Technology Roundtable: Unconventional Oil

Russia is starting to develop its unconventional reserves with pilot projects and longer term plans in place. How do you see the current state of the unconventional sector in Russia and how quickly do you think full scale unconventional development in the region will take place?

Weatherford: It is difficult to predict how quickly full scale unconventional development in Russia will take place. In North America it took close to ten years to fully ramp up to drilling thousands of horizontal wells every week. Having the right type of rigs is important at first. Mobile rigs that can be moved in less than 90 truck-loads helped. At least 1500 HP rigs with modern top drives are necessary and multiple (3+) mud pumps are instrumental in drilling the horizontal sections in North America.

LLC Trican Well Service: Russia is the world leader in natural gas reserves and has abundant oil reserves. For the last years Russia successfully concentrated on its traditional fields increasing crude production year on year. But the market drivers change and in order to secure Russia’s position as one of the world’s top crude producers oil and gas production companies started to look at the unconventional resources. The main focus of attention has been on Bazhenov shale. Rosneft, LUKOIL, Gazprom Neft have highlighted the potential for the Bazhenov shale in their strategies. JV’s with ExxonMobil, Statoil and Shell have started to introduce expertise, technology and experience. The development is at a very early stage – pilot projects are taking place. The speed with which the companies will develop the sector is difficult to predict. Economic imperatives combined with the legislative incentives will dictate the pace of the progress. Lower global crude oil prices can definitely slow the growth of shale production in Russia as all over the world.

Currently there is more interest to shale oil rather than shale gas that is again driven by the market forces. Russia has got sufficient gas reserves to produce it by traditional means rather than to develop unconventional that is several times more expensive.

Carbo Ceramics: Russia is exploring the economics of unconventional reserves by a pilot-project approach. There are still many rich conventional reserves which are much easier to develop so main attention remains at these reserves. Only economic viability can be the cause for a dramatic growth in this sector. Entering a new technological area needs motivators to off-set risks associated. These can be high profitability expectations on one hand. These have not materialized yet. There can also be tax breaks as a stimulus. These have not been overly attractive yet. I don’t see a full-scale development as in the US, as long the attraction is low.

Baker Hughes: There have been a lot of discussions going around the unconventional sector in Russia since the tax reductions were introduced in July 2013.

But in reality there are not that many big projects that are being currently executed. We can assume that the first pilots will be followed by the second stage of development. So then if you are successful we can talk about full unconventional development in the region. My prognosis would be that we will see a rapid change in developing for example Bazhenov formations since 2016.

Halliburton: This depends on which unconventional reservoirs we are discussing and which basins. Regarding true source rock reservoirs (ie “Shale”) Russia is in the exploration and appraisal phase, with the first few pilot production programs beginning. So there is a lot to learn about what characteristics of the reservoir will lead to the best production, and what controls the distribution of these characteristics. It will likely take several years to establish these ‘sweet spots’, but the potential is definitely there and the planning is underway.

There are other unconventional reservoir types, including fractured carbonate and tight oil sands that are natural extensions of existing development for many Russian field areas and can be developed in the near term with some new technologies and methodologies.

IHS: While the pace of unconventional development will be highly dependent on commodity prices, it also takes time for companies to change their thinking and processes to a mode that works for unconventional reservoirs. There is awareness in Russian companies of the paradigm shift required to exploit unconventional reservoirs, but the shift to working in situations where data is very limited and uncertainty as the norm often takes time. Companies with limited unconventional experience often want to approach unconventional play development like that of a conventional play, applying extensive research and simulation to predict field performance. Successful unconventional reservoir developers have struck a balance on how much science to apply to a field before the results of investigation and analysis diminish in value.

Russia has the chance to learn from unconventional experiences from around the world, but what do you think are the key challenges and learning opportunities that the operators will face in developing unconventional reserves in Russia?

Weatherford: The same challenges face all operators everywhere. See the attached diagram describing the four major challenges which I see as controlling cost, increasing well productivity, environmental footprint and people. We could spend a lot of time on each of these but the bullet points get the idea across. Unconventional wells have high decline rates. This leads to a larger number of wells needed to keep production flowing. Some refer to this as the “Red Queen” effect – a line from a famous children’s story, Alice in Wonderland. The Red Queen tells Alice she must run twice as fast tomorrow to stay in the same place she stands today. Unconventional production mimics this effect.

LLC Trican Well Service: First of all Russia can learn from unconventional oil development efforts around the world and take action to improve safety and mitigate environmental impacts. The safe and responsible development of unconventional domestic resources will bring much value – create jobs, provide economic benefits to the entire domestic production supply chain, secure crude production levels, etc.

Among the challenges I would point the geology of many of the reservoirs that seems very heterogeneous. Well costs are high and decline rates are rapid. Although reduction in taxes for hard-to-recover have now been introduced they may not be sufficent to encourage wide-scale investment. The keystone in any shale reserve development is horizontal directional drilling with multistage fracturing that requires significant expenditure by oil service companies on new heavy rigs and fracking equipments. A lack of the equipment and high demand can delay the projects.

Carbo Ceramics: Everybody understands that developing of unconventional reserves means using of modern technology, accumulated experience and knowledge. The right decision is to hire a high experienced service company which will be in charge of the developing process and which have all the necessary equipment knowledge and experience. Good service costs good money and I afraid that many operators will try a “trial-and-error” approach to avoid “unnecessary” expenses and will try to develop unconventional reserves by themselves. There is a unnecessary secrecy in many O&G companies about their experience or field data, leading to start from scratch in-house. This re-invention of the bicycle may lead to possible delays, damages or “killing” of many hydrocarbon fields with unconventional reserves all around the Russia.

Baker Hughes: Operators are not ready to follow the costly US experience. In Russia customers understand the importance of studying their payzones.

In order to successfully develop their unconventional (or how they call it – hard-to-recover) reservoirs, the main challenge is to move away from conventional thinking to integrate the stratigraphy, unconventional reservoir characterization, rock mechanical evaluation with drilling and completion technology for unconventional exploration production and development.

Halliburton: In general all unconventional reservoirs are different, but the workflows and techniques to appraise and develop them are consistent and usable around the world. We want to build on the experiences that we have gained by working internationally in the other unconventional plays, but not assuming that ‘one size fits all’. There are two views of challenges for unconventionals; the technical view of how to best produce the reservoir, and the commercial view of how to produce the reservoir economically. You can’t really separate the two, but I believe the latter will be the bigger challenge.

IHS: Unconventional development is all about operating in “mass production” mode. With profit margins often low on each well — and high costs to drill, complete, and produce — the transition into unconventional development requires a high level of commitment to realize success. Negotiating volume discounts by keeping drilling or completion crews working full time can make the difference between uneconomic and economic development. As wells come on stream, being able to quickly identify and quantify key performance drivers will allow dynamic tuning of the completion design or operational strategy, and companies will improve the performance of future development by learning from their own experience.

There have been plenty of discussions on the rate of pace of Russian unconventional development with some commenting that they have fallen behind when it comes to unconventional technology adoption and understanding. How much interest have you had, regionally, for your unconventional product/service offerings?

Weatherford: The interest is growing every day. From new logging tools (wireline, LWD, surface/cuttings logs) to Hydraulic Fracturing, Coiled Tubing, to the latest downhole completion systems Weatherford responds nearly every day to inquiries from operators about unconventional technology.

LLC Trican Well Service: In general Russia’s interest in shale oil and gas has increased dramatically just over the last couple of years. Government, institutions, oil & gas production companies, OFS companies now perfectly understand that shale oil and gas has the potential to change not only Russian energy market but the whole global energy market as well. Already, it has transformed the energy sector in the USA, positioning the USA as a potential net exporter rather than importer. Lots of different conferences are taking place in Russia with the focus on unconventional resources development with active participation of our customers, OFS companies, government representatives. We get much interest to our offerings and as a follow up provide additional information on our technologies and technical capabilities. We actively participate in tenders for unconventional resources projects.

Carbo Ceramics: Correct. The rate of pace of Russian unconventional development is not satisfying. But we shall to keep in mind that we start develop unconventional reserves because we have less and less conventional reserves but not vice versa. As long there is easy access to any reserves, we will develop it. As soon as we will face problem of decreasing production due to depletion of conventional reserves, operators will turn to develop of unconventional reserves. Our company carries a huge experience in production enhancement by engineering of hydraulic fracturing and entire field developments from unconventional developments in the US. We also produce ceramic proppant in Russia, the US and China. This ceramic proppant in the US is almost exclusively used in unconventional wells.

Baker Hughes: First of all I want to add that in Russia we have had the mineral extraction tax reduction for less than a year. But in the US It has been in place for 25 years and they started to really produce from Unconventionals only in 2006. So Russian Operators are much faster than US ones. And we see increased attention and interest in our product. We see an increased number of request for Multistage completion equipment and for horizontal drilling as well.

Halliburton: We have had significant interest, ranging from individual product and technology interest all the way to partnering around how best to develop a particular resource from appraisal through development. We have been bringing staff with North America experience to help speed up the learning curve.

IHS: The interest in the IHS Engineering software tools and services, including our Community of Best Practice program, has increased substantially in the past six months. Many inquiries have been around gaining understanding on why a different tool set is required to analyse unconventional wells, and how these tools are different from the tools they currently use. As more companies begin to see the limitations of the data they can collect and work with on their first multistage horizontal wells, it becomes more apparent why more simple models are required. For example, understanding the fluid contribution from any individual stage or perforation cluster over time is difficult, if not impossible, and likely economically unfeasible for routine work. As such, simple well completion geometry modelling reduces the assumptions required and provides reliable forecasts.

Are you seeing more interest from the operators to understand how your products/services work and how they can aid them with their field development?

Weatherford: Numerous Russian client delegations have visited our facilities, test centers and R&D labs in North America in the past three years. Likewise there is increased activity associated with Russian industry events where the latest products and services are described in detail.

LLC Trican Well Service: Definitely our company, providing the service on various geographical markets, communicates with our customers in order to address their current and future needs sharing its gained experience and knowledge. The customers appreciate it and are willing to see how our solutions can fit their plans and development challenges. As example, Trican’s TriFrac MLT™system addresses key issues surrounding the sourcing, use, and treatment of water in fracturing operations. Formulated using conventional fracturing fluid components enhanced with patent-pending chemistry, the crosslinked, gelled water system is highly tolerant of brine fluids. This tolerance allows the re-use of 100% untreated flowback water or produced water that occurs along with oil and/or gas production from a well. The system therefore eliminates the cost associated with upfront freshwater acquisition, and repurposes frac flowback and produced water into an asset that can be incorporated into fracturing fluid systems, rather than becoming a waste product in need of disposal. This dramatically reduces the logistical and infrastructural costs incurred in the sourcing of water. Furthermore, the need for wastewater treatment equipment is eliminated, providing further savings. TriFrac-MLT enables operators to use water with total dissolved solids (TDS) levels greater than 300,000 parts per million, and hardness greater than 30,000 ppm. Unlike most conventional fracturing fluid systems that are negatively affected by boron, the system’s chemistry supports use in waters with boron levels exceeding 500 ppm.

Operators can also tailor deployment to their requirements using a breaker schedule to optimise the viscosity of the fluid. Crosslinking at temperatures as low as 7°C (45°F), the fluid can also reduce fluid heating costs frequently incurred during colder operations.

Carbo Ceramics: Interest is permanently growing but I can’t say that it grows dramatically. We see that a new generation of specialists who are familiar with modern technology and have necessary knowelege is coming to Russian operators. We do master classes for fracturing and we see that operators are interesting in new development techniques. We also provide the frac simulation software that is wised used in Russia-FRACPRO. From our side we are ready to transfer that our Russian Specialists gained in the US to Russia. However, the huge Operators that now dominate the Russian O&G sector prefer in-house solutions and value experience less than hardware.

Baker Hughes: As I mentioned in the previous answer we see a lot of interest especially in stimulation and multistage completion.

Halliburton: As per above question we are seeing very strong interest from operators in both the appraisal and development of unconventional reservoirs.

IHS: Yes. The best example is probably our Community of Best Practice (COBP) initiative, which has been of interest to many companies working in the Bazhenov oil shale. COBP creates an opportunity for a number of companies to work together by sharing data with our Community team, having that team analyse all the data, and provide it back to all Community members in a way where all members benefit equally. Understanding what the permeability is in the play is of critical importance to ensure the economic viability of the shale. Given the lack of industry experience in this shale, a team of Community analysts could accelerate the learning process by applying their knowledge from working in other oil shale plays around the world by developing best practice recommendations. These could include guidance on designing and analysing minifrac tests, completion design, choke management, and selection and operational practices for artificial lift.

What are your solutions for the regions unconventional sector?

Weatherford: Weatherford is organized as an unconventional services provider. Our focus is to provide solutions for evaluation, drilling, completion and long term production of wells. This range of solutions begins with our Petroleum Consulting and Weatherford Labs teams who analyze existing information such as seismic data, wireline logs, cuttings and cores. Recommendations are then provided to clients to acquire additional data to facilitate the work flow (see them below).

LLC Trican Well Service: Trican Well Service has, alongside its other frac technology, developed a number of systems for the unconventional resources development including proppant, processes, and water solutions to meet the requirements of the industry. Some treatments are formulated to maximise tight gas yields, while others focus on maximising the value of oil field water in order to minimise the need for fresh water especially in large volume fracturing operqations in shale oil and gas formations.The newly developed system Maximum Volume Placement MVP Frac™ process increases the dispersal of proppant in slick water operations.It is a two-component slick water system designed to maximise the volume and distance of proppant distribution within fractured formations. First, Trican’s nonenergised FlowRider™ additive increases the volume of the proppant pack in the fracture. Second, an energised component, consisting of a low volume of nitrogen gas, works in tandem with the FlowRider treated proppant to transport it further into the formation.The result is that MVP Frac dramatically reduces the settling of proppant when carrying out slick water fracs. The process fluidizes and suspends the sand, carrying it deeper and distributing it more effectively into the reservoir without increasing viscosity. The result reaps all the benefits of slick water, but with a more effective proppant distribution across the fracture network, enhancing well production.

Carbo Ceramics: We use an engineering approach for fracture design as a production enhancement method. Our Strata-shale concept considers, beside many other factors, rock brittleness, ductility and homogeneity of the reservoir. We provide neural network analysis to determine best practices in operation and technology applied. We can access our comprehensive US data base to find similarities in reservoirs and completions. In the US our engineering arm, StrataGen, is hired mainly by many small and medium sized companies. Therefore we have huge experience across the entire unconventional industry with its different approaches, reservoirs and strategies.

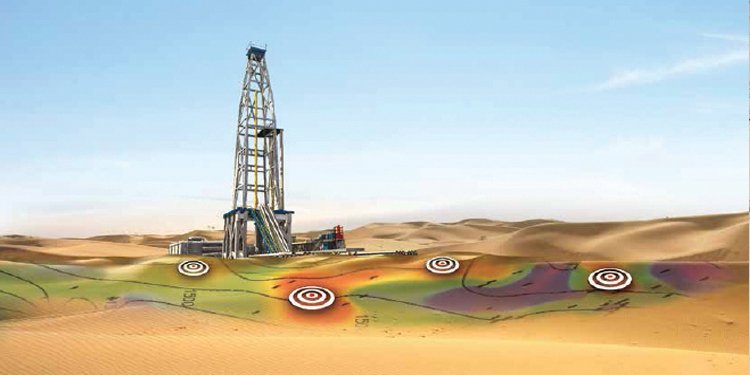

Baker Hughes: We have various solutions from drilling to production. But we believe that our alliance with CGG can help to identify sweet spots and significantly reduce number of dry wells with the help of 3D seismic interpretation and using our Wireline or LWD characterization to calibrate seismic.

Halliburton: To list all of our solutions that apply to the Russian unconventional sector would take quite a while! I would like to identify one new solution that is very appropriate for speeding the time from identification of an unconventional resource to commercial development, we call it the CYPHER Service. It is a Seismic-to-Stimulation Service that delivers enhanced profitability to our customers in shale and tight reservoirs. The CYPHER service achieves this through basin knowledge, accurate geoscience analysis coupled with precision engineering, operational experience, the continuous capture and application of lessons learned and model validation using actual well performance data.

IHS: IHS Harmony™ is our Well Performance analysis environment, which includes four different software tools to analyse production data on unconventional wells. The IHS DeclinePlus module will support the traditional evaluation methods, like Arps decline, along with the more modern rate only methods like stretched exponential, Duong, and Multi-Segment Decline. IHS RTA adds methods that use both rate and pressure, like typecurves, the flowing material balance, and analytical and numerical models. IHS Virtuwell and IHS Perform tools are used for wellbore calculation capabilities and artificial lift planning functionality. The IHS Welltest software is a comprehensive tool for analysing minifrac data – the commonly completed pressure transient analysis in unconventional wells. For companies who don’t have the time, or feel they have the expertise to use our software tools independently, we have a consulting organization that can step in to help start a project, or conduct a full turnkey field development study.

In terms of technology transfers, is it a simple case of introducing your technologies or services that have worked elsewhere in the world and applying them to Russia or do they need to be developed and adapted specifically for the region?

Weatherford: Using the Bazhenov formation as an example it would be a mistake to simply transfer the same techniques from North America’s Bakken formation in spite of the fact both are marine shale source rocks of upper Jurassic/lower Cretaceous age. Actual production may come from the silty dolomitic formations between the upper and lower Bazhenov. This is similar to the Bakken as well. Because the Bazhenov is so large a lot of learning will take place on a local basis. Drilling challenges and tough technical hurdles will be completely different from the Bakken formation in North Dakota. However, it might be useful to use the Bakken as an early analogue for technology transfer. For example the Bakken is characterised by extremely long horizontal completions (> 3300 meters), 30+ completions stages and high proppant loading to achieve optimal liquids production.

LLC Trican Well Service: The transfer of technologies is not an easy task. As it often happens the systems that have shown superior results on one field may not perform as predicted on the other within the same geographical region. The situation can be even more complicated if we talk about the application of technology developed in the other region like North America that needs to be applied in Western Siberia. Trican Well Service understands these challenges and in order to address them the research and development centre has been opened last year on the basis of Gubkin Oil and Gas University. The primarily goal was to use Trican’s experience alongside with University’s knowledge base to adopt the best technologies to the Russian environment. As of today, we have successfully adopted, and it’s better to say that actually re-developed, several systems for fracturing in unconventional formations with harsh and unique conditions – like PolarFrac™ for extra cold formation with temperatures as low as 8 deg C. Also, we are working on adaptation of our TriFrac MLT™ system to be compatible with water sources on the fields in Western Siberia to utilize its benefits in full to reduce the logistics expenses for water haulage of our customers, which contributes significantly to the costs of fracturing operations with slick water on unconventional formations.

Carbo Ceramics: Reservoir characteristics are the defining factor. If there is sufficient similarity between reservoirs, the likelihood that it works here well is high. But unconventional reservoirs can vary highly and each field that lacks in similarities will need its own research and approach. Front-end engineering is well spent money compared to trial-and-error. In our view intensive information exchange between experts will accelerate the economic development of unconventional reservoirs.

Baker Hughes: As you may know Baker Hughes leads in the US market in multistage completion from Fracpoint to Plug-and-Perf and we see that the adaption is a bit different. The Fracpoint open hole multistage completion system is more often used in Russia than Plug-and-Perf.

We do not chase a maximum number of stages. Instead we aim to do as many stages as reasonable necessary to maximize production.

Halliburton: As per my earlier comments there is no ‘one size fits all’ for unconventional reservoirs, but by analysis of local unconventional reservoirs experience and technologies from analogous other plays can be brought to Russia and then adapted to meet the specific characteristics and needs of the Russian market. The goal is to shorten the time from resource identification to commercial development as quickly as possible. There is also a training element to bring Russian scientists and engineers up the learning curve with unconventionals. I ‘grew up’ developing conventional reservoirs on the North Slope of Alaska, and have had to learn new approaches to be successful in unconventional reservoirs.

IHS: Adaptation is critical. That’s one of the reasons IHS products include most if not all of the industry-accepted methods for well performance analysis, and have been built to support user developed workflows. Although common analysis techniques may be used, the process by which one analyses an Eagle Ford gas condensate well is different than the process of analysing a Vaca Muerta shale oil well. There are also factors like pressure-dependant variables, natural fractures, and other geological influences that must be accounted for in an analysis. There is a tremendous value in experience though, and much of our experience in unconventional at IHS can be leveraged to quickly develop an understanding of the behaviour and critical analysis considerations that must be taken into account for unconventional wells.

What benefits will the regional operators gain by implementing or using your services/products?

Weatherford: Weatherford prefers to work with clients in a collaborative fashion using an integrated approach relying on decisions supported by solid science. We have worked on tens of thousands of unconventional wells where we’ve learned each area’s geology is unique and each country’s challenges unique. So in the final analysis the primary benefit of working with Weatherford is that we keep an open mind. We remain humble; not believing we have the answer until we share a lot of facts with each other. At this point we can recommend the right technology to get the job done without wasting time and money.

LLC Trican Well Service: First of all Trican employs a disciplined and scientific approach to research and development that delivers innovative products and processes, while addressing a shared commitment to safety, quality and reducing our impact on the environment. Our customers don’t only get technologies and processes focused on efficiency, effectiveness and significant savings but primarily on HSE. Minimizing the impact of our operations on the environment is one of Trican’s core values. Last year we also expanded our completion systems service line through the acquisition of a completion and intervention tools company based in Norway in early 2013 and by now managed to build a comprehensive, field-proven completion systems portfolio. The vision of our company is to provide the complete solution starting with completion, cementing, hydraulic fracturing, and finishing with coiled tubing. This can save much time to our customers.

We also believe that our continued focus on meeting the needs of our customers, our sustainable investments in R&D, global experience, expertise and skills will allow us to deliver customized solutions for both Russian traditional and unconventional resources and provide high-quality service.

Carbo Ceramics: We are producers of proppant which is used in hydraulic fracturing and we are proud of our consistent product quality worldwide. This quality gives our customers predictable and consistent production results. Our StrataGen engineering uses scientific methods not to model single fractures only but to determine the most efficient method for field development. We are very confident in our knowledge and we are the only company that has bi-lingual Russian engineers that have extensively worked in the US unconventional fields. We are ready to share this experience with our clients. Our FracPro software is the most popular frac simulation software in Russia.

Baker Hughes: The regional operators learned from US lessons and started to use geoscience in unconventional reserves. Baker Hughes and CGG have formed an alliance to provide an integrated geoscience solution for shale reservoir exploration and production, which now allows operators to move from statistical drilling to targeted, sweet spot drilling, ensuring optimum return on investment.

Out product Shadow plug is a large bore isolation device which incorporates an IN-Tallic frac ball. After stimulation, the ball disintegrates away leaving behind a large flow-through ID ready for production eliminating the need to mill-out the plugs. And from a customer perspective, this technology provides a number of advantages such as the elimination of costly milling time, reduced cost and time save to complete a well.

ProductionWave is a family of services tailored to boost production and reduce lifting costs in unconventional wells. It incorporates artificial lift, production chemicals and remote monitoring technologies.

Halliburton: Again there are quite a few, but to summarize

• Minimize the time from resource identification to commercial development

• Maximize asset value;

Increase total recoverable reserves

Enhance production rate

• Drive operational efficiency

IHS: As producing companies move towards unconventional development, a tool set that is equipped to handle a large volume of wells in a short period of time with reliable results can be found in IHS Harmony. Membership in our Community of Best Practice will add the experience of our engineers that have analysed thousands of shale wells to our offering, ensuring that Russian companies have the tools, and guidance to use those tools, to achieve reliable analysis, modelling, and forecasting. IHS has a track record of equipping unconventional reservoir developers to drill, complete, and operate their wells using the best practices in the industry and to achieve economic success.

Robert Fulks Weatherford

Robert Fulks, Director of Strategic Marketing for Pressure Pumping, has been with Weatherford for more than twenty-three years. In addition to being part of the fracturing technologies group Rob is also the Director of Weatherford’s Unconventional Resource Team (URT). The URT was chartered to introduce the same range of integrated services to emerging shale plays in South America, Asia, Africa and Europe. Since 2005 Rob has been instrumental in developing Weatherford’s shale oil & gas services portfolio.

Rob received a BS from Virginia Military Institute (VMI) and was class valedictorian. Rob attended Virginia Tech economics grad school on a state fellowship and later an MBA at the University of Houston. He began his oilfield career in 1980 with NL Baroid as a mud engineer, mud logger, and LWD logging engineer in the Gulf of Mexico. He later was promoted as an LWD technical sales engineer. A thirty-three year veteran of the oil & gas industry, Rob Fulks is a member of SPE and AAPG and has authored numerous technical articles covering both onshore and offshore projects.

Daniel Doll LLC Trican Well Service

Dan Doll is the General Director of Trican Well Service in Russia. Mr. Doll joined Trican as Executive Director, Operations in 2011, and is now responsible for Trican’s overall operations in Russia. Mr. Doll is a professional engineer with more than 20 years’ experience in the pressure pumping industry. He began his career as a field engineer, working offshore in the Gulf of Mexico in 1991. Since then, he has held various operational, technical and marketing positions and has a strong technical and operational background in cementing, fracturing, sand control and coiled tubing. In additional to his operational experience, Mr. Doll has a strong background in international business, having worked in the United States, Equatorial Guinea, Kazakhstan, Nigeria, Turkmenistan, Uzbekistan and Russia.

Andrey Potapov CARBO Ceramics (Eurasia)

Andrey Potapov is Regional Sales Manager for CARBO Ceramics (Eurasia) and has over12 years of working experience in Oil and Gas Industry. He graduated from the Gubkin Russian State University with a degree in the development of oil and gas fields before working for the Russian Academy for Foreign Trade in the International Commercial faculty. Andrey also worked for NOV Tuboscope as Sales Manager, responsible for tubular inspection management and Machinoimport as an expert for crude oil sales.

Kevin Dunn IHS

Kevin Dunn is Senior Director, Engineering Solutions at IHS. He joined IHS through the recent acquisition of Fekete Associates Inc. in April 2013. Prior to the acquisition, Kevin was the Vice President, Sales and Marketing for Fekete, where he spent the last 16 years in various roles including conducting pipeline modeling projects, performing well performance analysis on wells in various unconventional and conventional plays, and rigorous software testing. Kevin was responsible for the opening of Fekete’s office in Houston, Texas in 2011, which served as a software sales and support center for Fekete’s US based customers.

Scot Evans Halliburton

Scot Evans is an E&P leader with a combined 32 years of experience with Exxon and Landmark Graphics/Halliburton. Currently Vice President of Halliburton’s Integrated Asset Management group, his background is in production geoscience, reservoir engineering and New Ventures. He has helped develop several methodologies and technologies in the area of field development planning that are now industry standards. He has been involved with unconventional and naturally fractured reservoirs for 25 years beginning with the Monterey Shale in California. Scot is an active member of the SPE with over 10 publications to date.

Andrey Kravchenko Baker Hughes

Andrey Kravchenko has been working in Baker Hughes for around 7 years. Currently he is Marketing & BD Manager based in Moscow. Andrey has held several positions in Drilling Services Department. He joined Baker Hughes after graduating from Ufa State Petroleum Technological University in 2008 with specialty in Drilling of Oil and Gas Wells.