Russian Upstream Projects Require $102.6bn by 2020 to Maintain Stable Production, says GlobalData

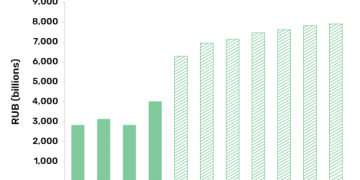

An average of $34.1bn per year in capital expenditure will be spent on 1,673 oil and gas fields in Russia between 2018 and 2020, according to GlobalData, a leading data and analytics company.

Capital expenditure into Russian traditional oil projects will add to up $55bn over the three-year period, while heavy oil fields will require $7.1bn over the same period.

Onshore projects will be responsible for over 85% of the $102.6bn of upstream capital expenditure in Russia, or $88bn by 2020. Russian shallow water projects will necessitate $14.6bn in capital expenditure over the period.

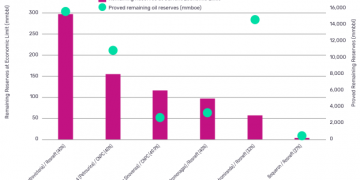

GlobalData expects that Gazprom, together with Gazprom Neft, will lead the country in capital expenditure, investing $37.5bn into upstream projects in Russia by 2020. Rosneft Oil Company and Lukoil Oil Company will follow with $30.9bn and $14.1bn invested into Russian projects over the period.

Gazprom’s producing Bovanenkovskoye field will lead capital investment with $5bn spent between 2018 and 2020, followed by Gazprom’s planned Kovyktinskoye gas field with $4.3bn over three years in capital expenditure. Rosneft Oil Company’s producing Samotlorskoye field will need a capital investment of $2.6bn by 2020.

GlobalData reports the average remaining capital expenditure per barrel of oil equivalent (capex/boe) for Russian projects at $6. Onshore gas projects have the lowest remaining capex/boe at $4.80, followed by onshore oil and onshore heavy oil developments with $6.80 and $7 respectively. Shallow water oil projects have the highest remaining capex/boe at $11.40, while shallow water gas projects need $8.70 per boe in remaining capital expenditure.