RPI Reports: The Predicted Oil Production Decline Will Boost the Sidetracking Market

The sidetracking (ST) market is one of the most important segments of the Russian oilfield services market (OSM); in 2017, its share in the total OSM volume was 8.7%. In the past ten years, this segment has been on the rise, demonstrating a remarkable growth rate. This operation has become an effective method of maintaining production rates for old wells in traditional producing regions, taking its rightful place among other methods of enhanced oil recovery (EOR) and production stimulation (PS). In 2017, the uptrend in the ST market continued, showing a growth rate of 10.5%. In the future, this market will continue to grow in money terms and may reach RUB 339 billion by 2030. One factor that may reinforce this trend is the increasingly real threat of a decline in oil production in the country, forcing oil companies to use all available techniques to prevent it.

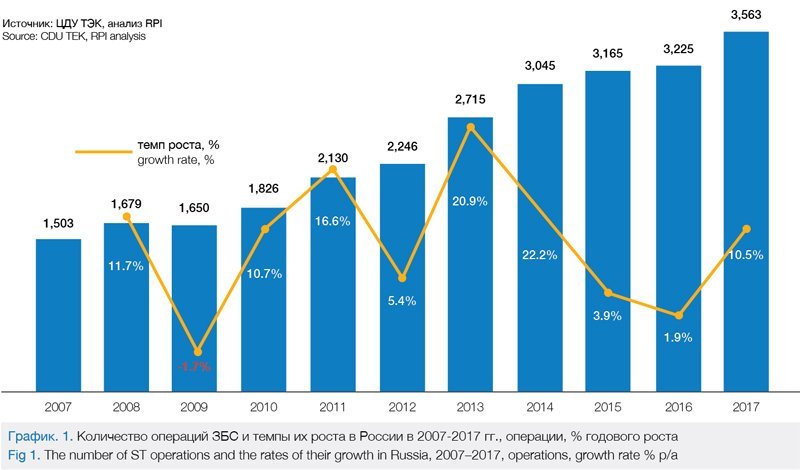

Since 2007, the number of ST operations in Russia has been predominantly growing. Between 2007 and 2017, the total number of operations of this type increased by 137%, from 1500 to 3600 per year. Over the same period, the annual rates of growth in the number of ST operations increased from -1.7% in 2009 to a maximum of 20.9% in 2013 (see Figure 1).

A significant increase in the number of ST operations during these years was due to the initial market penetration of the new technology. Yet another stimulus for this increase was Resolution No. 7 of the Federal Mining and Industrial Inspectorate of the Russian Federation (Gosgortekhnadzor) of June 6, 2003 entitled “On the Approval of the ‘Subsurface Resources Conservation Regulations.” It touched upon the issue of limiting the number of idle wells – according to this document, their proportion in the producing well stock must not exceed 10%. Seeking to comply with this prescription, VIOCs began to increasingly use ST operations to put their idle wells back to work.

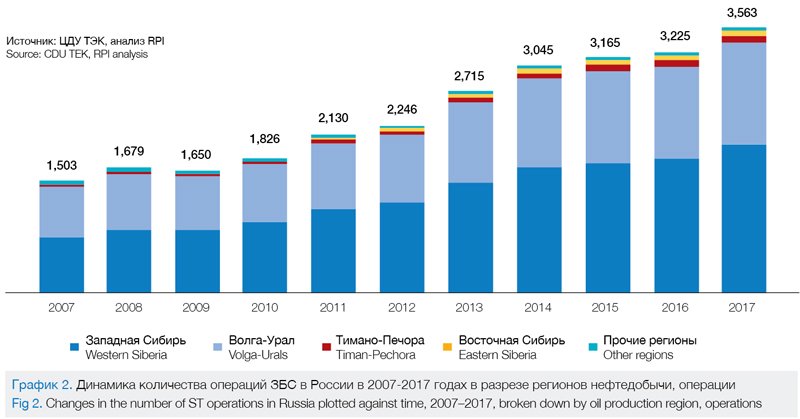

In 2007–2017, the number of ST operations was growing in all regions, primarily in Western Siberia and the Volga-Ural region. Out of the total Russia-wide increase in the number of ST operations during this period (+2060 operations), Western Siberia contributed an increase of 1242 operations, and the Volga-Urals contributed an increase of 696 operations (see Figure 2).

By 2017, the two largest producing regions – Western Siberia and the Volga-Ural region – held a physical market share of 94.2% in aggregate, their individual shares being 56.2% and 38.0%, respectively. By and large, such a significant weight held by the two regions in the total ST market can be explained by their weighty shares in the total oil well stock.

During 2007–2017, another notable trend has emerged: since 2007, the share of horizontal sidetracking (HST) projects in the total ST market has increased 6% – from 50% to 56% (see Figure 3).

The depletion of reserves resulted in an increase in the average sidetrack length – since 2007, this figure has grown by 100% and reached 400 m. Combined with the overall growth in the number of ST operations, this brought about a 9.5-fold increase in sidetrack drilling meterage since 2007.

In 2007–2017, the ST market kept growing in money terms, reaching a level of RUB 111.6 billion in 2017. Notably, in 2017 alone, the ST market increased by RUB 10.6 billion, demonstrating an annual growth rate of 10.5% (see Figure 4).

The average cost per ST operation in Russia remained at the same level in 2017 as it was in the previous two years, which was due to the intense pressure exerted by ST customers on ST on contractors in terms of job prices. This situation was prolonged through 2018 – according to industry experts, large VIOCs insist that prices be stabilized at the level of 2017, and sometimes also that the costs per operation be reduced by 10–15%. Apparently, this scenario will continue into 2019.

The Lineup of the Largest Customers Remains Unchanged

In 2017, the majority of large customers increased the number of ST operations: in 2017, their number in Rosneft increased by +11%, in LUKOIL – by +63%, and in Surgutneftegaz – by +4%. As a result, in 2017, the ST market grew in physical terms by 338 operations (+10.5% by 2016), reaching a total of some 3500 operations (see Figure 5).

In 2017, the aggregate share held by Rosneft, Surgutneftegaz, and LUKOIL in the total ST market was 70%, their individual shares being 36%, 25%, and 9%, respectively (see Figure 6).

The contractor entities can be split into two categories: independent companies and VIOC subdivisions. Figure 7 shows the shares held by individual contractors in the total number of operations.

In 2017, the following companies had the biggest shares in the ST market:

• Surgutneftegaz – 25%;

• RN-Burenie – 17%;

• EOR and Well WO Co. – 9%.

In total, the share of the above-listed companies reached 51%.

In 2017, contractors changed their sidetracking workloads. Most companies increased the number of ST operations in the face of increased demand for these services, which ultimately resulted in the above-mentioned ST market growth by a total of 10.5%.

In addition to the total number of ST operations, contracting entities have increased the number of their sidetracking crews; however, this trend is lagging behind that of the operations growth rate, from which we can infer that the average workload per sidetracking crew has increased.

In 2017, the input-specific efficiency of sidetracking work differed significantly among contractors. Among large companies, RN-Burenie is the one that boasts the largest number of operations per crew.

Where the Market is Going

The main factors that determined the course of development of the ST market in 2006–2017 were:

• the growing stock of oil wells, including horizontal ones;

• the decline in production rates at old wells;

• the increase in the number of EOR projects, including ST;

• the declining efficiency of EOR methods used, including ST;

• the increased proportion of HST operations and the reduced proportion of directional sidetracking (DST) operations in the total ST market structure.

During the 11-year period between 2006 and 2017, the stock of producing oil wells in Russia increased by 21,000, or by 18%, reaching a total of 151,000 wells. This indicator largely determines the number of ST operations. Notably, the two regions that boast both the biggest share in the total number of wells and the biggest increase in the number of wells are Western Siberia and the Volga-Ural region. By the end of 2017, there were 85,000 producing oil wells in Western Siberia (56% of the total stock Russia-wide) and 57,000 wells (38%) in the Volga-Urals.

The increase in the number of wells in 2006–2017 occurred mainly due to the introduction of directional wells. The number of wells completed in 2017 was 1.9 times higher than in 2007. However, if in 2007 horizontal wells accounted for only 10% of all completed wells, in 2017 their share increased to 33%.

Between 2007 and 2016, the percentage of idle wells in the producing stock decreased from 12.7% to 8.5%. In 2017, this figure increased to 9.7% due to the introduction of restrictions on oil production.

The increase in the number of wells occurred in the face of the decreasing production rates at the existing oil well stock. So, for example, if in 2007 the average production rate per oil well per day was 10.2t, by 2017 this figure decreased by 10%, to 9.3t. At the same time, the production rate at new wells went from 43.5 down to 36.2t (a decrease by 7.3t, or 17%), while at old wells it went from 9.8 to 8.8t (a decrease by 1.0t, or 10%).

The growth in the average daily production rate at new wells in 2016 was due to some effective well construction projects implemented at fields already in production, specifically at the Samotlorskoye Field (Rosneft) and the Novoportovskoye Field (Gazprom Neft), as well as due to the commissioning of new fields – so, for example, the V. Filanovsky Field allowed LUKOIL-Nizhnevolzhskneft, LLC to boost their average production rate 5.7 times up to 3,000 t per day.

The input-specific efficiency of EOR operations decreased as follows between 2007 and 2017: new drilling – by 20.9%; ST – by 35%; HF – by 100%; WWO – by 27.4%.

In 2017, incremental production due to EOR methods accounted for an average of 14.4% of the total production for the largest VIOCs. Here is how this incremental production figure breaks down by EOR method: 65% – new drilling, 15% – WWO, 10% – HF, 10% – ST.

Technology Does Not Stand Still

One of the key technological trends in the sidetracking market is the increase in the percentage of horizontal drilling operations. Over the past decade, this figure has grown by 6% and reached 56% in 2017. Thus, horizontal sidetracking projects began to prevail over directional ones.

Another important technological aspect in sidetrack drilling is the frequent use of multi-stage hydraulic fracturing (MSHF). So, for example, Slavneft uses MSHF in up to 90% of its sidetracking operations. Expectations have it that other companies will catch up on this figure in the near future. It should be noted that sidetrack drilling is carried out with practically no HF monitoring. Currently, the average number of MSHF stages per sidetrack is 3–4; in the long run, their number will increase to 6–7. Such an increase in the number of MSHF stages will be driven by the increase in the average sidetrack length.

Sidetrack lengths vary significantly by company and oil production region; however, all oil and gas provinces are witnessing an uptrend in the lengths of horizontal well sections and sidetracks drilled.

Industry experts point out that the use of controlled bottom-hole assemblies in sidetrack projects is negligibly rare, but in the mid-term future, this practice is expected to become more common. Rotary steerable systems (RSS) are also used quite rarely – their high cost being a key restrictive factor in this case. As a general rule, these systems are only used in ST projects if the customer so requires for some reason or other. Step-by-step introduction of this technology will drive its unit cost down, making it more affordable for customers, which, in turn, will result in an increase in the proportion of sidetrack drilling projects using RSS.

The use of downhole positive displacement motors (PDM) in sidetrack drilling is currently also quite uncommon, but industry experts point to a trend toward more sidetrack projects using them, which can be explained by their improvement and modernization.

What will Happen in the Next 12 Years?

When preparing our forecast for the number of ST operations in 2018–2030, we considered the following factors:

• projected oil production in Russia for the period 2018–2030;

• projected changes in the size of the producing well stock over time;

• projected proportion of the production well stock which is left idle;

• projected changes in the oil well production rates over time;

• projected changes in EOR efficiency over time, viz changes in incremental production due to EOR;

• projected changes in the specific contributions of horizontal (HST) and directional (DST) sidetrack drilling projects to the total number of ST operations over time.

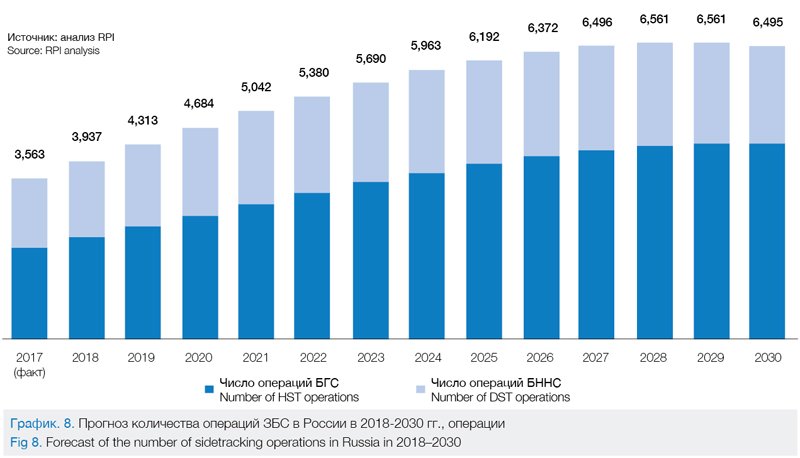

Between 2018 and 2030, the number of ST operations per year will keep growing, but the ST market growth rate figures will significantly decrease compared with the previous decade. Our outlook until 2030 has it that the rate of growth in the number of ST operations will not exceed 11% p/a, and the average annual growth will be 5.2%. By 2030, the number of ST operations will reach a level of 6,500 operations, which is 82% more than in 2017.

The increase in the number of ST operations by 2932 in the years 2018–2030 will, to the greatest extent, be driven by the growth in the number of such operations in Western Siberia (+1258 operations) and the Volga-Ural region (+796 operations).

The same two regions also occupy the top two lines of our breakdown of the number of ST operations in 2030, Western Siberia accounting for 50.2% and the Volga-Urals for 33.1% of the country’s total number of these operations.

Currently, the proportion of HST in the total number of operations, as we have already mentioned, averages 56% country-wide. This sidetrack type will become even more widespread: by 2030, its share in the total ST workload will reach 65% (see Figure 8).

It is expected that by 2019 the average sidetrack length will increase to 500m and subsequently remain at the same level. The growing number of ST operations, combined with the increased average sidetrack length, will result in 2.3-fold growth in sidetrack drilling meterage by 2030.

There are More Reserves Left

Given the current situation in Russia’s oil production market, the most likely scenario is one where oil production at mature fields will decline, and stable production volumes will be ensured by the commissioning of new fields. Notably, sidetracking operations will be carried out both at new fields and at mature fields – with a view to maintaining oil recovery.

In the coming years, there is a possibility that oil companies involved in production at mature fields will be subsidized. There are government support measures that provide for tax reliefs to be made available to companies who, in return, are supposed to increase production at their wells or, more likely, to maintain it at the current level.

In particular, mature fields include deposits with the longest production lifespan and a water cut above 85% – such as the Samotlorskoye, Varyoganskoye, and Megionskoye Fields. The total production volume at mature fields is 120 Mt.

To maintain the current level of production at fields of this type, additional oil recovery measures will be required. These include: construction of new wells and sidetracks as well as a number of advanced EOR and PS techniques.

Maintaining production will, first of all, call for the construction of more and more wells. The same scenario will play out in respect of the number of ST operations. Moreover, the lower cost of ST work compared to new well construction allows us to infer that sidetrack drilling operations may become a way to replace some part of new well projects. As a result, by 2030, the size of the ST market, in physical terms, may turn out to be bigger than that shown in Figure 8 by about 1,500 operations per year.

Vadim Kravets

The analytical report entitled “The Russian sidetracking market: current state and outlook until 2030” has been published by RPI. For questions related to this article and the said report, please call:

+7 (495) 5025433, +7 (495) 7789332

e-mail: research@rpi-research.com

www.rpi-consult.ru