SPD: Horizontal Wells

Salym Petroleum Development (SPD) is a Joint venture formed by a 50/50 partnership between Shell and Gazprom Neft to extract oil from the Cherkashin Formation in Western Siberia via three oilfields. The company operates 4 drilling rigs, 1 mobile sidetrack rig, 17 worker hoists and 6 wireline units in a portfolio of 1,100 wells producing about 120,000 bbl./d of oil.

The initial business approach revolved around the use of standard vertical and deviated wells in th e primary producing areas of the fields. World class drilling and operating performance led to an excellent Return on Investment (ROI) for shareholders. SPD has managed to maintain its cost base in the current environment after the Russian Rubble devaluation (in 2014 and 2015), and provides the company with very competitive UDC (Unit Development Cost), far below the global industry benchmark for land drilling projects. SPD enjoys a Payback Period of less than 4 years on its vertical wells with a very attractive Profitability Index (PI).

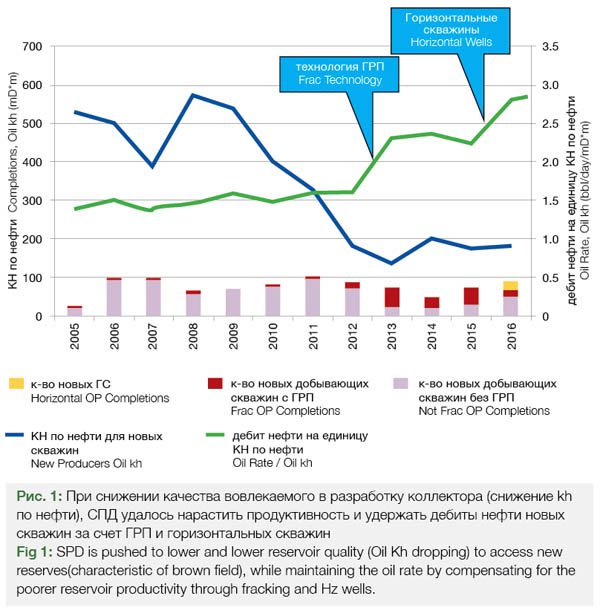

Nevertheless, Salym was a declining production field. With all the sweet spots drilled, the subsurface group could only target parts of the license with lower and lower reservoir quality (illustrated by Kh – horizontal permeability x net pay). Despite that inherent challenge of brown field and under the leadership of a new Management Team SPD decided to take on the challenge to ramp up its production. That decision triggered a series of initiatives to reverse the trend, including the introduction of Fracking, which resulted in an increase of 60% in new oil productivity from 2013 onwards as can be seen in the graph in figure 1.

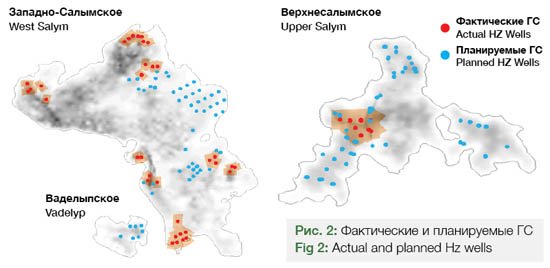

After Fracking, the next option explored to increase production was to introduce Horizontal Wells. The Horizontal Wells are able to access part of the license with shallow oil-water contact, access the flank areas with thin pay zone and low net to gross (LNTG) areas of the license that had thus far been left untouched.

Horizontal wells increase the drainage area in to the reservoir where the vertical net pay is too small for vertical wells. Thus, accelerating production.

Although well costs would be higher and the well duration longer in these more complex geological conditions, these wells would be subject to the same economic rules as the standard deviated wells and would have to compete for capital against the high performing standard wells. However, the potential volume of accelerated oil, the strength of innovation within SPD, and the motivation of SPD to create world class investment for its shareholders has led to performances that since f gn team in Moscow, which had the technical capability to rapidly engineer new designs and to make adjustments based on real time data and interaction with the subsurface group. This front end engineering team was set the target of designing wells for the flank, LNTG areas and infield shallow water-cut areas.

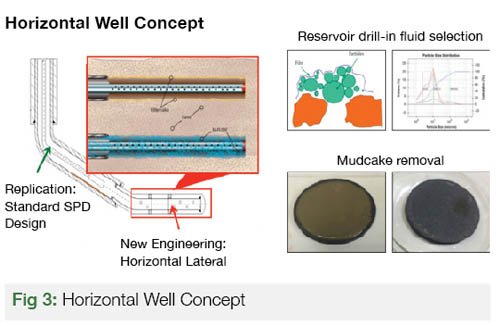

The team sprang to work on a new Horizontal (Hz) well design, which was developed by building on the successes and experience gained while drilling thousands of standard vertical wells. It was vital for the rapid deployment of Hz wells to use the local (West Siberia Basin) well design concepts to ensure that existing contractors could execute the new well type.

The Horizontal wells were going to be completed with an open hole system. Therefore the exist barite water based mud system would not be adequate as it would increase the skin by blocking the production from the reservoir sandstone. A new non-invasive mud system using calcium carbonate instead of barite as the weighting agent was developed.

Based on requirements defined by the subsurface group, the Front End Engineering design team also came up with a three strings design including a liner section in order to access the complicated reserves on the flank and LNTG areas. Optimizing acid breaker usage to remove the filter cake and improve the skin factor was achieved through implementing an open hole “plugged liner” system to accurately place the breaker.

Initial Results

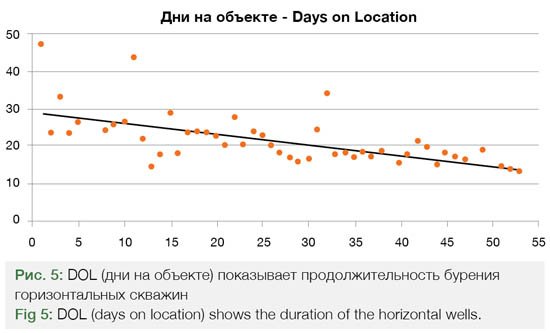

The first phase of Hz well implementation yielded positive production and economic performance but the duration of drilling and capex for each well was still high. A Hz well would take from 20 to 30 days to drill, which was two to three times the time required for standard wells. Capex was 60% higher to drill a Hz well leading to a UDC which was double that of the standard wells.

It was important for the team to improve the performance of the Hz wells, because any increase in the valuation of the Rubble (linked to the oil price) would negatively impact the PI. SPD’s shareholders had set aggressive PI thresholds for capital investment and a drop in the PI of the Hz wells could place them below the benchmark and thus eliminated from further investment. The devaluation of the Rubble had been so influential in creating the economic case for Hz well development that it was easy to forget that these wells would never have attracted any capital investment before the 2014 currency devaluation.

Another key motivator was the comparisons with other Gazprom Neft subsidiaries that showed the unit cost for Hz wells were higher in SPD than elsewhere. This provided a business case to continue to work on the Hz design in order to improve their competitiveness.

Technical Initiatives to Drive Down UDC

Once baseline data showing the potential of the Hz wells became apparent through subsurface analysis, especially in net pay zone less than 5-7m thick, the Moscow based well design team continued to work on initiatives to drive down the UDC and further improve the attractiveness of the investment.

1. Operational improvement – Introduction of micro-KPI

A detailed set of micro-KPI’s were negotiated and agreed with the mud logging services contractor to monitor the performance of the drilling on flat time. Comparisons could also be made between rigs and between contractors. Some of the key KPI’s are as follows:

• Drilling rate in meters per hour (ROP)

• BHA make up time

• BOP test time (including time taken to repair failures)

• Tripping and casing running speeds

There is a say that “if you cannot measure it you cannot improve it”. Hence the close monitoring of micro-KPI was developed in order to monitor and improve rigs performance without requiring additional investment except the additional services provided by the mud logging contractor (for less than 15 USD/day).

2. Migration to local breaker supplier and associated change to inner string design

Initial Hz wells were drilled using an acid breaker from international provider, which was expensive and forced SPD to deploy the open hole “plugged liner” system to limit the consumption. SPD joint forces with a local supplier to developed a tailor-made prototype product. Under the supervision of SPD Production technology group, trials were conducted using and the results are tabulated in the table below.

The substantial cost savings achieved by moving to the local product enabled the front end engineering team to develop an inner-string design, eliminating the need to do an extra run in the hole. The simplified drilling operation reduced the drilling duration by 36 hours, which is equivalent to a 6% reduction in total UDC for the Hz wells.

3. Use of engineering software

SPD has optimized the use of engineering software and trained all field personnel on torque and drag so that they could model these parameters for the casing. Real time monitoring is not needed in vertical or deviated wells but is critical for Hz wells in order to understand if the casing is going down smoothly in the well or is picking up drag as it descends, which indicates a problem.

4. Redesign of drilling fluid system for intermediate section

Observations of the drilling performance showed significant time was spent doing wiper trips to clean the hole prior to running the casing due to poor inhibition and high clay content in the mud. Using the solid control equipment, the majority of the low gravity clay solid was removed by increasing the inhibition and the clay coagulation chemical. As a result fewer wiper trips were required and this reduced the drilling duration by an average of 12 hours per well. The savings due to the shorter drilling duration compared to the cost of the mud properties upgrade yielded a return of 6 times the investment for this initiative alone.

Commercial Initiatives to Drive Down UDC

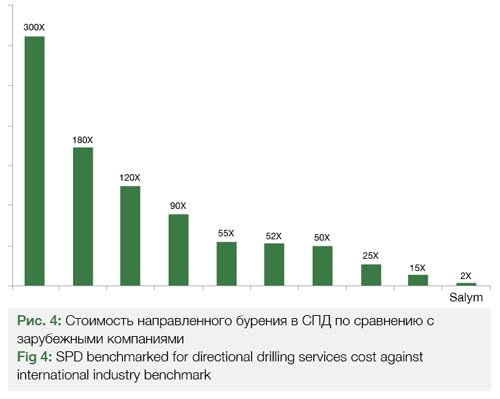

Fueled by the success of the technological advances and the negotiations for breaker fluid, SPD pursued commercial avenues to further drive down the UDC. Even though SPD was ranked no. 1 in cost per meter metrics against international benchmark, and was already working with a high quality international directional drilling service provider, a decision was taken to retender the directional drilling contract. This was justified based on Gazprom Neft Basin benchmarking, which showed a potential for cost improvement. Despite some organizational resistance to the initiative given the already solid performance, the retendering led to commercial cost savings on each well. Directional drilling costs dropped by almost 30%.

In addition, the new contracts have been drawn up with a guarantee of results as opposed to guarantee of service. This is a new approach for SPD and has been adopted to ensure well quality is maintained. Two contractors have been appointed simultaneously where rigs are being split to foster competition between the contractors and make use of the large number of rigs available. Rig allocation will be revisited every 6 months and re-allocated depending on contractor performance.

The commercial initiatives delivered approximately 10% costs saving per Hz well and a UDC reduction of about 3%.

The Results – Improved Hz Economical Performance

In almost every area, the Hz wells are delivering value to investors in terms of production and financial performance.

The average well duration has come down from the original 20 to 30 days to a figure of 15, which is much closer to the average duration for a standard well. In mid 2017, a single well was drilled in 13.5 days at a rate of 2.78 days per 1000 m. Standard wells are drilled at an average rate of 2.5 days per 1000 m and the 2017 target rate for Hz wells was set at 4.5 days per 1000m.

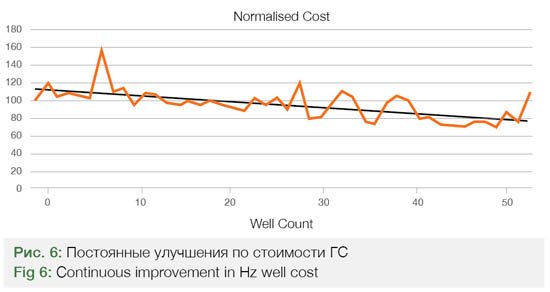

Initial Hz well costs were largely more expensive than a standard well (mostly due to time related cost), but the trend in figure 6 shows that these wells have reduced in cost by 35%, placing them now 40% over standard well costs.

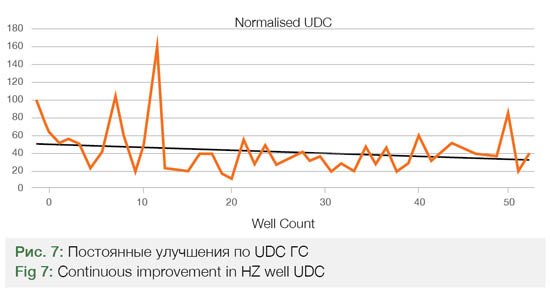

In parallel the UDC of Hz wells has seen a reduction of 20%. Tougher reservoir properties and more difficult well placement have led to a gradual reduction in initial rate, hence the cost reduction did not 100% materialized in UDC reduction.

Hz vs Vertical Wells Performance

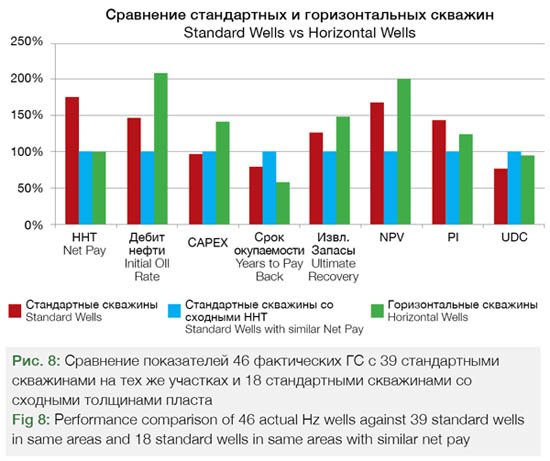

In light if the improvement shown, it is critical for SPD to understand the comparison of performance of 46 actual completed horizontal wells to 39 standard wells drilled at the same time in the same areas of fields. Comparison is complicated by the fact that geological conditions vary even within single area, and standard wells targeted mostly zones with higher net pay. This is because thicker reservoirs have more barriers to vertical flow, which negatively impact not only productivity of horizontal wells, but also recovery factor as a result of not drained volumes of oil. For proper comparison of Hz and standard wells in similar geological conditions – a third category “Standard Wells with similar Net Pay” was added by excluding 21 standard well with high net pay. This category was used as baseline for performance comparison.

Some key observation from that comparison:

• Hz wells provide higher productivity, more than twice outperforming standard wells in similar net pay zones

• Since Hz wells cost only about 40% more than standard wells – fast-producing Hz wells pay back 40% earlier than standard wells in similar net pay zones and even 20% earlier than all standard wells with 75%-thicker net pay

• Hz wells provide higher ultimate recovery per well (about 50% on top of standard wells in similar net pay zones and 20% higher than all standard wells with 75%-thicker net pay and hence STOIIP density) – because of larger drainage area

• higher than standard wells in similar net pay zones. NPV of Hz wells is highest of all categories due to best productivity and ultimate recovery

Conclusion

It was important for SPD to demonstrate that despite the higher cost, HZ wells are the investment of choice in low pay net zone and for difficult well placement. Hz wells provide higher reserves and NPV per well – thanks to larger drainage area and for lower net

pay zones.

After delivering 10 years of world class investment with their standards wells, SPD managed, in couple of years, to create another world class investment for a new type of well that will become predominant as the accessible reservoir properties worsen.

The next challenge for SPD will be to maintain the return achieved so far while always accessing more and more difficult reservoir conditions (lower and lower Kh). Under these conditions, the Subsurface Team and Front End Design Team need to continue to work together to sustain UDC down through continuous cost improvements with cheaper well design, longer horizontal for higher drainage or increase the Kh artificially through multistage fracc technology.

Recognitions

The authors would like to thank SPD management team that supported the publication of that article. More specifically Alexey Govzich SPD CEO, Blake Stephenson Wells Manager, Yakov Volokitin Petroleum Engineering Manager and Inna Edelman Head of Reservoir Engineering.

The authors would also like to recognize the accomplishment of the field team for the successful execution. The field team is based in Salym and made of Drilling and Subsurface high quality professionals that are led by Vitaly Mitroshkin & Andrey Kobylkin for the Subsurface, Jans Brummelman & Sean McGurk for the drilling. Without their skills and aptitude, the Horizontal Wells would not have yielded these high returns for SPD.

Andrey Frolov: Reservoir Engineer, SPD

Antoine D’Amore: Head of Front End Engineering, SPD