RPI: Taymyr Will Support the Drillers

In early February this year, at a meeting between the President of the Russian Federation and the Head of Rosneft, the implementation of the largest production project in decades was launched – the development of hydrocarbon reserves of the Taymyr Peninsula in synergy with the fields of the Vankor cluster. The planned production volume of this project is about 26 million tons of oil per year with an opportunity to reach 50 million tons. Together with other large and medium-sized fields the Taymyr-Vankor project will prevent a significant drop in annual production of oil and condensate in Russia in the period up to 2030, and possibly increase this volume by 10-15% compared to current levels.

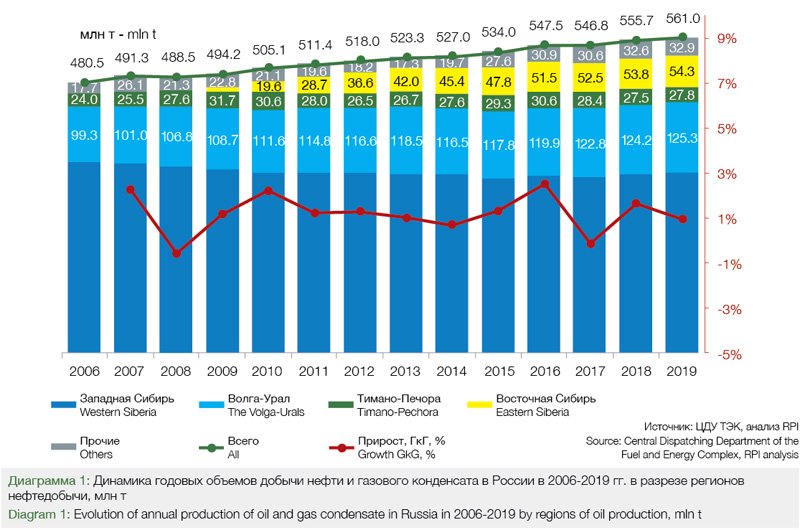

Last year, contrary to pessimistic forecasts, the annual production of oil and condensate in Russia not only did not decrease, but in fact it showed an increase. According to official data, production increased by almost 1% as compared to the previous year, up 561 million tons (see Fig. 1).

The positive trend has prevailed despite adverse factors such as the continued depletion of mature conventional fields and the production cut as a result of the OPEC+ agreement.

The production decline in depleted mature fields will continue for the foreseeable future. It can only be partially neutralized: by increasing development drilling volumes at these fields, drilling sidetracks and introducing more and more technologically advanced oil recovery enhancement and production intensification methods. All this has been performed in recent years.

The situation is a bit more complicated with the OPEC+ agreement. On the one hand, it limits production, but on the other hand, its termination may lead to a drop in oil prices and, consequently, to a drop in revenues for Russian oil companies.

In early December last year, the countries that are participates of the oil production limitation agreement agreed on new production cut levels, which are valid in the first quarter of 2020. OPEC and non-OPEC producers committed to reduce their average daily production by another 503 thousand barrels per day (bpd) above the current levels.

The production cut level of Russia increased by 70 thousand bpd since January to 298 thousand bpd and does not include gas condensate from 1 January 2020. As of mid-February 2020, it was announced that the OPEC+ Technical Committee recommended that consideration be given to extending the current oil production cut level until the end of 2020. At the same time, Russia has not yet decided to extend its participation in the OPEC+ agreement. As this issue went to print the OPEC+ agreement collapsed as Saudi Arabia and Russia failed to agree an extension. Saudi Arabia ramped up to maximum production to flood the market and gain share during the Covid-19 pandemic.

To date this has collapsed prices to 30USD a barrel.

Thus, the question of what will be the trend of production in the future remains unclear.

New Fields Can Support Production

As our analysis shows, the evolution of Russia’s production in the coming years will be determined to a large extent by the development of new onshore fields, including hard-to-recover reserves, as well as production in the Russian shelf.

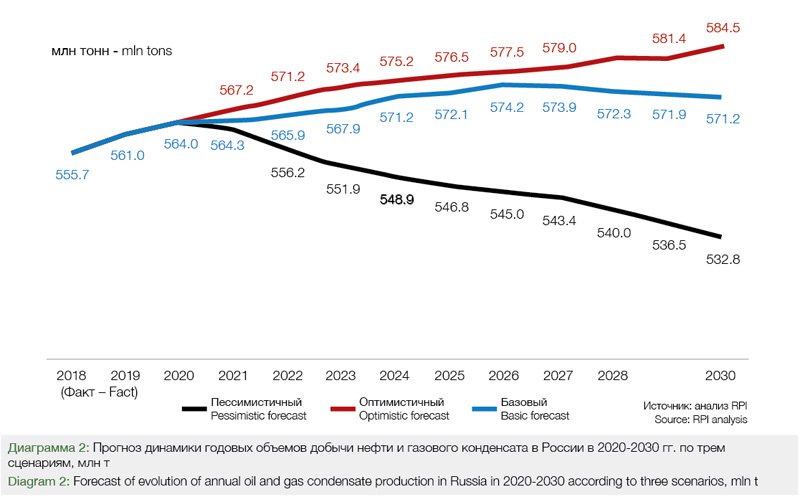

When predicting investments in fields that include well drilling, RPI identified three scenarios for the Russian oil industry: pessimistic, basic and optimistic (see Figure 2).

The pessimistic scenario assumes that the sanctions imposed on the oil and gas industry will be extended and even toughened. Foreign companies, including international majors, are leaving the oilfield services market, as well as Chinese companies. Equipment import substitution projects are not successful.

The basic scenario assumes that sanctions are maintained at the current level. Foreign companies strengthen their positions in the market, implementation of projects on import substitution of equipment is within the announced deadlines.

The optimistic scenario assumes that sanctions will be eased in about three-five years, the import substitution process will accelerate, and the global demand for oil will increase significantly.

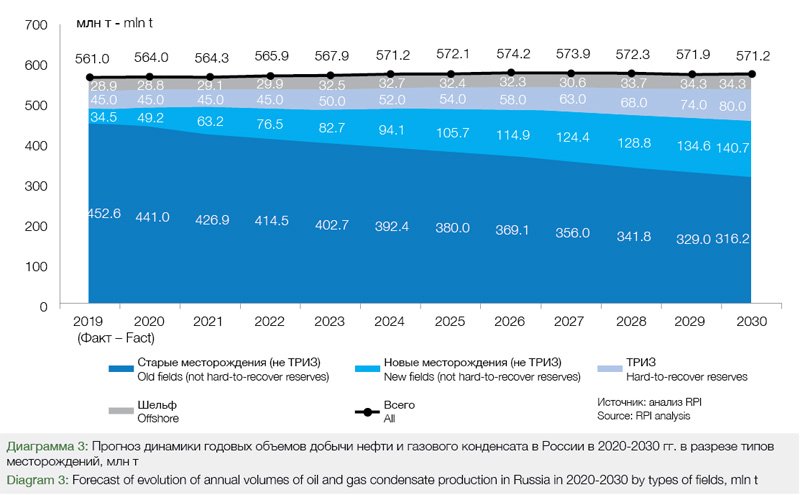

Figure 3 shows the basic forecast of drilling volumes for four groups of fields, which are brought into commercial development in different periods of time:

• old fields (commissioned before 2014);

• new fields (commissioned and to be commissioned in 2014-2030);

• hard-to-recover reserves;

• offshore fields.

This chart shows that new fields together can provide about 141 million tons per year by 2030. Even if there is a sharp slowdown in the implementation of offshore production projects (due to low world oil prices and sanctions restrictions), after 2026 the decline in Russian oil production will be contained, which will keep it at approximately 571 million tons per year in 2030.

In practice, the introduction of new fields is not always smooth. Thus, during 2014-2019, two factors had the greatest impact on the rate of commissioning of new fields:

• evolution of world oil prices;

• OPEC+ agreement on production cuts, that was signed by Russia and first entered into force in early 2017.

Russia’s participation in the OPEC+ agreement combined with low oil prices as compared to 2014 caused a slowdown in the rate of commissioning of new fields. For example, the commissioning of Rosneft’s Russkoe field was postponed from 2017 to the fourth quarter of 2018, while the planned commissioning of the Taas-Yuryakhskoye, Kuyumbinskoye and Tagulskoye fields was also postponed from 2016 to the fourth quarter of 2018.

The two factors mentioned above also had a strong impact on the pace of development of the Russian offshore fields, primarily the Arctic fields – in some cases, offshore operations at some license areas were placed on hold or postponed for several years.

In recent years, the above-mentioned factors that affect the rate of commissioning of new fields have been supplemented by the third factor- the depletion of old fields in conventional Russian oil production regions. On the contrary, in some cases it stimulated companies to accelerate the rate of fields commissioning. This has happened, for example, to the Imilorskoye field of LUKOIL and is currently happening with the commissioning of the Erginskoye field by Rosneft.

However, despite all the difficulties encountered during developing new onshore fields, Russian oil and gas companies do not freeze the development. The companies adjust investment programs to focus on strategically important locations.

Geography of New Fields

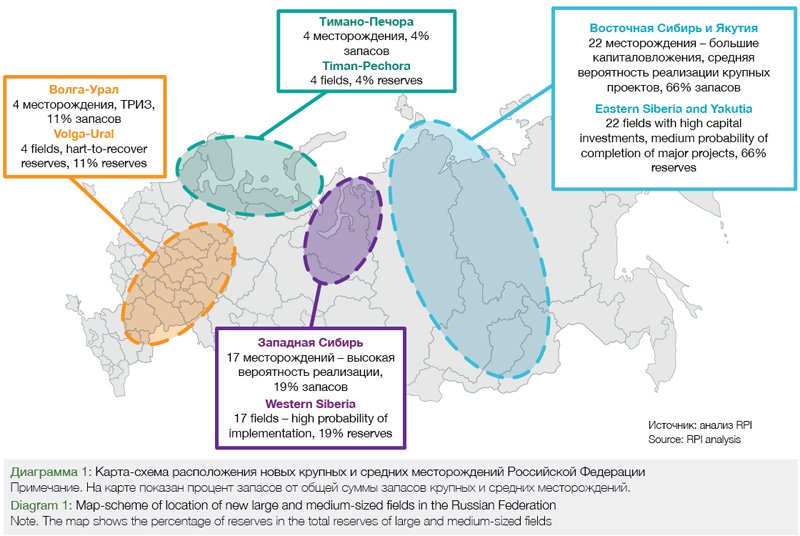

The analysis shows the following geography of the new large and medium-sized onshore fields that could be brought into commercial development between now and 2030 (see figure 4):

• Eastern Siberia and Yakutia – 22 fields with high capital investments;

• Western Siberia: 17 fields;

• Volga-Ural – 4 fields;

• Timano-Pechora – 4 fields.

The largest number of fields is in Eastern Siberia, primarily in Evenkia and the Taymyr Peninsula (East-Oil project). These fields require significant capital investments and some fields in Evenkia have not yet been explored.

Fields in the southern part of the Yamal Peninsula have a high probability of development projects. These fields are compactly located and do not require significant construction costs for transport infrastructure. All of these fields are included in Gazprom Group’s Yamal megaproject.

The new fields have specific features. Reserves of these fields are 42% hard-to-recover reserves, particularly the large Velikoye field in the Volga-Urals and the fields included in the Payakh project. The oil from the Velikoye field is highly viscous and some of the fields in the Payakh project have low permeability reservoirs.

Calculations based on open data from the producing companies show that in 2020-2026 mainly 4-6 fields will be put into commercial operation annually, with a subsequent decrease of this figure to one or two fields per year in 2027-2030.

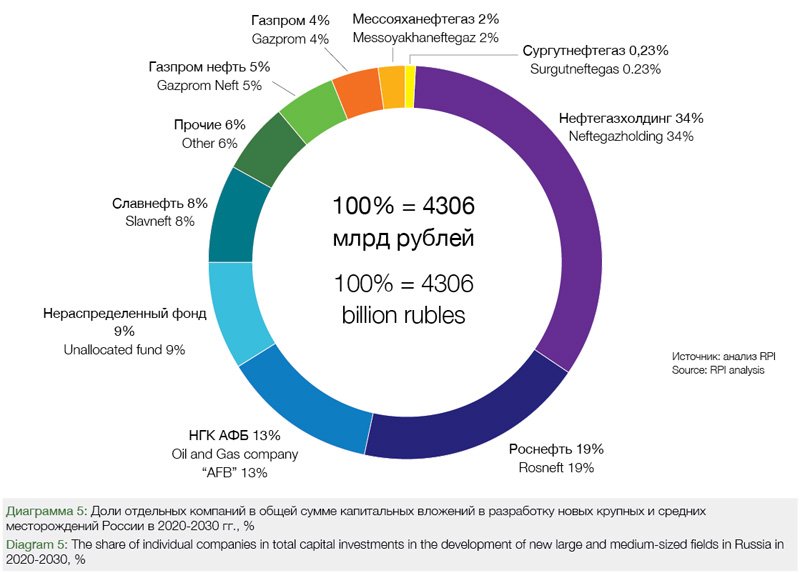

In total, capital investments in the development of these fields will exceed 4.3 trillion rubles, and more than half of this amount of investments will be spent on well construction.

According to RPI forecasts, the largest capital investments in field development will be made by (see Fig. 5):

• Neftegazholding (34%);

• Rosneft (19%);

• Oil and Gas company «AFB» (13%).

In total, these companies will account for 66% of all capital investments in the development of large and medium-sized oil and gas fields in Russia. At the same time, most of the investments of Rosneft and Neftegazholding will be made as part of the joint project «Vostok Oil».

A large share of Neftegazholding is due to the implementation of the Piakh project on the Taymyr Peninsula, where the company’s current estimate of total recoverable reserves reaches 1.2 billion tons of oil. In addition to the Vostok Oil fields, a significant share of Rosneft is determined by its cost projects in Evenkia and Irkutsk regions.

The presence of oil and gas company «AFB» in the top three is explained by the development of its large field Velikoye in the Astrakhan region. The recoverable reserves of this field are classified as hard-to-recover reserves. The company may be sold to vertically integrated company, which has more financial resources than the current license holder. The previous two attempts to sell AFB, first to LUKOIL and then to Gazprom Neft, were unsuccessful.

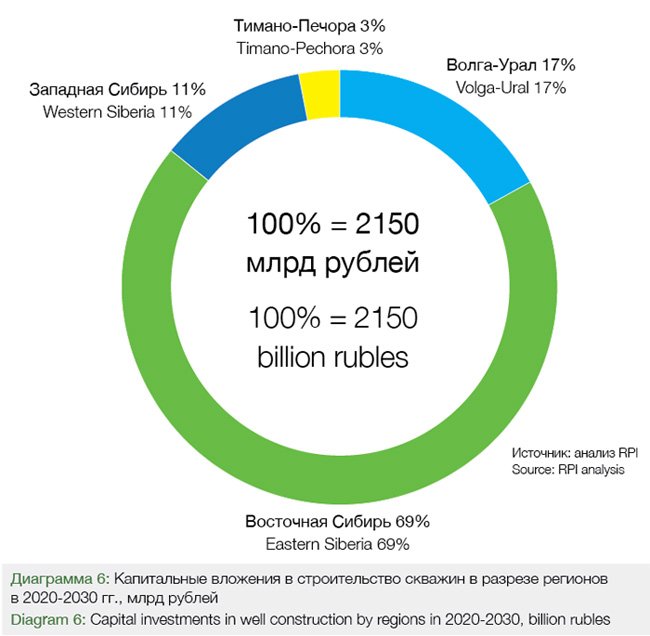

In the regional perspective, about 72% of capital investments in the development of large and medium-sized fields will be made in Eastern Siberia, where projects are planned for the Taymyr Peninsula, Evenkia, and Irkutsk Oblast.

The total share of the other three regions – Western Siberia, the Volga-Urals and Timan-Pechora – will not exceed 28%, as there are very few large and medium fields left to be commissioned there (except for the Yamal Peninsula).

Well construction accounts for up to 50% of the total capital expenditures. As a result, the distribution of companies’ shares in total well construction investments is qualitatively similar to the companies` shares in total capital investments. The three leaders are as follows:

• Neftegazholding – 32%;

• Rosneft – 18%;

• Oil and Gas company «AFB» – 15%.

Eastern Siberia, primarily Evenkia, the Taymyr Peninsula and the Irkutsk Region, will account for about 69% of the total well construction capital investment. The reason is the same – the Payakh project, the Evenkia and Irkutsk region fields (see Figure 6).

Project of The Century

Vostok Oil project is the largest and most strategically important among all new fields. It is named after the management company Vostok Oil LLC, which was established in 2019 by renaming OVIT LLC.

This company will manage: the Payakhskoye oilfield (Neftegazholding), the Vankorskoye, Suzunskoye, Tagulskoye and Lodochnoye fields already under development (all these fields belong to the Vankor cluster) and not yet commissioned Rosneft fields located in the Taymyr Peninsula. A joint venture between Rosneft and BP «Ermak Neftegaz» may be added to this list. Rosneft’s head Igor Sechin estimates that the total oil reserves of the Vostok Oil project may reach 5 billion tons.

The full implementation of the project, which will last beyond 2030, will require investments of about 10 trillion rubles, with investments of at least 2.2 trillion rubles until 2030. The launch date of the first fields in the project is 2024.

It is planned to attract foreign investors in the project – companies from India and Southeast Asia. The share of these companies in the project is expected to be within 20%.

Back in the autumn of 2019, Eduard Khudainatov, the head of Neftegazholding, appealed to the Russian government to provide the Payah project with tax benefits for the payment of Mineral Extraction Tax, exemption from land tax and estate tax, which are estimated at 250 billion rubles per year. As of mid-February this year, no government response had been received.

The full implementation of the project requires the construction of about 6 thousand wells with capital investments of at least 5 trillion rubles. As RPI analysis showed, approximately 2,000 of these wells will be drilled in the Payyakhskoye oil field and the North Payyakhskoye license area in the period 2024-2030. Technology wise, about 90% of the producing wells at the fields of the Vankor cluster included in the «Vostok Oil» project will be horizontal or multilaterals. Construction of these wells will be accompanied by an increasing number of multistage hydraulic fracturing operations with the number of stages exceeding 10.

In addition, in terms of Vostok Oil project it is planned to construct:

• 15 industrial camps;

• two airfields;

• an offshore terminal with a transshipment volume of up to 100 million tons per year;

• 800 kilometers of main pipelines and about 7,000 kilometers of infield pipelines;

• 3,500 kilometers of electricity networks and 2,000 megawatts of power generation facilities.

Crude oil is expected to be transported by tankers along the Northern Sea Route both eastward and westward.

Technological Trends

New drilling technologies will be widely used at new fields, including the Vostok Oil mega-project.

One of the main technological trends will be a continued growth of the average length of horizontal well sections. This indicator increased back in 2010-2019. In 2010, when Russia started a dynamic growth of horizontal drilling volumes, the average horizontal section length was approximately 300m. During 2010-2018, this parameter reached 850m for onshore wells. Currently, it reaches 1000m in Evenkia wells. According to industry experts, in the next five to seven years, the average length of horizontal sections in onshore wells will reach about 1300m. By 2030, it may increase to 1700m.

The second trend, which continued in 2019, was the increasing use of multistage fracturing in horizontal well construction. The feature of multistage operations is a constant increase in the technological complexity, which is reflected, first of all, in the number of stages performed. Last year, the weighted average number of fracturing stages was approximately six. At the same time, the average number of fracturing stages in horizontal wells and sidetrack operations differed: about seven stages per operation – in horizontal wells, and about three stages – in sidetracks. There were some cases of 20 stages of multistage hydraulic fracturing performed. For example, such operations were carried out one time by Rosneft and Gazprom Neft. In 2020-2030 perspective, multistage hydraulic fracturing with 18-20 stages will be a standard operation for development of shale oil deposits and sediments of the Bazhenov formation.

It can be predicted with a high degree of probability that development of new fields will reveal already relevant managerial challenges and trends on the drilling market, namely:

• gradual transition from the general contracting model of project implementation to separate services and invoice calculations at daily rates;

• the dominating role of the price component in the contractor selection and order placement by operators;

• price dumping by individual contractors as a guarantee of victory (and a way to survive) in the competitive struggle;

• increased competition among drilling/ well intervention service contractors;

• reduced investment for upgrading contractors` own drilling rigs, threatening to create a shortage of rigs;

• attraction of cheaper personnel from the former Soviet republics by contractors and, as a result, a decrease in the quality of work performed due to the low level of qualification of the specialists involved;

• other negative consequences of attracting cheaper personnel from abroad: imbalance in the labor market, decrease in wages, increase in occupational injuries;

• large gap between the speed and mobility indicators of Russian companies in the process of rigging-down and transportation of drilling rigs, and similar indicators of leading industry companies in the international market;

• transition to modular drilling rigs, as the most effective way to reduce the time required to rig down and transport drilling rigs.

All the above-mentioned technological trends and challenges will be especially strong in the development of new fields and should be taken into account by oilfield service contractors when entering new promising drilling markets.

The analytical report «Russian Oil Production Forecast 2030: Evolution, Infrastructure, Investments, Technologies» is issued by RPI. For questions related to the article and report, please contact: +7(495) 5025433, +7(495)7789332,

e-mail: research@rpi-research.com.

Author

Vadim Kravets, Lead Analyst at RPI Research&Consulting