterate the dynamics of the above mentioned factors. In the long-term perspective of the period from 2018 to 2030, the growth of MSF jobs is expected, with the average annual rate of 10.7%, and by the year of 2030 this rate will amount to 8.2 ths. jobs.

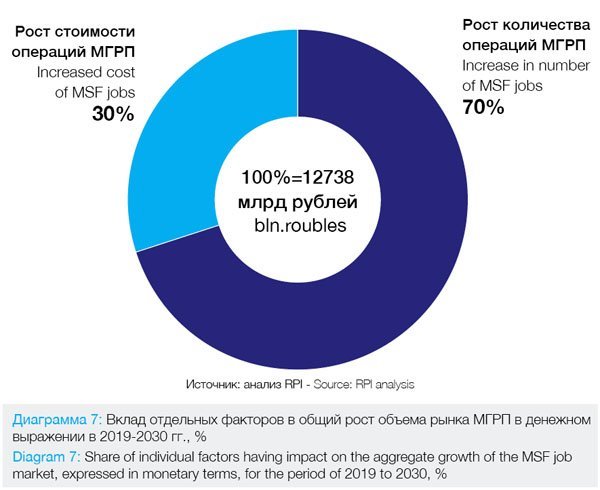

The increase of the MSF job market size, expressed in monetary terms, is expected in the period from 2019 to 2030, with the average annual rate of 18.1%, and its size will amount to 469.9 bln.rbl by 2030. Its growth, expressed in monetary terms, will be by 30% achieved due to the increased cost of jobs, and by 70% – due to the increasing number of them (see Diagram 7).

Since the beginning of 2018, more than 94.9% of MSF jobs were performed by the largest VOIC’s, dominated by «LUKOIL», «Rosneft», «Gasprom Neft» and «Surgutneftegas».

The maximum number of MSF jobs were performed by «Rosneft» -45.2% of the aggregate number of jobs across Russia. The company is active in application of new technology solutions when running MSF jobs, for instance, MSF jobs performed with the use of fully dissolvable frac balls, which allows to exclude milling up the balls and to accelerate well commissioning (this technology makes it possible to reduce the timing for completion of every well after MSF job was performed on it, from 18 down to 8 days, and, thus, accelerates bringing up well into production). The company introduces its own science and technology solutions too.

The share of «Gasprom Neft» in the MSF job market decreased in 2018, and, compared with 2017, it amounted to 19.1% of the total number of jobs performed across Russia.

The share of MSF jobs performed by LUKOIL in 2018, in the aggregate number of jobs performed across Russia, amounted to 6.0%. At present, LUKOIL performs MSF jobs in the Volga-Urals region («LUKOIL-Perm», LLC) and the Timan-Pechora province («LUKOIL-Komi», LLC). The average well flow rate, after MSF job performed on it, has amounted in the company to 43.5 ton/day.

The share of jobs performed at the fields of «Surgutneftegas» was 12% of the total number of MSF jobs in 2018 (284 jobs). The company carries out the MSF jobs using the resources of its own service subdivision – the Surgut department for enhanced oil recovery and

well workover.

The share of «RussNeft» amounted to 4.3% in 2018. The MSF jobs were carried out in its two subsidiary companies – «Varyeganneft» and JSC NAK «Aki-Otyr».

For the whole of Russia, in the long-term perspective up to the year of 2030, the increased number of all types of hydraulic fracturing jobs is expected, with the average annual rate of 2.4%, which will amount to 20.2 ths. jobs by 2030, in absolute terms. This will be, first of all, conditioned with the increased number of MSF jobs, the share of which will increase from the current 16% to 40% by 2030. The key trend of the market will be presented by refocusing of customers towards the MSF job sector, as the most effective, in terms of oil recovery enhancement. Summarizing the talk, the size of the whole market of hydraulic fracturing jobs will, in monetary terms, amount to 577.3 bln. rbls by the year of 2030, and the share of MSF jobs will be 81.4%.

This brings us to conclusion that MSF jobs will become the main driver which will draw the whole train of the hydraulic fracturing market upward.

Author: Vadim Kravets, lead analyst of RPI Research&Consulting

The analysis report ‘The Russian Market of Hydraulic Fracturing of Formation’ was released by the RPI company. On all the issues, related to this article and the report, please, contact us by phone: +7(495) 5025433,

+7 (495)7789332. e-mail: research@rpi-research.com

www.rpi-consult.ru