RPI: Russian Drilling Equipment Market, Outlook to 2030, Key Challenges and Trends

The drilling equipment market, the key segments of which are drilling rigs and top drives, is characterized, on the one hand, by fleet obsolescence, and on the other, by increased requirements toward drilling equipment on the part of major contractors. Considering the outlook until 2030, the accumulated demand for drilling rigs could reach 1396 units, more than 50% of which are going to be heavy duty rigs with a load carrying capacity of more than 300 tonnes.

Drilling Rigs: The Need to Upgrade

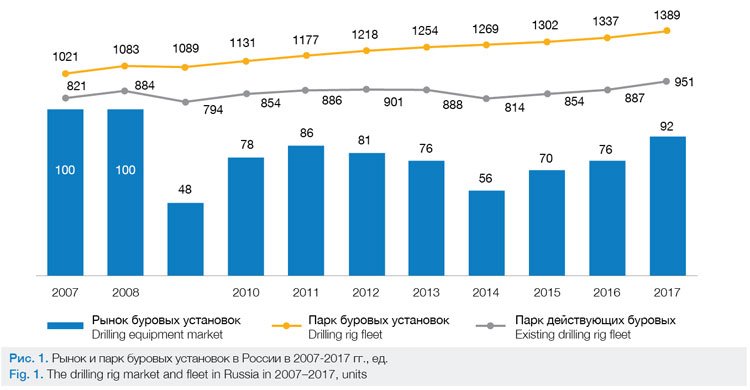

In 2007–2017, Russia saw a 36% increase in its drilling rig fleet, to a total of 1389 units, according to RPI’s estimates. That kind of growth was mainly due to a more than twofold increase in well construction. However, the percentage of active rigs has dwindled from 93% to 79% over the same period. That is, in fact, the existing rig fleet has grown by only slightly more than 15%.

Such dynamics have had a number of pre-requisites

to it, viz:

1. Increased drilling efficiency, especially in terms of improved rate of penetration, improved mobilization times due to modular design approach, increased use of telemetry, more efficient bits, etc.;

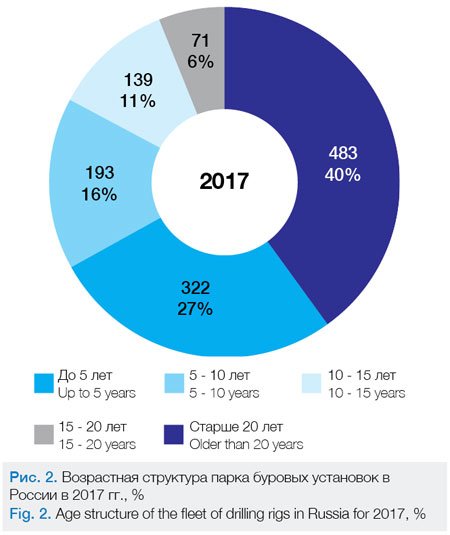

2. Increased share of machines aged 20 years or more (see Figure 2), which are practically out of use due to expensive transportation;

3. Increased share of relatively cheap wells (primarily in the Volga-Ural region), which are characterized by faster construction rates.

Thus, the drilling workload per rig has increased drastically over the past 10 years, but now given that 40% of the fleet is made up of old drilling rigs, such double-digit workload growth rates (10% and 12% in 2016 and 2017, respectively) create a potential shortage of drilling rigs if and when the current growth patterns continue.

In recent years, the drilling equipment market has demonstrated a variety of upward and downward trends, the latter being especially significant during the crises of 2009 and 2014. Where this market goes next will highly depend on the demand for well construction services and on the overall oilfield services market environment.

In 2007, Russia’s drilling rig market displayed a demand of more than 100 units, but the economic crisis of 2008–2009 saw fewer and fewer players wanting to invest in new and expensive machines. The entry of Chinese manufacturers into the Russian market, as well as the restored operation of the Uralmash production plant, triggered a new wave of market growth in 2010–2013. 2014 was another crisis year that witnessed a steep decline in oil prices, which forced large oil and gas companies to cut down their investments in drilling operations as well as to save money on contract work, which in turn resulted in weaker demand for drilling machinery. In 2016-2017, the drilling rig market showed a significant growth following that of the drilling services market and encouraged by the major contractors’ need to upgrade and increase their rig fleet.

After the crisis of 2008–2009, drilling companies significantly decreased their equipment upgrade programs as they preferred to recondition their existing equipment wherever possible, while purchasing new machines for the most important projects. This led to an increase in the average age of the rig fleet: more than 40% of the rigs currently operated in Russia are older than 20 years (the average service life being 25 years).

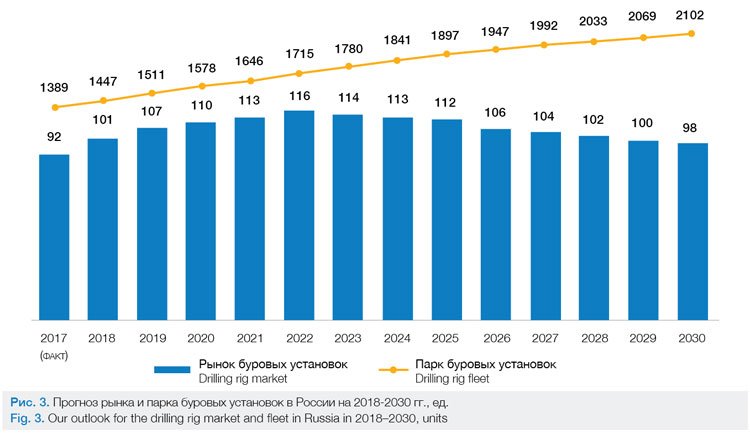

The increase in well construction operations as well as the need for fleet renewal will drive the growth of the drilling rig market in 2018–2022. The cumulative demand for this period will be 547 units. For the time being, most of this market will be covered by Russian manufacturers, Chinese companies, and foreign players that have production facilities in the Russian Federation (NOV-Kostroma, Bentek, Honghua CIS).

Beginning in 2023, the volume of the drilling rig market will show a slight decrease, which will be caused by both the absence of new large projects and the more efficient utilization of the equipment fleet due to the expansion of drilling operations on typical wells in old fields with developed infrastructure.

By 2030, the market volume will plateau at around 100 units per year, with 74% of the fleet being under 15 years old. The total demand for drilling rigs over the period of 2018–2030 is estimated at 1396.

Money-wise, the market will grow from 26 billion rubles in 2017 to 45 billion rubles in 2030.

In terms of the structure of demand for drilling rigs, it is cluster drilling rigs that account for more than half of the market. This is because cluster solutions strike a remarkable balance between a large load lifting capacity and speedy mobilization, which is most relevant for the cluster drilling operations deployed in the fields of Western Siberia. Currently the most popular type of drilling rig among Russian consumers is a cluster drilling rig with a conditional depth of drilling of 5000 m and a lifting capacity of 320 tonnes (e. g., 5000/320 EК-BMC produced by Uralmash NGO Holding LLC). Stationary drilling rigs are mainly used for drilling individual wells with complex profiles, as well as for exploratory wells. The tendency toward greater average depth of penetration and a greater proportion of horizontal wells curbs demand for mobile drilling rigs, which are limited in terms of lifting capacity. Another such deterrent for the mobile rig market is the fact that the heart of drilling activity is shifting to Eastern Siberia, where the transport infrastructure in the fields is poorly developed. On the other hand, the increase in sidetracking operations supports the need for mobile units with a capacity of more than 160 tonnes. In addition, heavy duty mobile rigs (capable of lifting more than 200 tonnes) are actively used for infill drilling in mature fields. In general, the future of mobile drilling machinery largely depends on the ability of manufacturers to adapt to changing trends and create a product that meets the requirements of the present day.

It is expected that the current trend will continue through 2030, that is, the share of cluster drilling rigs will keep increasing, and so will their spread into Eastern Siberia. One thing that has become a standard requirement nowadays is that such rigs come in prefab modular design – because of their high mobilization speed. The emergence of more complex drilling techniques and the development of hard-to-recover reserves will call for higher and higher rig capacity: even now heavy duty rigs that can support a drill string weighing more than 300 tonnes make up about 40% of the market. In the future, the trend toward increasing the average lifting capacity will continue, and by 2030 it is projected that the capacity of more than half of the new rigs will exceed 300 tonnes.

Drilling Companies

The size, age, and structure of the fleet of drilling rigs varies significantly by company. So, for example, the largest drilling contractor in Russia in terms of fleet size – Eurasia Drilling Company Limited (258 units) – is currently in the process of upgrading its aging equipment. Some two-thirds of the company’s fleet are cluster-type machines, most them are deployed in Western Siberia.

Yet another major contractor who is busy upgrading its fleet is RN-Burenie LLC (218 units). In 2016–2017, the company acquired 28 drilling rigs manufactured by Uralmash NGO Holding LLC.

At the same time, there are several smaller players on the market with a young fleet of drilling rigs, such as ERIELL, Investgeoservis JSC, PNG Drilling Company, NSH Asia Drilling.

Some of the key aspects drilling companies cite as pertinent to their selection of a rig supplier are the latter’s compliance with technical specifications as well as their pricing, terms and times of delivery, the manufacturer’s market image, and the availability of after-sales equipment support.

Competitive environment: growth of domestic production and import substitution

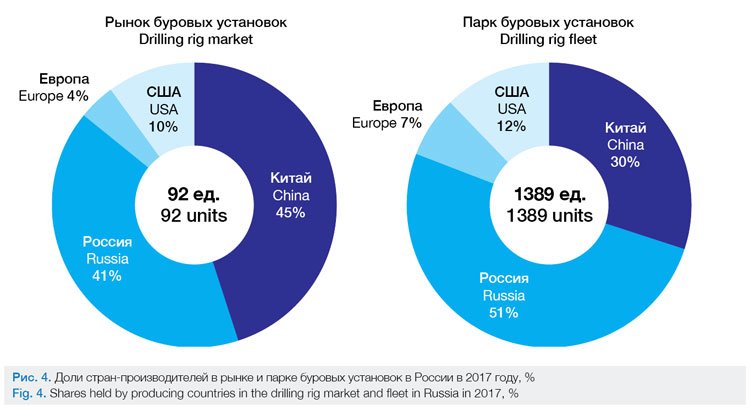

Beginning in the late noughties, we have seen Chinese companies hold leading positions in the drilling rig market, their advantage being great price-to-quality value of their equipment. The largest among them, in terms of their market share in Russia, are Sichuan Honghua Petroleum Equipment and RG Petro-Machinery. In total, Chinese manufacturers retain about 45% of the local drilling rig market. A constraining factor that deters further expansion of Chinese players to the Russian market is all about the limitations of their drilling rig offerings in terms of climatic performance, viz, their rigs are often not suitable for the colder regions of our country.

According to RPI’s estimates, some 41% of the drilling rig market is occupied by Russian companies. Their share began to increase in 2010, when the production assets of the Uralmash plant were used to launch the operation of Uralmash Oil and Gas Equipment Holding (Uralmash NGO Holding), whose current output includes a wide range of drilling equipment. In addition, the growth of the Russian market segment was facilitated by government subsidies to domestic producers through the introduction of an import duty on drilling rigs in 2012, which discouraged the expansion of Chinese companies to the Russian market.

Currently 55% of the domestic market segment is controlled by Uralmash NGO Holding. Their plant has the advantage of being able to produce drilling rigs of any type and capacity, and since 2014, their product offering also comes complete with a top drive system (TDS), their own designed solution. After the Volgograd Drilling Equipment Plant had gone out of business, Uralmash NGO Holding essentially lost all of its major competitors, but before long their shoes were filled by subsidiaries of foreign companies who started doing production business in Russia, such as Bentek (Germany) and NOV-Kostroma (USA).

Bentek’s plant, set up in 2009 in Tyumen, is currently capable of producing up to 10 drilling rigs per year.

Following suit was National Oilwell Varco, whose plant saw the light in 2016 in the Kostroma region. This was yet another attempt (this time successful) by the American company to enter the Russian market in a big way. The success was largely facilitated by the government support provided during the implementation of the project, highlighting the interest of the Russian authorities in boosting the supply of drilling rigs in the domestic market. One of the possible focus areas for the development of NOV-Kostroma is implementing joint R&D projects with Russian companies. In other words, import substitution is an integral part of NOV-Kostroma’s strategy, which is very unusual for a foreign company, especially in the context of possible additional sanctions from the US. The company has facilities capable of producing up to 35 drilling rigs a year, as well as drilling platforms, including those fit for arctic service. Moreover, in addition to the production of standard cluster-type and stationary rigs, the company plans to augment its offering by adding heavy-duty mobile drilling rigs, based on the 200-tonne drilling rigs used in the Canadian market. This may be one of the most promising niches for the company due to the growing demand for heavy mobile drilling rigs, which is triggered by the current increase in horizontal sidetracking operations and the deterioration of the existing fleet of mobile drilling machines, primarily of American production (Surgutneftegaz being a good example).

Top Drive Systems: Sustained Market Growth

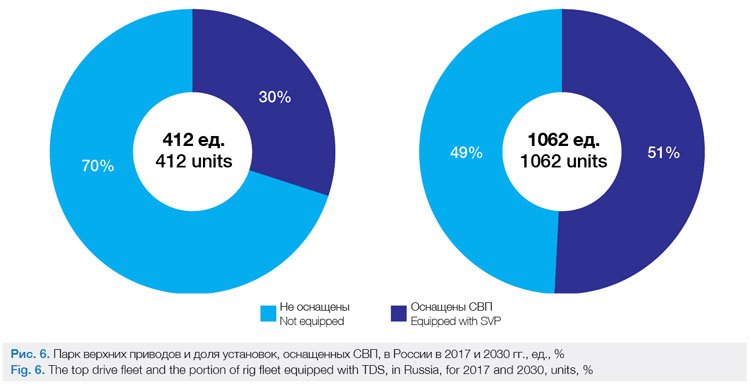

Top drive systems (TDS) came to the Russian market relatively recently. Their production in the territory of our country was launched as late as 2003 by PromTechInvest, which remained the only domestic manufacturer of this type of equipment until 2014. Today, top drives are manufactured by Uralmash NGO Holding, with NOV Kostroma planning to join it in the near future as soon as it has set up the required facilities. Uralmash Holding’s entry into the TDS market has significantly increased the popularity of top drives, especially with a view to using them to augment existing drilling rigs, many of which are products of the same plant. Being an expensive piece of engineering (a TDS could cost up to half as much as the drilling rig itself), imported top drives were unaffordable to many oilfield service organizations, but the expansion of domestic production has had a positive impact on the TDS fleet, which now amounts to more than 400 units (about one-third of the drilling rig fleet). In 2017, the top drive market volume was 75 units (2.7 times the figure for 2007) – 70% of new drilling rigs are purchased complete with a TDS. In monetary terms, the TDS market was estimated at about 6 billion rubles as of 2017.

Improved top drive pricing coupled with their technological advantages will drive a steady growth in the TDS market volume, which by 2022 will reach 100 units and will later be fixed at this level. By 2030, the top drive market will outperform the drilling rig market in volume, as oilfield service contractors continue to install new TDSs on existing rigs.

The key competitors of Russian manufacturers in the top drive market are Chinese companies, as well as Bentek, Drillmec-R, MHWirth, NOV, Canrig, Tesco, and a number of other foreign companies. The leadership distribution in this market is, notably, correlated with the supply of drilling rigs – companies from China equip their drilling machines with top drives of their own production, and so does Uralmash. The remaining demand portion is distributed among the rest of

the players.

The analytical report entitled “Drilling equipment: a comprehensive analysis of the Russian market, key players, outlook until 2030” has been published by RPI. For questions related to this article and the said report, please call: +7 (495) 5025433, +7 (495) 7789332; e-mail: research@rpi-research.com.

www.rpi-consult.ru

Nikita Medvedev. Head of Research and Consulting, RPI

Maxim Nemushkin. Oil and Gas Analyst, RPI