Rystad Energy Forecasts Maximum Investment in Deepwater Projects This Year

Capital spending on new deepwater drilling is forecast to hit a 12-year high next year, according to consultancy Rystad Energy. Once upon a time, the shale revolution somewhat pushed back interest in the development of shelf hydrocarbons. However, recent deep-sea discoveries off Guyana, Namibia and the Gulf Coast are bringing …

There Are Not Enough Traditional Gas Fields for Everyone

Even with the expansion of the use of renewable energy sources, existing gas fields will not be able to satisfy the growing global demand for this energy carrier, Rystad Energy calculated. Gas production growth is projected at 12.5% from 2023 to 2030, with the Middle East playing a decisive role. …

Shale Needs Money to Keep Production

In Q2 2023, U.S. shale oil reinvestment rates hit a 3-year high Rystad Energy analysts indicated that the 18 oil and gas companies that account for 40% of U.S. shale production had a reinvestment rate (the ratio between capital expenditures and cash flow from operations) was at 72% during the …

World Recoverable Oil Reserves Increased by 52 Billion Barrels in a Year – Rystad

The volume of recoverable oil reserves in the world is estimated at 1.624 trillion barrels, the figure increased by 52 billion barrels over the year, according to a study by Rystad Energy. At the same time, it will be economically feasible to extract less than 1.3 trillion barrels before 2100 …

Rystad Energy: OPEC+ First in Person Meeting Since pre-Covid as 23 Energy Ministers Meet in Vienna

Here is Rystad Energy Oil Market note with Senior Vice President Jorge Leon: OPEC+ ministers are meeting on 5 October in Vienna, Austria to discuss production policy for the months ahead. While there is naturally uncertainty around what decision they will take, we believe that a decision to cut production …

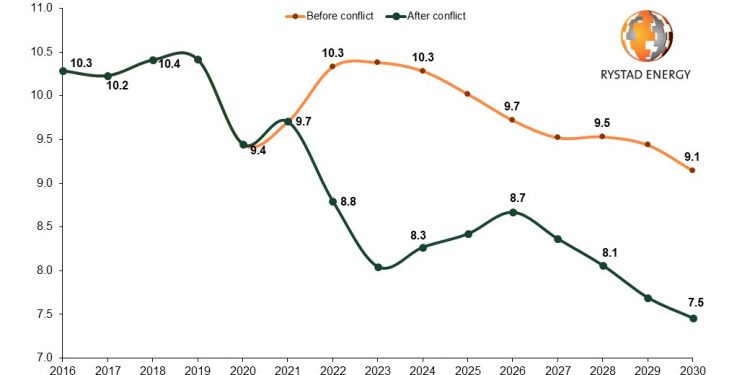

Rystad Energy: Russian Crude Output Rebounds Strongly, But Hard Times Lie Ahead

Russia has so far demonstrated high resilience to the unprecedented pressure imposed by Europe and the US – but the worst is yet to come, according Rystad Energy research. While Russian crude output is expected to remain high for the remainder of the Northern Hemisphere summer it is expected to decline …

Rystad Energy: OCTG Prices in Japan and China Diverge While European and Chinese Steel Prices Narrow

OCTG prices for Japan rise on high raw material prices, while they drop in China due to lower demand. Scrap metal prices fall and the price gap between European and Chinese steel narrows with global steel production set to be close, but not match the 2020 peak. Here is Rystad …

OCTG Prices Expected to Remain High for Remainder of 2022 – Rystad Energy OCTG and Energy Steel Market Note

The OCTG sector in the US continues to struggle with extremely restricted supply in the face of strong demand as China’s steel production and prices begin to return to normal. Here is Rystad Energy’s weekly steel and OCTG note from two of our analysts, Alistair Ramsay and Matthew Loffman: Energy …

Steel Inventory Falls as Demand Recovers, OCTG Prices Expected to Remain Elevated – Rystad Energy Steel and OCTG Market Note

Positive signals for Chinese steel demand, but prices slipping. OCTG demand expected to revive in June. Here is Rystad Energy’s weekly steel and OCTG note from two of our analysts, Alistair Ramsay and Marina Bozkurt: Steel Steel inventory levels in China have fallen in May, a positive signal for demand …

Lifting the Curtain on Russia’s Oil and Gas Sectors That Will Bring in an Estimated $260 Billion in 2022

Despite the severe oil production cuts expected in Russia this year, tax revenue will increase significantly to more than $180 billion due to the spike in oil prices, Rystad Energy research shows. This is 45% and 181% higher than in 2021 and 2020, respectively. Russia’s progressive tax system means that …