RPI Reports: Russian MWD/LWD Market Outlook – Light at the End of the Tunnel

The first half of 2021 was marked by a decline in exploration and production drilling figures, which started in 2019, yet continued during this period. The data demonstrated that, compared to the same period in 2020, production drilling decreased by about 6%, and exploration drilling fell by 20%. All of this predetermined the crisis developments in the drilling support services market, in the telemetry and measuring while drilling (MWD and LWD, correspondingly) segments. At the same time, monthly oil and condensate production volumes reached a plateau level of about 40 mln., which exceeded the same 2020 figures by 6-7%. The OPEC+ deal allows our country to produce even more oil and condensate in 2022 – approximately 525 MMT per year. Achieving this production level would inevitably necessitate an increase in well commissioning, and therefore, result in some revival to the drilling support market.

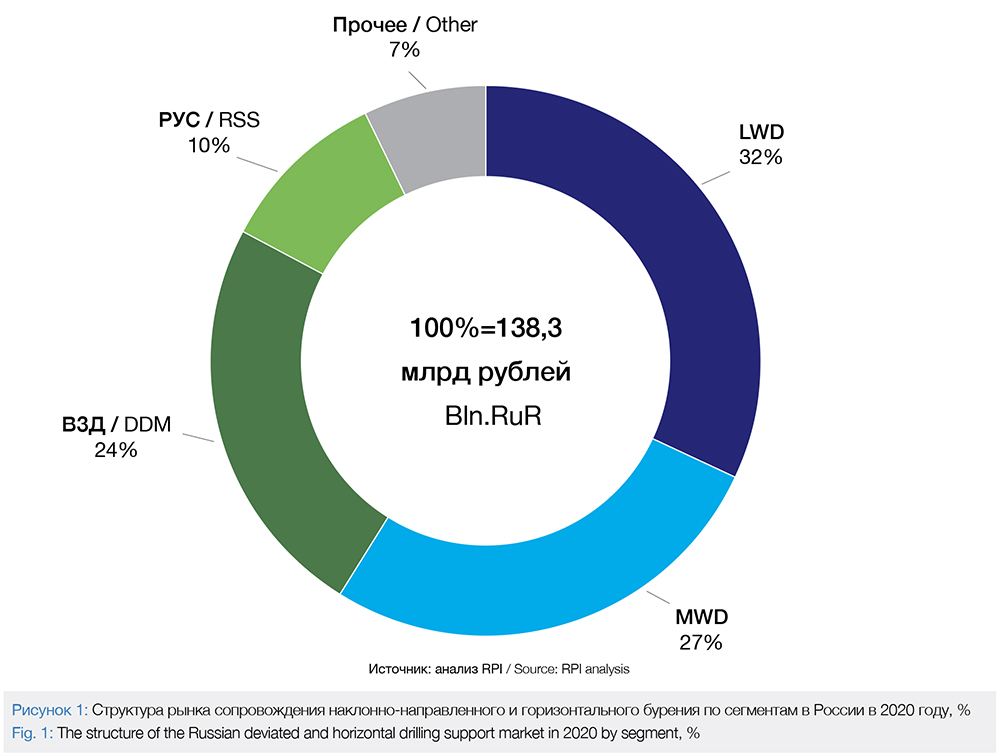

The following status quo was achieved in the services supporting deviated and horizontal drilling market in 2020.

The market volume, expressed in monetary terms, reached 138.3 bln. rubles in 2020 (see Diagram 1).

Compared with the previous year, this sector grew 3.3%. This was caused by growth charges for the works with relatively low decline in the figures of production well commissioning and sidetracking jobs – by 4% and 2%, correspondingly.

The largest segments of the market have been: LWD – 32%, or 43.6 bln.rubles, MWD – 27%, or 37.8 bln.rubles, and downhole drilling motor services (DDM) – 24%, or 32.0 bln.rubles.

Regionally, the largest shares of the deviated and horizontal drilling support market were: Western Siberia – 65%, or 90.1 bln.rubles, and the Volga-Urals region – 16%, or 21.7 bln.rubles.

In 2020, due to the geological specifics of these regions, their fields and the currently developed reservoirs, the structure of the regional markets varied considerably by segment: the MWD segment (40% share) prevailed in the Volga-Urals region, while Western Siberia had 32% of the LWD market, and the segment for rotary steerable systems (RSS) had the leading positions in Eastern Siberia (38%).

Decline Not COVID Related

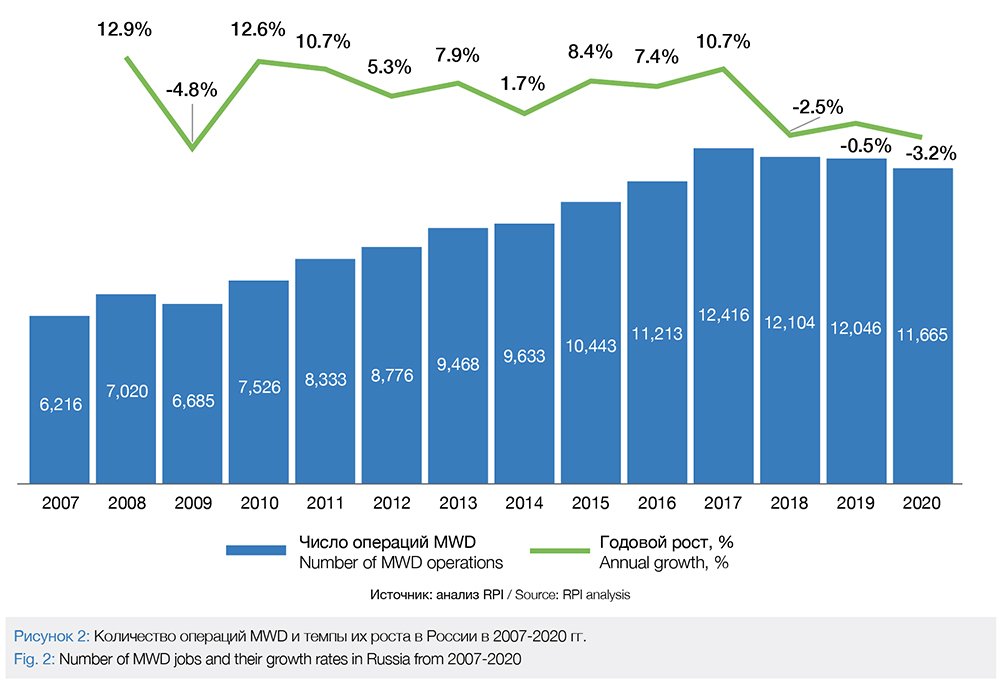

In the longer term, the number of MWD operations in Russia during the period from 2007 – 2019 increased 1.94 times, from 6216 to 12046 jobs. The average annual growth rate increased 5.7% for these services (see Diagram 2).

In 2020, the annual number of MWD jobs, compared with the previous year, reduced 3.2%, continuing the trend of 2018-2019. This was driven by both the decline in the number of commissioned deviated wells, compared to 2019 (-2.4%), and the reduction in the number of commissioned horizontal wells (-5.7%).

From 2007-2020, the number of MWD jobs increased by 5449. The increase was due to the increase in the number of horizontal, deviated, and sidetracked wells, which needed MWD services. The annual figures related to horizontal wells increased by 3015, by 1118 for deviated wells and by 2324 for sidetracking operations.

Regionally, the growth in the number of MWD jobs was registered across the oil production areas from 2007 through 2020, however, basic growth rates were demonstrated in two regions – the Western Siberia and the Volga-Urals.

Of the total number of increased MWD operations during the period of 2007-2020 (+ 5449), Western Siberia delivered 3353 more jobs, while the Volga-Urals region increased by 1125.

The change in the number of MWD operations during 2007-2020 was caused by various factors. For instance, the major reason for the growth in MWD jobs in the Volga-Urals region was the increased number of sidetracking operations, while in other regions this was caused by the increased volume of horizontal well construction.

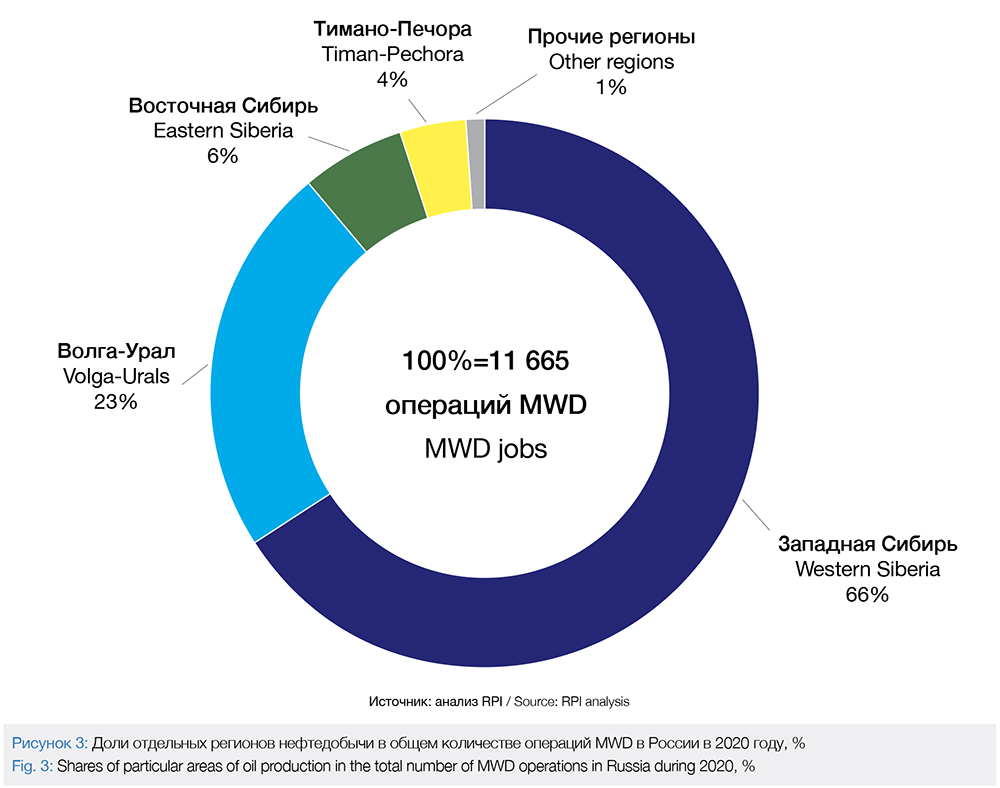

Western Siberia and the Volga-Urals region held 89% of the total number of MWD operations in 2020, having the shares of 66% and 23%, correspondingly (see Diagram 3).

The following factors contributed to the drop in the number of MWD operations in 2020, compared with 2019: the decline in construction of deviated wells in Western Siberia and horizontal wells in both Western and Eastern Siberia, in the Timan-Pechora province and other regions, as well as the decline in sidetracking jobs in Western Siberia and the Volga-Urals region.

In monetary terms, the market of MWD operations amounted to 37.8 bln.rubles in 2020, Western Siberia being the largest regional market with a 66% share.

The simpler the operation, the more of them there are

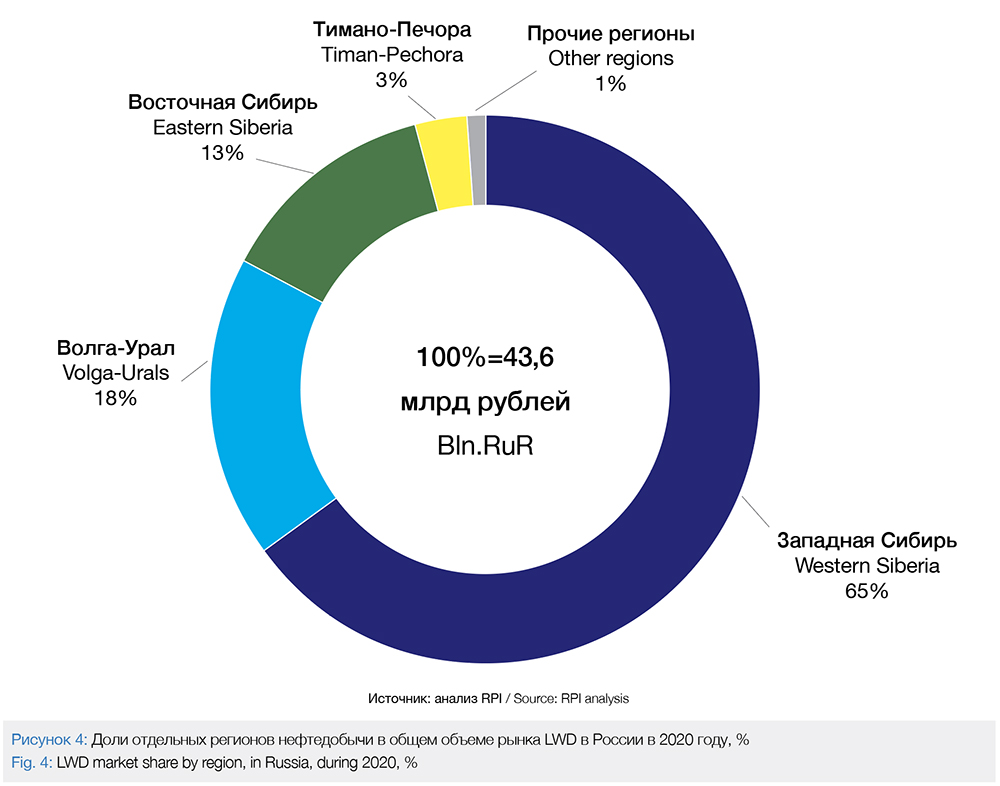

In 2020, 6125 LWD operations were run, and 97% of them were related to construction of horizontal wells (63%) or horizontal sidetracking (34%).

Regionally, 71% of LWD operations were delivered in Western Siberia in 2019, while 17% – in the Volga-Urals region.

The LWD services had the following spread by segments:

• LWD segment 1 (gamma-ray logging + resistivity logging) – 51%;

• LWD segment 2 (gamma-ray logging + resistivity logging + gamma-gamma-ray logging + neutron logging) – 37%;

• LWD segment 3 (gamma-ray logging + resistivity logging + gamma-gamma-ray logging + neutron logging + azimuthal logging) – 12%.

The three segments, mentioned above, had different geographical uptakes due to the various specifics in geology in the regions and their fields. Operations of the LWD segment 1 were 83% located in Western Siberia and 12% – in the Volga-Urals region. The spread of the Western Siberia LWD operations in the LWD 2 and LWD 3 segments were: 61% and 51%, correspondingly, while the correlation was 22% to 24% in the Volga-Urals region. Segment 3 was occupied by Eastern Siberia, with its shares of 11% and 22%, correspondingly.

Regionally, segment 1 prevailed in Western Siberia (59% of the total number of jobs in the region), while the segment 2 played a leading role in other regions. Segment 3 occupied 32% of the total number of jobs in Eastern Siberia, beating segment 1.

Expressed in monetary terms, the LWD market amounted to 43.6 bln.rubles in 2020, with the Western Siberia’s share of 65%, the Volga-Urals region’s at 18% (see Diagram 4).

And yet it will grow

Over the course of researching the drilling support market, including telemetry and logging while drilling, future market predictions were developed using the following three scenarios – the neutral (base) scenario, the optimistic and a pessimistic scenario.

The following factors were considered while developing the predictions:

• Anticipated oil production in Russia during the period of 2021 through 2030, analyzed using the three scenarios: neutral, optimistic, and pessimistic

• Predicted development of new fields

• Predicted volumes of drilling and sidetracking operations

• Predicted commissioning of horizontal wells and horizontal lateral operations

• Predicted changes in the depth of new wells and sidetracks, including the length of horizontal laterals

• Predicted expansion of the application of more complex LWD technologies

• Inflationary pressures in the country during the period from 2021-2030;

• Probability of customer’s price pressure on contractors

• Probability of China’s oilfield service companies dumping activities in the event of them entering the Russian oilfield service market.

The predicted neutral scenarios of MWD/LWD operations, as well as the DDM and RSS services, are based on the neutral scenario of predicted oil production.

It presumes that the developing macroeconomic situation would result in Russia having to follow its concluded agreements and the country’s production volume would be curbed due to quantitative parameters, given provisions in the deal.

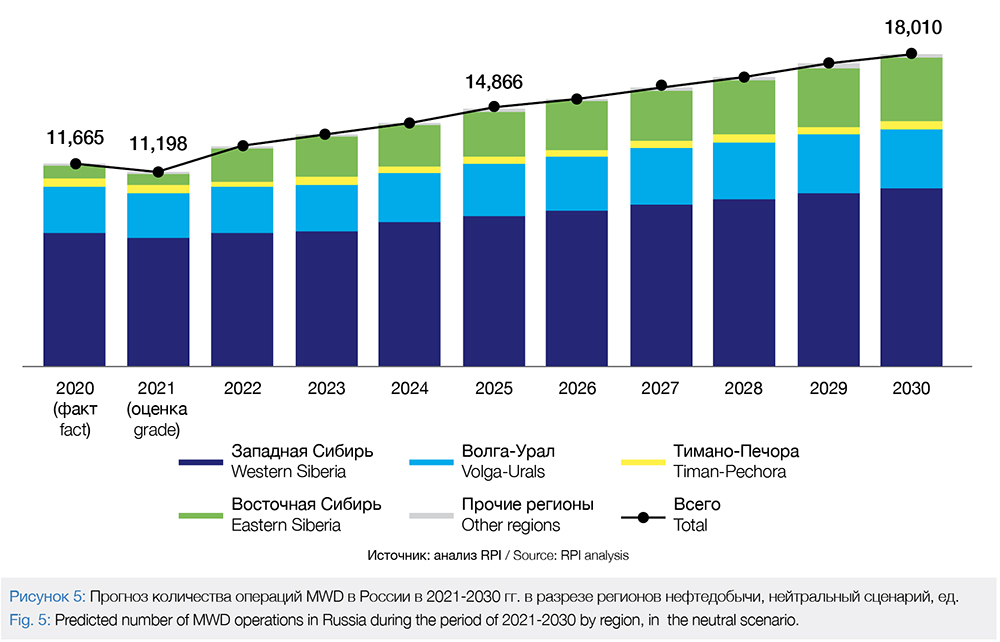

The neutral scenario of MWD operations presumes that they would increase by 54.4%, in Russia before 2030, compared with 2020, resulting in 18010 total number of jobs.

The average annual growth rate for these operations would be 4.4% during the period from 2021-2030 (see Diagram 5).

The number of MWD operations increased by 6345 from 2021-2030. This was estimated through an increasing number of commissioned horizontal wells and sidetracking operations alongside a reduction in the number of deviated well.

Regionally, Western Siberia would remain the major area for the MWD operations during the period of 2021-2030, while Eastern Siberia would hold the second place.

The number of increased MWD operations from 2021-2030, would be driven by the increase in number of MWD operations in Eastern Siberia (47%), and in Western Siberia (40%).

The change in demand for MWD operations, in the bulk of the regions from 2021-2030, would be a result of the increased volume of horizontal well construction, as well as the increased number of completed sidetracking jobs.

In 2030, Western Siberia and Eastern Siberia would account for around 78% of the total volume, holding shares of 57% and 21%, correspondingly.

In the optimistic scenario for the predicted MWD and LWD operations, as well as the DDM and RRS services, are based on the optimistic scenario of the predicted oil production.

It assumes that the oil demand recovery, over the next few years, will go faster due to which Russia would stick less rigidly to any production restrictions.

This scenario of predicted that MWD operations, by 2030, compared with 2020, would increase by 61.9%, up to a total of 18885 jobs. The average annual growth rate in the number of these operations would amount to 4.9% from 2021-2030.

The growth in the number of MWD operations during 2021-2030 is based on the growth of the number of commissioned horizontal wells, as well as increased number of sidetracking operations with some reduced volume of deviated wells. Regionally, Western Siberia would remain the major region where MWD operations would prevail just like it is in the neutral scenario, while Eastern Siberia would hold second place.

The increased number of MWD operations is based on an increase of 44% in Eastern Siberia and a 39% increase in Western Siberia.

Just like in the neutral scenario, the changes in the number of MWD operations, in the bulk of the regions, is caused by an increase in horizontal wells and the increase in sidetracking jobs.

In the total number of MWD operations to be performed in 2030, Western Siberia and Eastern Siberia would account for 76%, holding shares of 55% and 21%, correspondingly.

The negative scenario presumes the imposition of limitations on production due to extended economic recession and the aftermath of the COVID-19 pandemic.

In this scenario of the predicted MWD operations, it is believed that the number of MWD operations in Russia would increase by 2030, compared with the year of 2020, by 38%, up to 16136. The average annual growth rate of the number of these operations would amount to 3.3% during 2021-2030.

The increased number of MWD operations, by 4471, is due to the increased commissioning of horizontal wells, increased number of sidetracking operations with reduced volume of the deviated wells.

Regionally, Western Siberia and the Volga-Urals region remain the major MWD operating areas.

As for the negative scenario, the number of MWD operations, increased by 4471 during the period. This is based on an increase in operations by 45% in Western Siberia and by 38% in Eastern Siberia.

In this scenario, the changed in number of MWD operations is caused by an increased volume of horizontal wells and sidetracks. In 2030 Western Siberia and Eastern Siberia would account for 79% of the total scope, holding the shares of 58% and 21%, correspondingly.

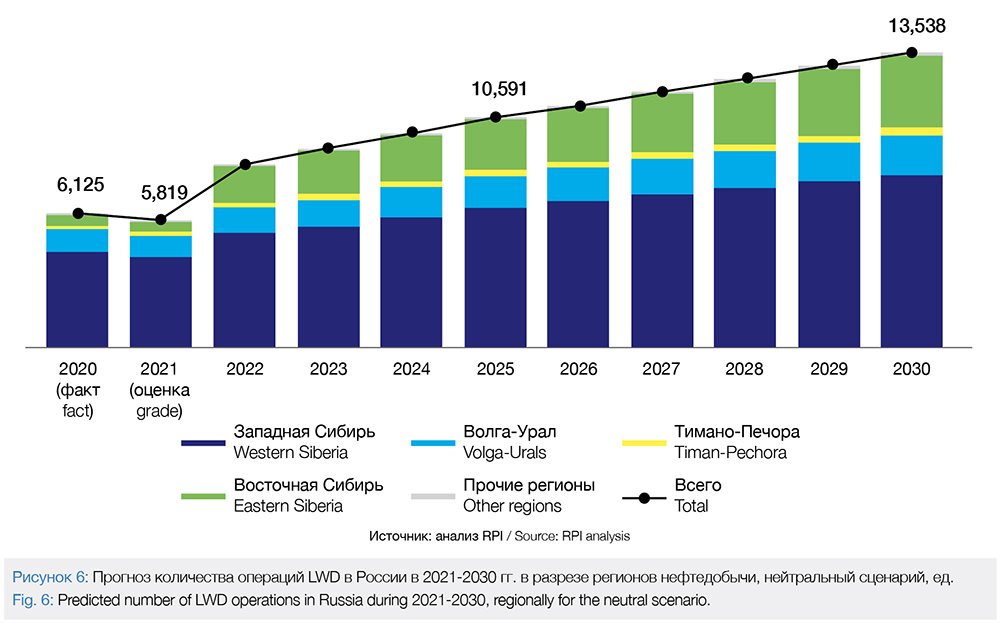

In the neutral scenario the predicted logging while drilling (LWD) operations would increase by 2.21 times by 2030 and would reach 13,500 operations. With an average annual growth rate of 8.2% in the period of 2021-2030 (see Diagram 6).

In this scenario, the increased number of the LWD operations would be based on the increase in the number of LWD operations in Western Siberia (48%) and in Eastern Siberia (39%). The total number of the LWD operations by 2030, Western Siberia and Eastern Siberia would account for 83% of the total occupying the shares of 58% and 25%, correspondingly.

By segments of LWD operations, the LWD 1 and LWD 2 segments would prevail.

In the optimistic scenario, the number of LWD operations in Russia would increase 2.31 times by 2030, with 14,100 operations. For the period of 2021-2030 the average annual growth rate of the operations would be 8.7%.

In this scenario, the number of LWD operations increased by 8013 from 2020-2030, an increase of 46% in the number of the LWD operations in Western Siberia and the 38% in Eastern Siberia.

In 2030, in the total number of LWD operations, Western Siberia and Eastern Siberia account for 82% of the total, holding the shares of 57% and 25%, correspondingly.

By LWD segments, the LWD 1 and LWD 2 segments would prevail in the period of 2020-2030.

In the negative scenario, the number of LWD operations in Russia would increase1.89 times by 2030, reaching the level of 11,600 operations. The average annual growth rate in the number of these operations would

be 6.6%.

In this scenario, the number of LWD operations, increased by 5436 from 2021-2030, with an increase of 53% in Western Siberia and 37% increase in Eastern Siberia.

By 2030, Western Siberia and Eastern Siberia would provide 85% of the total of the LWD operations, holding shares of 63% and 22%, correspondingly.

LWD segments, LWD 1 and LWD 2 would remain the main segments in the period of 2020-2030.

What will happen with the MWD/LWD tool market

In 2020, expressed in physical terms, the major Western producers were the leaders of the MWD/LWD tool market (46%) (a combined market share of Schlumberger, Halliburton, Baker Hughes and Weatherford), as well as APS Technology and NewTech Services with their shares of 6% each. Among other significant market players there are such companies like: SC GEO, NNPK ECHO, NPP VNIIGIS, Tyumenpromgeophisica, Axel, LiM-service, Geoplast Telecom, Permskaya Kompaniya Neftyanogo Mashinostroyeniya (Perm Petroleum Engineering Company), CNPС, Beijing Geoshine Drilling Technologies Inc., Beijing HTWB Petroleum Technology Co., Ltd, RENHESUN, Oliden Technology, Telemetrix (Newsco) and a few others.

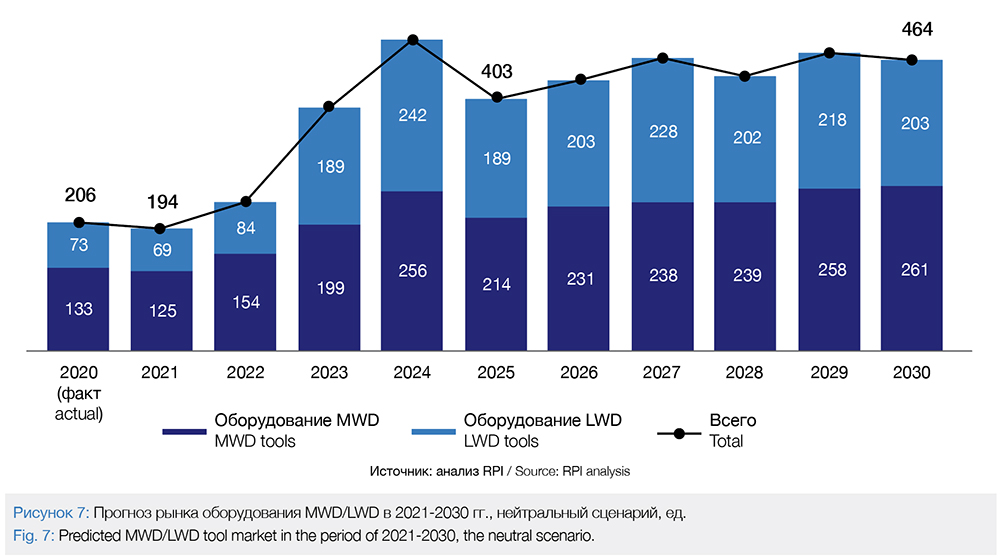

The size of the MWD/LWD tool market in 2020, according to the conducted analysis, is estimated at 206 units. Demand for the MWD tools is greater, 133 vs 73 units of the LWD tools.

In 2020, the maximum consumer demand for the MWD tool segment, of 65%.

Among the LWD tools, the LWD-1 assemblies were most utilized in 2020 (49.3% or 36 units), due to the fact that the gamma logging + resistivity logging are most used while drilling, compared to other types. In 2020, the maximum demand for the MWD/LWD tools was in the Volga-Urals region and in Western Siberia – 39% and 36%, correspondingly, which was due to the presence of the largest well stock of Russia there, and as a result of that, due to the maximum volumes of drilling both deviated and horizontal wells in those regions.

Considering the regional structure of each of the tool segments individually, it was revealed that they have different geographical spreads due to various geology specifics to the regions and their fields. For instance, the MWD tools are mostly used in Western Siberia; the LWD-1 tools are 83% located in Western Siberia and 12% of them are in the Volga-Urals region, with insignificant shares held by other regions.

The LWD-2 and LWD-3 segments are less concentrated in Western Siberia and amount to 61% and 51%, correspondingly, while their presence is higher in the Volga-Urals region: 22% and about 24%. Besides, these tools are significantly more prevalent in Eastern Siberia, reaching the levels of up to 10% and 20%, correspondingly. In 2020, the size of the MWD/LWD tool market, expressed in monetary terms, amounted to 4.7 bln.rubles. The segment of MWD tools was dominant, amounting to 62%. Its high share is based not only on prevailing quantity but on the high cost, compared with LWD tools, as well.

In 2020, by the assembly types, the largest share of the market was occupied by the LWD 2 segment with its 46% (0.8 bln.rubles), the LWD 3 segment held 20% (0.4 bln. rubles). The technological segment of the LWD market was represented by LWD 2 (gamma ray logging + resistivity logging + gamma-gamma ray logging + neutron logging), which explains its high share in the aggregate LWD market. Regionally, the maximum share of the market would be occupied by the Volga-Urals region and Western Siberia – 39% and 35%, correspondingly.

The scenario predictions for the MWD/LWD tool market takes the following input data and factors into account:

• The scenario prediction for the quality of the MWD/ LWD oilfield service operations which require the use of appropriate oilfield service tools with details given on the types of operations, regions and well types;

• Dynamics of special aspects in the use of the tools in the long term, including the productiveness of equipment and expert evaluations of the equipment operation rate;

• Average lifetime of equipment, normal wear and tear on equipment and equipment losses in operation rate;

The computed model presents predictions for the MWD/LWD tool market and their fleet based on predicted number of MWD/LWD operations and appropriate assumptions. The neutral scenario of predicted tool market is based on the neutral scenario of the predicted dynamics of telemetry and logging while drilling operations, described above.

The neutral scenario for the MWD/LWD tool market in the period of 2021-2030 would increase with the average annual rate of 10.2%, reaching the level of 548 operations in 2030. Due to pent-up demand, the market size would grow most rapidly 2021-2022, whereupon it would drop in 2023, and then, again, the dynamics of the market size would become mostly positive from 2024-2030 (see Diagram 7).

The pattern of demand for the LWD assemblies would change by 2030. The LWD-2 segment would prevail in the years 2021-2022, occupying a 44% share by 2030 or 85 units in total for the LWD equipment.

This is driven by the fact that the share of technically complex operations of the LWD-2 and LWD-3 drilling support would increase by 60-65% while the share of the simpler LWD-1 segment would decrease by 40% by 2030.

In the neutral scenario, the MWD/LWD tool market would grow from 2021-2030, with the average annual rate of 16.6%, up to the level of 21.9 bln.rubles annually by 2030, i.e. it would increase by 4.64 times for this period. The especially high growth rates can be attributed to 2021-2022, since these years can be characterized by the recovery growth of the market, expressed in monetary terms.

In the optimistic scenario, the MWD/LWD market would increase in 2021-2030, at the average annual rate of 10.8%, reaching the level of 583 units in 2030. The most dynamic growth of the market, due to pent-up demand, would take place in 2021-2022, whereupon some decline would happen in 2023, and then the dynamics of the market would become significantly positive from

2024-2030.

The pattern of demand for the LWD assemblies would change in this scenario by 2030. The LWD-2 segment would prevail, beginning from 2021, however its share would become equal to LWD-from 2029-2030.

In the optimistic scenario, the market would grow in 2021-2030, with the average annual rate of 17.6%, up to the level of 23.9 bln.rubles in 2030. The market size in 2030 would exceed this parameter of 2020 by 5.07 times. Again, just like in the neutral scenario, 2021-2022 would be the period of especially high rates of the market recovery growth.

In the negative scenario, the MWD/LWD tool market would in aggregate grow in the period of 2021-2030, with the average annual rate of 8.1%, up to the level of 450 in 2030. According to this scenario, the recovery growth of the market would take place in 2021-2022, whereupon its size would fluctuate within the corridor between 383 and 450 units per year.

In the negative scenario for 2021-2029, the maximum share of the LWD market belongs to the LWD-2 segment, and only by 2030, the maximum share would become typical for the LWD-1 segment.

In the negative scenario, the market would grow in the period of 2021-2030, with the average annual rate of 13.7%, up to the level of 17.0 bln.rubles in 2030. The size of the market in 2030 would exceed the 2020 parameter by 3.6 times. The particularly high rate of the market recovery falls in the period 2021-2022.

In the negative scenario, the LWD tool market size would grow with the average annual rate of 14.8%, reaching the level of 7.1 bln.rubles by 2030. The LWD-2 assemblies would prevail in the period of 2021-2030.

Thus, both in the MWD/LWD service market, and in the market of associated equipment, it is probable to expect some revival, but not earlier than the period of 2022-2023.

Author

Vadim Kravets, Lead Analyst for RPI Research & Consulting