Russian Offshore: Promising Oil & Gas Exploration Areas

Despite the accelerating technological developments enabling the use of various alternative energy sources, the world is currently facing an increased demand for hydrocarbon (HC) supplies [1, 2], hence the need for reserve replacement. This is certainly possible in Russia over the next two to four decades (2020–2060s) [3], but only by leveraging the efficiency of HC resource development in onshore as well as offshore areas, primarily in the most promising Arctic and Far-Eastern waters [4, 5].

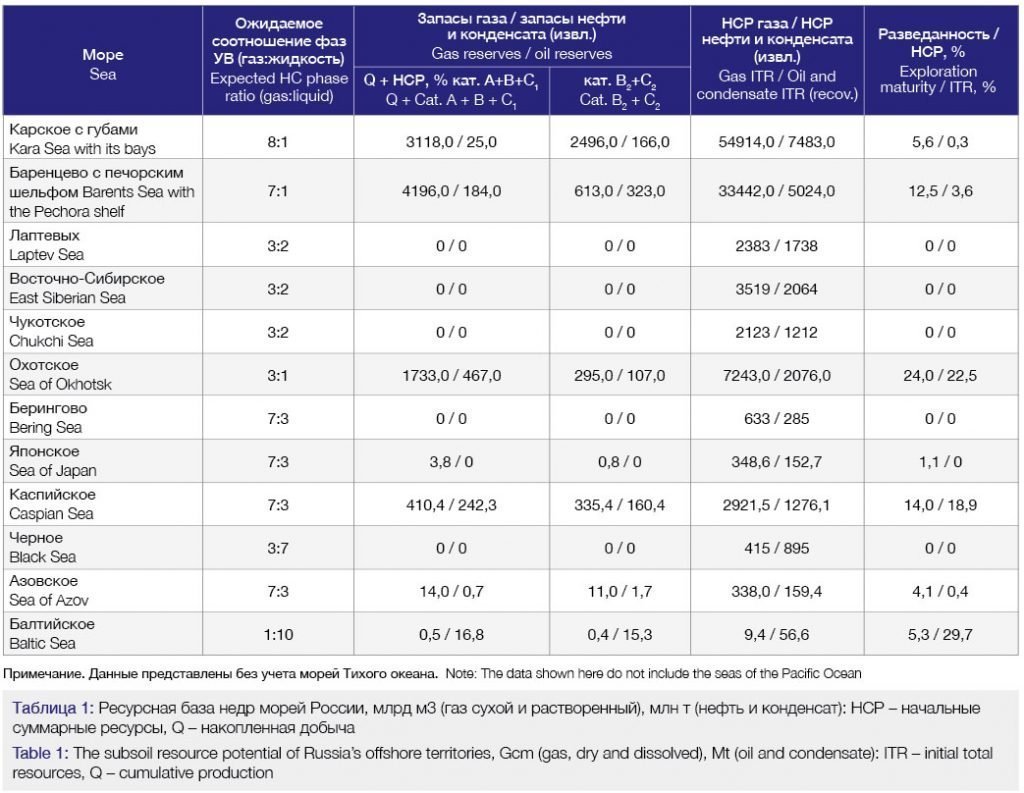

According to the updated results of HC resources performed in 2012, it was established that the natural gas, condensate, oil, and dissolved gas reserves concentrated along the continental shelf of Russia amount to more than 122 GtC1 (recoverable) (Table 1).

The HC resources found in offshore areas, except for those located in the Baltic Sea and, possibly, the Black Sea, are predominantly gas. At present, Gazprom PJSC controls offshore license blocks (LB) located on and off the shelf of the Barents (including Pechora shelf), Kara (including the Gulf of Ob and the Taz Estuary), Okhotsk, East Siberian, Caspian, and Azov seas. As of September 1, 2017, Gazprom Group holds licenses for 41 blocks, out of which:

• 26 blocks were registered directly under Gazprom PJSC, including 7 in the Barents Sea; 13 in the Kara Sea; 2 in the Taz Estuary, and 4 on the shelf of Sakhalin in the Sea of Okhotsk;

• 6 blocks were registered under subsidiaries (wholly owned companies) of Gazprom PJSC, including five in the Gulf of Ob and the Taz Estuary – Severo-Kamennomysskiy, Kamennomysskoye-more, Chugoryakhinskiy, Obskiy, Semakovskiy (Gazprom Dobycha Yamburg LLC, the last one of the five currently belonging to RusGazAlyans LLC) – plus the Beysugskiy block in the Sea of Azov (Gazprom Dobycha Krasnodar LLC);

• 6 blocks belong to Gazprom Neft PJSC, including the Kheysovskiy block in the Barents Sea (Gazpromneft-Sakhalin LLC), Severo-Zapadnyy block on the Pechora shelf, and two more blocks in the Dolginskoye and Prirazlomnoye fields, namely, the Ayashskiy block in the Sea of Okhotsk on the shelf of Sakhalin and the Severo-Vrangelevskiy block in the East Siberian Sea (Gazpromneft-Sakhalin LLC);

• 3 blocks belong to joint ventures in which Gazprom PJSC participates: the Tsentralnyy block in the Caspian Sea as well as the Piltun-Astokhskiy and Lunskiy blocks (Project Sakhalin-2).

Considering the geography of the fields, the newly identified structures with good prospects of hydrocarbons, and both the on/offshore infrastructure being developed for tapping into the HC potential of the emerging offshore gas and oil hubs in the XXI century – it makes sense to group the LBs, HC fields and gas-and-oil-promising structures found within their boundaries into ‘clusters´. These will serve as a practical framework not only for optimizing further advancements in prospecting and exploration operations (P&E), but also for launching new projects within the oil and gas processing sector aimed at shortening the lead times taken to prepare the field for the development of known reserves. In the harsh climatic conditions of the Arctic, such clusters will help diversify the economy and achieve a multiplier effect for the development of infrastructure within the Arctic and Far Eastern regions [6].

The Norilsk and Sakhalin clusters are two examples of such cluster building projects. Among other things, they promise a 10–15% reduction in capital and operating expenses and a 5–10% increase in ultimate oil recovery [7]. Also, there is a need for improving coordination among the investment projects deployed in the Arctic to boost spending efficiency and achieve a multiplier effect.

Barents Sea Region

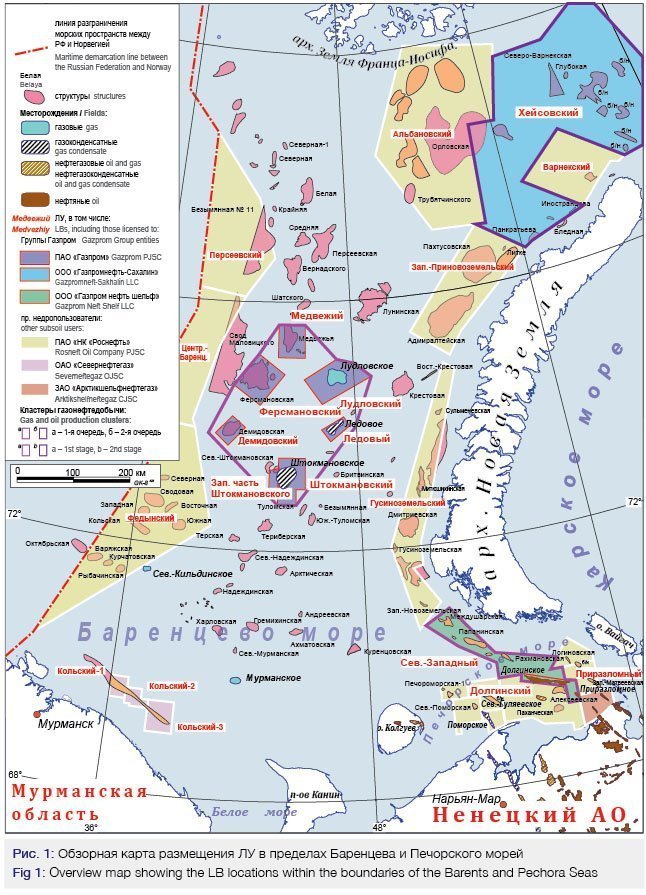

As of July 1, 2018, Gazprom PJSC holds licenses for 11 LBs located on the Barents Sea shelf (Fig. 1), including 3 blocks on the Pechora shelf.

This cluster’s total category C1 + C2 gas reserves amount to 4.9 Tcm and its total condensate reserves stand at 70.3/62.4 Mt (geological/recoverable), out of which more than 3.9 Tcm of gas (81%) and 62.9/56.1 Mt (geol./recov.) of condensate are contained in the deposits of the Shtokman field. The gas resources found in the Ludlow field, including the West-Ludlow and East-Ludlow structures, and in the Ledovoye field stand at 659.8 Gcm. Condensate resources – 5.9/5.0 Mt (geol./recov.) – are contained in the Ledovoye field only. The potential and localized gas resources of the Demidovskoye, Fersmanovskoye, and Medvezhye projected fields are estimated at 3.2 Tcm and their condensate resources are estimated to be 44.1/37.7 Mt (geol./recov.). However, it should be noted that, after detailed seismic surveying, the quantities of localized HC resources may change significantly as we gain more refined data about the size, closure, and morphology parameters of local structures. Yet another cluster may be formed around a group of projected fields within the Kheysovskiy LB, located near the northern extremity of Novaya Zemlya. The geological resources across the five largest gas-and-oil-promising structures (Tegetgofskaya-1, Tegetgofskaya-2, Zhelaninskaya-1, Tegetgofskaya-2/1, and Severo-Zhelaninskaya-1) may amount to as much as 1.3 Gtoe. One more cluster is being pooled together on the Pechora shelf, drawing on the resource base of the Prirazlomnoye oil field, which is already under development [for which the current figures are as follows: Q – 1.145 Mt of oil, Cat. C1 + C2 reserves – 288.2/80.4 Mt (geol./recov.), Cat. D0 resources – 151.1/42.3 Mt (geol./recov.)], the Dolginskoye oil field, which is under exploration [Cat. C1 + C2 reserves – 274.7/82.4 Mt (geol./recov.), Cat. D0 resources – 51.9/15.6 Mt (geol./recov.)], and the projected HC fields associated with the Mezhdusharskaya, Kostinosharskaya, Papaninskaya, and Rakhmanovskaya oil-and-gas- promising structures within the Severo-Zapadnyy LB. Cat. DL geological resources across these structures are estimated at 815.9 Mt of oil, out of which 244.8 Mt are recoverable resources.

Kara Sea Region

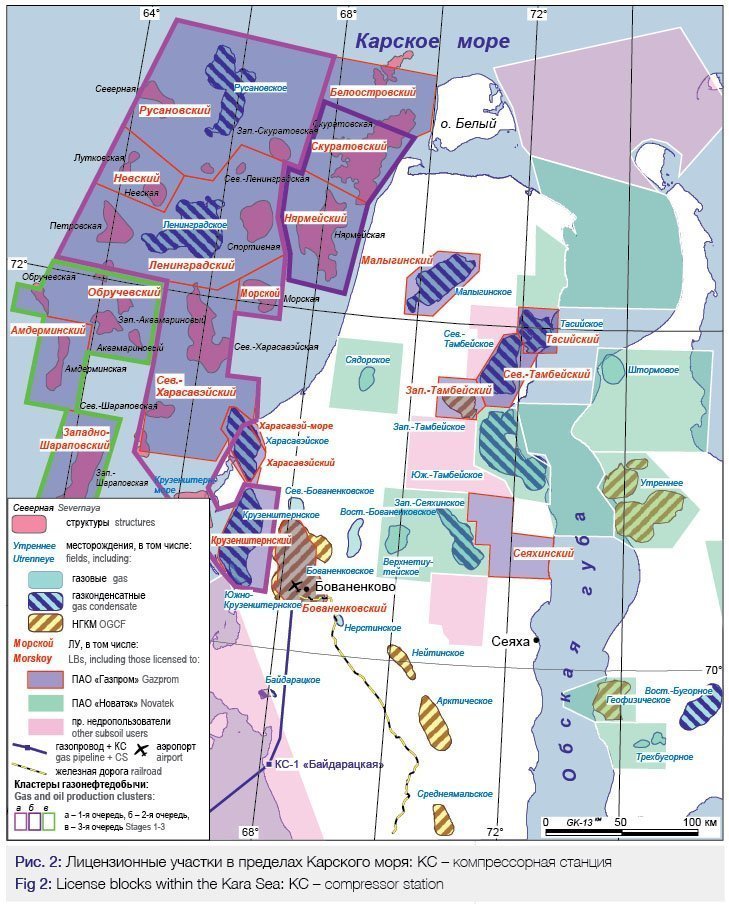

As of January 1, 2018, Gazprom PJSC holds licenses for 22 subsoil blocks on the Kara shelf (including the Gulf of Ob and the Taz Estuary waters), out of which 15 LBs with oil-and-gas-promising structures and HC fields cover the entire near-Yamal portion of the Kara shelf, stretching from Bely Island in the north almost all the way down to the Baydarata Bay in the south. Here, in the land-to-sea transition areas, two HC fields with unique reserve profiles – Kharasaveyskoye and Kruzenshternskoye (Fig. 2) – are in their final exploration phases. Onshore Yamal, there is yet another unique project, the Bovanenkovskoye oil and gas condensate field (OGCF), which is in the development phase.

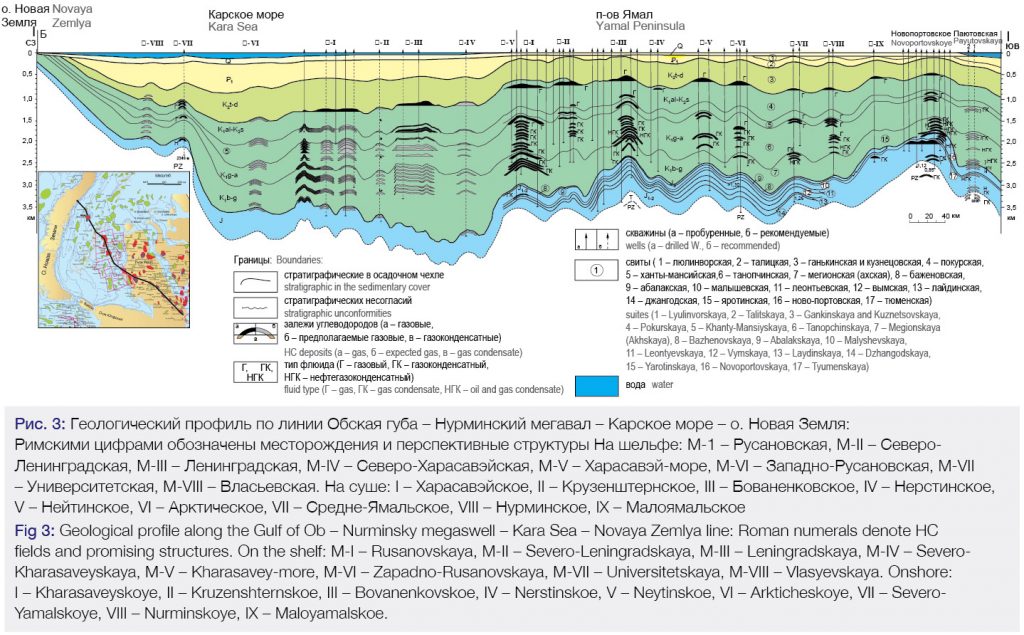

In the deep-water regions of the Kara Sea, 120 km away from the coastline, two HC fields – Leningradskoye and Rusanovskoye – allegedly possessing unique reserves were discovered as early as the late 1980s. In 2017, a wildcat well drilled into the Leningradskoye gas condensate field (GCF) resulted in a significant upward revision to its reserves figures. This finding warrants a conclusion that the field may, in fact, be much larger than previously predicted. Another important point is that all the fields possessing unique reserves – Bovanenkovskoye, Kruzenshternskoye, Kharasaveyskoye, Leningradskoye, and Rusanovskoye – are confined to a well-defined elongated zone, stretching some 350km in length, which tectonically is a concatenation of exceptionally large megaswells – Nurminskiy, in the north-east, and Leningradsko-Rusanovskiy. The total length of these oil and gas accumulation zones that almost join each other where they meet – stretching from the Novoportovskoye field to the Rusanovskoye field – is greater than 700km (Fig. 3).

Still further to the northeast, the Leningradsko-Rusanovskaya gas and oil accumulation zone joins with the Universitetsko-Vlasyevskaya gas and oil accumulation zone, within which, in 2015, the Pobeda OGCF (Rosneft Oil Company) discovered that it holds gas reserves of some 500 Gcm associated with Cenomanian, Albian, and Aptian rocks and oil reserves of some 130 Mt in the Jurassic complex. Considering the geographic distribution of the HC fields possessing unique reserves that have already been discovered in the Kara Sea and the adjacent areas onshore Yamal, as well as the coastal infrastructure facilities being created here, including pipelines, railways, residential areas, etc., the first-stage offshore gas and oil production cluster to be formed here (let us call it Leningradsko-Rusanovskiy) will include the Kruzenshternskoye, Kharasaveyskoye-more, Leningradskoye, and Rusanovskoye HC fields and the projected fields located in their vicinity and associated with the Severo-Leningradskaya, Zapadno-Leningradskaya, Sportivnaya, Nevskaya, Zapadno-Nevskaya, Morskaya, Severo-Sharapovskaya, and Yuzhno-Kruzenshternskaya structures.

This cluster’s total category C1 + C2 gas reserves amount to 5.2 Tcm and its total condensate reserves stand at 64.7/26.6 Mt (geol./recov.), out of which more than 4.8 Tcm of gas (91.9 %) and 43.8/40.3 Mt (geol./recov.) of condensate are contained in the deposits of the Kruzenshternskoye, Leningradskoye, and Rusanovskoye fields.

Category D0 and DL gas resources in the discovered and projected fields of this cluster are estimated at 4.2 and 0.8 Tcm, respectively, making up a total of 5.0 Tcm. The two fields with which the largest gas resources are Rusanovskoye and Leningradskoye – 1.9 and 1.0 Tcm, respectively.

Cat. D0 and DL condensate resources in the discovered and projected fields of this cluster are estimated at 307.6/217.1 Mt and 88.0 /61.9 Mt (geol./recov.), respectively, making up a total of 395/6/279.0 Mt (geol./recov.).

Similar organizational principles suggest that the second-stage oil and gas production cluster (Nyarmeisko-Skuratovskiy) be formed around a group of projected large OGCFs confined to the Nyarmeyskaya, Skuratovskaya, and Severo-Skuratovskaya structures located near the coastline of the northwestern part of Yamal and to the Zapadno-Skuratovskaya structure located nearby. This group of offshore fields will also be associated with offshore projects involving the development of HC resources of the large Malyginskoye GCF and a group of projected fields – Zapadno-Malyginskoye, Severo-Malyginskoye, etc. – in the coastal zone.

Category D0 and DL gas resources in the projected fields of this cluster are estimated at 2.2 and 0.8 Tcm, respectively, making up a total of 3.0 Tcm. The two structures with which the largest gas resources are associated are Skuratovskaya and Nyarmeyskaya – 1.8 and 1.4 Tcm, respectively.

Cat. D0 and DL condensate resources in the projected fields of this cluster are estimated at 156.9/131.9 and 144.9/101.6 Mt (geol./recov.), respectively, making up a total of 301.8/233.5 Mt (geol./recov.).

The third-stage gas and oil production cluster (so prioritized due to the lower resource potential, remoteness from the coast, and development lead time) will form around a group of projected fields located in the Obruchevskiy, Amderminskiy, and Zapadno-Sharapovskiy swells and a number of projected fields adjoining them, hosted in the Akvamarinovskaya and Zapadno-Akvamarinovskaya structures, which are not so large in terms of reserves.

Category D0 and DL gas resources in the discovered and projected fields of this cluster are estimated at 405.0 and 504.5 Gcm, respectively, making up a total of 909.5Gcm. The structure with which the largest gas resources are associated is Zapadno-Sharapovskaya – 347.5 and 1029.2 Gcm, respectively. Cat. D0 and DL condensate resources in the projected fields of this cluster are estimated at 8.2/5.8 and 21.1/13.8 Mt (geol./recov.), respectively, making up a total of 29.3/20.6 Mt (geol./recov.), out of which some 7.7/5.3 Mt (geol./recov.) are attributable to the Zapadno-Sharapovskaya structure.

At present, in parallel with Gazprom PJSC’s efforts focused on developing the near-Yamal portion of the Kara shelf, Rosneft Oil Company is busy preparing for the development of HC resources of the north-western portion of the shelf adjoining Novaya Zemlya, where the Pobeda field was discovered. Next in line are the regional investigation and exploration phases of the project deployed in the North-Kara depression.

Gulf of Ob and Taz Estuary

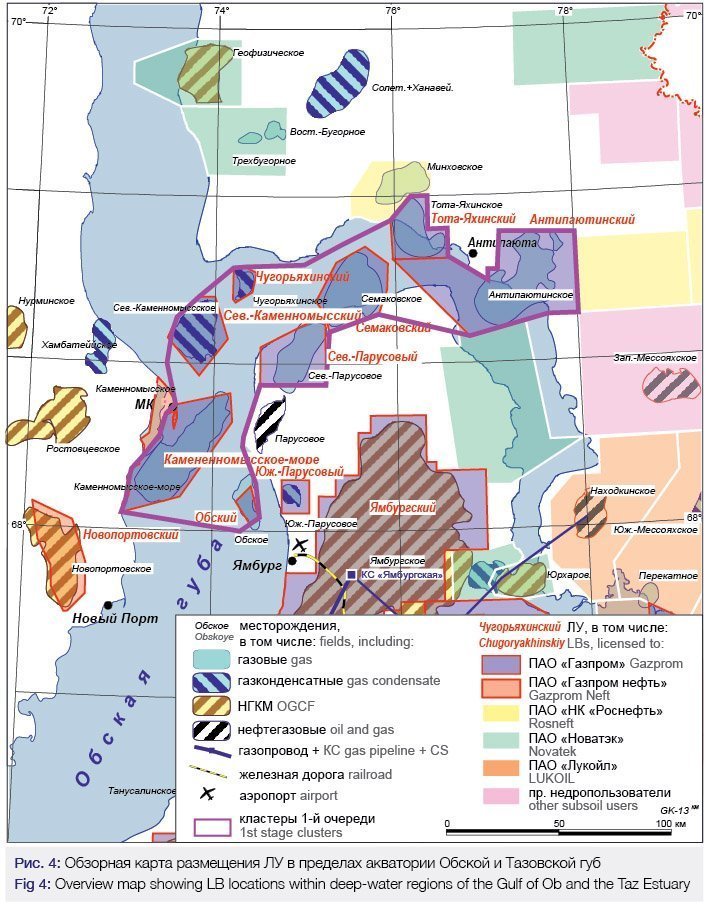

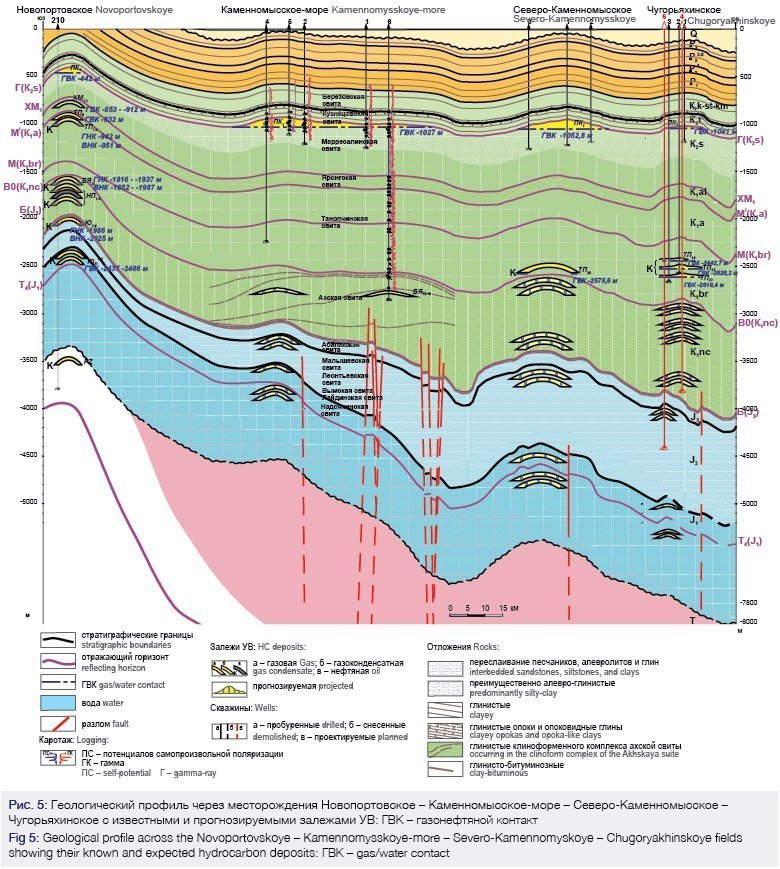

The deep-water regions of the Gulf of Ob and Taz Estuary are objectively predisposed to host two gas and oil production clusters. The first-stage cluster (Fig. 4) includes the Kamennomysskoye-more, Severo-Kamennomysskoye, Obskoye, Chugoryakhinskoye, Semakovskoye, Tota-Yakhinskoye, Antipayutinskoye, and Severo-Parusovoye fields, are all prepared for development, covered by an integrated transport system that will collect the HCs produced. The last one on the list is located within the boundaries of a LB which is mostly land-based. This cluster’s total Cat. C1 + C2 gas reserves amount to 1.9 Tcm and its total condensate reserves stand at 8.4/5.6 Mt (geol./recov.), out of which the biggest gas reserves are found in the following fields (the figures being given in Tcm): Kamennomysskoye-more – 544.7; Severo-Kamennomysskoye – 431.9; Antipayutinskoye – 340.4, and Semakovskoye – 320.5. Condensate is only found in the Neocomian deposits of the Severo-Kamennomysskoye and Chugoryakhinskoye fields. The only two blocks that possess registered gas and condensate resources are Antipayutinskiy and Tota-Yakhinskiy. For the Antipayutinskiy block, the aggregate Cat. D0 and DL gas resources hosted in infra-Cenomanian rocks are estimated at 0.8 Tcm and the respective condensate figures are 87/60.9 Mt (geol./recov.). For the Tota-Yakhinskiy block, the aggregate Cat. D0 and DL gas resources are estimated at 250.9 Tcm and the respective condensate figures are 27.8/19.5 Mt (geol./recov.). One promising focus area to shape the future of these fields will be the follow-up exploration of the discovered infra-Cenomanian gas condensate deposits and the identification of new HC deposits – including GCD, OGCD, and, possibly, oil deposits – in the Lower Cretaceous and Jurassic sediment rocks (Fig. 5).

Located in the northern part of the Gulf of Ob is the Tasiyskiy LB (see Fig. 2), most of which is land-based, comprising a GCF known by the same name. This block may later be incorporated into a cluster formed around the Tambeyskaya group of fields joined by the Preobrazhenskaya and Korpachevskaya gas-and-oil-promising structures located in the northern part of the Gulf of Ob.

East-Arctic Seas

The geological structure and HC potential of the East-Arctic seas are among the least known so far. The deep-water regions of the Laptev, East Siberian and Chukchi Seas are yet to see their first deep-hole drilling projects. The only category of HC resources for which any estimates are available is D2; in total, these amount to 22.4 GtC (geol.) and 13.0 Gtce (recov.), out of which 8.0 Tcm is free gas (making up 57.5 % of the total recoverable resources). The biggest HC resources – 9.3/5.6 Gtce, out of which 3.3 Tcm (60.0 % of the total recoverable volume) is free gas – are expected to be found in the deep waters of the East Siberian Sea.

To date, 13 subsoil use licenses for portions of the East-Arctic shelf are in place, out of which 8 blocks are licensed to be used for geological exploration and HC production at the licensees’ own entrepreneurial risk (they are valid through 2043), including 7 LBs held by Rosneft Oil Company and one LB held by Gazprom PJSC; the remaining 5 licenses, valid through 2014 or 2015, were prospecting licenses. One of the blocks – Pritaymyrskiy – is in Rosneft Oil Company’s plans for further surveying. Geophysical studies carried out in the deep-sea regions of the East-Arctic seas have identified more than 100 gas-and-oil-promising structures: 18 in the North Chukotka sector, 20 in the East Siberian Sea, and 59 in the Laptev Sea. According to earlier estimates of Gazprom VNIIGAZ LLC, the largest ones of these structures promise future discoveries of HC fields whose reserves may amount to 150–250 Mtce. Here, some of the larger uplifts may host so-called absorption traps, including groups of traps confined to the same dome or megaswell structure like the Mininskiy or Trofimovskiy in the Laptev Sea [8].

The Severo-Vrangelevskiy subsoil block of federal significance licensed to Gazprom PJSC includes the following identified gas-and-oil-promising structures: Bezymyannaya, Severo-Shelagskaya, Shelagskaya, Vostochno-Shelagskaya, Dremkhedskaya 1, Dremkhedskaya 2, Dremkhedskaya 3, Zapadno-Vrangelevskaya 1, and Zapadno-Vrangelevskaya 2. In the future, the projected fields associated with these structures may be combined into a gas and oil production cluster, which, in conjunction with other HC field clusters, will be able to support the operation of a natural gas liquefaction facility with a capacity of up to 15 Mt, which may be built in the city of Pevek.

The southern and eastern portions of the block, studied by 2D seismic survey methods (the northern, western, and central portions have not yet been studied), have been shown to include 22 gas-and-oil-promising structures, out of which nine have been shown to possess Cat. D2 resources estimated at 102.3 Gcm of gas and 238.8/71.6 Mt (geol./recov.) of oil. The remaining 13 structures within this LB account for ca. 67 Gcm of gas and ca. 46 Mt (recov.) of oil. The structures that boast the largest estimated Cat. D2 HC resources are Bezymyannaya – about 31.0 Gcm of gas and 21.7 Mt (recov.) of oil, Severo-Shelaginskaya – 22.6 Gcm of gas and 15.8 Mt (recov.) of oil, and Dremkhedskaya 2 – 15.8 Gcm of gas and 11.2 Mt (recov.) of oil. One point worth mentioning is that it makes sense to postpone the prospecting efforts focusing on some of the smaller projected fields until after 2035.

Sea of Okhotsk Region

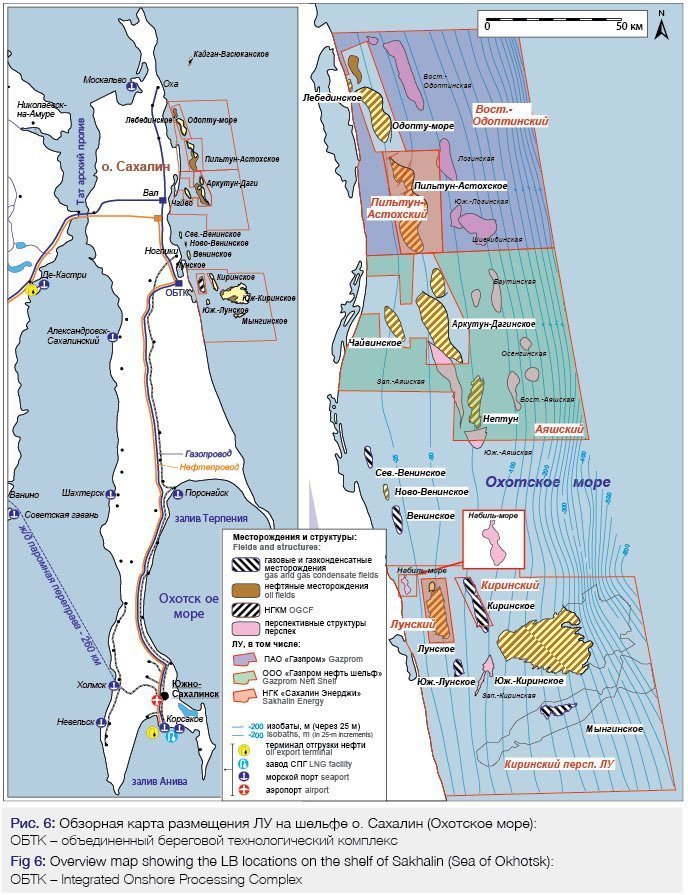

In the coming decades, the Far-Eastern region of Russia is expected to host some highly promising development projects deployed in the near-Sakhalin portion of the Sea of Okhotsk shelf. Here, Gazprom PJSC controls 7 LBs, out of which 6 are located on the northeast shelf of Sakhalin (Fig. 6) and one lies on the shelf of Western Kamchatka.

Two of these blocks – Lunskiy and Piltun-Astokhskiy – are being developed by Gazprom PJSC together with other companies.

Within the boundaries of the Kirinskiy LB lies the Kirinskoye GCF, already explored and brought into development. For now, the accumulated HC production figures for this field stand at 0.7 Gcm of gas and 0.1 Mt of gas condensate. The gigantic Yuzhno-Kirinskoye OGCF is currently in its final exploration phase. The Kirinskoye, Yuzhno-Kirinskoye, Yuzhno-Lunskoye, and Mynginskoye fields, including the Lunskoye OGCF, form one single gas production cluster connected to onshore infrastructure facilities used for conditioning gas and liquid HCs and transporting them to consumers. It should be noted that smaller-scale oil production targeting structurally complex ‘lumped’ oil fringe zones will begin no earlier than 2030.

The cumulative gas production at the gigantic Lunskoye field has exceeded 102 Gcm (more than 99% of the total production on the shelf, including production at the Kirinskoye field), and the same figure for condensate is now over 10.5 Mt. category B + C1 + C2 gas reserves for the Lunskoye and Kirinskoye fields stand at 404.7 and 161.8 Gcm, respectively, and their respective condensate reserves amount to 48.1/27.8 and 26.5/19.0 Mt (geol./recov.). Yuzhno-Kirinskoye OGCF is, like Lunskoye, quite a behemoth in terms of gas reserves: its Category C1 + C2 gas reserves are at 913.1 Gcm and its condensate reserves measure 223.5/145.4 Mt (geol./recov.). The respective oil reserves figures are 46.7/4.7 Mt (geol./recov.) and dissolved gas reserves score 10.0 Gcm (geol.).

In the Kirinsky cluster, the reserves of these fields together with the Yuzhno-Lunskoye GCF and the Mynginskoye OGCF are as follows: gas – 1.5 Tcm, condensate – 313.0/202.4 Mt (geol./recov.), oil – 46.7/4.7 Mt (geol./recov.), dissolved gas – 10.2 Gcm (geol.). In addition, the Vostochnaya and Nabilskaya-morskaya structures possess category D0 gas resources (34.9 Gcm) and condensate resources [5.3/3.6 Mt (geol./recov.)].

The second cluster is formed around the projected deposits of Ayashskiy and Vostochno-Odoptinskiy LBs, which will most probably be developed together with the Piltun-Astokhskoye OGCF already brought into development. At the Piltun-Astokhskoye field, the current figures are 4.7 Gcm for gas, 0.26 Mt for condensate, 42.2 Mt for oil, and 6.3 Mt for dissolved gas. The current (residual) Cat. C1 + C2 gas reserves stand at 131.5 Gcm, condensate reserves – at 15.1/10.4 Mt (geol./recov.), and oil reserves – at 405/85.6 Mt (geol./recov.).

The respective Cat. D0 HC resources of the Vostochno-Odoptinskiy (East-Odoptinskaya and Lozinskaya structures) and Ayashskiy (Ayashskaya and Bautinskaya structures) LBs are as follows: gas – 101.4 and 36.2 Gcm; condensate – 5.4/4.7 (geol./recov.) and 3.9 (geol.) Mt; oil – 617.0/96.3 (geol./recov.) and 412.3 (geol.) Mt; dissolved gas – 64.1/11.1 (geol./recov.) and 62.1 (geol.) Gcm.

Caspian Sea Region

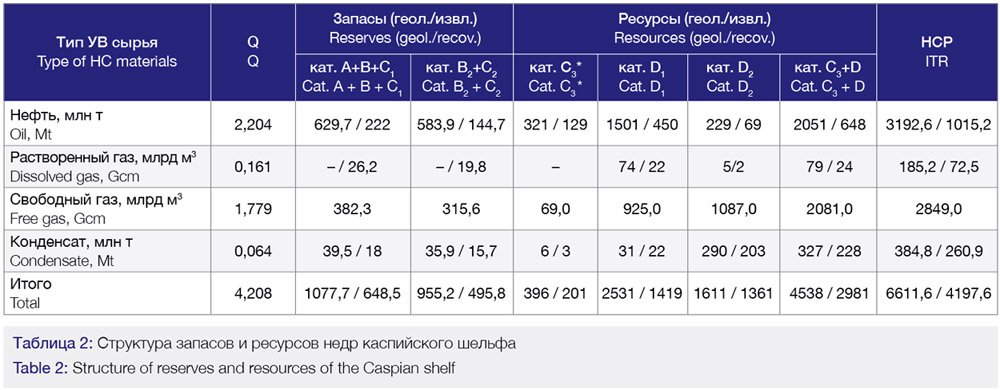

According to official estimates, the initial total HC resources (ITR) available on the Russian portion of the Caspian shelf amount to 6.6/4.2 Gtce (geol./recov.). Gas ITR is estimated at 2.8 Tcm, condensate ITR – at 384.8/260.9 Mt (geol./recov.), oil ITR – 3.2/1.0 Gt (geol./recov.), and dissolved gas ITR – at 185.2/72.5 Gcm (geol./recov.) (see Table 1).

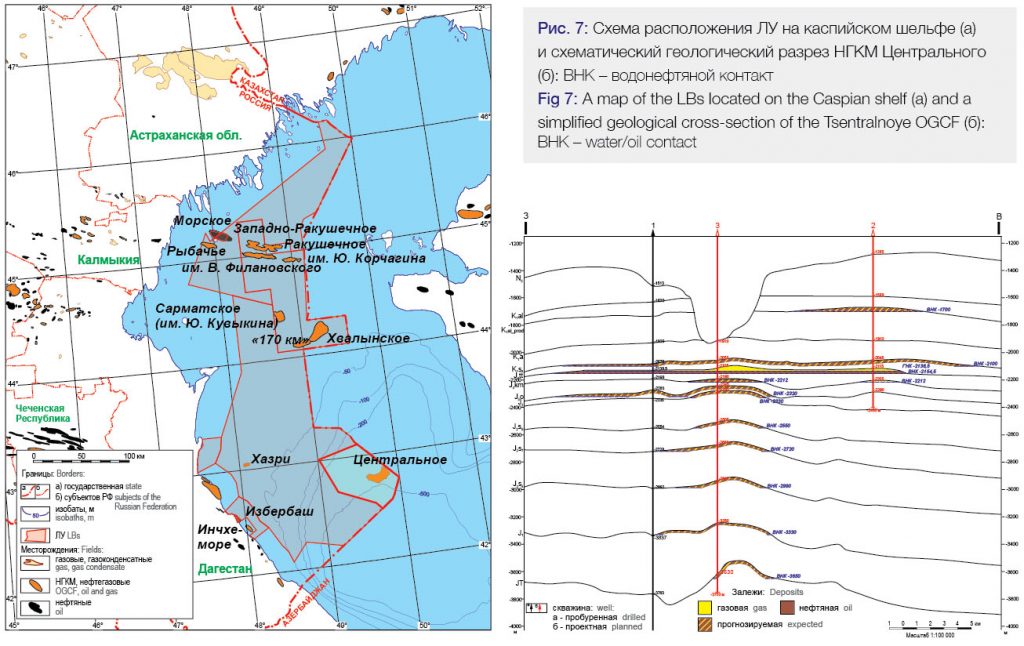

The State Register of Mineral Reserves of the Russian Federation includes records of 11 HC fields located within the Russian sector of the Caspian Sea, out of which nine fields are registered as possessing gas reserves and 11 fields are registered as possessing oil reserves (Fig. 7).

Overall, out of all the fields that have been identified, two are oil fields (Zapadno-Rakushechnoye and Morskoye) and nine are oil and gas condensate fields (Izberbash, Inchkhe-more, Khvalynskoye, “170km,” Yu. Korchagin field, Sarmatskoye, V. Filanovsky field, Tsentralnoye, and Rakushechnoye). Only one of the fields found in the Russian sector of the Caspian Sea is currently in the development phase (Yu. Korchagin field). Since the beginning of the development phase (2010), its performance has been as follows: gas – 1.8 Gcm, oil – 2.2 Mt, condensate – 0.064 Mt, dissolved gas – 0.164 Gcm. The remaining fields are registered as being under exploration.

In terms of gas reserves, measured in Gcm, three fields are classed as medium-size (3–30) and five are classed as large (30–500). In terms of oil reserves, measured in Mt (recov.), one field is classed as small (< 1), six are classed medium-size (3–30), and two are classed as large (30–300) (Table 2). These HC reserves span a wide stratigraphic range – from the Middle Miocene (Chokrak) to the Middle Jurassic. The free gas reserves attributable to the Paleogene and Miocene layers are quite insignificant – 18.2 Gcm.

The first-priority project whose feasibility in terms of setting the stage for P&E on the Caspian shelf will be centered around an oil and gas accumulation zone associated with the large Tsentralny dome and complete with an already discovered OGCF known by the same name. It is considered a key element in shaping the geological exploration strategy for the region and requires follow-up exploration. In 2016, Tsentralnaya Oil and Gas Company LLC (in which Gazprom PJSC holds a 25% interest) was granted the subsoil use license for the Tsentralnyy LB for purposes of geological exploration, prospecting, and HC production.

The field’s reserves profile is as follows: oil, Mt (geol./recov.): Cat. C1 – 21.3/6.4, Cat. C2 – 281.7/84.5; condensate, Mt (geol./recov.): Cat. C1 – 0.7/4.0, Cat. C2 – 3.8/2.1; dissolved gas, Gcm (geol./recov.): Cat. C1 – 3.1/0.9, Cat. C2 – 41.5/12.5; gas-cap gas, Gcm: Cat. C1 – 6.9, Cat. C2 – 34.8. Cat. D0 oil resources (geol./recov.) for 10 expected HC accumulations (to be found in Albian, Neocomian, and Jurassic rocks) amount to 510.2/127.2 Mt, and the respective figures for dissolved gas (geol./recov.) are 50.9/13 Gcm.

Black Sea Waters

In the coming years, P&E will continue in the Russian sector of the Black Sea. Here, the presence of tectonically screened-type traps associated with thrust faults within the boundaries of the Tuapse trough allows for possible discoveries of medium-sized Cenozoic HC fields. After the completion of Rosneft Oil Company’s well drilling project at the Shatsky swell (Maria structure) in 2018, more work is being planned toward improving the current HC resource estimates and making future P&E efforts more target-specific.

Sea of Azov

The gas production hub operating in the Russian sector of the Azov Sea is of little importance, but its current ITR estimates also need improvement. Here, the Beysugskoye gas field is being developed by Gazprom Dobycha Krasnodar LLC. According to the State Register of Mineral Reserves, the cumulative gas production at the Beysugskoye field has reached 9.7 Gcm, while the remaining Cat. C1 gas reserves stand at 8.0 Gcm. Among the top-priority areas for further development of HC resources one can name the oil and gas accumulation zones located in the deep-water areas projecting beyond the North-Azov and South-Azov steps and the West-Kuban trough.

The layers to be explored here for potential discoveries of new HC fields are the Lower Cretaceous and Middle Miocene – Pliocene rocks. The Upper Jurassic and Upper Cretaceous – Eocene complexes of the same structural elements are much less attractive focus areas. Within the rest of the tectonic elements of the region, gas resources per stratigraphic complex are less significant. Considering the possible new oil and gas accumulation zones capable of sustaining and even increasing the current gas production volumes, we would like to highlight the already discovered Oktyabrskoye field and two or three projected fields within the Zapadno-Yeyskiy LB. At the Oktyabrskoye field, gas presence has been detected in the Meotian and Sarmatian rocks. The bulk of its gas reserves (87%) are associated with the Meotian layers. At the Zapadno-Beysugskoye field, gas presence has been detected in

the Maykopian and Meotian rocks. The bulk of its reserves (74%) are associated with the Maykopian layers. On the Azov shelf, there are two promising oil and gas accumulation zones – Oktyabrskaya and Limannaya. Their expected reserves are 9.3 Mtce for the former, 15.0 Mtce for the latter.

If necessary, the gas production resource potential of the Azov hub can be increased thanks to numerous promising gas structures, including those located in unlicensed areas such as those of the Taganrog Bay, the Azov swell, the South-Azov step, and the West-Kuban trough.

Summing up what has been said, new research findings have made it possible to identify the most promising focus areas for prospecting and exploration operations. A conclusion has been made to the effect that the available reserves and potential resources of gas, condensate, and oil in the Russian offshore areas are sufficient to maintain the levels of reserves additions and production growth required to fill the country’s energy supply and export needs in the first half of the XXI century. The most prominent gas-and-oil-promising regions capable of sustaining the expanded reserves replenishment to meet Russia’s gas production requirements in the XXI century will be the South-Kara and Barents oil and gas basins, whose combined gas resource potential currently stands at ca. 80 Tcm.

In the Far East of Russia, it is the Okhotsk shelf waters, offshore Sakhalin that remain a top-priority oil and gas production region with opportunities for maintaining the expanded HC reserves replenishment process, later to be joined by other offshore areas like those of the Sea of Japan, Bering Sea, East-Arctic (Chukchi, East Siberian) seas, and the Laptev Sea as their resources are brought into development in the future.

In the southern regions of Russia, the portions of the continental shelf that are capable of ensuring high efficiency of P&E efforts and sustaining expanded replenishment of the gas and oil production resource base in the coming decades are located in the waters of the Caspian and Azov Seas, also joined by certain areas on the Black Sea shelf.

Bibliography

1. S. K. Akhmetsafin. On the key objectives for the development of the mineral resource base of Gazprom PJSC / S. К. Akhmetsafin, V. V. Rybalchenko, D. Ya. Khabibulin // In: IV International Conference titled “World Gas Resources and Reserves and Advanced Development Technologies” (WGRR-2017), November 8–10, 2017. – Moscow: Gazprom VNIIGAZ, 2017. – pp. 4–5

2. D. V. Luygay. A scientific rationale and support measures for the development of the gas production resource base in Russia and at Gazprom PJSC / D. V. Lyugay // In: IV International Conference titled “World Gas Resources and Reserves and Advanced Development Technologies” (WGRR-2017), November 8–10, 2017. – Moscow: Gazprom VNIIGAZ, 2017. – p. 6

3. V. A. Skorobogatov. The problems encountered in managing the supply of resources required for the production of natural gas in Russia until 2050 / V. A. Skorobogatov, S. N. Sivkov, S. A. Danilevskiy // Vesti Gazovoy Nauki: The problems encountered by Russia’s gas producing regions in managing the supply of resources until 2030. Moscow: Gazprom VNIIGAZ, 2013. – No. 5 (16). – pp. 4–14

4. A. I. Varlamov. Gas future of Russia: the Arctic / A. I. Varlamov, A. P. Afanasenkov, O. M Prishchepa et al. // In: IV International Conference titled “World Gas Resources and Reserves and Advanced Development Technologies” (WGRR-2017), November 8–10, 2017. – Moscow: Gazprom VNIIGAZ, 2017. – pp. 9–10

5. V. A. Skorobogatov. The largest and unique gas- and oil-bearing basins of the Earth and their role in the development of the global gas industry / V. A. Skorobogatov // In: IV International Conference titled “World Gas Resources and Reserves and Advanced Development Technologies” (WGRR-2017), November 8–10, 2017. – Moscow: Gazprom VNIIGAZ, 2017. – p. 21

6. A. N. Dmitriyevsky. Prospects for the creation of a tech-hub: the Norilsk cluster / A. N. Dmitriyevsky, N. A. Yeremin, N. A. Shabalin // In: All-Russia scientific conference dedicated on the 30th anniversary of the Oil and Gas Research Institute of the RAS (IPNG RAS) titled “The Fundamental Basis of Innovative Technologies in the Oil and Gas Industry.” – Moscow: IPNG RAS, 2017. – pp. 55–56. – (the Conferences series)

7. N. A. Yeremin. The innovative potential of smart oil and gas technologies / N. A. Yeremin, O. N. Sardanashvili // In: All-Russia scientific conference dedicated on the 30th anniversary of the IPNG RAS titled “The Fundamental Basis of Innovative Technologies in the Oil and Gas Industry.” – Moscow: IPNG RAS, 2017. – pp. 61–62. – (the Conferences series)

8. D. A. Astafyev. Analyzing the feasibility of prospecting and exploration projects to be deployed on the East-Arctic portion of the continental shelf to identify the top-priority oil and gas accumulation zones / D. A. Astafyev, V. G. Kaplunov, V. A. Shein, A. G. Chernikov // Vesti Gazovoy Nauki: Modern approaches and advanced technologies in projects focusing on the development of Russian offshore oil and gas fields. – Moscow: Gazprom VNIIGAZ, 2013. – No. 3 (14). – pp. 70–78

D. A. Astafyev, A. V. Tolstikov, L. A. Naumova, M. Yu. Kabalin

Gazprom VNIIGAZ LLC, Proyektiruyemyy pr-d # 5537, vl. 15, str. 1, s/p Razvilkovskoye, pos. Razvilka, Leninsky District, 142717, Moscow Oblast, Russian Federation

The original article was first published in the «Vesti Gazovoy Nauki» scientific journal no. 4, 2018.

Published with thanks to the Gazprom VNIIGAZ LLC.