The Big Oil to Big Energy Transition

Geopolitical, sociological, and economic factors that shape the future of the energy sector

Preface

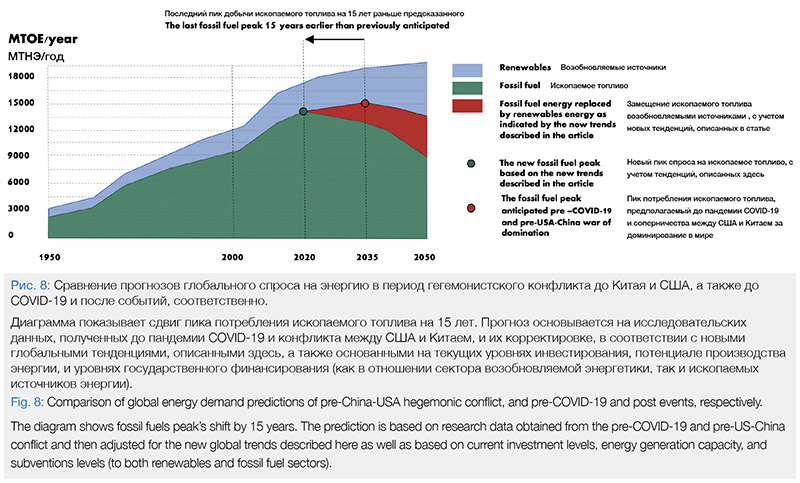

Current global energy consumption forecasts indicate that although renewables are set to expand by 50% between 2020 and 2025, they will not fully replace fossil fuels in our lifetimes. However, if recent geopolitical, economic, and sociological factors are taken into account, this prediction becomes obsolete. The world is about to enter a period of rapid energy transformation.

In today’s unprecedented setting, what previously was estimated as a gradual «not-in-our-life-time» transition to 100% renewable energy usage is expected to occur at an accelerated rate and could now happen during our imaginable lifetime.

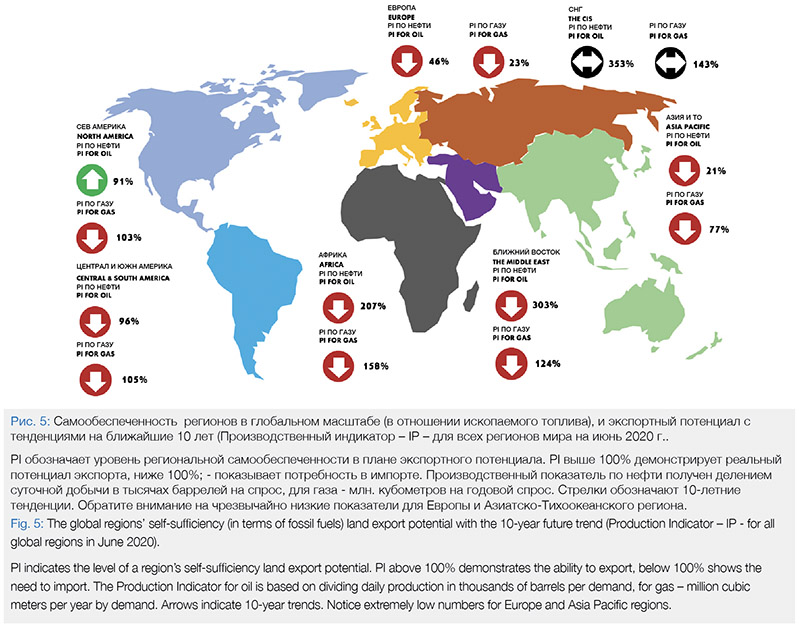

Less obvious but highly impactful factors that are currently transforming the world energy mix are the China – USA war of domination, the consequential decoupling of supply chains caused by the end of the globalization era and the COVID-19 pandemic. These factors have created an immediate need for an accelerated process of industry digitalization, regionalization of the energy supplies, and an extensive transformation of the industry workforce. These changes will create a further decrease in the demand for fossil fuels energy sources in certain parts of the world and push production rates in gradual decline. Direct outcome of such circumstances for governments across the world is the threat to the security of global energy supply chains and disruption of stable energy flow. In order to obtain such security, fossil fuel poor regions of the world will turn towards the energy source which is available in one form or another in most geographic locations – renewables.

Here, an overview of these new geopolitical, economic, and sociological worldwide factors that have a direct impact on the energy sector is presented.

1. End of Globalization and its Effect on Energy Security

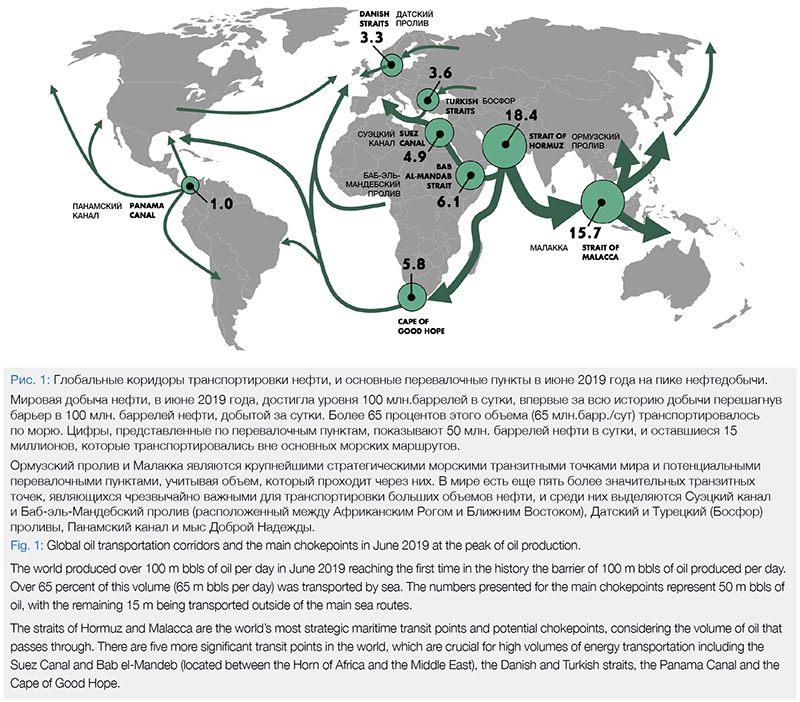

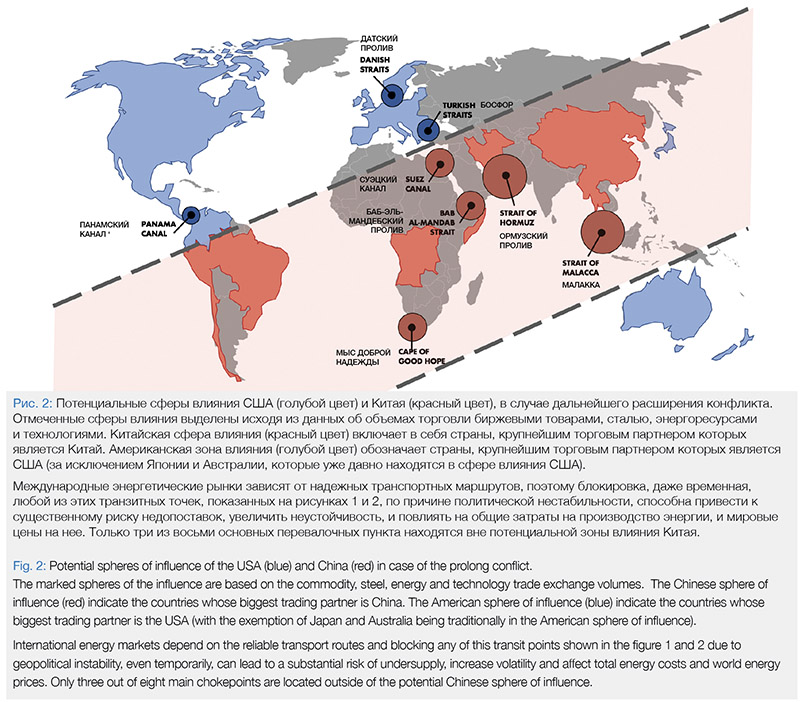

The world still operates under the Pax Americana rules, based on the Bretton Woods agreement and US dollar where the US Navy secures free trade across the entire world allowing energy products to reach any imaginable port around the globe. The preeminent geostrategic test of this era is the impact that China’s ascendance will have on the USA-led international free trade order, which has provided unprecedented peace and prosperity for the past 30 years. Whatever the result of this conflict will be in the future, the main outcome for this is an irreversible «decoupling» (read: break out) of the world’s two largest economies and the global supply chains. This is already creating two distinct spheres of influence and relationships in the world economy, which extends beyond traditional politics into any type of commodity goods and services. This also includes the oil and gas products and its global and the political stability dependant value chains (figure 1).

Decoupling means ripping up global energy supply chains, shutting down the energy transportation corridors between these two economic powers, freezing foreign investment initiatives, and burning down the geopolitical bridges that were built over the past three decades between the Western and Eastern world. It means cost-push inflation and the slowing down of innovation and technological exchange. It also means sanctions, trade and price wars. As a result of that, the global energy supply and strategic flows may significantly diminish its volumes.

Re-creating global supply chains outside of Chinese dependencies will require capital which could otherwise be spent on investments, development projects, and technological advancement. Further deterioration of the US-China relationship to the extent that countries must decide to trade with a partner they value most, is probable. If a country is to «choose» to side with the USA, the energy companies of such country will be obliged to reduce their dependencies on China and China’s sphere of influence (figure 2).

As a consequence, energy supply chains are predicted to become more regional, even national, improving safety of supplies and reducing the geopolitical impact of trade in the process. The only suitable solution for establishing such security and the energy flow stability is to create one’s own independent energy source and to remove political dependencies in the supply chains’ systems.

COVID-19 vividly exposed the fact that each region or country needs to take care of itself in terms of medical supplies and lifesaving. The same will apply to energy resources (figure 4). In terms of the COVID-19’s effect on the sector, the pandemic has further accelerated the process of breaking the links in the world’s energy supply chains which now will be even more difficult to re-establish post-virus.

Unlike fossil fuels, renewable energy sources are available in one form or another in most geographic locations. This is a significant factor in developing greener energy sources with the faster transition to renewable sources in fossil fuel poor regions of the world. This abundance in renewable sources will strengthen energy security and promote greater energy independence for most states.

2. From Big Oil to Big Energy

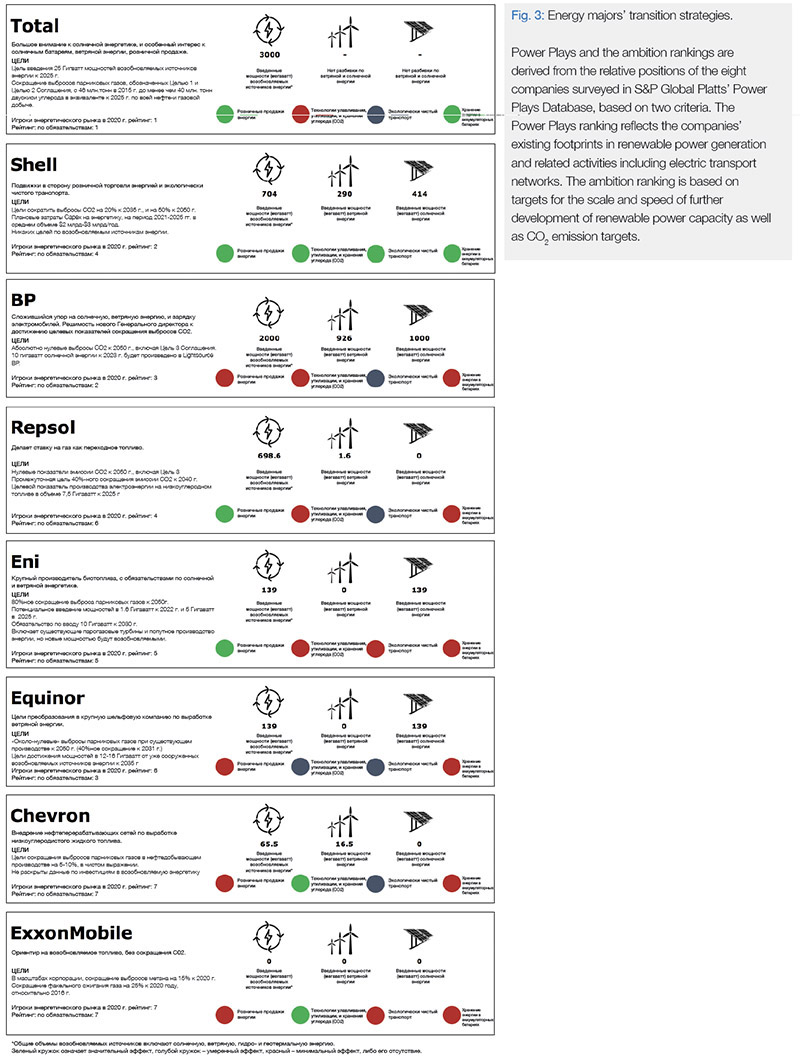

Across the globe, 67 countries have already revealed an ambition to net-zero emission targets of various forms in line with the Paris Climate Agreement (signed by 195 countries worldwide). This is being followed by the major oil and gas companies (figure 3) and other international businesse, now restructuring into energy businesses and diversifying their portfolios. With environmental impact being high on global agendas and with the existing oil and gas prices, companies must seek the opportunities elsewhere. Most of the oil majors are investing heavily in renewables, such as wind and solar, as they look to transition towards cleaner energy sources, and lower CO2 emissions from their existing operations.

It is also a strategic decision and a matter of survival. The reserves that can be developed at current oil and gas prices are concentrated in the Middle East and other unstable areas such as Venezuela and Libya. Almost all of those supplies are controlled by state companies and are therefore inaccessible to the international companies. Dependence on such areas is likely to grow but will be strategically unattractive to importing customers due to lack of political stability. The only remained option is to turn towards other energy sources like renewables.

While the depth and duration of this oil crisis are uncertain, this research suggests that the industry will undergo a fundamental change much quicker, becoming overall energy generation focused rather than traditional fossil fuels exploration and production focused. This diversification in terms of energy sources is a must for the industry to survive the current crisis. On its present course and speed, the industry is now entering an era defined by intense competition, technology-led rapid supply response, flat to declining demand, investor scepticism, and increasing public and government pressure regarding impact on climate and the environment.

3. Digital Revolution Pushes Talent Towards Renewables

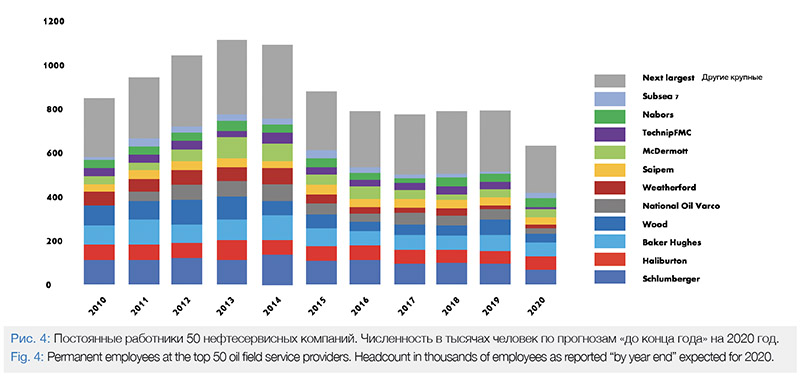

The oil and gas industry is experiencing its third price collapse in 12 years. After the first two shocks, the industry rebounded, and business as usual continued. This time is different. The current context combines a global energy supply shock with an unprecedented demand drop and a global humanitarian threat.

In the face of the existing geopolitical, sociological and economic climate, the oil & gas has become significantly more risk-averse with companies working on joint-ventures to prepare for another big downturn. The aversion to risk is filtered into the organizational culture, with companies looking at how they can run leaner operations with the help of automation and digitalization. These initiatives introduce efficiencies and significantly reduce operating cost. In addition to cost savings, digitalization can also increase productivity by increasing uptime, optimizing reservoir depletion strategies, and minimizing greenhouse emissions. Digitalization, however, has an impact on high numbers of talent being pushed out of the industry. Only over the last decade approximately 500,000 oil and gas professionals globally left the sector permanently with 40-50% of the skilled workforce in the oil & gas sector retiring in the next 6-10 years. How the industry responded to COVID-19 by freezing recruitment and most operators laying off thousands of workers is yet another litmus paper of the industry talent attraction, retention and adaptation.

Digitalization and automation present a huge growth area of new jobs that existing oil & gas professionals could not undertake without the assistance of re-training. The new digital oilfield demands different skillset and capabilities and a different type of workforce. Training, however, requires sufficient budgets and leadership commitment to this transformation which due to the current economic circumstances, has been put on hold. Oil & gas industry has failed to attract new digital professionals over the last decade, and the lack of adequate skills will be the main threat to the oil and gas business continuity.

Hence, even when the oil and gas sector survives yet another crisis, the lack of digital talent will limit the organic growth and affect its production capability. This will further push the workforce towards more stable jobs in, for instance, renewables sector where highly transferable skills of the former oil & gas professionals can be utilised.

It is worth noting that the only sub-sector that increased its workforce by 100,000 professionals over the last decade (globally) is renewables. These ratios for renewables will likely be growing in the near-by future.

4. Shaping the Future of Energy in EU

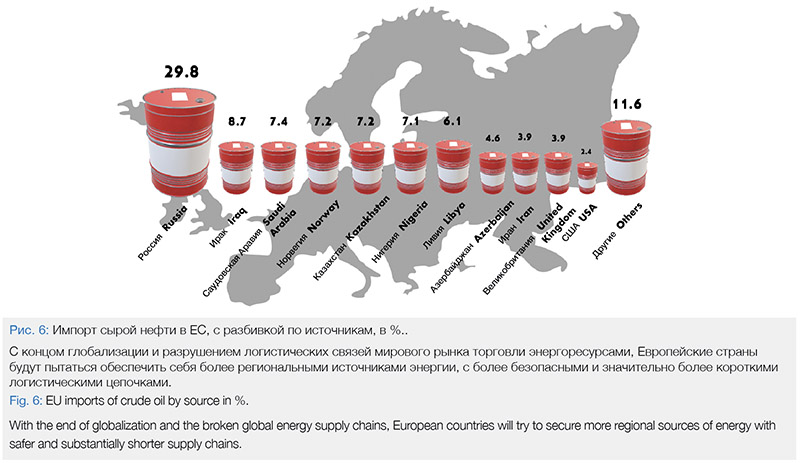

The USA may have achieved effective self-sufficiency in terms of energy sources by development of shale oil and gas industry on their own territory. However, Europe and Asia, which now imports 50% of all oil that is internationally traded, remain reliant on external suppliers. Countries such as China, which imports 11m bbls/day, Japan (3.7m bbls/day) and India (5m bbls/day) as well as the European Union (EU) (15m bbls/day) are the most vulnerable.

The biggest risk in the case of EU, the net importer of the energy, is the breakdown of global supply chains, serious delays along energy supply chains, and the subsequent increased costs of energy. Crude oil and natural gas are some of the top commodities traded globally and political conflict or a pandemic are disrupting the energy flows to EU. The threat to investment and uncertainties regarding trade relationships with the EU main partners could be devastating to the Europe’s economy.

In the case of Europe, the oil and gas supply chain regionalization would mean that fossil fuel energy sources would have to be located in a safe and relatively short distance locations. This would point out to the mostly mature and depleted North Sea reserves, and Russia’s gas fields. However, Eastern and Southern European countries are unlikely to resign from opposing Russian energy dominance and will continue to try and block initiatives like Nord Stream 2 and South Stream (the latter project already abandoned). With relatively mature and declining North Sea reserves, and production less profitable than before, a push for an independent and easily accessible new source of energy like renewables will be apparent.

The obvious choice to minimize the risk of the energy products’ undersupply is energy security resulting from renewable energy sources developed within the EU itself. Solar and wind energy are free goods that are essentially available everywhere. The more power generated from renewable sources in the EU, the less it has to rely on importing energy from abroad, worry about the inefficient supply chains or price volatility of fossil fuels. This is fully aligned with the EU’s net zero-emission and minimal environmental impact strategy that is planned to be obtained by 2050. EU has had an appetite to move towards being energy self-sufficient for quite a while now and COVID-19 will only speed up this process. Relatively lower energy consumption rates caused by the pandemic are the perfect opportunity to perform this shift.

In the EU in 2018, the dependency rate was equal to 58%, which means that more than half of the EU’s energy needs were met by net imports (figure 5). The dependency rate on energy imports has increased since 2000 when it was just 56%. Energy supply chains are critical for the European economy and the countries cannot survive currently without external sources of energy.

As the cost of renewables reduces, many European countries will reach a tipping point in the coming five years (2020 – 2025), where newbuild solar or wind capacity will be cost-competitive with the fuel cost of existing conventional plants. As a result, a further acceleration of the ramp-up of renewables will occur. Countries that are similarly heavily reliant on fossil fuel imports will have to significantly improve their trade balance and reduce the risks associated with vulnerable energy supply lines and volatile fuel prices by developing a greater share of energy domestically.

5. The East is also Green

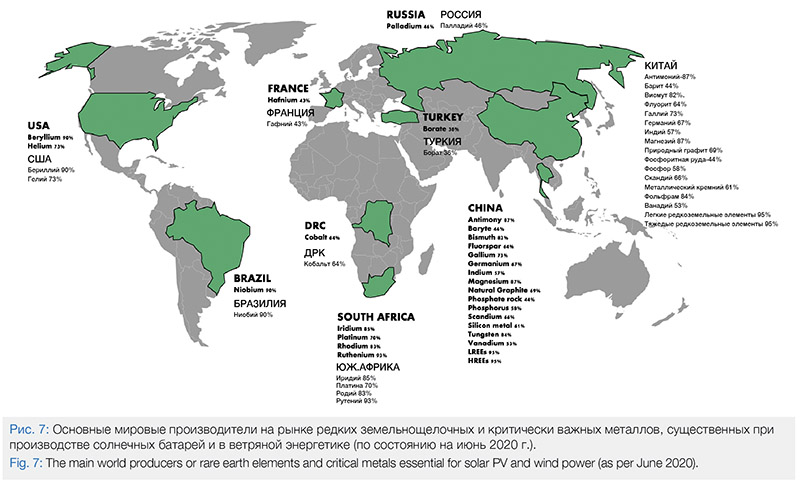

China has also taken the lead in the clean energy race to become the world’s largest producer, exporter, and installer of solar panels, wind turbines, batteries, and electric vehicles. In case of fossil fuel energy sources, apart from national coal resources, the country would heavily depend on external supplies. China’s commitment to invest in renewables is due to its large potential for further production and increase in consumption. By 2030, one-fifth of the country’s electricity consumption is forecast to come from non-fossil fuel sources. According to the International Energy Agency, 36% and 40% of the world’s growth in solar and wind energy in the next five years will come from China. Renewable energy deployment is also a part of a larger China’s effort to develop a cross-industrial approach to lower pollution levels and the coal usage, mitigate climate change, and improve energy efficiency.

By increasing the proportion of renewable sources in its energy mix for electricity consumption, China can also mitigate geopolitical tensions by making the country less dependent on unstable regions for energy security. The fossil fuel energy market relies on securing oil and gas transportation routes to and from fossil fuel-rich countries, which in turn requires extended military protection. The protection of oil transit chokepoints was one of the reasons why China constructed its first overseas naval base in Djibouti. In contrast, the availability of resources such as wind and sunlight for renewable energy far outstrips that of fossil fuels and is much more evenly spread across different countries.

With large investments in renewable energy technologies strengthening the influence of some countries, the energy transformation will create new energy leaders (e.g. China). This creates implications for the renewable energy materials supply. Ongoing and increased exploitation of metals resources will inevitably reduce the global proven reserves of these materials. The rare earth and critical metals which are essential to make solar PV and wind power have the potential to become supply constrained as economically viable concentrations of elements such as neodymium, dysprosium, indium, selenium, tellurium, terbium, and gallium are found in only a handful of countries (figure 7). This will shape the geopolitics of critical metals and rare earths with new interdependencies and trade patterns emerging.

As the USA ceased the production of these strategic metals with most of the mines being shut down in the late ‘90s, its shift towards the renewables will not be that apparent. The USA will not easily resign from the energy independence and from the use of the fossil fuels even at the expense of higher carbon emissions and the global climate. The shale oil and gas are the main strategic energy sources the country possesses at the moment. Since the USA is facing the biggest opposition to its domination from China, the country’s priorities here are to win this conflict at all cost.

6. Has the World just Experienced the Last Oil Production Peak in History?

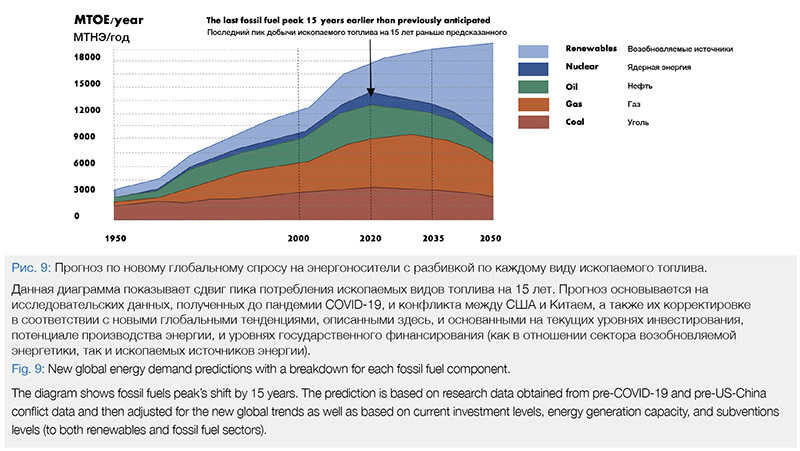

Just at the beginning of the last year (January 2019), after more than a century of rapid growth, global energy demand was predicting growth to slow and then plateau around 2035. This prediction was primarily driven by the timing of renewable energy sources penetration into the energy mix that gradually has been increasing in 21st century. Renewables were expected to double their share in the overall energy mix from 2020 until 2050 (from 19% to 35%) and provide more than half the demand for electricity by 2035 with a clear break from the historical fossil fuel-based electricity generation. An expected 79% increase in electricity generation within the overall energy portfolio between 2020 and 2050, was expected to exhibit renewables – including solar, wind, and hydropower – as being the fastest-growing energy source.

This prediction, however, was based on pre-China-USA hegemonic conflict climax, pre-COVID-19 pandemic, and another oil price shock events which now are anticipated to even further accelerate the process of transforming the global energy mix and fast-track the replacement of fossil fuels by renewables in some parts of the world.

The fast uptake of renewables is a key driver as they will substitute low-efficiency fossil-fuel-based generation technologies and faster than ever digitalization. More efficient technologies will also become available across all sectors, driving down energy consumption in large industrial countries (e.g. China). Additionally, based on current investment levels, energy generation capacity, and subventions levels (to both renewables and fossil fuel sectors), renewables will also become cheaper than oil and gas in most regions before 2025 which will only speed up the process of replacement in the energy mix. Current pre-pandemic scenarios excluded the 15-20% returns on fossil fuel investments which were only possible due to a lack of significant competition. However, with renewables competing for market share, the existing fossil fuel margins will decrease significantly and faster (figure 8 and 9).

Although 2019 was the first year in history when global demand reached 100 million barrels of oil per day, with the new global conditions, oil demand growth is projected to halt. Despite stable historic growth of more than 1% per annum, the current new circumstances (geopolitical, economical, and sociological that have not been taken into account previously when forecasting) lead to a conclusion that the world has already seen the peak oil demand (in 2019) and will unlikely reach again that level in the future. The oil demand is expected to be only half of today’s levels by 2050. The only fossil fuel to grow its share of global energy demand is gas however, its demand will likely plateau right after 2030. Given the increasing competitiveness of renewables versus gas, halving gas prices will only enable marginal incremental demand.

Five Key Takeaways:

• With the end of globalization and decoupling of the global energy supply chains due to the USA – China conflict, governments and businesses must secure more regional sources of energy with safer and substantially shorter supply chains. In the case of the EU, the only available source of energy apart from nuclear are renewables.

• With the climate change being the top priority on global agendas the carbon emission reduction is looming. The world of fossil fuels being the only main energy source soon will be over. This will further reshape the traditional oil and gas industry forcing businesses to significantly decrease their carbon emissions, invest in more sustainable projects, and pay more attention to the social impact of their operations and overall reputation.

• Businesses and governments will use the current pandemic to slow down and shift their operations and portfolios towards renewable sources of energy. This will remove their dependencies on global supply chains and reduce their risk of undersupply in case of geopolitical instability.

• Digitalization will further transform oil and gas companies around the world pushing for highly disruptive ML and AI initiatives. This will not likely just push hundreds of thousands of oil and gas employees out of the industry but will also require a different set of skills among the workforce. As the oil and gas industry has failed to attract new digital talent, the lack of adequate skills will be the main threat to the oil and gas business continuity.

• Although the oil and gas industry will definitely not disappear from the global markets and there will still be a substantial demand for it, it is highly unlikely we will ever see a 100 million barrels of crude per day production again, as in 2019. It is highly unlikely production will exceed the values of 2019 in future years and a gradual decline in daily production is being predicted onwards.

About the Author

Piotr Przybylo (piotr.przybylo@geomodes.com) is founder and chief executive officer of GeoModes, London, UK. Most recently he has been helping oil and gas businesses prepare for future challenges related to new technologies, digitalization, and talent pool uncertainties. Previously he worked for Maersk Oil in project planning and execution. He holds an MS (2006) in geology from Aarhus University, Denmark, an MS (2008) in exploration and production of oil and gas from Instituto Superior de la Energia, Repsol, Mostoles, Spain, and an MBA (2018) from Hult International Business School, Ashridge Executive Education, UK.