Supervision Service Market in Russia: Providing Value for Money

Supervision as an element of management in the oil and gas industry originated in early 1990’s. Today almost all Russian oil companies utilize this management tool in drilling, well workover and seismic surveys. There are both private companies specializing in supervision services (so-called external supervision) and supervision departments in the oil companies (internal supervision). Several important trends appeared recently which will determine the development of supervision services in the near future. Most oil companies contract drilling services on an independent services basis (as opposed to general contract) which requires more management functions than the supervision functions provided by the supervisors. Another trend is an increase in the share of internal supervision leading to an intensification of competition between the supervising companies in the remaining part of the market. Another trend is caused by an increase in the scope of supervision services. If the oil companies traditionally utilized supervision services in drilling, well workover and seismic surveys, there are also the tenders for supervision services in such exotic activities as contaminated soil reclamation, registration and storage of pipes, repair of submersible pumps and process plants.

All of the technical aspects of supervision services are discussed in detail in different press reports (1) and publications (2). In this article however, we will consider supervision services solely from the point of view of conducting business, market development and prospects, economics and supervision company management.

Supervision Services Market

It is fair to say that the supervision services market in Russia has been going for some time. Almost all oil and gas companies (except for Surgutneftegas) contract private companies that provide supervision services. As the tendering process has been transferred to open electronic trading platforms, we can now evaluate the companies that are available on the supervision services market, distinguish its main segments and determine the main clients. In particular, when we analyze tenders issued for the period from 2014 through November 2016, its suggests a stable demand for supervision services on the part of oil companies (Fig. 1).

During this period, 278 tenders were held for a total of 13.5 billion rubles.. The main client for these supervision services is Rosneft (35%), followed by Lukoil (25%) and Gazprom Neft (16%). We noticed an increase in the scope of the tenders – and this was down to a decision made by Lukoil and Gazprom Neft to sign three year contracts for supervision services (for 2017-2019).

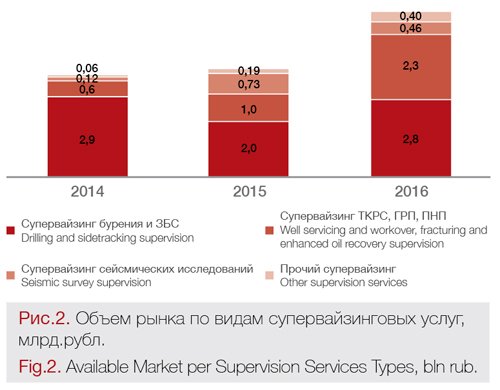

The market can be divided into 4 key segments: supervision over drilling and sidetracking, supervision over well workover (including supervision over enhanced oil recovery and fracturing), supervision over seismic surveys and other types of supervision services (soil reclamation, equipment repair and environment).

Predictably (Fig. 2), the main scope of supervision services (more than 50%) covers supervision over drilling and sidetracking, and we have noticed an increase in the need for sidetrack supervision. We believe that this market will remain high and stable when we bear in mind the operating well stock. The seismic survey supervision segment is completely dependent on the exploration programs implemented by the oil companies, and the drilling and sidetracking supervision segment is directly attributed to the intensity of production drilling by the oil companies.

Another market growth factor is the gain in popularity of other types of supervision services. Oil companies that have seen the benefit of incorporating supervision services in drilling and well workover are more likely to use this practice for environmental protection (soil reclamation supervision) and repair (supervision over repair of tubing, ESP, refineries, etc.). Generally, it is safe to forecast the cost of supervision services in 2017 will constitute a minimum RUR 4 billion.

Market Analysis

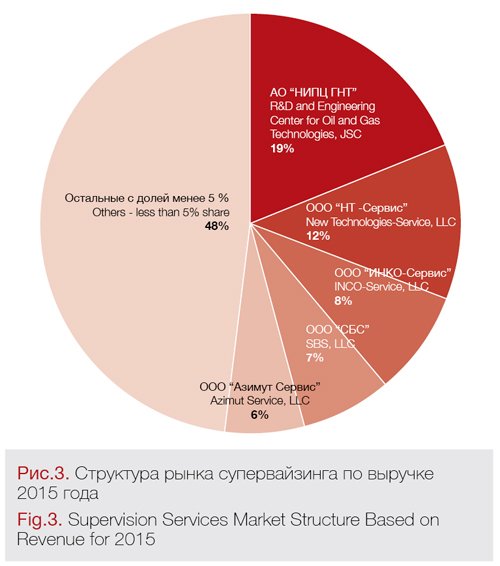

Currently there are 40 companies in Russia that provide supervision services. When analyzing the tender data base and available accounting documentation for 2015 (Kontur Focus), only five companies command more than half of the market share. The remaining market is occupied by many small enterprises and non-core divisions of leading service companies.

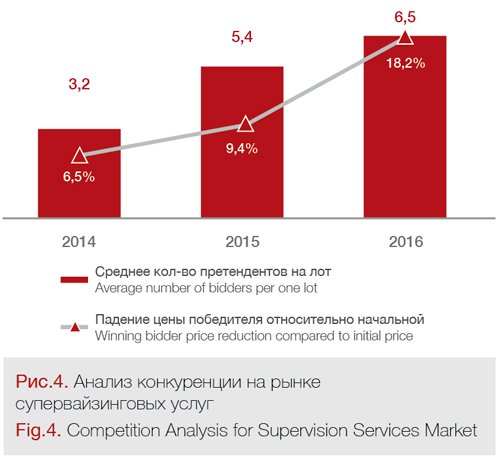

As explained below, the supervision services business does not require major capital expenditures or high initial investments. To participate in the tender for supervision services, it is often sufficient to submit the SRO permit and information on the experience of the staff which is rarely checked by tender boards of the oil companies. Almost all oil companies (except for Lukoil) elect not to use scoring system when carrying out technical evaluation of the companies and just apply the formal evaluation procedure, i.e. “acceptable/not acceptable”. An on-site audit, which would be an effective tool of the bidder, is in fact not often utilized (it only has been three times in more than 15 year history of R&D and Engineering Center for Oil and Gas Technologies: 2014 – Tatneft, 2015 – Bashneft and 2016 – Slavneft-Megionneftegas) and the setting of a minimum allowable (anti-dumping) price in tender procedures is persistently rejected by the oil companies regardless of continuous discussions. Recently, the only determining factor for selecting the winning bidder is low price.

With the emergence of many companies in this market, due to the tender policies of the oil companies, there has been something of a price war and marked drop in the profits that are available. For this reason, the foreign service companies and the service divisions of foreign oil companies have vacated the market, leaving it to the smaller players.

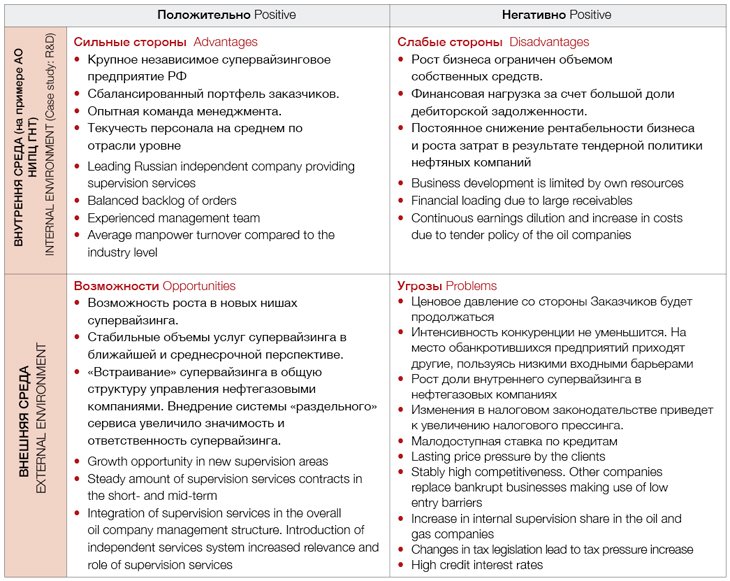

Internal Business Environment

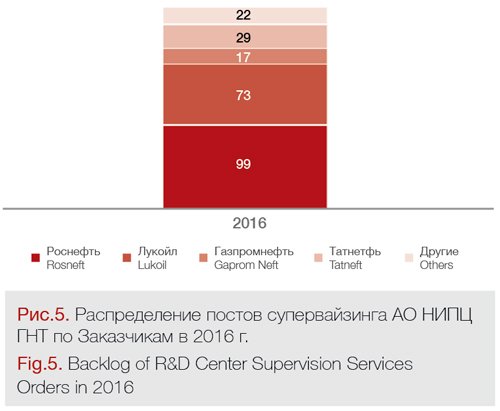

We will analyze the internal business environment of the companies providing supervision services using the example of the R&D and Engineering Center for Oil and Gas Technologies, JSC. The company provides supervision services on 240 sites for clients that include Rosneft, Lukoil, Tatneft, Gazprom Neft and the National Oil Company (Fig. 5). The core activity of the company is supervision over drilling, sidetracking and well workover.

There are seven standalone divisions in five regions. There are over 600 employees, and revenue for 2015 totaled RUR 800 million. For the purposes of this article we will say that the business carried out by R&D and Engineering Center for Oil and Gas Technologies, JSC (hereinafter referred to as R&D Center), described below, are typical for other supervision companies as well.

Structure of Contract Backlog

The main clients of the R&D Center in the drilling and workover supervision segment are Rosneft (48%), LUKOIL (30%), Tatneft (12%) and Gazprom Neft (7%). This proportion corresponds to the tender ratio placed by the above oil companies. It is believed that other supervision companies have a similar backlog of orders where the major share falls on Rosneft and Lukoil.

Financial Activities

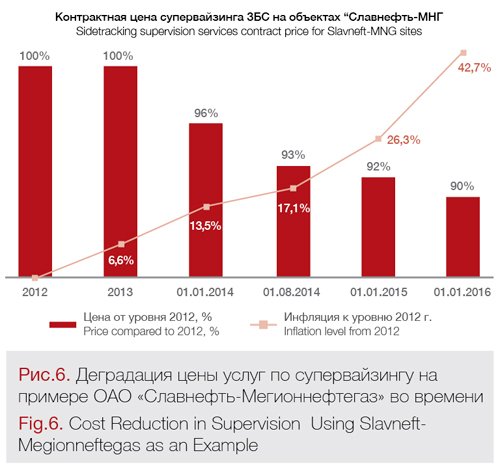

Revenue of the R&D Center depends on the cost of services under the signed contracts and on the work scope. As noted above, the supervision services are to be provided in the extremely competitive market and price pressure conditions created by the oil companies. To demonstrate this phenomenon, let’s consider the dynamics of the sidetracking supervision services cost reduction using the example of the signing of contracts with Slavneft-Megionneftegas when price decreased by 10% as a result of tenders and by 52.7% if adjusted for inflation (Fig. 6).

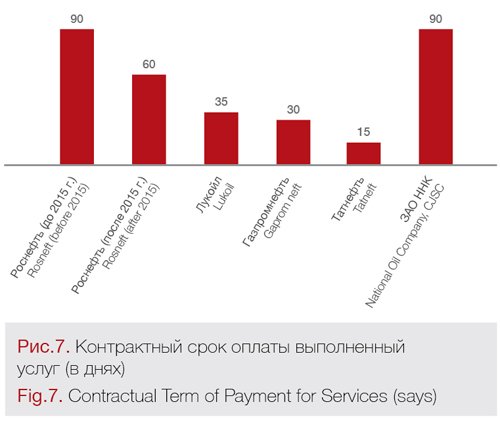

Another factor materially influencing the company’s financial stability is receivables due to payment terms and conditions under contracts with clients (Fig. 7).

The share of receivables in the R&D Center assets is continuously increasing, reaching 25% of the total turnover. The effect of large accounts receivable on activities of the oil service company is discussed in detail in article (3).

Problems arising from the late payment for services within this market are typical to the entire Russian oil industry and supervision services market is no exception.

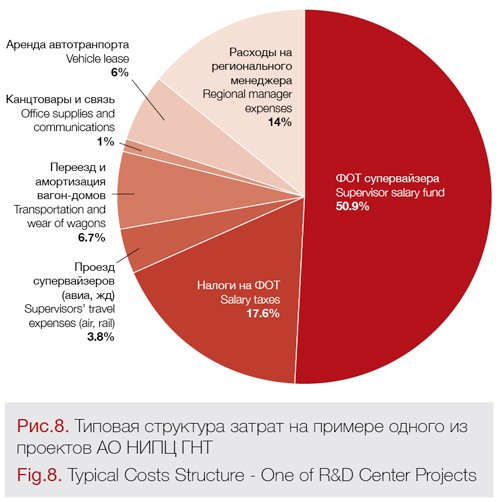

All these complicated financial factors force R&D Center to optimize costs wherever possible. The structure of supervision costs reflects the nature of supervision activities where the main component is a field specialist-supervisor. Thus, salary and salary taxes of the specialist and his/her regional managers constitute more than 75% of the services prime cost (Fig. 8). Other expenditures are not material. So, the primary resource for supervision costs optimization is supervisor’s salary. In the R&D Center, the costs are optimized be means of a flexible remuneration system depending on the supervisors’ category, a reward system based on supervisors rating and penalties imposed on employees.

Unfortunately, a number of recent changes in the tax and labor codes regulating the payment of salaries (Federal Law No. 272 as amended on October 01, 2016) and new procedures for taxation of compensation payments (rotational allowance), effective as of January 01, 2017, impose additional restrictions and obligations on the employer as related to salary payments to the employees. The only remedy is to reduce the salary fund and number of personnel.

Personnel

Supervision is perhaps the only industry where the number and qualification of personnel are determined by the client. Almost all contracts set requirements to the field personnel and regional management staff. As a rule, higher specialized education and a minimum of 5 years’ experience is required. Considering that supervision services contracts with the oil companies are signed for 1-2 years, the industry suffers high manpower turnover. Usually employees work with the company until contract expires and then become employed by another company (winning bidder).

Average figures for R&D Center employees are as follows: age – 41, total experience – 12.4 years, experience of working with R&D Center – 1.1 year. 77% of the staff has higher education. 88% of the employees are Russian citizens (others are from CIS states). R&D Center manpower turnover in 2016 constituted 23.4%, which is rather good for the supervision services industry. In other companies this figure can be as high as 75%.

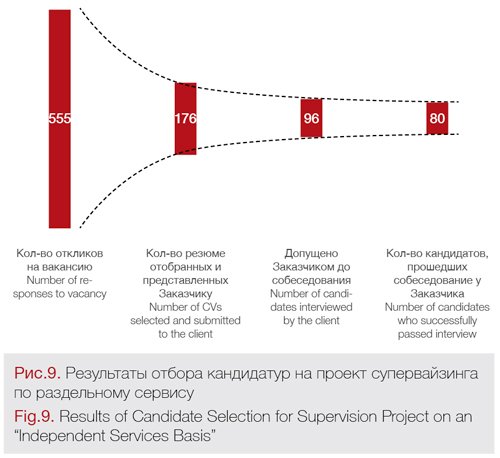

Special attention should be paid to qualification of personnel particularly when you consider that drilling supervision is carried out on an independent services basis (management supervision). Apart from technical competency, the supervisor needs to have managerial and project planning skills and be sociable. Considering the practice of candidate selection for one of the management supervision projects, many of the specialists do not meet the new requirements (Fig. 9).

In general, irrespective of more stringent requirements to personnel qualification, the transition to management supervision can be regarded as a positive trend as the relevance of supervision services and economic benefits for the oil companies materially increased.

Plans for Development

The management R&D Center Management are optimistic and are betting on an increase in demand for the company’s services by providing a new type of service – geosupervision. The geosupervision concept is the provision of integrated services: supervision, geotechnical survey, instrumental measurements and the analysis thereof. This integration allows us to optimize our clients costs and still provide high quality services.

Conclusion and Prospects for the Supervision Services Market

Looking at this market from a business perspective, we can confidently say that demand for supervision services will remain high. On the other hand the market will remain difficult because of price pressure and the competitiveness of the market.

Over the long term we can predict further price pressures within this market, requiring constant innovation on our part. Only those companies that can successfully optimize costs will win this competition.

A. V. Schebetov, Deputy Director for Development in R&D and Engineering Center for Oil and Gas Technologies, JSC

1. Кульчицкий В.В., Щебетов А.В. Супервайзинг – управление качеством строительства и ремонта скважин. Управление качеством в нефтегазовом комплексе. №2-2016. С. 11-15.

Kulchitsky VV, Shchebetov AV Supervising – quality management of construction and repair of wells. Quality management in the oil and gas sector. №2-2016. Pp. 11-15.

2. Кульчицкий В.В., Ларионов А С., Гришин Д.В., Александров В.Л. Учебное пособие. Технико-технологический над зор строительство нефтегазовых сква жин (Буровой супервойзинr). ГУП издательства «Нефть и газ» РГУ нефти и газа им. И.М. Губкина. М. 2007. – С.125.

Kulchitsky V.V., Larionov A.S., Grishin D.V., Aleksandrov V.L. Tutorial. Technical and technological supervision of the construction of oil and gas wells (Drilling Supervozin). GUP publishing house “Oil and Gas” of the RSU of oil and gas. THEM. Gubkin. M. 2007. – P.125.

3. Щебетов А.В., Кульчицкий В.В. «Пора вводить мобилизационный план» – Нефть России №1-2, 2016, стр.52-54.

Schebetov AV, Kulchitsky V.V. “It’s time to introduce a mobilization plan” – Oil of Russia №1-2, 2016, pp.52-54.