RPI: Strong Drivers for Well Logging Market

As of 2018, the well logging sector was one of the largest, ranking fifth in monetary terms among all sectors of the Russian oilfield services market. In addition to its significant volume, it is one of the most technologically advanced sectors, as companies already apply and will apply many innovations that are still at the stage of development. The future for this sector is considered optimistic, even bright, as it is supported by strong and reliable drivers, such as drilling, sidetracking, hydraulic fracturing and well workover.

The well logging market includes drilling, hydraulic fracturing, sidetracking and workover operations.

The volume of this market is determined by the integral dynamics of these sectors. Currently, the following types of operations are being carried out within the logging market:

• Analysis of well logs of the near-wellbore region

• Analysis of wells technical state (wellbore, cement column, casing) and location of technological equipment;

• Well testing (pressure, flow rate, fluid composition and properties);

• Reservoir testing (reservoir fluids sampling) and rock sampling.

RPI considered all these factors and conducted market research that has shown that in physical terms, the volume of the well logging market between 2007-2018 grew annually, with the exceptions for the crisis year of 2009 and the last year – 2018. During this period of time, the logging market increased by 78%, from 20,800 operations in 2007 up to 37,200 operations in 2018 (diagram 1).

In 2018, as compared to the previous year, the logging market remained at a comparable level, decreasing by 0.9%. The decrease was mainly caused by the reduction of the number of logging operations in the Volga-Urals region.

In 2018, the majority of logging operations included logging for hydraulic fracturing (14.3 thousand), drilling (10.8 thousand) and workover (8.2 thousand).

The highest growth in 2018 as compared to the previous year was demonstrated by the workover logging segment (+1451 operations), while the largest decrease was demonstrated by the hydraulic fracturing sector (-1145 operations).

Analysis over a longer period shows that starting from 2007 the share of the logging sector for hydraulic fracturing has decreased by 6%, while the share of workover logging has increased by 5% and sidetracking logging has increased by 2%. Other logging area decreased by 1%.

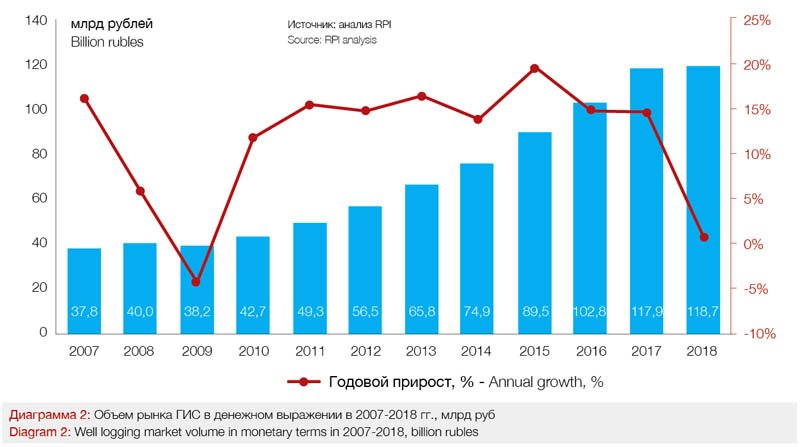

In money terms in 2007-2018 the well logging market volume has tripled, from 37.8 billion rubles up to 118.7 billion rubles (diagram 2). However, in 2018 the market growth rate decreased to the level of 1%, which is the lowest level since 2010.

As for individual sectors, logging while drilling demonstrated the largest share in monetary terms in 2018 – 67%. Workover logging demonstrated the highest market growth in monetary terms in 2018 – 1.6 billion rubles with overall sector reduction by 0.9 billion rubles.

The Market was Supported by Drivers

As previously mentioned, the logging market depends on such drivers as drilling, fracturing, sidetracking and workover.

The change in the number of operations for the commissioning of production wells in the 2007-2017 period is generally consistent with the drilling volume during this period. In 2007-2017 the number of newly commissioned production wells increased by 89%. During this period the reduction of the volume of logging while drilling operations has been observed twice – in 2009 and 2014 crisis years. The reason for the reduction in the number of newly commissioned production wells was a slowdown in investment activity.

In 2015, despite the ongoing crisis, growth in the number of production wells resumed – companies were forced to increase their drilling volume in order to prevent a possible drop in oil production.

After three years of increases in the overall rate of penetration by more than 10% per year, this volume growth has stopped 2018. This is due to the rising trend for drilling more efficient horizontal wells and a corresponding decrease in the volume of commissioning of directional wells. The logging for production drilling sector experienced the same pattern. For example, in 2018 the volume of this sector decreased by 3%.

The share for the logging for exploration drilling sector was significantly less than logging for production drilling (3% in 2018) due to the smaller number of wells of this type.

The growth of logging for fracturing operations in 2007-2014 was due to the increase in the number of fracturing operations in both new and producing wells. This proved to be the result of the following trends.

The number of hydraulic fracturing operations in new wells increased due to the positive dynamics of production wells commissioning and the increase in the share of new wells in which hydraulic fracturing was performed. In 2014-2015 this share was within the range of 70-80% in most companies.

In 2015-2017 the rate of the growth in the number of operations significantly decreased due to the steady decrease in the number of candidate wells for re-fracturing and the increase in the number of horizontal wells with more expensive multi-stage fracturing technology.

2018, in contrast to the 2006-2017 years, saw the upward trend for the increase in the number of fracturing operations changed to a downward trend. The key factor affecting the market dynamics was the reduction of the number of single-stage hydraulic fracturing operations in both producing and new wells, as a result of the greater diversification of vertically integrated oil companies demands for multistage fracturing.

As a result, during the 2007-2014 period, the number of logging operations for hydraulic fracturing increased by 64% from 9.5 thousand in 2007 to 15.6 thousand in 2014. In 2015-2016 there was a slight reduction in the number of operations. More favorable economic environment in 2017 supported the growth of this market by 4% in physical terms. In 2018 due to the above-mentioned reasons the number of logging operations for hydraulic fracturing decreased by 7% and amounted to 14.3 thousand.

The annual rate of change in the number of logging operations for sidetracking in the 2007-2013 period increased from 2% in 2009 to 21% in 2013, except for 2012, which saw a year of short-term reductions in the growth rate up to 5%.

Due to the fact that sidetracking is the most expensive method of enhanced oil recovery in producing wells, depreciation of the ruble and oil prices led to a significant reduction in the growth rate of the number of logging operations for sidetracking during 2014-2016. However, in the next year, 2017, stabilization of the economic environment led to a significant increase in the growth rate to 10.5%. In 2018, for the first time from 2009, there was a decrease in the number of operations – by 2% as compared to last year.

The increase in the number of workover logging operations in 2007-2018 was due to the steady increase in the number of workover operations in this time period. Workover operations have become an effective method of maintaining the wells in working condition.

The workover market growth was due to the increase in the number of production wells and the frequency of workover operations. As a result, the number of workover logging operations in the 2007-2018 period increased by 134% from 3.5 thousand in 2007 to 8.1 thousand in 2018.

The types of workover logging operations in 2007 have not changed significantly. The main scope of work (68%) was for operations focused on recording and analyzing well logs.

The number of other logging operations (in particular, logging for enhanced oil recovery) in 2015-2018 remained at approximately the same level, not exceeding 500 operations per year.

Customers and Contractors

During the period 2007-2018, leading companies for the number of logging operations were (see diagram 3):

• Rosneft (35% in 2018);

• Surgutneftegaz (21%);

• LUKOIL (14%),

This is due to a large number of drilling, workover and fracturing operations within these companies. In 2018 Rosneft´s share has reached 35% (taking into account the acquisition of «Bashneft» the actual share was 39%), which is a significant increase compared to 2007, when the company’s share reached 17%. This is a non-systematic growth caused by Rosneft`s acquisition of TNK-BP in 2013. Mergers and acquisitions in last five years have made Rosneft the undisputed leader in the number of logging operations. The shares of the other companies have not changed significantly during this period.

Between 2007-2018 the top three leaders in the logging market for production drilling were Rosneft, Surgutneftegaz and LUKOIL. Companies balance in the logging market for production drilling is fully consistent with market shares in production drilling segment.

During the 2007-2014 period Surgutneftegaz was a leader in the logging market for exploration drilling. This is due to a large number of newly commissioned exploration wells. In 2015, the leading position was taken by LUKOIL that drastically increased the volume of exploratory drilling after the company had faced the prospect of production decline. In 2017 the leading position was taken by Rosneft that maintained this position in 2018.

In 2007-2018 the largest number of logging operations for fracturing was performed by Rosneft (32% in 2018), Surgutneftegaz (21%) and LUKOIL (12%). In 2013-2018 Tatneft significantly increased the number of these operations by increasing the number of newly commissioned production wells and fracturing operations. As a result, Tatneft share in 2018 reached 11%. In 2007-2018 the top three leaders in the logging market for sidetracking were Rosneft, Surgutneftegaz and LUKOIL.

These companies had a large number of mature wells in Western Siberia and the Volga-Urals. Sidetracking was used for increasing the production rate in old wells. In particular, in 2018, 69% of all logging operations for sidetracking were performed by these companies.

In 2007-2018 the largest number of workover logging operations was also performed by Rosneft, Surgutneftegaz and LUKOIL.

These companies had a large number of production wells, some of which have been in operation for a long time. These wells require frequent and complex workover operations, for example, remedial operations or emergency response operations. As a result, these companies performed a large number of workover logging operations.

In 2007-2018 the undisputed leader for all other logging operations was Surgutneftegaz (38% of all operations in 2017). Top three leaders in 2018 also included LUKOIL (21%) and Rosneft (20%).

Contractors balance in the logging market last year was as follows. Leading positions among major contractors with the largest volume of logging services (see diagram 4 – the share of major Russian companies is presented integrally):

• Schlumberger;

• Gazprom Georesurs;

• TNG Group;

• Surgutneftegeofizika;

• Bashneftegeofizika;

• Rosgeologiya;

• Kogalymneftegeofizika;

• Gazpromneft-Noyabrskneftegeofizika.

In 2018, the total market share of these companies reached 81% in monetary terms.

In 2018, the price pressure of oil and gas companies on logging contractors remained at the same level. The increase in the number of operations in physical terms and reduced revenues, forced a number of companies to use low pricing to get contracts, which led to the elimination of funding for some logging research and development projects.

Despite the fact that in 2018 Schlumberger remained first placed in the logging market (25%), the company lost 2% compared to the previous year. The Russian market leaders remained unchanged: Gazprom-Georesurs, TNG-Group, Surgutneftegeofizika, Bashneftegeofizika and Rosgeologiya.

Further weakening of foreign companies and, consequently, strengthening of domestic companies can be considered a positive trend in the Russian logging market.

The efficiency of logging companies depends not only on the amount of operations performed, but also on the number of crews working in the company. Bashneftegeofizika and Surgutneftegeofizika demonstrated the highest numbers in 2018 with 150-250 crews were involved in 25 – 30 thousand operations.

Future Outlook

The following indicators were taken into account when forecasting the logging market volume:

• forecast of oil production volumes for 2018-2030;

• companies’ announced plans for field development and drilling;

• profile of well production decline at mature fields;

• companies’ announced plans for well workovers;

• dynamics of operations in hydraulic fracturing, sidetracking and optimization of well operation modes as well as total and specific operational effects;

• the impact of sanctions on the technological equipment of service companies and the financial condition of logging customers.

The forecasted information on logging operations in all market sectors presented in this paper is based on oil companies’ data, estimates by market experts’ and RPI internal specialists’ calculations.

At present, the number of logging operations is most strongly influenced by the following factors:

• changes in drilling operations, primarily production drilling;

• changes in the number of hydraulic fracturing operations in both new and producing wells;

• changes in the number of sidetracking operations;

• changes in the number of workover operations.

In the last few years these factors have been developing irregularly (especially for production drilling, hydraulic fracturing and sidetracking operations). These trends are expected to remain the same in the near future.

In addition to the above-mentioned factors, the logging market will be significantly affected by a number of production and technological trends, as well as possible future tax incentives.

Currently, the well logging sector is growing largely due to the introduction of new technological solutions and related equipment in the research process. These solutions include the following technologies:

• monitoring and production systems without reservoirs separation;

• bypass monitoring systems for simultaneous production from multiple reservoirs;

• monitoring and production systems with reservoirs separation;

• remote mapping of reservoir boundaries during drilling – PeriScope;

• NeoScope technology;

• software optimization.

The possibility of integrating these technologies into daily practice has been taken into account when making the forecast.

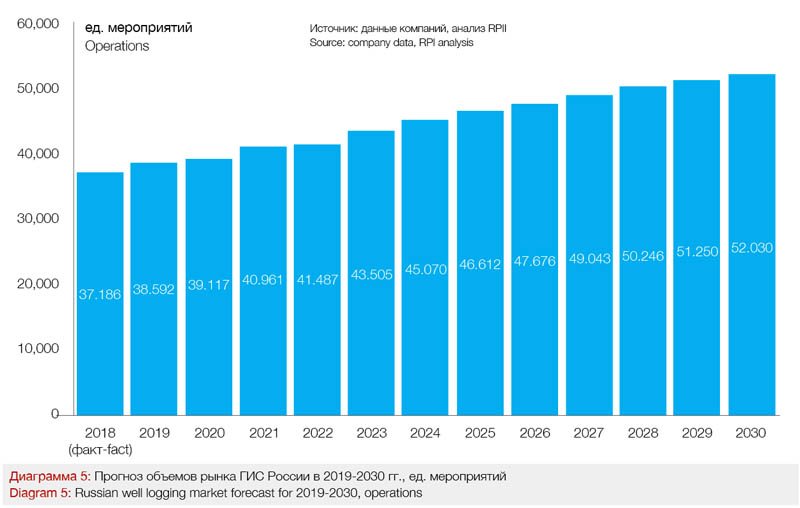

The forecast showed that in the years between 2019-2030 the total number of logging operations in Russia will increase by 40% in physical terms – from 37 thousand in 2018 up to 52 thousand in 2030 (diagram 5).

The total growth of the logging market will amount to 14,844 operations. 7,104 (47%) operations will be in Western Siberia and 6,988 (47%) in Eastern Siberia.

In 2019 – 2023 the development of the oilfield services market in general and the logging segment in particular is expected to be progressive thus supporting the previous trends. This will be primarily due to consecutive plans for drilling and commissioning of fields in Eastern Siberia.

The contribution of other regions to the overall growth will be less than 5%. The depletion of Volga-Ural reserves will lead to a decrease in the number of operations in that region and, as a result, to a downward trend of the logging segment at the end of the forecast period by 0.5% as compared to the current period. By 2030, the share of Western Siberia will decrease by 6% while the share of Eastern Siberia will increase by 12% due to the start of fast development of the fields in the region.

It is expected that all logging segments will grow, except for logging for hydraulic fracturing segment which will be reduced by 1,727 operations, which is 12% of the total volume of the segment in 2018.

By 2030, the logging market structure in terms of individual segments will become more uniform. The main growth in the market segments share will be for logging while drilling (4%) and workover logging (9%).

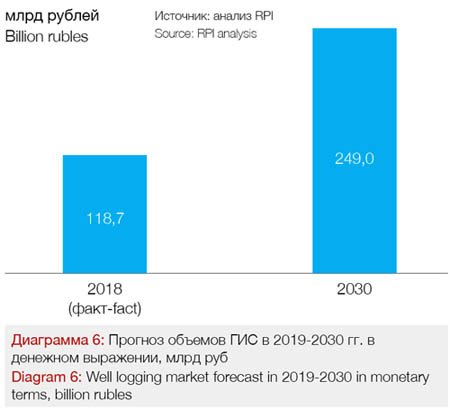

During the 2018-2030 period the number of logging operations in the country will increase by 40%, but in the same period the volume of Russian logging market in monetary terms in current prices will increase by 110% – 130.4 billion rubles (diagram 6). This sharp growth of the market volume in monetary terms in comparison with the market dynamics in physical terms is explained by the growth of price for operations due to increased technological complexity and inflationary processes in the country.

By 2030, Western Siberia will have the largest share in monetary terms among oil production regions – 60%, Eastern Siberia will have 22%.

It is these two regions that will contribute the most to the growth of the logging market in monetary terms by 2030: with 64.5 and 47.7 billion rubles, respectively.

In terms of individual segments, the largest share in monetary terms by 2030 will be occupied by the logging while drilling segment – 71%. This segment will ensure the highest growth of the logging market in monetary terms by 2030 – by 98.6 billion USD. The growth of other segments will be significantly lower.

Analytical report «Russian Well Logging Market» is released by RPI. For questions related to the article and the report, please contact us:

phone: +7 (495) 5025433, +7 (495)7789332,

e-mail: research@rpi-research.com.

Author: Vadim Kravets, lead analyst of RPI Research&Consulting