RPI: The Russian Drilling Market in 2017, Market Outlook and Management Challenges

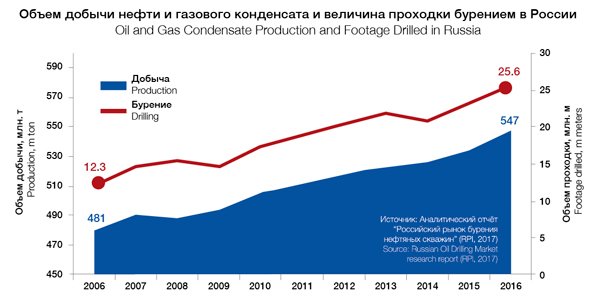

Between 2006-2016 Russia almost doubled the footage drilled, resulting in a significant growth in oil production. During this period the drilling market grew followed by an explosive growth throughout the last two years but this could end in 2017 due to the global agreement to cut production. In the coming years, provided that the production restriction agreement is extended, the drilling growth rate will reduce significantly with sustaining production becoming the key objective. In these circumstances improvements and enhancements in the efficiency of well construction will become a priority, just like the improvement in customer and contractor interactions.

The Drilling Market Outlook

Between 2006-2016 the Russian drilling market had physically grown two fold and reached the historical maximum of 25.6 million meters drilled. That dynamic growth of the footage drilled had fostered the oil and gas condensate production bringing the Russian oil industry to the peak production of 547.5 million tons in 2016 and making it, for several months, the global oil production leader out producing Saudi Arabia.

Under the Vienna Oil Production Restriction Agreement on the 10th December 2016, Russia had undertaken to cut production by 300k barrels per day or by 2.7% versus the October 2016 level.

So, if this agreement is executed throughout 2017, the Russian production can trim down by 0.5% compared to 2016 and reach 545 million tons at the year end. The Ministry of Energy data show that the Russian oil industry fulfills the obligations undertaken and in January-February reduced production by 100k barrels per day with further plans to cut production by 200k barrels per day in March-April.

The oil companies can reduce production in 2017 through combination of the following means:

- production drilling footage reduction: the estimates show that deployment of this approach only may lead to a footage reduction of approximately 20% versus 2016;

- the well interventions reduced by 17% relative to 2016.

The industry statistics show that the production drilling scope started declining in November 2016 completing an almost three-year growth trend. In February 2017 the monthly footage drilled had dropped by 17% below the average of the three-year drilling footage growth trend.

Based on this data an assumption could be made that the Russian oil companies have chosen an approach based primarily on the reduction of production drilling.

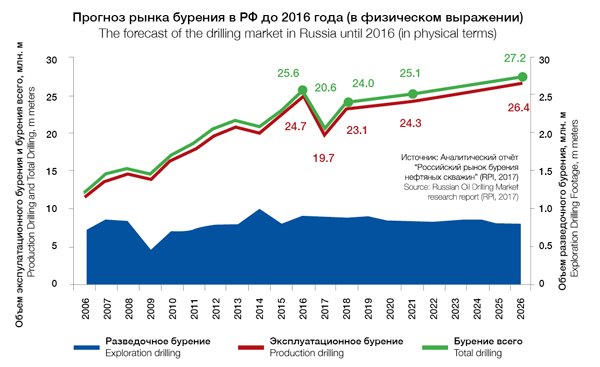

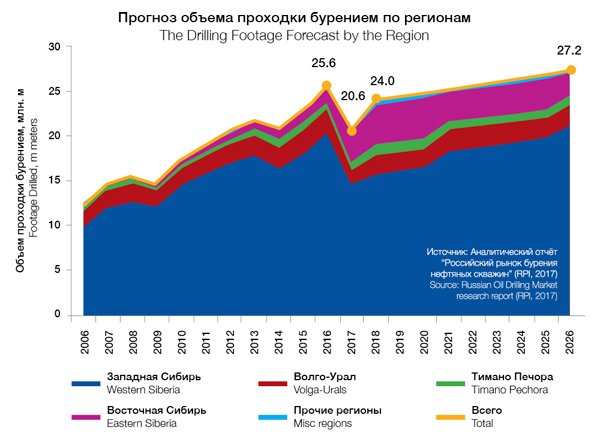

As such, the basic (in current conditions) scenario calls for the reduction in production drilling, in 2017, by 20% to 19.8 million meters with subsequent growth by 23% in 2018-2021. The exploration drilling scope in 2017-2021 is expected to be around 850-900k meters due to the new field development projects in Eastern Siberia as well as the conventional field extensions in Western Siberia. The total footage will shrink from 25.6 to 20.6 million meters with further growth by 2021 to 25.1 million meters and by 2026 to 27.2 million meters.

It should be noted that at the time of writing, the key drilling services customers (Rosneft, Surgutneftegaz, LUKOIL and Gazprom Neft) have either directly or implicitly confirmed their plans to increase the drilling scope in 2017 by 5-10%, being motivated by the necessity to keep up production under the conditions of the declining production rates in the existing fields and the reduction in well intervention.

The factor, which to the great extent will impact the market dynamics in 2017, will be the outcome of the forthcoming meeting in Vienna in May where the future of the production restriction agreement will be decided. If the agreement is not extended the oil production will continue to grow and the footage drilled by the end of 2017 will exceed production of the previous year.

Among the major production regions Western Siberia will take 73-77% (of the total footage drilled) which is due to the conventional field drilling expansion and new field development. Eastern Siberia will also take a significant market share (10-13%).

In case the production restriction agreement is extended, the Russian market would face a substantial correction followed by the period of the moderate drilling footage growth. Consequently the major objective for drilling, in the coming years, would be to maintain production levels which makes the efficiency enhancements in well construction a priority, alongside customer and contractor interactions and interest harmonization.

Therefore, searching for the extra efficiency and improvements within the existing management systems becomes an imperative need. This problem is further complicated by the fact that currently there are several well construction management contracts, co-existing in parallel:

- General contract

- General contract with select services («partial general contract»)

- Integrated services

- Split services

Drilling Management: Priorities

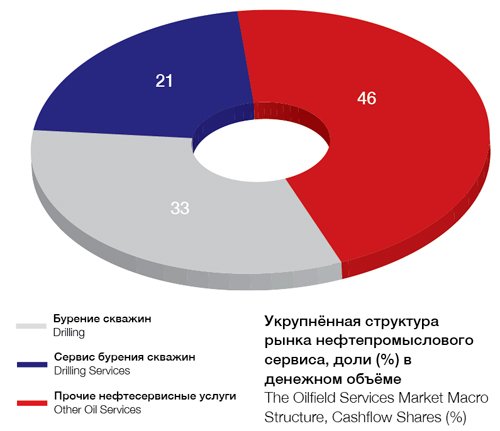

Drilling oil and gas wells is an extremely capital-intensive discipline within capital construction. Listed below is the cost relationship for different types of services related to oil production.

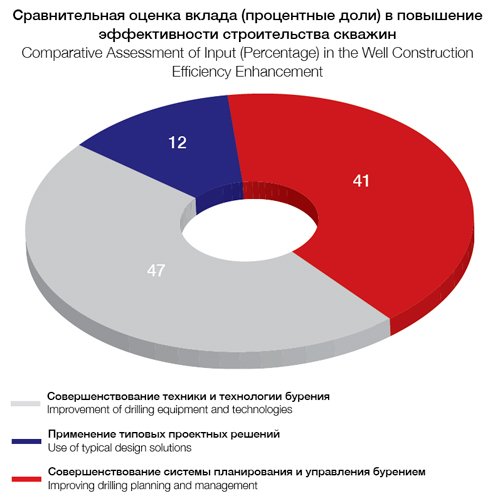

Increasing the efficiency of the resources allocated to well construction programs is one of the key objectives of any oil producer. In practical terms the main ways to achieve this are:

- application of advanced technologies, equipment, materials and chemicals;

- wide application, whenever possible and appropriate, of using proven design solutions which have been justified in practice;

- management systems improving well construction times and costs.

To assess the relative input of each of the mentioned activities we have done our own study by the expert evaluation method. The results are presented below.

According to the experts who participated in this study (representatives of all Russian major oil companies), at the present stage of the Russian drilling industry, the development of business management systems is one of the key ways to enhance the efficiency of drilling operations.

Pricing and Cost Management

Well construction is a part of capital construction. The regulatory framework and feasibility studies are the integral parts of well construction management. They, in turn, require the application of specific tools regulating the time and resources dedicated for the particular types of the work carried out.

Generating an adequate, transparent and credible regulatory framework for construction and workover had recently been discussed, very actively, at different levels. Close attention has been paid to determining the actual cost of a wells construction, which identified: the lack of continuation of the legal and regulatory regulations, outdated methodological systems, isolation of the different types of costs that were evaluated at different stages of the investment and construction cycle, etc., the main directions of the construction pricing reform, the real actions for their implementation, are underway.

The oil and gas companies are keen to control and optimize the well construction and workover capital investment and have recently started to establis permanent construction cost management systems.

Currently there are several approaches to drilling and conducting workover on wells:

- a company has its own resources for drilling and workover – Surgutneftegaz;

- the drilling and workover services are provided by the third parties- LUKOIL;

- combined service provision systems where both the subsidiaries/affiliated companies and outside organizations are engaged in well construction and workover operations- Rosneft.

For each of the described approaches, the well construction and workover pricing system is one of the most important factors determining the business development success.

The present well construction pricing system was developed in 1980’s and does not fully reflect the fundamental operational and procedural changes that have occurred, including the following:

- Well complexity has grown significantly. In particular, the horizontal wellbore length increased significantly and its profile has also become more complex, multilateral wells have appeared, wells with complex bottom hole designs, including multi-zone hydraulic fracturing, are more common now as well.

- Brand new technologies and technical solutions, which have never been used before are being actively introduced.

- Well reliability and production safety requirements are being changed significantly.

The drilling cost determination system applied in the oil and gas industry differs noticeably from the systems established in other branches of the civil and industrial construction where the cost is directly or indirectly regulated by law. In the case of well construction there are no unified approaches to determine the cost. The drilling of oil and gas wells is fundamentally distinguish from other types of the capital construction because of its dependence on the unique geological structure of the fields where the wells are drilled.

Thus, the well drilling pricing system is one of the most challenging parts of the investment process.

The current state of business is characterized by the lack of the modern methodological and regulatory grounds for determining the well construction cost and its lack of monitoring and analysis. The capital expense planning process is conducted by the operators in different ways. Some of them calculate the capital expenses based on the actual or expected drilling contractor (material and service supplier) rates following the approved company development scenarios. Other companies use the price ranges established based on the market average prices and physical scope of the orders. In both cases the basic information is generated outside the company. Essentially, the conditions for planning and, consequently the results, are determined at the counterparty level. That is exactly why such estimates are not viewed as reliable.

The following solutions could help the oil companies in solving their existing investment planning problems:

- Incorporate monitoring systems from company’s own actual well construction costs, split by the work conducted, by well or by the type of service, equipment and materials used;

- modern standards of time and costs associated with well construction with various detail levels.

The aforementioned analysis tool will be addressed by the authors in a separate article dedicated to the subject.

Risk Management in a Customer-Contractor Relations

The major well construction difficulties include (a) the inconsistent objectives and goals (b) different investment objectives between the operators and contractors.

The difference between the objectives of the two parties is due to the customer’s desire to maximize profit (through cost minimization and achieving well targets and standards, including HSE standards and oil recovery factor), at the well production stage. The contractor, in its turn, is keen to make a maximise profit at the well construction stage. This contradiction results in a conflict of interests which necessitates some kind of a compromise in the course of the development and management decision making.

A compromise, meeting the parties’ interests, while ensuring the maximum well construction efficiency is almost unachievable without an adequate risk consideration. The well construction activities cannot, by nature, be risk-free. The risk management is understood as an activity aimed at mitigation of the internal and external conditions impact on the final results, specifically, protection against those conditions, prevention and mitigation of the negative consequences.

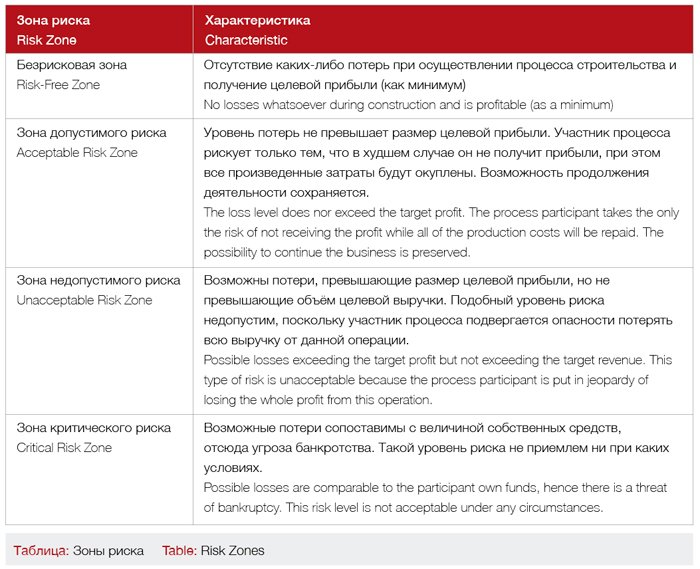

In the Russian well construction practice, the risk is usually understood as an undesirable event occurrence (for example, drilling problems). In the authors’ opinion, to make the risk management an effective management element, it would be reasonable to treat the risk as a threat of the resources loss or shortfall in income (compared to the planned level of with other alternatives). With this approach the risk management main objective, as a minimum, would be to see the company breakeven. The basis for that is a balanced consideration of the company capabilities and potential profit which is achieved by comparison of the positive and negative financial consequences of the decisions made. For risk management it is important to determine the following: what specific risks need to be considered; in what way can they be managed; what volume of risk is acceptable.

An approach widely applied in the banking sector can be used as a coordinates system for the risk management, when the entire risk area is split into four zones in which the probable losses do not exceed a specific level.

Within one transaction the risk zones for different participants can be, and frequently are, different due to the different investment capabilities.

The issue of an optimal combination of the customer and contractor interests in the Russian practice has not so far been adequately addressed and does not have a rigorous scientific coverage. The methods and approaches applied to the investment projects implementation are single-sided and assessed, as a rule, from the position of a customer dictating its terms.

The assessment criteria for the optimal combination of interests in the customer-contractor circuit are scarce. In some of the tender rounds for the contractor selection the service cost is frequently the only criterion. Moreover, no consideration is given to the values of profit received by the customer in the course of the further well operation. Already at the stage of the well design assignment generation, no target values of the following indicators

are set:

- an ultimate well construction return on investment period in the context of oil production within a specific period;

- a maximum permissible well construction period;

- a maximum allowable risk of the complications occurrence;

- a minimum oil recovery factor.

With this approach a well construction project will have

a permissible but not an executive nature. Because of the recent changes to the project state review legislation, the design documentation frequently becomes unclaimed. Approaches to the new well construction design efforts need to be revised: it would be reasonable to generate the design documentation whenever the existing design solutions do not allow for the changes in the well target indicators but not when there is nothing for a new

well tie-in.

The problem of the customer and contractor interest reconciliation can be methodologically solved by simulating a composition structure and generating the contractual relations optimization algorithm based, for instance, on the application of the graphs theory and combinatorial computation methods. This approach had already been successfully applied while executing the investment projects in industrial and civil construction.

Conclusions

1. The situation unfolding around the oil production restriction agreements with OPEC and others (given its possible extension in May 2017) will, to a great extent, will determine the Russian drilling market dynamics.

2. Analysis of the main industrial interfaces and trends shows that the production decline (in accordance with international agreements) is achieved by the operators, through the reduction in production drilling.

3. In accordance with the baseline scenario, after a decrease of approximately 20% from the level of 2016 in the medium term, the growth of drilling operations is expected. The intensity of this growth, however, will be lower in comparison with the previous period.

4. In line with the drilling operations structural changes, significant growth in complex wells, significant cost growth with fracking horizontal wells, the role of the well construction management process, as a main tool for assuring capital investment efficiency, will increase noticeably.

5. The drilling process management systems efficiency enhancement is impossible without the creation of the adequate tools for that management, such as the integrated time and resource consumption standards for the particular operation and entire facilities construction.

6. A reasonable combination of the customer and contractor interests during the well construction is the key factor in drilling efficiency growth. This is only achievable through a proper assessment and allocation of the risks which are inevitable in this business.

Sergei Ananenko, RPI

Victor Gnibidin, Ph.D, Technical Sciences, Samara State Technical University

Sergei Rudnitskiy, RPI

RPI является специализированной консультационной компанией в области ТЭК РФ, стран СНГ, Центральной и Восточной Европы.

Дополнительная информация:

www.rpi-consult.ru,

research@rpi-research.com

или +7 495 778-9332.

RPI is a specialist consulting company covering the fuel and energy industry of the Russian Federation, CIS, Central and Eastern Europe countries.

Additional Information:

www.rpi-consult.ru,

research@rpi-research.com

or +7 495 778-9332.