Russian Oil Export Duty Phase-Out Requires Balancing Act, Says GlobalData

Russia’s recent decision (June 6, 2018) to complete the ‘tax maneuver’ and phase out oil export duty will have wide-ranging policy implications, says GlobalData, a leading data and analytics company.

The tax maneuver commenced in 2015 with the marginal export duty rate reduced from 59% to 30% over three years. The rate remains at 30% for 2018 but policymakers have now reportedly agreed to reduce the rate by 5% per year until it reaches zero in 2024.

Will Scargill, Senior Oil & Gas Analyst at GlobalData, comments: “Duty on oil product exports will also phase out as these rates are linked to the crude oil duty. The policy has been pushed with the aim of simplifying the tax structure and improving the competitiveness of the domestic refining sector by reducing the level of insulation from global markets.

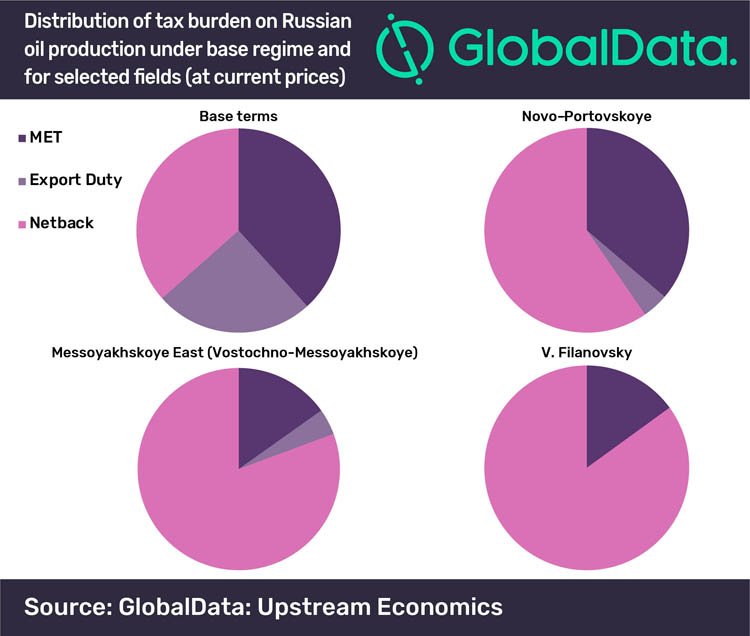

“The revenue loss from the removal of oil export duties is to be offset by an increase in Mineral Extraction Tax (MET). The phase-out of export duty will require an increase of around 50% in the base MET rate to maintain the overall tax burden under base terms.

“However, changes to MET rates may need to be more nuanced, as the distribution of the tax burden between MET and export duty across different fields varies significantly due to the complex array of incentives available. The government is separately piloting a new profit-based tax regime avoiding the need for targeted incentives, but the prospects for a full roll-out remain uncertain.”

The more challenging task for the government as export duty is phased out may be limiting domestic fuel price inflation. At the end of May the government agreed to reduce excise taxes in return for a freeze on fuel prices, but increased duty on exports of light oil products has also been threatened if price rises continue.

Scargill adds: “The planned phase-out of oil export duties risks further increases in product prices as the price of feedstock crude equalizes to international market levels. The Ministry of Finance has proposed to combat this effect through the introduction of negative excise taxes, effectively subsidizing oil products for the domestic market. However, this measure has not yet been fully defined and subsidies may be targeted to aid more complex refineries and support the aim of modernizing the sector.

“The political sensitivity of domestic fuel prices means that political backing for the export duty phase-out could falter if it leads to further inflation, particularly given that President Putin’s term will also end in 2024.”